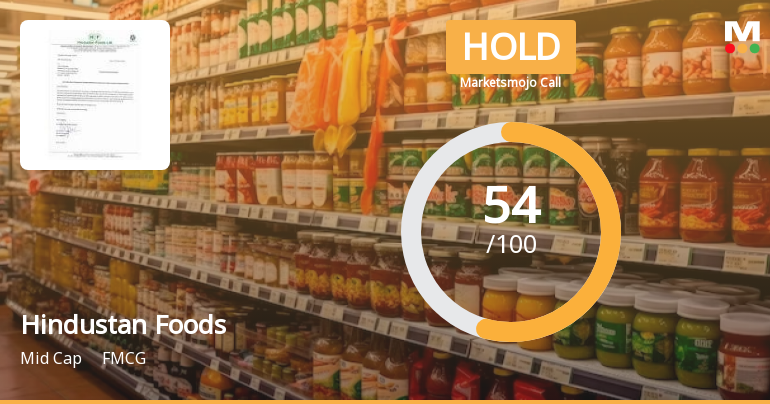

Hindustan Foods Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-02 08:02:11Hindustan Foods, a midcap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 549.50, down from a previous close of 565.85, with a 52-week high of 685.70 and a low of 461.80. Today's trading saw a high of 566.80 and a low of 545.00. In terms of technical indicators, the weekly MACD shows a mildly bullish trend, while the monthly perspective indicates a mildly bearish stance. The Relative Strength Index (RSI) presents no signals for both weekly and monthly evaluations. Bollinger Bands are mildly bullish on both timeframes, suggesting some stability in price movements. Moving averages indicate a mildly bearish trend on a daily basis, while the KST shows a mildly bullish trend weekly and bullish monthly. When comparing the stock's performance to the Sensex, Hindustan Foods has demonstrated resilience. Over the past ...

Read MoreHindustan Foods Adjusts Valuation Grade Amid Strong Financial Performance and Market Position

2025-04-02 08:00:34Hindustan Foods, a midcap player in the FMCG sector, has recently undergone a valuation adjustment, reflecting its strong financial metrics and market position. The company currently boasts a PE ratio of 61.83 and an EV to EBITDA ratio of 25.46, indicating robust earnings relative to its valuation. Additionally, its PEG ratio stands at 5.65, suggesting a significant growth expectation compared to its earnings. In terms of return on capital employed (ROCE) and return on equity (ROE), Hindustan Foods reports figures of 13.02% and 13.50%, respectively, highlighting effective management of its resources. The company's performance over various time frames shows resilience, with a year-to-date return of 5.51%, outperforming the Sensex, which has seen a decline of 2.71% in the same period. When compared to its peers, Hindustan Foods demonstrates a competitive edge, particularly in its valuation metrics. For inst...

Read MoreHindustan Foods Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-01 08:00:48Hindustan Foods, a midcap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 565.85, showing a notable increase from the previous close of 550.00. Over the past week, the stock has reached a high of 571.10 and a low of 550.00, indicating some volatility. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands indicate bullish trends on both weekly and monthly charts, suggesting potential upward momentum. Additionally, the KST and OBV metrics also reflect a mildly bullish stance on a weekly basis, reinforcing the stock's positive technical outlook. When comparing the performance of Hindustan Foods to the Sensex, the company has demonstrated impressive returns across various time frames. Over th...

Read MoreHindustan Foods Adjusts Evaluation Amid Mixed Technical Trends and Market Dynamics

2025-03-25 08:01:14Hindustan Foods, a midcap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 554.70, slightly down from the previous close of 555.00. Over the past year, Hindustan Foods has demonstrated a robust performance, with a return of 14.27%, significantly outpacing the Sensex's 7.07% during the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly outlook indicates a mildly bearish trend. The Bollinger Bands show a mildly bullish trend on a weekly basis and a bullish stance monthly, indicating some volatility in price movements. The daily moving averages reflect a mildly bearish position, suggesting mixed signals in the short term. Hindustan Foods has shown impressive long-term returns, with a staggering 6903.79% return over the past decade, compared to th...

Read MoreHindustan Foods Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-24 08:00:25Hindustan Foods, a midcap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 555.00, having seen fluctuations with a previous close of 564.25. Over the past year, Hindustan Foods has demonstrated a robust performance, achieving a return of 14.62%, significantly outpacing the Sensex, which returned 5.87% in the same period. The technical summary indicates a mixed outlook, with the MACD showing a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Bollinger Bands and KST metrics suggest a bullish sentiment in both weekly and monthly evaluations, contrasting with the daily moving averages that indicate a mildly bearish stance. In terms of stock performance, Hindustan Foods has shown resilience, particularly over longer time frames, with a staggering 565.87% return over th...

Read MoreHindustan Foods Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-20 08:00:46Hindustan Foods, a midcap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 550.00, showing a slight increase from the previous close of 544.00. Over the past year, Hindustan Foods has demonstrated a robust performance with a return of 13.55%, significantly outperforming the Sensex, which recorded a return of 4.77% in the same period. The technical summary indicates a mixed outlook, with the MACD showing mildly bullish signals on a weekly basis, while the monthly perspective leans mildly bearish. The Bollinger Bands present a bullish stance for both weekly and monthly evaluations, suggesting some positive momentum. However, moving averages indicate a mildly bearish trend on a daily basis, reflecting short-term challenges. In terms of stock performance, Hindustan Foods has shown resilience, particularly over lon...

Read MoreHindustan Foods Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-19 08:00:49Hindustan Foods, a midcap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 544.00, showing a slight increase from the previous close of 542.00. Over the past year, Hindustan Foods has demonstrated a robust performance, with a return of 11.92%, significantly outperforming the Sensex, which recorded a return of 3.51% in the same period. The technical summary indicates mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) remains neutral, indicating no significant momentum in either direction. Bollinger Bands reflect a bullish stance weekly, contrasting with a sideways trend monthly. Moving averages suggest a mildly bearish sentiment on a daily basis, while the KST ind...

Read More

Hindustan Foods Shows Strong Financial Growth Amidst Stable Market Conditions

2025-03-18 08:03:02Hindustan Foods has recently adjusted its evaluation, reflecting strong financial performance with net sales of Rs 1,762.93 crore and significant cash reserves. The company has seen increased institutional investment, indicating confidence in its fundamentals, while maintaining a stable technical trend and attractive valuation metrics.

Read MoreHindustan Foods Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-18 08:00:44Hindustan Foods, a midcap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 542.00, showing a slight increase from the previous close of 532.25. Over the past year, Hindustan Foods has demonstrated a robust performance with a return of 11.71%, significantly outperforming the Sensex, which recorded a return of 2.10% during the same period. The technical summary indicates a mixed outlook, with the MACD showing mildly bullish signals on a weekly basis while reflecting a mildly bearish trend monthly. The Bollinger Bands suggest a bullish stance weekly, contrasting with a sideways trend monthly. Notably, the stock's moving averages indicate a mildly bearish position on a daily basis, while the KST shows mildly bullish signals weekly and bullish monthly. In terms of returns, Hindustan Foods has consistently outperfor...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSEPlease refer to attached PDF file.

Announcement Under Regulation 30 (LODR)

08-Apr-2025 | Source : BSEPlease refer attached PDF file.

Closure of Trading Window

27-Mar-2025 | Source : BSEPlease refer to attached PDF file.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Hindustan Foods Ltd has announced 2:10 stock split, ex-date: 21 Jul 22

No Bonus history available

No Rights history available