Hawa Engineers Faces Market Position Shift Amid Mixed Performance and Valuation Changes

2025-04-03 08:02:59Hawa Engineers, a microcap in the Engineering - Industrial Equipment sector, has experienced a recent evaluation adjustment reflecting changes in its technical and valuation metrics. The company's mixed stock performance and concerns regarding its debt servicing capabilities underscore the complexities of its current financial landscape.

Read MoreHawa Engineers Adjusts Valuation Grade, Highlighting Competitive Position in Industry

2025-04-03 08:00:28Hawa Engineers, a microcap player in the Engineering - Industrial Equipment sector, has recently undergone a valuation adjustment. The company's current price stands at 115.75, reflecting a notable increase from the previous close of 110.25. Over the past year, Hawa Engineers has experienced a decline of 31.77%, contrasting with a modest gain of 3.67% in the Sensex during the same period. Key financial metrics for Hawa Engineers include a PE ratio of 22.06 and an EV to EBITDA ratio of 7.82, which positions the company competitively within its industry. The return on capital employed (ROCE) is reported at 17.14%, while the return on equity (ROE) stands at 10.15%. In comparison to its peers, Hawa Engineers maintains a more favorable valuation profile, particularly when looking at the EV to sales ratio of 0.42, which is significantly lower than many competitors. This evaluation revision highlights the compa...

Read MoreHawa Engineers Ltd Sees Notable Gains Amid Increased Buying Activity and Market Outperformance

2025-04-02 09:35:28Hawa Engineers Ltd is witnessing significant buying activity, with the stock gaining 4.94% today, outperforming the Sensex, which rose by only 0.54%. This marks the second consecutive day of gains for Hawa Engineers, accumulating a total return of 10.19% over this period. The stock opened with a gap up of 2.04% and reached an intraday high of Rs 115.75, reflecting a 4.99% increase during the trading session. In terms of performance metrics, Hawa Engineers has shown mixed results over various time frames. While it has declined by 4.38% over the past month and 31.80% over the past year, it has demonstrated remarkable growth over the longer term, with a 143.58% increase over three years and an impressive 542.78% rise over five years. The recent buying pressure may be attributed to the stock's current performance relative to the broader market, particularly its ability to outperform the sector today. Additio...

Read More

Hawa Engineers Adjusts Valuation Amid Mixed Financial Performance and Market Challenges

2025-04-02 08:09:14Hawa Engineers, a microcap in the Engineering - Industrial Equipment sector, has recently adjusted its valuation grade, reflecting significant changes in financial metrics. The company shows a favorable valuation landscape with a PE ratio of 21.02 and an EV to EBITDA ratio of 7.52, despite facing challenges in stock performance over the past year.

Read MoreHawa Engineers Ltd Sees Significant Buying Activity Amid Broader Market Decline

2025-04-01 14:15:13Hawa Engineers Ltd is currently witnessing significant buying activity, with the stock rising by 4.76% today, contrasting sharply with the Sensex, which has declined by 1.78%. This performance marks a notable day for the microcap company, especially as it opened with a gap up of 4.67% and reached an intraday high of Rs 110. Despite the positive movement today, Hawa Engineers has faced challenges over the longer term. Over the past month, the stock has decreased by 9.09%, and year-to-date, it is down by 51.11%. However, its three-year performance shows a substantial increase of 131.58%, significantly outperforming the Sensex's 28.27% gain during the same period. The current buying pressure may be attributed to various factors, including potential market corrections or sector-specific developments that have led to increased interest in Hawa Engineers. Notably, the stock is currently trading 4.55% above its ...

Read More

Hawa Engineers Faces Significant Stock Volatility Amid Weak Financial Fundamentals

