HEG Ltd Shows Strong Reversal Amid Broader Mid-Cap Market Momentum

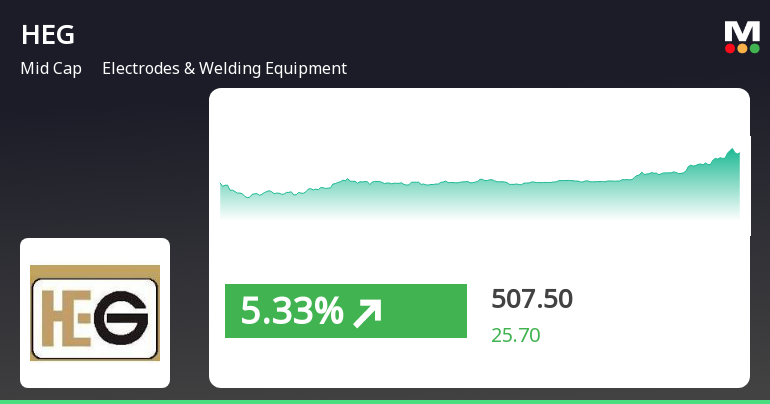

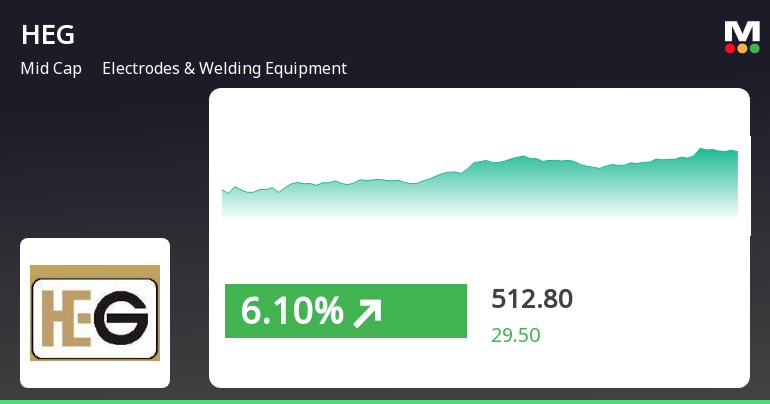

2025-04-02 12:45:14HEG Ltd, a midcap in the Electrodes & Welding Equipment sector, rebounded today after three days of decline, gaining 5.75%. The stock traded between Rs 468.7 and Rs 502.9, outperforming its sector. The broader market also showed positive momentum, with mid-cap stocks leading gains.

Read MoreHEG Experiences Technical Trend Shifts Amid Strong Historical Performance and Volatility

2025-04-02 08:01:25HEG, a midcap player in the Electrodes & Welding Equipment industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The stock is currently priced at 481.80, slightly down from its previous close of 483.70. Over the past year, HEG has demonstrated notable resilience, with a return of 22.58%, significantly outperforming the Sensex, which recorded a return of 2.72% in the same period. In terms of technical metrics, the weekly MACD indicates a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands show a mildly bullish trend on both weekly and monthly charts, suggesting some volatility in price movements. However, moving averages on a daily basis reflect a mildly bearish stance, indicating potential short-term challenges. The company's performance over various time frames highlights its strong historical...

Read MoreHEG Ltd Experiences High Trading Volume Amid Notable Market Dynamics

2025-03-27 10:00:06HEG Ltd, a prominent player in the Electrodes & Welding Equipment industry, has emerged as one of the most active stocks today, with a total traded volume of over 21.9 million shares and a total traded value of approximately Rs 110 crore. The stock opened at Rs 480 and reached a day high of Rs 516, before closing at Rs 502.2, reflecting a decline of 2.57% for the day. Despite this drop, HEG is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a generally positive trend over the longer term. However, it has underperformed its sector by 0.34% today, marking a notable shift after five consecutive days of gains. The stock also touched an intraday low of Rs 482, representing a decrease of 3.46% from its previous close of Rs 483. Investor participation has seen a significant uptick, with delivery volume rising by 130.01% compared to the 5-day average. With a mar...

