Hero MotoCorp Shows Resilience Amid Recent Stock Fluctuations and Market Trends

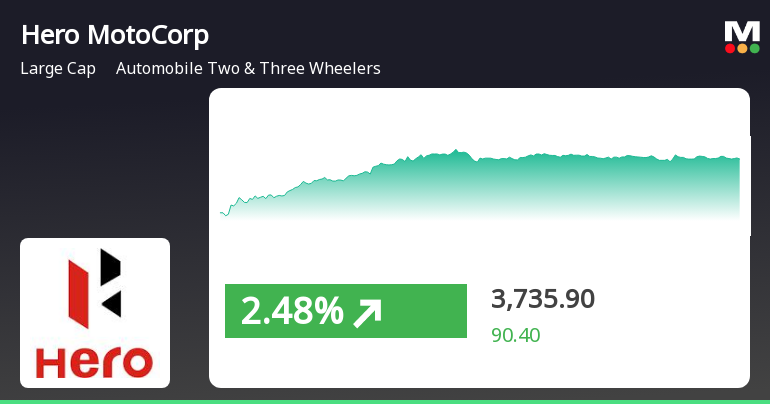

2025-04-03 12:35:09Hero MotoCorp, a prominent player in the Automobile Two & Three Wheelers industry, has shown notable activity today, outperforming its sector by 0.36%. However, the stock has experienced a trend reversal, declining by 0.75% after two consecutive days of gains. Currently, the stock's performance metrics reveal that it is trading above its 5-day and 20-day moving averages, yet remains below its 50-day, 100-day, and 200-day moving averages. With a market capitalization of Rs 75,081.07 crore, Hero MotoCorp holds a price-to-earnings (P/E) ratio of 18.22, significantly lower than the industry average of 31.31. The company also boasts a high dividend yield of 3.7% at the current price, appealing to income-focused investors. Over the past year, Hero MotoCorp's stock has declined by 17.61%, contrasting with the Sensex's gain of 3.32%. In the year-to-date performance, the stock is down 9.80%, while the Sensex has d...

Read More

Hero MotoCorp Adjusts Evaluation Amidst Mixed Financial Performance Indicators

2025-04-02 08:13:49Hero MotoCorp has recently experienced an evaluation adjustment, indicating a change in market sentiment. The company demonstrates strong management efficiency with an 18.40% return on equity and a low debt-to-equity ratio. Despite a challenging year, profits increased by 11.4%, while long-term growth remains modest.

Read MoreHero MotoCorp Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-04-02 08:01:13Hero MotoCorp, a prominent player in the Automobile Two & Three Wheelers industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 3,761.25, showing a slight increase from the previous close of 3,722.10. Over the past week, the stock has demonstrated a return of 3.72%, contrasting with a decline of 2.55% in the Sensex, indicating a relative outperformance in the short term. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly assessments. Bollinger Bands also reflect a mildly bearish trend on both timeframes. Moving averages indicate a bearish stance on a daily basis, while the KST presents a mildly bullish view weekly but shifts to mildly bearish monthly. Looking at the company's perform...

Read MoreHero MotoCorp has emerged as one of the most active stock calls today amid notable trading activity.

2025-04-01 11:00:03Hero MotoCorp Ltd., a prominent player in the Automobile Two & Three Wheelers industry, has emerged as one of the most active stocks today. The company’s underlying stock, HEROMOTOCO, has seen significant trading activity, particularly in call options set to expire on April 24, 2025. Notably, 4,969 contracts were traded at a strike price of Rs 3,800, resulting in a turnover of approximately Rs 843.27 lakhs. The open interest stands at 2,511 contracts, indicating ongoing interest in this option. In terms of price performance, Hero MotoCorp reached an intraday high of Rs 3,816.6, reflecting a gain of 2.52%. The stock's current value is Rs 3,721.0, which is higher than both the 5-day and 20-day moving averages, although it remains below the 50-day, 100-day, and 200-day moving averages. The stock has a high dividend yield of 3.76%, contributing to its attractiveness among investors. Despite a decline in deliv...

Read MoreHero MotoCorp Shows Short-Term Resilience Amidst Long-Term Challenges in Auto Sector

2025-03-28 09:20:05Hero MotoCorp, a prominent player in the Automobile Two & Three Wheelers sector, has shown notable activity today, outperforming its sector by 1.07%. The stock has been on a positive trajectory, gaining for the last four consecutive days, with a total return of 4.03% during this period. Currently, the stock is trading at Rs 3,772.4, maintaining this price since the market opened. In terms of moving averages, Hero MotoCorp's stock is performing higher than its 5-day and 20-day averages, although it remains below the 50-day, 100-day, and 200-day averages. The company boasts a high dividend yield of 3.72% at the current price, which is noteworthy for investors seeking income. Despite a challenging year, with a 1-year performance decline of 20.25%, the stock has shown resilience in the short term, outperforming the Sensex over the past week and month. With a market capitalization of Rs 75,244.08 crore and a P...

