HFCL Faces Mixed Technical Trends Amidst Competitive Market Challenges

2025-04-03 08:03:48HFCL, a midcap player in the telecommunication equipment industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 81.77, showing a slight increase from the previous close of 80.81. Over the past year, HFCL has experienced a decline of 17.45%, contrasting with a 3.67% gain in the Sensex, highlighting the challenges faced by the company in a competitive landscape. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but lacks a definitive trend on a monthly scale. Bollinger Bands and KST also reflect a mildly bearish stance, suggesting caution in the short term. In terms of returns, HFCL has shown a notable performance over the long term, with a st...

Read MoreHFCL Ltd Sees Significant Open Interest Surge Amidst Declining Stock Performance

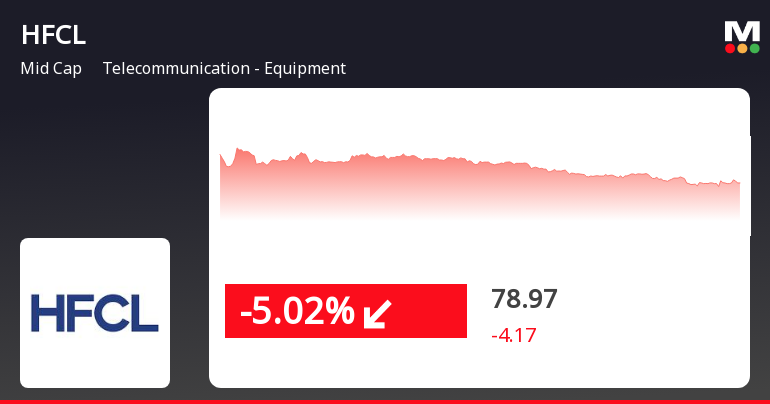

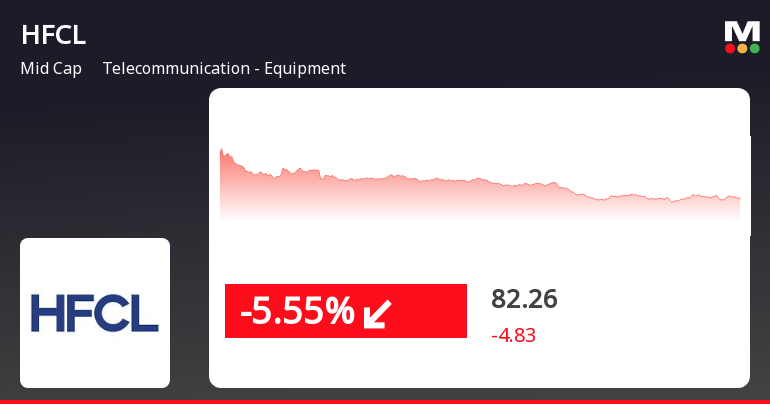

2025-03-26 15:00:29HFCL Ltd, a mid-cap player in the telecommunication equipment industry, has experienced a notable increase in open interest today. The latest open interest stands at 26,818 contracts, reflecting a rise of 2,462 contracts or 10.11% from the previous open interest of 24,356. The trading volume for the day reached 11,308 contracts, contributing to a futures value of approximately Rs 21,683.91 lakhs and an options value of Rs 1,777.41 crores, culminating in a total value of Rs 22,251.91 lakhs. In terms of price performance, HFCL is currently trading 4.51% away from its 52-week low of Rs 77. The stock has been under pressure, recording a decline of 5.06% over the past two days. It is also trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a challenging trend. Despite these challenges, there has been a notable rise in delivery volume, which increased by 47.45% compared to t...

Read MoreHFCL Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-25 08:03:20HFCL, a midcap player in the telecommunication equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 84.95, showing a notable increase from the previous close of 82.97. Over the past year, HFCL has experienced a decline of 7.71%, contrasting with a 7.07% gain in the Sensex, indicating a challenging performance relative to the broader market. In terms of technical indicators, the weekly MACD and KST are both bearish, while the monthly metrics show a mildly bearish trend. The Relative Strength Index (RSI) presents a more favorable picture with bullish readings on both weekly and monthly scales. However, moving averages and Bollinger Bands suggest a bearish sentiment in the short term. Despite recent fluctuations, HFCL has demonstrated resilience over longer periods, with a remarkable 883.22% return over the past five years, s...