Read MoreHEG Ltd Sees Surge in Trading Activity Amid Strong Market Performance

2025-03-26 12:00:04HEG Ltd, a prominent player in the Electrodes & Welding Equipment industry, has emerged as one of the most active stocks today, with a total traded volume of 10,827,682 shares and a total traded value of approximately Rs 54.14 crore. The stock opened at Rs 480.0 and reached an intraday high of Rs 516.0, reflecting a notable increase of 6.83%. However, it also experienced a low of Rs 473.35 during the trading session. In terms of performance, HEG has outperformed its sector by 2.11% today, contributing to a consecutive gain over the last five days, during which it has recorded a remarkable return of 20.78%. The stock is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a strong upward trend. Investor participation has seen a significant rise, with delivery volume on March 25 reaching 151,600 shares, a staggering increase of 501.31% compared to the 5-day ave...

Read MoreHEG Ltd Shows Strong Market Activity and Outperformance in Electrodes Sector

2025-03-26 11:00:05HEG Ltd, a prominent player in the Electrodes & Welding Equipment industry, has emerged as one of the most active equities today, with a total traded volume of 9,286,316 shares and a total traded value of approximately Rs 46.30 crore. The stock opened at Rs 480.00 and reached a day high of Rs 516.00, reflecting a notable intraday increase of 5.53%. However, it also experienced a low of Rs 473.35, marking a decline of 2%. In terms of performance, HEG has outperformed its sector by 2.36%, with a remarkable 22.02% increase over the past five days, indicating a strong upward trend. The stock is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a robust market position. Additionally, the delivery volume surged to 15.16 lakh shares on March 25, representing a significant increase of 501.31% compared to the 5-day average delivery volume. With a market capitalizat...

Read More

HEG Ltd Shows Strong Momentum Amid Broader Market Trends and Midcap Gains

2025-03-26 10:30:14HEG Ltd, a midcap company in the Electrodes & Welding Equipment sector, has shown strong performance, gaining 5.1% on March 26, 2025. The stock has achieved consecutive gains over five days, with a total return of 20.8%. It is currently trading above key moving averages, indicating positive momentum.

Read MoreHEG Stock Shows Mixed Technical Signals Amid Strong Long-Term Performance

2025-03-26 08:00:33HEG, a midcap player in the Electrodes & Welding Equipment industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 483.30, showing a notable increase from the previous close of 433.25. Over the past year, HEG has demonstrated a robust performance with a return of 27.05%, significantly outperforming the Sensex, which recorded a return of 7.12% in the same period. The technical summary indicates mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) remains neutral for both weekly and monthly evaluations. Bollinger Bands suggest a bullish stance in both time frames, while moving averages indicate a mildly bearish trend on a daily basis. The On-Balance Volume (OBV) reflects bullish momentum weekly and monthly. ...

Read MoreHEG Ltd Sees Active Trading Amidst Notable Stock Performance and Market Volatility