Read More

Hero MotoCorp Shows Short-Term Gains Amidst Broader Market Recovery Trends

2025-03-27 10:45:18Hero MotoCorp has experienced significant activity, marking its third consecutive day of gains. The stock is currently above its short-term moving averages but below longer-term ones. Despite recent performance, it has declined over the past year, contrasting with broader market trends, including a rebound in the Sensex.

Read MoreHero MotoCorp Faces High Volatility Amidst Mixed Performance Indicators and Market Trends

2025-03-27 09:25:05Hero MotoCorp, a prominent player in the Automobile Two & Three Wheelers sector, has shown notable activity today, trading close to its 52-week low, just 4.5% away from Rs 3,455.3. The stock has outperformed its sector by 0.5%, although it has experienced a trend reversal after two consecutive days of gains. Today's trading saw the stock fluctuate within a narrow range of Rs 27, reflecting high volatility with an intraday volatility rate of 74.32%. In terms of moving averages, Hero MotoCorp's stock is currently above its 5-day moving average but below the 20-day, 50-day, 100-day, and 200-day moving averages. The company boasts a high dividend yield of 3.84% at the current price, which may appeal to income-focused investors. Despite a challenging year, with a 1-year performance decline of 20.22%, the stock has shown resilience over a longer horizon, with a 3-year performance of 53.33%. The market capitaliz...

Read MoreHero MotoCorp Shows Volatility Amidst Mixed Performance Metrics and Market Sentiment

2025-03-26 09:25:07Hero MotoCorp, a prominent player in the Automobile Two & Three Wheelers sector, has shown notable activity today, outperforming its sector by 0.6%. The stock has experienced a consecutive gain over the last two days, rising by 0.8% during this period. Despite this positive trend, the stock has been characterized by high volatility, with an intraday volatility of 68.4%, indicating significant price fluctuations. Currently, Hero MotoCorp's stock is trading in a narrow range of Rs 22.5, reflecting a cautious market sentiment. The stock's performance metrics reveal that it is above its 5-day and 20-day moving averages, yet below its 50-day, 100-day, and 200-day moving averages. The company boasts a high dividend yield of 3.86%, which may appeal to income-focused investors. In terms of broader performance, Hero MotoCorp has faced challenges over the past year, with a decline of 22.14%, contrasting sharply wit...

Read MoreHero MotoCorp Faces Mixed Momentum Amidst Challenging Market Conditions

2025-03-25 09:20:04Hero MotoCorp, a prominent player in the Automobile Two & Three Wheelers industry, has shown notable activity today, with its stock price opening at Rs 3,655. The stock has underperformed the sector by 0.43%, reflecting a challenging market environment. Currently, the stock is trading above its 5-day moving average but remains below its 20-day, 50-day, 100-day, and 200-day moving averages, indicating mixed short-term momentum. With a market capitalization of Rs 72,714.94 crore, Hero MotoCorp maintains a price-to-earnings (P/E) ratio of 17.47, significantly lower than the industry average of 35.67. The company also boasts a high dividend yield of 3.86%, which may appeal to income-focused investors. In terms of performance metrics, Hero MotoCorp has faced a decline of 22.41% over the past year, contrasting sharply with the Sensex's gain of 7.52%. Year-to-date, the stock has decreased by 12.65%, while the Se...

Read MoreIntimation Under Regulation 30 Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

03-Apr-2025 | Source : BSEPlease find enclosed herewith the intimation made by the Company under Regulation 30 read with Schedule III of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015.

Announcement under Regulation 30 (LODR)-Press Release / Media Release

02-Apr-2025 | Source : BSEPlease find enclosed herewith a copy of the Press Release being issued by the Company.

Closure of Trading Window

25-Mar-2025 | Source : BSEPlease be informed that the trading window for dealing in securities of the Company will remain closed from Tuesday April 1 2025 till 48 hours after the declaration of the financial results for the quarter and financial year ending on March 31 2025.

Corporate Actions

No Upcoming Board Meetings

Hero MotoCorp Ltd. has declared 5000% dividend, ex-date: 12 Feb 25

No Splits history available

No Bonus history available

No Rights history available