Hikal's Strong Performance Highlights Resilience in Pharmaceuticals Amid Market Gains

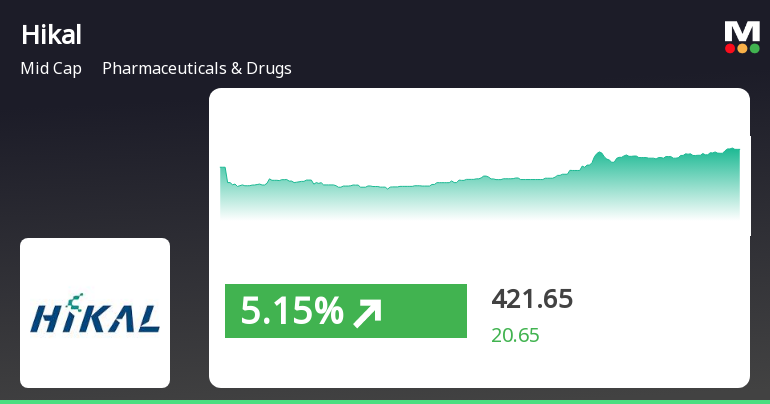

2025-04-02 12:45:20Hikal, a midcap pharmaceutical company, experienced notable trading activity on April 2, 2025, with a significant intraday gain. The stock has shown a consistent upward trend over the past two days and is currently positioned above key moving averages, reflecting strong market performance compared to broader indices.

Read MoreHikal's Technical Trends Indicate Strong Momentum Amid Market Dynamics

2025-03-19 08:00:23Hikal, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 401.45, showing a notable increase from the previous close of 384.35. Over the past year, Hikal has demonstrated a robust performance with a return of 49.15%, significantly outperforming the Sensex, which recorded a return of 3.51% during the same period. The technical summary indicates a generally positive outlook, with bullish signals observed in both weekly and monthly MACD and Bollinger Bands. However, the KST shows a mixed picture, with a bearish weekly signal contrasted by a bullish monthly trend. The moving averages also reflect a bullish stance on a daily basis, suggesting a favorable short-term momentum. In terms of stock performance, Hikal has shown resilience, particularly over the last five years, achieving a r...

Read More

Hikal's Strong Performance Highlights Divergence from Sector Trends in February 2025

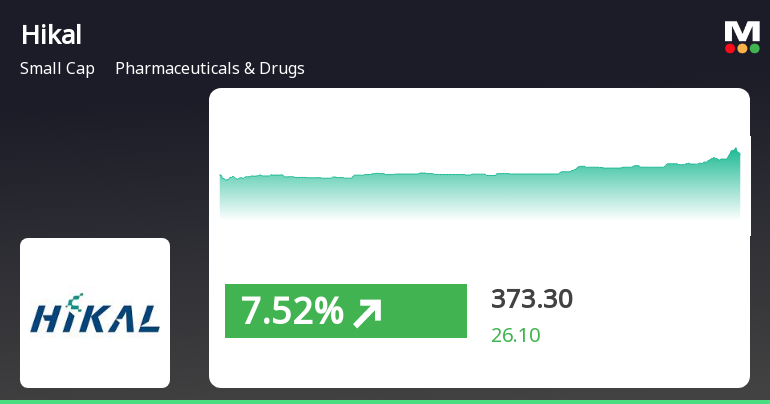

2025-02-05 15:15:16Hikal, a small-cap company in the Pharmaceuticals & Drugs sector, experienced significant trading activity on February 5, 2025, outperforming its peers. The stock's current price exceeds its short-term moving averages, while it lags behind in the medium term. Recent performance metrics indicate a mixed outlook compared to the broader market.

Read More

Hikal's Strong Performance Highlights Divergence from Sector Trends in February 2025

2025-02-05 15:15:16Hikal, a small-cap company in the Pharmaceuticals & Drugs sector, experienced significant trading activity on February 5, 2025, outperforming its peers. The stock's current price exceeds its short-term moving averages, while it lags behind in the medium term. Recent performance metrics indicate a mixed outlook compared to the broader market.

Read More

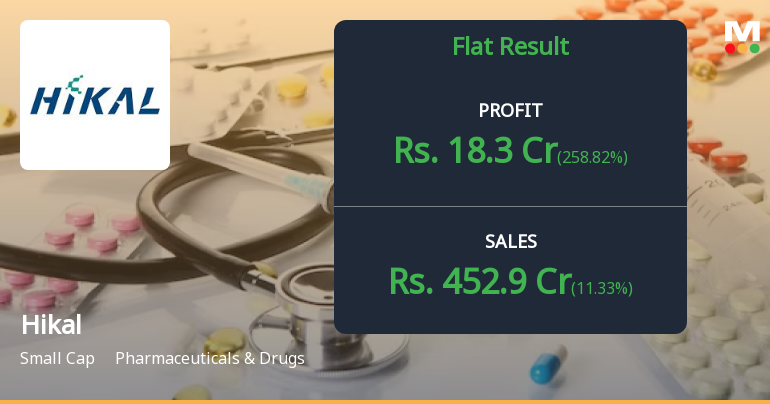

Hikal Reports Flat Q3 FY24-25 Results Amid Rising Costs and Evaluation Adjustments

2025-02-04 17:48:02Hikal has reported flat financial performance for Q3 FY24-25, with a notable adjustment in its evaluation score. The company maintains a commendable debt-equity ratio of 0.64, reflecting prudent financial management. However, it faces challenges with declining profit before and after tax, alongside rising interest costs. Non-operating income has reached a five-quarter high, though its sustainability is uncertain.

Read MoreAnnouncement under Regulation 30 (LODR)-Cessation

09-Apr-2025 | Source : BSEIntimation about cessation of employment of Mr. Dharmesh Panchal as Chief Technology Officer of the Company with effect from close of business hours on April 09 2025.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025

Closure of Trading Window

24-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

Hikal Ltd has declared 30% dividend, ex-date: 07 Feb 25

Hikal Ltd has announced 2:10 stock split, ex-date: 27 Feb 15

Hikal Ltd has announced 1:2 bonus issue, ex-date: 22 Jun 18

No Rights history available