Hazoor Multi Projects Faces Market Sentiment Shift Amid Declining Sales and Profit

2025-03-21 08:00:16Hazoor Multi Projects, a microcap in construction and real estate, has seen a shift in its technical outlook amid recent financial challenges, including a 25.78% decline in net sales. Despite these issues, the company demonstrates strong debt servicing capabilities and impressive long-term growth metrics, outperforming the BSE 500.

Read MoreHazoor Multi Projects Faces Mixed Technical Trends Amid Market Volatility

2025-03-20 08:00:20Hazoor Multi Projects, a microcap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's technical indicators present a mixed picture, with the MACD signaling bearish trends on both weekly and monthly scales, while the Bollinger Bands show a mildly bearish stance weekly and bullish monthly. The daily moving averages also indicate bearish momentum, suggesting a cautious outlook. In terms of performance, Hazoor Multi Projects has experienced notable fluctuations in its stock price, currently trading at 41.51, down from a previous close of 43.03. Over the past year, the stock has seen a high of 63.90 and a low of 28.41, highlighting significant volatility. When comparing the company's returns to the Sensex, Hazoor Multi Projects has faced challenges. Over the past week, the stock returned -0.77%, while the Sensex ...

Read MoreHazoor Multi Projects Faces Stock Volatility Amidst Strong Long-Term Growth Trends

2025-03-19 18:00:13Hazoor Multi Projects Ltd, a microcap player in the construction and real estate sector, has experienced notable fluctuations in its stock performance today. The company, with a market capitalization of Rs 888.00 crore, currently holds a price-to-earnings (P/E) ratio of 47.13, which is below the industry average of 62.41. Over the past year, Hazoor Multi Projects has shown a robust performance of 29.50%, significantly outperforming the Sensex, which recorded a gain of 4.77%. However, in the short term, the stock has faced challenges, with a decline of 3.53% today, contrasting with the Sensex's slight increase of 0.20%. Looking at broader trends, the stock has seen a decrease of 19.83% year-to-date, while the Sensex has fallen by 3.44%. In the longer term, Hazoor Multi Projects has demonstrated impressive growth, with a staggering 26797.61% increase over the past five years, compared to the Sensex's 166.7...

Read More

Hazoor Multi Projects Faces Sales Decline Amid Strong Debt Management and Growth Potential

2025-03-18 08:00:29Hazoor Multi Projects, a microcap in construction and real estate, has faced a significant decline in net sales and profit after tax in the latest quarter. Despite these challenges, the company maintains a low debt-to-EBITDA ratio and has shown strong long-term growth, outperforming the BSE 500 index consistently.

Read MoreHazoor Multi Projects Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-18 08:00:17Hazoor Multi Projects, a microcap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 42.23, showing a notable increase from the previous close of 39.31. Over the past year, Hazoor Multi Projects has demonstrated a significant return of 26.55%, outperforming the Sensex, which recorded a return of 2.10% in the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Relative Strength Index (RSI) indicates no signal for both weekly and monthly assessments. Bollinger Bands present a mildly bearish outlook weekly, contrasting with a bullish stance monthly. Daily moving averages suggest a mildly bullish trend, while the KST and Dow Theory indicate bearish and no trend signals, respectively. The...

Read More

Hazoor Multi Projects Faces Declining Sales Amidst Strong Debt Management and Growth Potential

2025-02-27 18:45:28Hazoor Multi Projects, a microcap in construction and real estate, has experienced a recent evaluation adjustment amid a significant decline in net sales and profit after tax. Despite these challenges, the company maintains a low debt-to-EBITDA ratio and demonstrates strong long-term growth potential, attracting institutional investors.

Read MoreHazoor Multi Projects Faces Mixed Technical Signals Amid Market Evaluation Revision

2025-02-25 10:26:30Hazoor Multi Projects, a microcap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 41.80, slightly up from the previous close of 41.70, with a 52-week high of 63.90 and a low of 28.41. Today's trading saw a high of 42.76 and a low of 41.25. The technical summary indicates mixed signals across various indicators. The MACD shows a bearish trend on a weekly basis while remaining bullish monthly. The Relative Strength Index (RSI) presents no signals for both weekly and monthly assessments. Bollinger Bands reflect a bearish stance weekly, with a mildly bullish outlook monthly. Moving averages indicate a mildly bullish trend on a daily basis, while the KST and Dow Theory suggest bearish tendencies on a weekly basis. In terms of performance, Hazoor Multi Projects has faced challenges, particul...