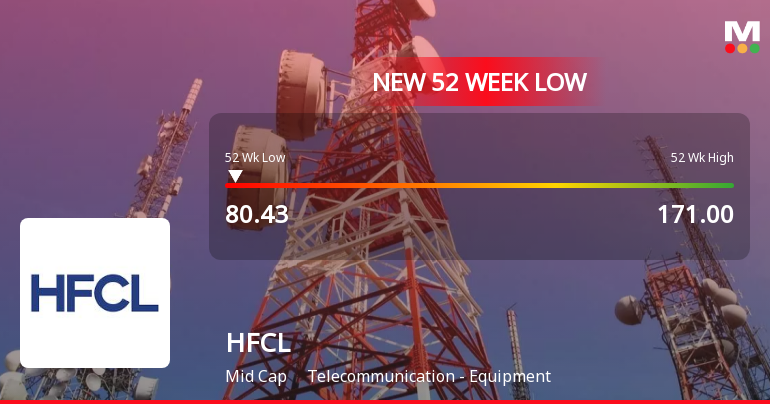

Read MoreHFCL Faces Mixed Technical Trends Amidst Market Underperformance and Volatility Concerns

2025-03-19 08:02:55HFCL, a midcap player in the telecommunication equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 80.43, showing a slight increase from the previous close of 77.64. Over the past year, HFCL has experienced a decline of 10.68%, contrasting with a 3.51% gain in the Sensex, highlighting a notable underperformance relative to the broader market. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) indicates bullish momentum on both weekly and monthly scales, suggesting some resilience in the stock's performance. However, the Bollinger Bands and KST metrics reflect a mildly bearish stance, indicating potential volatility. HFCL's stock performance over various time frames reveals a significant ...

Read More

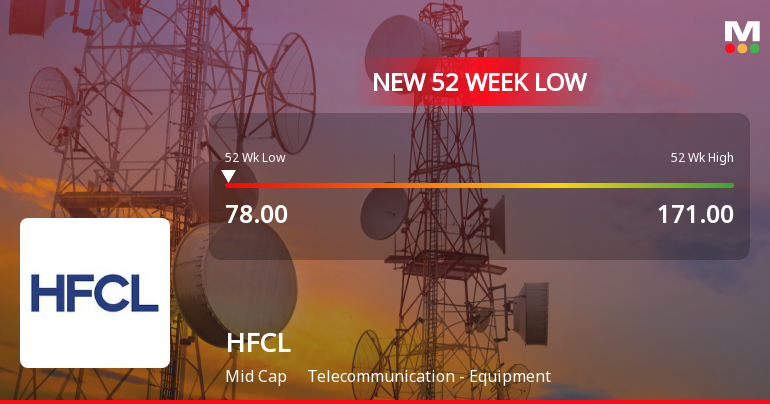

HFCL Faces Significant Challenges Amidst Sustained Downward Trend in Telecom Sector

2025-03-03 09:36:33HFCL, a midcap telecommunications equipment firm, has hit a new 52-week low, reflecting significant volatility and a 13.44% decline over the past six days. The stock has underperformed its sector and is trading below all major moving averages, indicating ongoing challenges in the market.

Read More

HFCL Stock Hits New Low Amid Broader Telecom Sector Decline

2025-02-28 13:05:21HFCL, a midcap telecommunications equipment company, has seen its stock price drop significantly, reaching a new 52-week low. The stock has declined 12.7% over the past five days and 15.93% in the last month, underperforming both its sector and the broader market indices.

Read More

HFCL Hits 52-Week Low Amidst Ongoing Downward Trend and Sector Resilience

2025-02-28 09:37:31HFCL, a midcap telecommunications equipment company, has reached a new 52-week low, continuing a downward trend with a 9.7% decline over five days. Despite this, it has outperformed its sector slightly today. Over the past year, HFCL's stock has decreased by 22.68%, contrasting with the Sensex's modest gain.

