HBL Engineering Ltd Sees Surge in Trading Activity Amid Sector Dynamics

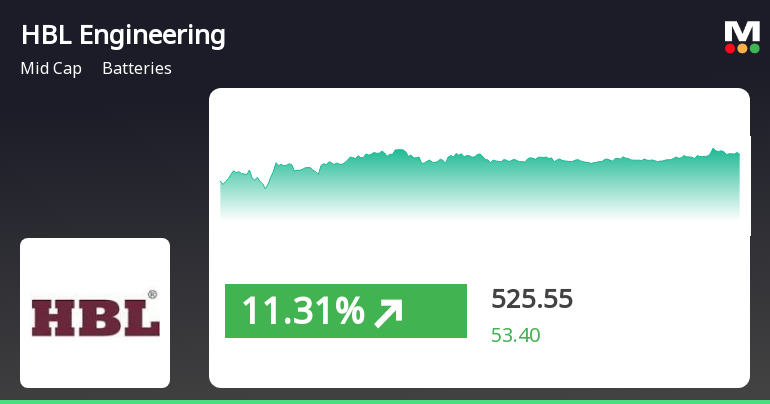

2025-04-02 10:00:14HBL Engineering Ltd, a midcap player in the batteries industry, has emerged as one of the most active equities today, with a total traded volume of 36,806,766 shares and a total traded value of approximately Rs 191.19 lakhs. The stock opened at Rs 490.55 and reached a day high of Rs 532.40 before settling at a last traded price of Rs 515.90. Despite a notable performance today, HBL Engineering's stock has experienced a trend reversal, falling after three consecutive days of gains. The stock outperformed its sector by 0.64%, while the sector itself recorded a slight decline of 0.13%. HBL Engineering's performance is also noteworthy in comparison to the Sensex, which returned 0.49% on the same day. In terms of moving averages, the stock is currently above the 5-day, 20-day, and 50-day averages but remains below the 100-day and 200-day averages. Additionally, investor participation has surged, with a delive...

Read MoreHBL Engineering Sees Surge in Trading Activity Amid Increased Investor Engagement

2025-04-02 10:00:11HBL Engineering Ltd, a mid-cap player in the batteries industry, has emerged as one of the most active equities today, with a total traded volume of 36,806,766 shares and a total traded value of approximately Rs 191.19 lakhs. The stock opened at Rs 490.55 and reached a day high of Rs 532.40 before settling at a last traded price of Rs 515.90. Despite a slight decline after three consecutive days of gains, HBL Engineering has outperformed its sector by 0.64%. The stock's performance today reflects a 0.69% return, while the broader Sensex index posted a return of 0.49%. Notably, the stock's delivery volume surged to 26.75 lakhs, marking a significant increase of 242.28% compared to the five-day average delivery volume, indicating rising investor participation. In terms of moving averages, HBL Engineering's stock price is currently above the 5-day, 20-day, and 50-day moving averages, yet remains below the 10...

Read MoreHBL Engineering Shows Resilience Amid Mixed Technical Indicators and Market Trends

2025-04-02 08:06:07HBL Engineering, a midcap player in the batteries industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 511.65, showing a notable increase from the previous close of 472.15. Over the past week, HBL Engineering has demonstrated a strong performance with a return of 8.38%, significantly outperforming the Sensex, which reported a decline of 2.55% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Moving averages also reflect a mildly bearish sentiment on a daily basis. HBL Engineering's performance over various time frames highlights its resilience,...

Read MoreHBL Engineering Ltd Sees Surge in Trading Activity Amid Sector Outperformance

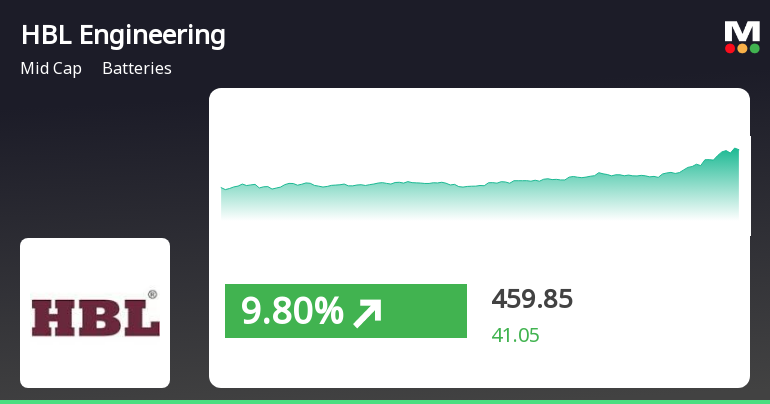

2025-04-01 12:00:08HBL Engineering Ltd, a mid-cap player in the batteries industry, has emerged as one of the most active equities today, with a total traded volume of 19,555,692 shares and a total traded value of approximately Rs 101.32 crores. The stock opened at Rs 490.55, reflecting a gain of 3.82% from the previous close of Rs 472.50, and reached an intraday high of Rs 530.70, marking a notable increase of 12.32%. In terms of performance, HBL Engineering has outperformed its sector by 7.92% today, continuing a positive trend with a 13.42% rise over the past three days. However, it is important to note that investor participation has seen a decline, with delivery volume dropping by 26.42% compared to the five-day average. The stock's liquidity remains robust, with trading activity sufficient for a trade size of Rs 2.58 crores, based on 2% of the five-day average traded value. While the stock is currently above its 5-day...