Read More

Hazoor Multi Projects Reports Financial Results Indicating Significant Performance Shift in December 2024

2025-02-13 22:46:11Hazoor Multi Projects has announced its financial results for the quarter ending December 2024, revealing a significant shift in performance. The company's score has declined to -29 from -13 in the previous quarter, indicating unfavorable changes in its financial metrics during this period. Stakeholders are advised to monitor ongoing trends.

Read More

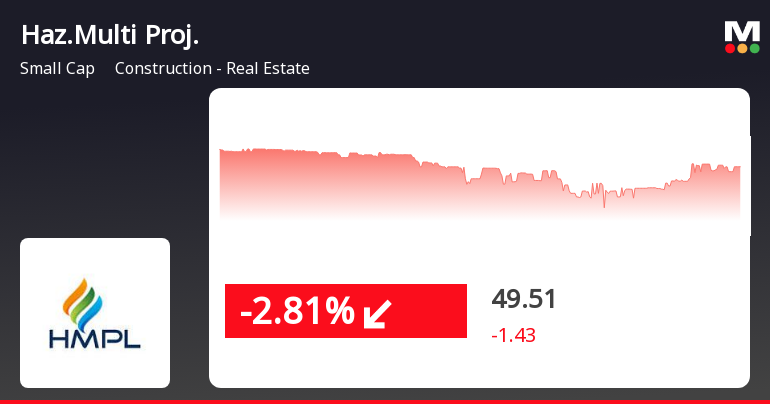

Hazoor Multi Projects Faces Continued Decline Amid Broader Market Weakness

2025-02-11 13:45:11Hazoor Multi Projects, a small-cap construction and real estate firm, saw a notable decline of 7.15% on February 11, 2025, continuing a downward trend. The stock has underperformed its sector and the Sensex, with a 9.04% drop over the past month, reflecting ongoing market challenges.

Read MorePress Release: Square Port Shipyard Private Limited Subsidiary Company Of M/S. Hazoor Multi Projects Limited Signs Mou With Damen Technical Cooperation B.V. To Develop Its Shipyard And Build Ships For Local And International Markets.

09-Apr-2025 | Source : BSEPress Release: Square Port Shipyard Private Limited Subsidiary company of M/s Hazoor Multi Projects Limited signs MoU with Damen Technical Cooperation B.V. to develop its Shipyard and build ships local and International markets.

Intimation Pursuant To Regulation 30 Of The SEBI (Listing Obligation And Disclosure Requirement) Regulations 2015

09-Apr-2025 | Source : BSEWe wish to inform you that Wholly-Owned Subsidiary Company (WOS) of M/s. Hazoor Multi Projects Limited (the Company) in the name of the Hazoor Multi Projects UK LTD has been incorporated on 08th April 2025 in the jurisdiction of England and Wales United Kingdom (UK).

Intimation Pursuant To Regulation 30 Of The SEBI (Listing Obligation And Disclosure Requirement) Regulations 2015.

08-Apr-2025 | Source : BSEPursuant to regulation 30 read with clause 11 of Para B of Part A of Schedule III of the Securities and Exchange Board of India( LODR) Regulations 2015 we enclose herewith the requisite details in respect of the Support rendered by providing Corproate Guarantee including security for an amount not execeeding Rs.75.00 Crores as Security for term loan facilities availed by Rappture Projects Private Limited (Associate Company)

Corporate Actions

No Upcoming Board Meetings

Hazoor Multi Projects Ltd has declared 20% dividend, ex-date: 28 Aug 24

Hazoor Multi Projects Ltd has announced 1:10 stock split, ex-date: 07 Nov 24

Hazoor Multi Projects Ltd has announced 1:1 bonus issue, ex-date: 28 Dec 06

Hazoor Multi Projects Ltd has announced 1:2 rights issue, ex-date: 20 Jan 23