HMA Agro Industries Sees Surge in Trading Activity Amid Sector Outperformance

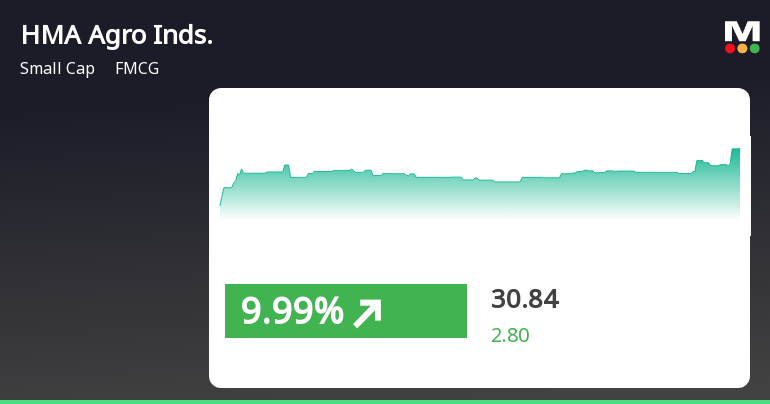

2025-04-02 10:01:51HMA Agro Industries Ltd, a small-cap player in the FMCG sector, has experienced significant trading activity today, hitting its upper circuit limit with a high price of Rs 30.92. The stock closed at Rs 30.5, reflecting a change of Rs 2.39, which translates to a percentage increase of 8.5%. Throughout the trading session, the stock recorded a low of Rs 27.75 and a total traded volume of approximately 4.29 lakh shares, resulting in a turnover of Rs 1.28 crore. Notably, HMA Agro Industries outperformed its sector by 1.97%, while the broader market, represented by the Sensex, saw a modest gain of 0.29%. In terms of moving averages, the stock is currently above its 5-day moving average but remains below the 20-day, 50-day, 100-day, and 200-day averages. However, it is important to note that investor participation has seen a decline, with delivery volume dropping by 55.74% compared to the 5-day average. Overa...

Read More

HMA Agro Industries Shows Resilience Amid Broader Market Decline and Long-Term Challenges

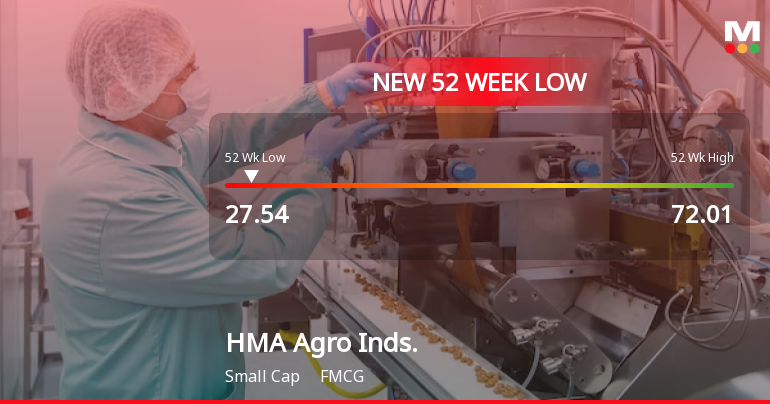

2025-04-01 15:20:33HMA Agro Industries saw a significant increase on April 1, 2025, after five days of decline, reaching an intraday high of Rs 30.3. Despite this uptick, the stock remains below key moving averages and has experienced notable declines over the past week, month, and year, hitting a new 52-week low.

Read More

HMA Agro Industries Hits 52-Week Low Amid Broader Market Decline and Profitability Concerns

2025-04-01 12:02:16HMA Agro Industries has hit a new 52-week low amid a five-day losing streak, despite a brief intraday recovery. The stock remains below key moving averages, reflecting a bearish trend. The company faces financial challenges, including a high Debt to EBITDA ratio and low profitability metrics, with no domestic mutual fund investments.

Read More

HMA Agro Industries Faces Financial Struggles Amidst Market Volatility and Debt Concerns

2025-04-01 12:02:15HMA Agro Industries has faced significant volatility, hitting a 52-week low and underperforming the market with a 44.70% decline over the past year. Concerns about its financial health are evident, with a high Debt to EBITDA ratio and stagnant operating profit growth, compounded by a recent drop in profit after tax.

Read More

HMA Agro Industries Faces Financial Struggles Amid Broader Market Decline

2025-04-01 12:02:12HMA Agro Industries has faced significant volatility, reaching a new 52-week low and underperforming the broader market. Concerns about its financial health are highlighted by a high Debt to EBITDA ratio and declining profit after tax. The company's struggles are further underscored by a lack of investment from domestic mutual funds.