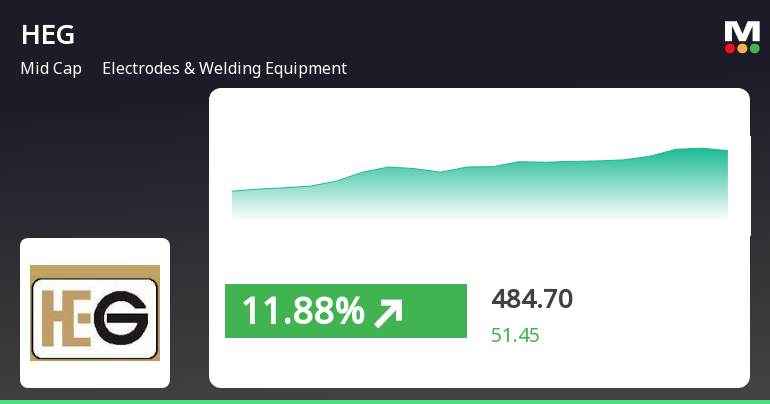

2025-03-25 10:00:06HEG Ltd, a prominent player in the Electrodes & Welding Equipment industry, has emerged as one of the most active stocks today, with a total traded volume of 4,613,804 shares and a total traded value of approximately Rs 222.51 crores. The stock opened at Rs 434.60 and reached a day high of Rs 495.50, reflecting a significant intraday volatility of 5.68%. Currently, HEG is trading at Rs 490.50, marking a notable performance with a 12.70% return for the day, outperforming its sector, which has gained 8.03%. Over the past four days, HEG has shown a consistent upward trend, accumulating a total return of 15.95%. The stock has also maintained a position above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating strong momentum. Despite the positive performance, there has been a decline in investor participation, with delivery volume dropping by 29.95% compared to the 5-day average. The ...

Read More

HEG Stock Surges Amid Positive Trends in Electrodes and Welding Sector

2025-03-25 09:30:15HEG, a midcap in the Electrodes & Welding Equipment sector, has demonstrated notable activity, achieving consecutive gains over four days and outperforming its sector. The stock reached an intraday high, showing significant volatility and trading above multiple moving averages, reflecting strong short-term performance amid a positive market trend.

Read MoreFormat of the Annual Disclosure to be made by an entity identified as a LC - Annexure B2

09-Apr-2025 | Source : BSEFormat of the Annual Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | HEG Ltd |

| 2 | CIN NO. | L23109MP1972PLC008290 |

| 3 | Report filed for FY | 2024-2025 |

| Details of the Current block (all figures in Rs crore): | ||

| 4 | 2 - year block period (Specify financial years)* | FY 2025 FY 2026 |

| 5 | Incremental borrowing done in FY (T)(a) | 0.00 |

| 6 | Mandatory borrowing to be done through debt securities in FY (T) (b) = (25% of a) | 0.00 |

| 7 | Actual borrowing done through debt securities in FY (T)(c) | 0.00 |

| 8 | Shortfall in the borrowing through debt securities if any for FY (T - 1) carried forward to FY (T) (d) | NA |

| 8 | Quantum of (d) which has been met from (c)(e)* | NA |

| 9 | Shortfall if any in the mandatory borrowing through debt securities for FY (T) { after adjusting for any shortfall in borrowing for FY(T - 1) which was carried forward to FY(T)}(f) = (b) - [(c) - (e)]{ If the calculated value is zero or negative write nil}* | NA |

| Details of penalty to be paid if any in respect to previous block (all figures in Rs crore): | |

| 2 - year Block period (Specify financial years) | NA |

| Amount of fine to be paid for the block if applicable Fine = 0.2% of {(d) - (e)}# | 0.00 |

| Name of the Company Secretary :- | Vivek Chaudhary |

| Designation :- | Company Secretary |

| Name of the Chief Financial Officer :- | Ravi Kant Tripathi |

| Designation : - | Chief Financial Officer |

Date: 09/04/2025

Format of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

07-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | HEG Ltd |

| 2 | CIN NO. | L23109MP1972PLC008290 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 0.00 |

| 4 | Highest Credit Rating during the previous FY | AA- |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | INDIA RATINGS AND RESEARCH PVT. LTD. |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: Company Secretary

EmailId: heg.investor@lnjbhilwara.com

Designation: Chief Financial Officer

EmailId: rk.tripathi@lnjbhilwara.com

Date: 07/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSEAttached

Corporate Actions

No Upcoming Board Meetings

HEG Ltd has declared 225% dividend, ex-date: 31 Jul 24

HEG Ltd has announced 2:10 stock split, ex-date: 18 Oct 24

No Bonus history available

No Rights history available