Read More

HBL Engineering Outperforms Market Amid Broader Decline, Highlighting Sector Resilience

2025-04-01 11:40:28HBL Engineering, a midcap battery manufacturer, experienced notable gains today, significantly outperforming the broader market. The stock has shown a consistent upward trend over the past three days and has impressive long-term returns, despite a decline year-to-date. Its performance contrasts sharply with the overall market's challenges.

Read MoreHBL Engineering Shows Strong Trading Activity Amid Declining Investor Participation

2025-04-01 11:00:12HBL Engineering Ltd, a mid-cap player in the batteries industry, has emerged as one of the most active equities today, with a total traded volume of 16,888,331 shares and a total traded value of approximately Rs 87.42 crore. The stock opened at Rs 490.55, reflecting a gain of 3.82% from the previous close of Rs 472.50, and reached an intraday high of Rs 530.70, marking a notable increase of 12.32% during the trading session. In terms of performance, HBL Engineering has outperformed its sector by 7.08% and has shown a consecutive gain over the last three days, accumulating returns of 13.02% in this period. The stock's last traded price stands at Rs 523.70, indicating a 1D return of 11.01%, while the sector's 1D return is at 2.84%, and the Sensex has declined by 1.16%. Despite the positive price movements, there has been a decline in investor participation, with delivery volume dropping by 26.42% compared t...

Read More

HBL Engineering Shows Strong Short-Term Gains Amid Mixed Long-Term Trends

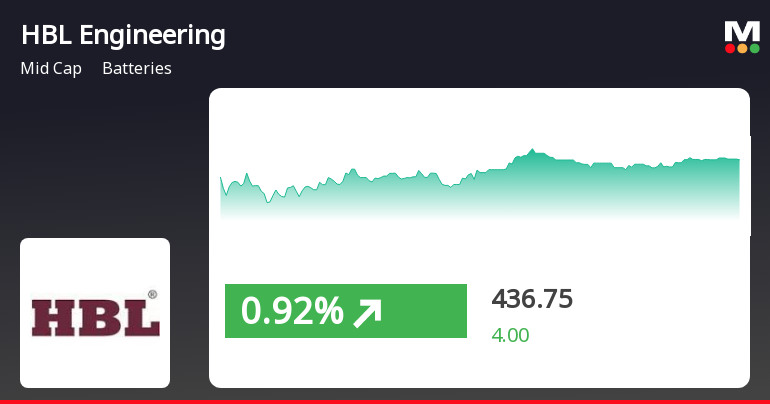

2025-03-19 11:15:22HBL Engineering has experienced notable activity, gaining 9.36% on March 19, 2025, and outperforming its sector. The stock has shown mixed trends in moving averages and has recorded a 612.89% increase over three years, despite a decline of 6.04% in the past month.

Read More

HBL Engineering Faces Significant Stock Decline Amid Broader Market Weakness

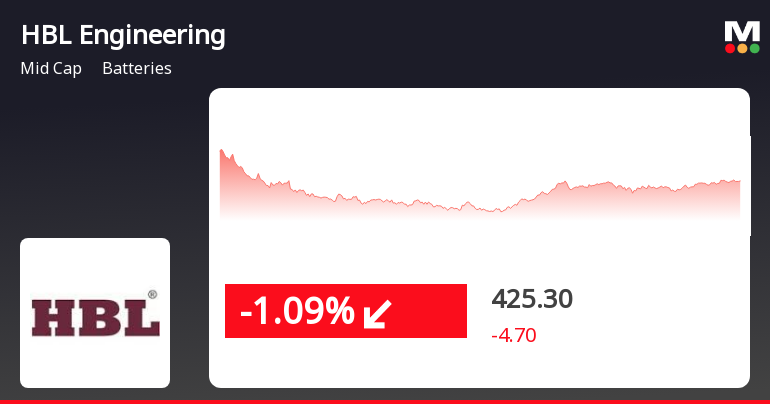

2025-03-10 15:35:19HBL Engineering, a midcap battery manufacturer, saw a notable decline on March 10, 2025, underperforming its sector. The stock is trading below key moving averages, indicating a bearish trend. In the broader market, the Sensex also turned negative, reflecting overall bearish sentiment amid recent volatility in HBL's performance.

Read More

HBL Engineering Faces Continued Decline Amid Broader Challenges in Batteries Sector

2025-03-03 11:50:24HBL Engineering, a midcap batteries company, has seen a notable decline, falling for six consecutive days and totaling a 16.84% drop. The stock experienced high volatility during trading, reaching an intraday high of Rs 447.5 before closing lower. The broader batteries sector also faced challenges.

Read MoreAnnouncement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

28-Mar-2025 | Source : BSEIntimation about receipt of two letter of acceptances for Supply of Kavach systems

Announcement under Regulation 30 (LODR)-Credit Rating

22-Mar-2025 | Source : BSEIntimation about updated credit rating

Integrated Filing (Financial)

04-Mar-2025 | Source : BSEFiling of integrated financial results

Corporate Actions

No Upcoming Board Meetings

HBL Engineering Ltd has declared 50% dividend, ex-date: 13 Sep 24

HBL Engineering Ltd has announced 1:10 stock split, ex-date: 24 Nov 09

No Bonus history available

HBL Engineering Ltd has announced 1:10 rights issue, ex-date: 31 May 06