Hisar Metal Industries Faces Financial Challenges Amidst Market Resilience and Evaluation Adjustments

2025-03-19 08:03:14Hisar Metal Industries, a microcap in the steel sector, has recently adjusted its evaluation amid ongoing financial struggles, including declining profits and negative growth trends. Despite these challenges, the company has shown resilience with an 11.46% stock return over the past year, outperforming the BSE 500 index.

Read More

Hisar Metal Industries Faces Financial Challenges Amid Market Reassessment and Declining Profits

2025-03-13 08:02:54Hisar Metal Industries has undergone a recent evaluation adjustment, indicating a reassessment of its financial standing. The company faces challenges with debt management and declining operating profits, having reported negative results for eight consecutive quarters. Despite these issues, it retains an attractive valuation relative to its peers.

Read More

Hisar Metal Industries Faces Financial Struggles Amidst Valuation Opportunities and Debt Challenges

2025-03-10 08:03:16Hisar Metal Industries, a microcap in the steel sector, has recently adjusted its evaluation amid ongoing financial challenges, including a significant profit decline and negative results for eight consecutive quarters. Despite these issues, the company shows an attractive valuation and faces difficulties in managing its debt levels.

Read More

Hisar Metal Industries Faces Financial Struggles Amid Declining Performance Metrics

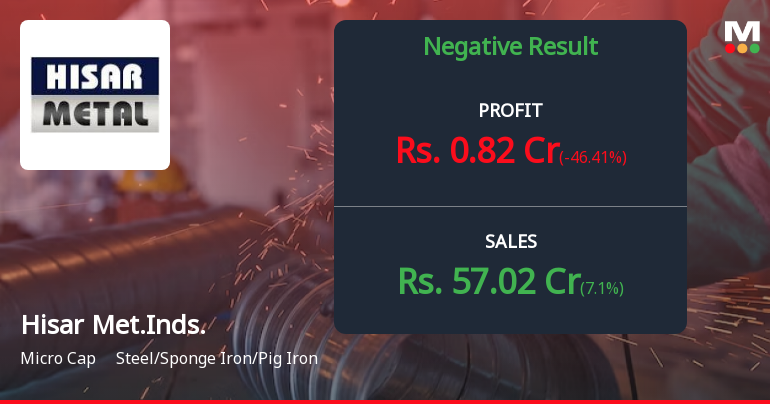

2025-03-03 18:35:44Hisar Metal Industries, a microcap in the steel sector, has faced significant financial challenges, including a high Debt to EBITDA ratio and declining operating profits. The company has reported negative results for eight quarters, with a notable drop in profit after tax, raising concerns about its long-term growth potential.

Read MoreHisar Metal Industries Shows Mixed Technical Trends Amid Market Challenges

2025-02-25 10:31:29Hisar Metal Industries, a microcap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 187.75, slightly down from the previous close of 190.10. Over the past year, the stock has experienced a decline of 9.78%, contrasting with a modest gain of 2.07% in the Sensex during the same period. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a mildly bearish sentiment, while the daily moving averages indicate a mildly bullish trend. The KST shows a bullish signal on a weekly basis, although it remains mildly bearish on a monthly scale. Notably, the stock's performance over longer periods has been more favorable, with a remarkable 962.73% return over the last decade, significantly outpacing the Sensex's 157.37% return. Hisar Metal Industries' recent performan...

Read More

Hisar Metal Industries Faces Financial Challenges Amid Evaluation Adjustment and Declining Profits

2025-02-24 18:18:50Hisar Metal Industries, a microcap in the Steel sector, has recently experienced an evaluation adjustment due to its negative financial performance in Q3 FY24-25. The company reported a significant decline in profits and has faced negative results for eight consecutive quarters, highlighting challenges in its financial landscape.

Read More

Hisar Metal Industries Faces Financial Struggles Amid Declining Profitability and High Debt Levels

2025-02-19 18:57:55Hisar Metal Industries, a microcap in the Steel/Sponge Iron/Pig Iron sector, has faced ongoing financial challenges, including a high Debt to EBITDA ratio and declining operating profits. The company has reported negative results for eight consecutive quarters, with a significant drop in profits and low return on capital employed.

Read More

Hisar Metal Industries Faces Financial Challenges Amid Declining Profits in Q3 FY24-25

2025-02-10 18:43:44Hisar Metal Industries, a microcap in the Steel/Sponge Iron/Pig Iron sector, has recently adjusted its evaluation amid ongoing financial challenges. The company reported a decline in profits for Q3 FY24-25 and has faced negative results for eight consecutive quarters, alongside difficulties in debt servicing.

Read More

Hisar Metal Industries Reports Mixed Financial Results Amidst Declining Profitability Metrics

2025-02-10 13:33:29Hisar Metal Industries has released its financial results for the quarter ending December 2024, highlighting a mixed performance. The company achieved its lowest Debt-Equity Ratio in recent periods, but faced challenges with a significant decline in Profit After Tax and Operating Profit, alongside reduced Earnings per Share and slower Debtors Turnover Ratio.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Reg. 74(5) of SEBI (DP) Regulations 2018

Compliance Certificate For The Year Ended On March 31 2025-Regulation 40(9) &40(10)

08-Apr-2025 | Source : BSEReg 40 (10)-Compliance Certificate

Format of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

07-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Hisar Metal Industries Ltd- |

| 2 | CIN NO. | L74899HR1990PLC030937 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 22.59 |

| 4 | Highest Credit Rating during the previous FY | NIL |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | Not Applicable |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | NSE |

Designation: Company Secretary and Compliance Officer

EmailId: vchugh@hisarmetal.com

Designation: CFO

EmailId: rsbansal@hisarmetal.com

Date: 07/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Corporate Actions

No Upcoming Board Meetings

Hisar Metal Industries Ltd has declared 10% dividend, ex-date: 09 Sep 24

No Splits history available

Hisar Metal Industries Ltd has announced 1:2 bonus issue, ex-date: 09 Aug 16

No Rights history available