Hindustan Oil Exploration Faces Technical Trend Shifts Amid Market Volatility

2025-04-02 08:01:39Hindustan Oil Exploration Company, a player in the oil exploration and refinery sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 175.45, showing a slight increase from the previous close of 170.25. Over the past year, the stock has experienced a high of 293.60 and a low of 158.90, indicating significant volatility. In terms of technical indicators, the weekly MACD suggests a bearish sentiment, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly periods, indicating a lack of momentum. Bollinger Bands also reflect a mildly bearish trend on both weekly and monthly scales. Daily moving averages are bearish, while the KST indicates a mildly bullish trend on a weekly basis but shifts to mildly bearish monthly. When comparing the company's performance to t...

Read MoreHindustan Oil Exploration Faces Bearish Technical Trends Amid Market Volatility

2025-03-07 08:01:03Hindustan Oil Exploration Company, a small-cap player in the oil exploration and refinery sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 178.35, down from a previous close of 181.85, with a notable 52-week high of 293.60 and a low of 156.85. Today's trading saw a high of 187.05 and a low of 177.75, indicating some volatility. The technical summary reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands and moving averages also reflect bearish conditions, suggesting a challenging environment for the stock. The KST indicator presents a mildly bullish weekly trend but is mildly bearish on a monthly basis, indicating mixed signals. In terms of performance, Hindustan Oil Exploration's returns have lagged behind the...

Read MoreHindustan Oil Exploration Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-03 08:01:27Hindustan Oil Exploration Company, a small-cap player in the oil exploration and refinery sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 180.10, down from a previous close of 184.75, with a notable 52-week high of 293.60 and a low of 156.85. Today's trading saw a high of 184.00 and a low of 175.50. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis but shifts to mildly bearish on a monthly scale. The Relative Strength Index (RSI) presents no signals for both weekly and monthly periods, while Bollinger Bands and daily moving averages indicate a bearish stance. The KST reflects a mildly bullish trend weekly but aligns with a bearish outlook monthly. In terms of returns, Hindustan Oil Exploration has faced challenges compared to the Sense...

Read MoreHindustan Oil Exploration Faces Mixed Technical Signals Amid Market Evaluation Revision

2025-03-02 08:01:26Hindustan Oil Exploration Company, a small-cap player in the oil exploration and refinery sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 180.10, down from a previous close of 184.75, with a notable 52-week high of 293.60 and a low of 156.85. Today's trading saw a high of 184.00 and a low of 175.50. The technical summary indicates mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis but shifts to mildly bearish on a monthly scale. The Relative Strength Index (RSI) presents no clear signals for both weekly and monthly assessments. Bollinger Bands and moving averages indicate bearish trends, while the KST reflects a mildly bullish weekly outlook but is mildly bearish monthly. In terms of performance, Hindustan Oil Exploration's returns have varied significantly compared to the Sensex. O...

Read MoreHindustan Oil Exploration Faces Mixed Technical Signals Amid Market Dynamics

2025-03-01 08:01:24Hindustan Oil Exploration Company, a player in the oil exploration and refineries sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 180.10, down from a previous close of 184.75, with a notable 52-week high of 293.60 and a low of 156.85. Today's trading saw a high of 184.00 and a low of 175.50. The technical summary indicates mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) presents no clear signals for both weekly and monthly assessments. Bollinger Bands and moving averages indicate bearish trends, suggesting caution in the short term. In terms of performance, Hindustan Oil Exploration's returns have varied significantly over different periods. Over the past week, the stock has returned ...

Read MoreHindustan Oil Exploration Faces Mixed Technical Signals Amid Market Volatility

2025-02-25 10:27:14Hindustan Oil Exploration Company, a small-cap player in the oil exploration and refinery sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 193.45, showing a slight increase from the previous close of 192.15. Over the past year, the stock has experienced a decline of 4.04%, contrasting with a 2.05% gain in the Sensex, indicating a challenging performance relative to broader market trends. The technical summary reveals mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis but leans mildly bearish on a monthly scale. Meanwhile, the Bollinger Bands and daily moving averages suggest bearish conditions. The KST presents a mildly bullish outlook weekly, yet remains mildly bearish monthly, highlighting the volatility in the stock's performance. In terms of returns, Hindustan Oil Exploration has...

Read MoreHindustan Oil Exploration Adjusts Valuation Amid Competitive Market Dynamics

2025-02-25 10:22:40Hindustan Oil Exploration Company has recently undergone a valuation adjustment, reflecting changes in its financial metrics and market position within the oil exploration and refinery sector. The company's current price stands at 193.75, slightly above the previous close of 192.15, with a 52-week range between 156.85 and 293.60. Key financial indicators reveal a PE ratio of 18.23 and an EV to EBITDA ratio of 10.46, suggesting a competitive stance in the market. The company's return on capital employed (ROCE) is reported at 13.20%, while the return on equity (ROE) is at 11.63%. These metrics highlight the company's operational efficiency and profitability. In comparison to its peers, Hindustan Oil Exploration's valuation metrics indicate a relatively favorable position. For instance, Deep Industries is noted for a higher PE ratio of 20.47, while Jindal Drilling presents a lower PE at 17.35. Additionally, ...

Read More

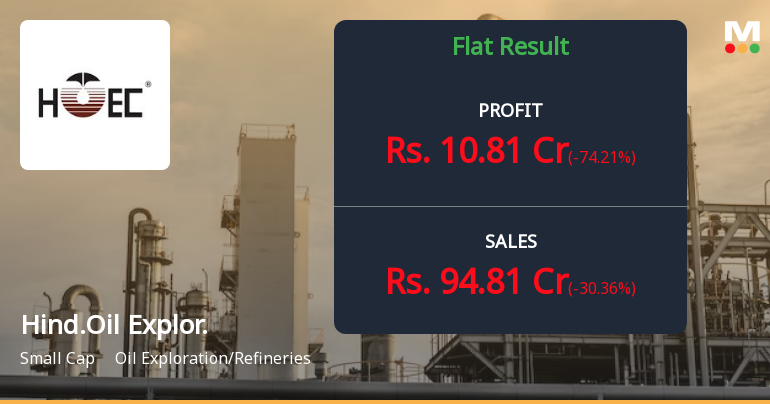

Hindustan Oil Exploration Reports Flat Q3 FY24-25 Results Amid Mixed Financial Trends

2025-02-05 10:02:40Hindustan Oil Exploration Company has announced its financial results for Q3 FY24-25, showing a flat performance. Key highlights include a significant improvement in the operating profit to interest ratio and a notable increase in profit before tax. However, net sales have declined, indicating potential challenges ahead.

Read MoreSubmission Of Information Pursuant To Regulation 30 Of SEBI (LODR) Regulations 2015

03-Apr-2025 | Source : BSEUpdate on Block B-80 is submitted herewith.

Closure of Trading Window

31-Mar-2025 | Source : BSEPursuant to SEBI (Prohibition of Insider Trading) Regulations 2015 it is informed that the Trading window shall be closed from April 1 2025 till 48 hours after the declaration of audited standalone and consolidated financial results for the quarter and financial year ending March 31 2025

Shareholder Meeting / Postal Ballot-Scrutinizers Report

10-Mar-2025 | Source : BSEResult of Postal Ballot (Remote E-Voting) as per Regulation 44 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 and submission of Scrutinizers Report.

Corporate Actions

No Upcoming Board Meetings

Hindustan Oil Exploration Company Ltd has declared 5% dividend, ex-date: 23 Aug 10

No Splits history available

No Bonus history available

Hindustan Oil Exploration Company Ltd has announced 2:3 rights issue, ex-date: 15 Nov 07