Read More

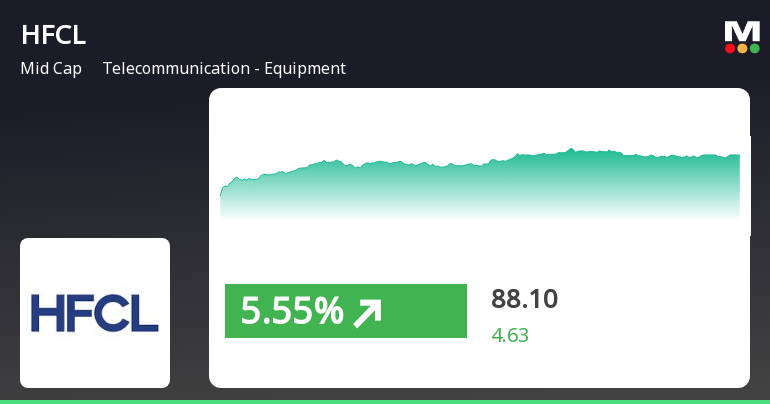

HFCL Shows Strong Daily Performance Amid Broader Sector Gains and Long-Term Challenges

2025-02-19 12:10:30HFCL, a midcap telecommunications equipment company, experienced significant activity on February 19, 2025, outperforming its sector. Despite today's gains, the stock remains below its moving averages across multiple time frames and has declined over the past month, contrasting with the broader market's slight decrease.

Read More

HFCL Faces Significant Stock Decline Amid Broader Market Weakness and Sector Underperformance

2025-02-18 13:05:32HFCL, a midcap telecommunications equipment firm, has seen a notable decline in stock performance, trading near its 52-week low. The company has underperformed both its sector and the broader market over the past month, with significant drops in its stock price and trading below key moving averages.

Read MoreChange In The Senior Management Personnel Of The Company - Retirement Of Mr. Nand Lal Garg President- Supply Chain

31-Mar-2025 | Source : BSEIn terms of Regulation 30 read with Para A of Part A of Schedule III to the SEBI Listing Regulations we wish to inform you that Mr. Nand Lal Garg President- Supply Chain a Senior Management Personnel of the Company has retired from services of the Company w.e.f. the closing of business hours of March 31 2025. The details as required under SEBI Master Circular No. SEBI/HO/CFD/PoD2/CIR/P/0155 dated November 11 2024 read with SEBI Circular no. SEBI/HO/CFD/CFD-PoD-2/CIR/P/2024/185 dated December 31 2024 are as per attached letter. However he will continue to discharge his role and functions in the capacity of strategic advisor of the Company.

Intimation Of ESG Rating By SES ESG Research Private Limited

29-Mar-2025 | Source : BSEIn terms of Regulation 30 read with Para A of Part A of Schedule III to the SEBI Listing Regulations read with SEBI Master Circular No. SEBI/HO/CFD/PoD2/CIR/P/0155 dated November 11 2024 and SEBI Circular no. SEBI/HO/CFD/CFD-PoD-2/CIR/P/2024/185 dated December 31 2024 we wish to inform that SES ESG Research Private Limited (SES) has assigned an Environmental Social and Governance (ESG) Score (Adjusted) of 70.9 for the Company vide its report received by the Company on March 28 2025. Please note that the Company has not engaged SES for ESG Rating. SES has independently prepared the report based on data pertaining to FY 2023-24 of the Company available in public domain.

Intimation Of ESG Rating By SES ESG Research Private Limited

29-Mar-2025 | Source : BSEIn terms of Regulation 30 read with Para A of Part A of Schedule III to the SEBI Listing Regulations read with SEBI Master Circular No. SEBI/HO/CFD/PoD2/CIR/P/0155 dated November 11 2024 and SEBI Circular no. SEBI/HO/CFD/CFD-PoD-2/CIR/P/2024/185 dated December 31 2024 we wish to inform that SES ESG Research Private Limited (SES) has assigned an Environmental Social and Governance (ESG) Score (Adjusted) of 70.9 for the Company vide its report received by the Company on March 28 2025. Please note that the Company has not engaged SES for ESG Rating. SES has independently prepared the report based on data pertaining to FY 2023-24 of the Company available in public domain.

Corporate Actions

No Upcoming Board Meetings

HFCL Ltd has declared 20% dividend, ex-date: 23 Sep 24

No Splits history available

No Bonus history available

No Rights history available