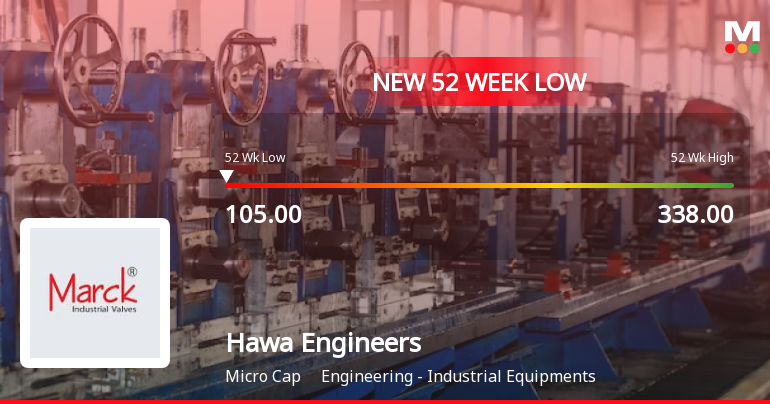

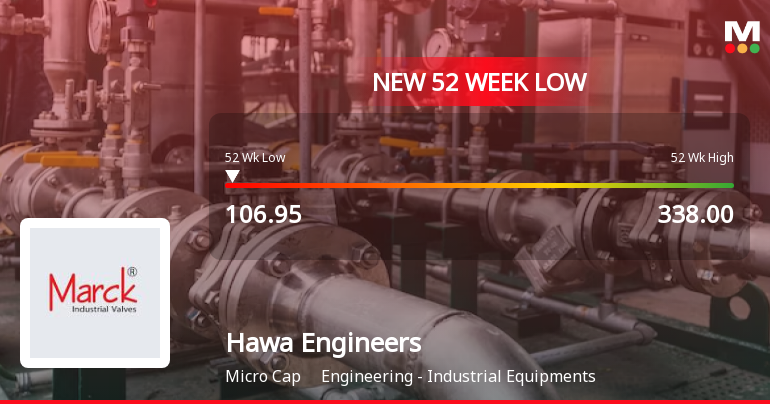

2025-03-28 12:37:24Hawa Engineers, a microcap in the engineering sector, hit a new 52-week low today, reflecting significant volatility. The company has seen a 35.29% decline in stock value over the past year, with disappointing quarterly results and weak long-term fundamentals, despite a relatively attractive valuation.

Read MoreHawa Engineers Adjusts Valuation Grade Amid Competitive Industry Landscape

2025-03-27 08:00:29Hawa Engineers, a microcap player in the engineering and industrial equipment sector, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (P/E) ratio of 20.78 and an enterprise value to EBITDA ratio of 7.45, indicating a competitive positioning within its industry. The return on capital employed (ROCE) stands at 17.14%, while the return on equity (ROE) is reported at 10.15%, reflecting solid operational efficiency. In comparison to its peers, Hawa Engineers maintains a favorable valuation profile. For instance, Mamata Machinery and Eimco Elecon(I) are positioned at higher P/E ratios of 24.15 and 21.7, respectively, suggesting that Hawa Engineers may offer a more attractive entry point based on current metrics. Additionally, while some competitors are categorized as risky or expensive, Hawa Engineers stands out with a more stable financial outlook. Despite rece...

Read MoreHawa Engineers Faces Intense Selling Pressure Amid Significant Price Declines

2025-03-24 15:35:10Hawa Engineers Ltd is currently facing significant selling pressure, with today's trading session showing only sellers in the market. The stock has experienced a notable decline of 4.96% today, contrasting sharply with the Sensex, which has gained 1.40%. This marks a trend reversal for Hawa Engineers, which had seen four consecutive days of gains prior to this downturn. Over the past week, Hawa Engineers has performed positively with a 7.16% increase, outpacing the Sensex's 5.14% rise. However, the stock's longer-term performance reveals concerning trends, including a 48.56% drop over the past three months and a 24.08% decline over the past year, while the Sensex has risen by 7.07% during the same period. Today's trading saw the stock reach an intraday high of Rs 127, but it fell to a low of Rs 117, indicating volatility. The stock is currently above its 5-day and 20-day moving averages but below its 50-d...

Read More

Hawa Engineers Faces Ongoing Challenges Amid Weak Fundamentals and Market Performance

2025-03-13 09:42:42Hawa Engineers, a microcap in the engineering sector, reached a new 52-week low today, reflecting a year-long decline of 26.98%. Despite a brief intraday high, the stock remains below key moving averages and shows weak long-term fundamentals, including low profitability and challenging debt servicing.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECompliances certificate under Reg 74(5) of SEBI (DP) Regulations2018

Closure of Trading Window

24-Mar-2025 | Source : BSEClosure of trading window

Announcement under Regulation 30 (LODR)-Change in Directorate

16-Jan-2025 | Source : BSEreappointment of Mr. Mohammed Khan pathan as a whole time director of the company

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available