HDFC Bank Experiences High Trading Volume Amidst Stable Market Conditions

2025-04-03 10:00:11HDFC Bank Ltd., a prominent player in the private banking sector, has shown significant trading activity today. The stock, traded under the symbol HDFCBANK, recorded a total volume of 5,786,757 shares, with a total traded value of approximately Rs 103.65 crore. Opening at Rs 1,770.70, the stock reached a day high of Rs 1,799.20 before settling at a last traded price of Rs 1,798.90. Despite today's activity, HDFC Bank's stock is currently 4.82% away from its 52-week high of Rs 1,880. The stock has exhibited a narrow trading range of Rs 17.50 throughout the day, indicating relatively stable price movements. Notably, HDFC Bank's performance aligns closely with its sector, which saw a 1D return of -0.13%, while the Sensex experienced a decline of -0.34%. In terms of moving averages, HDFC Bank's stock is above the 20-day, 50-day, 100-day, and 200-day moving averages, although it is below the 5-day moving avera...

Read MoreHDFC Bank Sees Surge in April 2025 Call Options with 12,529 Contracts Traded

2025-04-03 10:00:07HDFC Bank Ltd., a prominent player in the private banking sector, has emerged as one of the most active stocks today, particularly in the options market. The bank's underlying stock, HDFCBANK, is currently valued at Rs 1790.2, with a notable call option expiring on April 24, 2025, at a strike price of Rs 1800. Today, 12,529 contracts of this call option were traded, generating a turnover of approximately Rs 2360.65 lakhs. The open interest stands at 4,547 contracts, indicating a robust interest in this option. In terms of performance, HDFC Bank's stock has shown a slight decline of 0.21% today, which is in line with the sector's performance, where the average return was down by 0.13%. The stock has traded within a narrow range of Rs 15.45, reflecting stability amid market fluctuations. Additionally, HDFC Bank's stock is currently above its 20-day, 50-day, 100-day, and 200-day moving averages, although...

Read MoreHDFC Bank Experiences Strong Trading Activity Amid Declining Investor Participation

2025-04-02 10:00:11HDFC Bank Ltd., a prominent player in the private banking sector, has shown significant trading activity today, with a total traded volume of 14,255,503 shares and a total traded value of approximately Rs 253.99 crores. The stock opened at Rs 1,802.00 and reached a day high of Rs 1,809.90, while the day low was recorded at Rs 1,765.35. As of the latest update, the last traded price stands at Rs 1,769.90. In terms of performance, HDFC Bank has outperformed its sector, achieving a 1.28% return compared to the sector's 0.91% and the Sensex's 0.49% return for the day. The stock is currently trading above its 20-day, 50-day, 100-day, and 200-day moving averages, although it is below the 5-day moving average. However, there has been a decline in investor participation, with delivery volume dropping by 9.86% against the 5-day average. Despite this, the stock remains liquid enough for trades sized at Rs 60.48 cro...

Read MoreHDFC Bank has emerged as one of the most active stock calls today amid robust options trading.

2025-04-02 10:00:06HDFC Bank Ltd., a prominent player in the private banking sector, has emerged as one of the most active stocks today, particularly in the options market. The bank's underlying stock, HDFCBANK, is currently valued at Rs 1769.9, which positions it 4.87% away from its 52-week high of Rs 1880. On April 24, 2025, a significant call option with a strike price of Rs 1800 saw robust trading activity, with 14,275 contracts exchanged, resulting in a turnover of approximately Rs 2544.59 lakhs. The open interest for this option stands at 5,238 contracts, indicating a notable level of market engagement. In terms of performance metrics, HDFC Bank has outperformed its sector by 0.49% today, with a 1.39% return compared to the sector's 0.91% and the Sensex's 0.49%. The stock is trading above its 20-day, 50-day, 100-day, and 200-day moving averages, although it is slightly below the 5-day moving average. Despite a decl...

Read MoreHDFC Bank has emerged as one of the most active stock puts today amid strong options trading.

2025-04-02 10:00:05HDFC Bank Ltd. has emerged as one of the most active stocks in the options market today, particularly in the put options segment. The bank's underlying stock, HDFCBANK, is currently valued at Rs 1769.9, just 4.87% away from its 52-week high of Rs 1880. Notably, the put options with an expiry date of April 24, 2025, have seen significant trading activity. The put option with a strike price of Rs 1800 recorded the highest volume, with 10,235 contracts traded and a turnover of Rs 2022.03 lakhs, alongside an open interest of 3,236 contracts. Similarly, the Rs 1780 strike price put option saw 7,122 contracts traded, generating a turnover of Rs 1149.28 lakhs, while the Rs 1760 strike price option had 7,514 contracts traded with a turnover of Rs 943.91 lakhs. In terms of performance, HDFC Bank has outperformed its sector by 0.49%, with a one-day return of 1.39%, compared to the sector's 0.91% and the Sensex's 0...