Read More

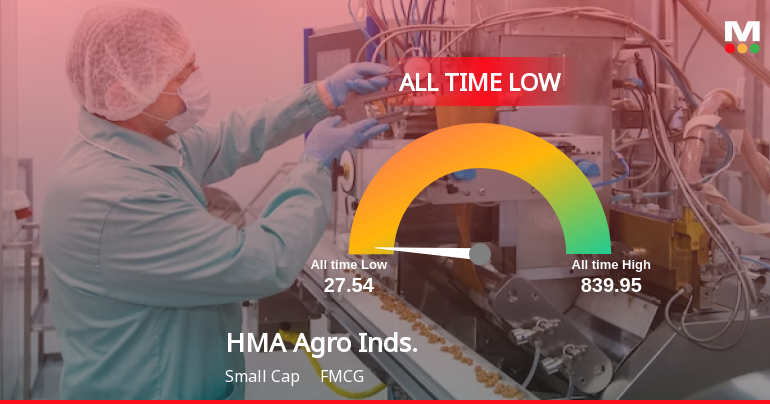

HMA Agro Industries Hits All-Time Low Amid Ongoing Financial Challenges

2025-04-01 11:43:46HMA Agro Industries has faced notable volatility, hitting an all-time low before a brief recovery. Despite a daily gain, the stock has significantly declined over the year. Financial challenges persist, including a high Debt to EBITDA ratio and a decrease in profit, while domestic mutual funds show no investment interest.

Read More

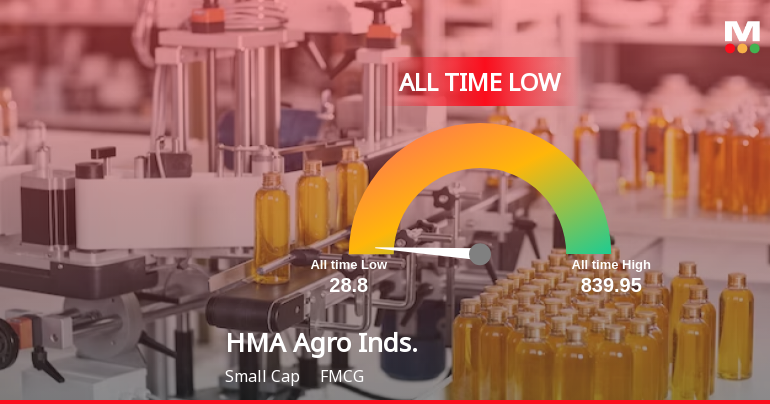

HMA Agro Industries Reaches All-Time Low Amid Ongoing Financial Challenges

2025-03-28 10:32:35HMA Agro Industries has faced notable volatility, hitting an all-time low and underperforming its sector. The stock has declined significantly over the past week and year, trading below key moving averages. Financial challenges include a high Debt to EBITDA ratio and modest growth in operating profit, indicating limited long-term potential.

Read More

HMA Agro Industries Faces Significant Challenges Amid Broader Market Volatility

2025-03-28 10:03:40HMA Agro Industries has faced notable volatility, hitting a 52-week low and experiencing a five-day losing streak. The company's stock performance has significantly lagged behind the sector, with a substantial decline over the past year. Financial indicators reveal challenges, including a high Debt to EBITDA ratio and decreased profits.

Read More

HMA Agro Industries Faces Financial Struggles Amid Broader Market Gains

2025-03-28 10:03:39HMA Agro Industries has faced notable volatility, hitting a 52-week low and underperforming its sector. The company shows a concerning financial outlook, with a high Debt to EBITDA ratio and a decline in profit after tax. Its one-year return significantly lags behind broader market indices.

Read MoreDisclosure under Regulation 30A of LODR

06-Apr-2025 | Source : BSEWe hereby inform that the promoters of the company have entered into the shareholders agreement dated 04th day of April 2025.

Announcement under Regulation 30 (LODR)-Memorandum of Understanding /Agreements

06-Apr-2025 | Source : BSEWe hereby inform that the promoters of the company have entered into the shareholders agreement amongst themselves dated 04th Day of April 2025.

Intimation Under Regulation 30-Recognition As Five Star Export House

04-Apr-2025 | Source : BSEWe hereby submit the Intimation under Regulation 30 for Recognition of the company as the Five Star Export House .

Corporate Actions

No Upcoming Board Meetings

HMA Agro Industries Ltd has declared 30% dividend, ex-date: 20 Sep 24

HMA Agro Industries Ltd has announced 1:10 stock split, ex-date: 29 Dec 23

No Bonus history available

No Rights history available