Read MoreHDFC Bank Adjusts Valuation Grade Amidst Competitive Private Banking Landscape

2025-04-02 08:01:20HDFC Bank has recently undergone a valuation adjustment, reflecting its current financial standing within the private banking sector. The bank's price-to-earnings (PE) ratio stands at 20.42, while its price-to-book value is recorded at 2.82. The bank's PEG ratio is noted at 1.23, and it offers a dividend yield of 1.10%. Key performance indicators include a return on equity (ROE) of 13.81% and a return on assets (ROA) of 1.76%. Additionally, the net non-performing assets (NPA) to book value ratio is 2.42. In comparison to its peers, HDFC Bank's valuation metrics position it alongside other major players in the industry. For instance, ICICI Bank shows a similar PE ratio, while Kotak Mahindra Bank presents a higher valuation. Axis Bank, on the other hand, is positioned more favorably in terms of its valuation metrics. HDFC Bank's stock performance over the past year has outpaced the Sensex, with a return of 2...

Read MoreHDFC Bank has emerged as one of the most active stock calls today amid notable options trading.

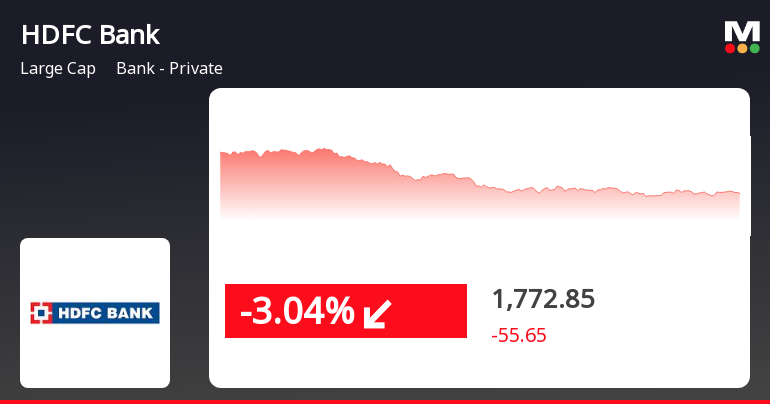

2025-04-01 14:00:03HDFC Bank Ltd., a prominent player in the private banking sector, has emerged as one of the most active stocks today, particularly in the options market. The bank's call options, set to expire on April 24, 2025, with a strike price of Rs 1800, saw significant trading activity, with 9,691 contracts exchanged, resulting in a turnover of approximately Rs 1,871.76 lakhs. The open interest for these options stands at 4,454 contracts, indicating a robust interest among traders. Despite this activity, HDFC Bank's stock has underperformed relative to its sector, declining by 3.10% today, compared to a sector decline of 1.51%. The stock reached an intraday low of Rs 1769.25, reflecting a drop of 3.22%. Currently, the underlying value of HDFC Bank is Rs 1772.25, which remains above its 20-day, 50-day, 100-day, and 200-day moving averages, although it is below the 5-day moving average. Investor participation appears...

Read More

HDFC Bank Faces Short-Term Volatility Amid Broader Market Decline, Yet Shows Long-Term Resilience

2025-04-01 11:45:21HDFC Bank's stock declined on April 1, 2025, amid a broader market downturn, marking a reversal after two days of gains. Despite this short-term dip, the bank has shown strong long-term growth, outperforming the Sensex over the past year and maintaining a generally positive trend in moving averages.

Read MoreHDFC Bank Experiences High Trading Volume Amid Notable Stock Fluctuations

2025-04-01 11:00:09HDFC Bank Ltd., a prominent player in the private banking sector, has seen significant trading activity today, with a total traded volume of 5,184,509 shares and a total traded value of Rs 93,321.162 lakhs. The stock opened at Rs 1,802.0 and reached a day high of Rs 1,809.9, but it also experienced a decline, touching an intraday low of Rs 1,782.95, reflecting a decrease of 2.48% from the previous close of Rs 1,828.2. Despite its large market capitalization of Rs 13,82,986.00 crore, HDFC Bank has underperformed its sector by 1.17% today, with a 1D return of -2.14%. The stock has fallen after two consecutive days of gains, indicating a potential trend reversal. Additionally, the delivery volume has decreased by 3.23% compared to the 5-day average, suggesting a decline in investor participation. HDFC Bank's liquidity remains robust, with trading activity sufficient for a trade size of Rs 56.29 crore, base...

Read MoreAnnouncement under Regulation 30 (LODR)-Change in Management

08-Apr-2025 | Source : BSEIntimation under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Intimation Under SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

03-Apr-2025 | Source : BSEIntimation under SEBI (Listing Obligation and Disclosure Requirements) Regulations 2015

Intimation Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

02-Apr-2025 | Source : BSEIntimation under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

HDFC Bank Ltd. has declared 1950% dividend, ex-date: 10 May 24

HDFC Bank Ltd. has announced 1:2 stock split, ex-date: 19 Sep 19

No Bonus history available

No Rights history available