IFB Industries Faces Technical Challenges Amidst Resilient Long-Term Performance Trends

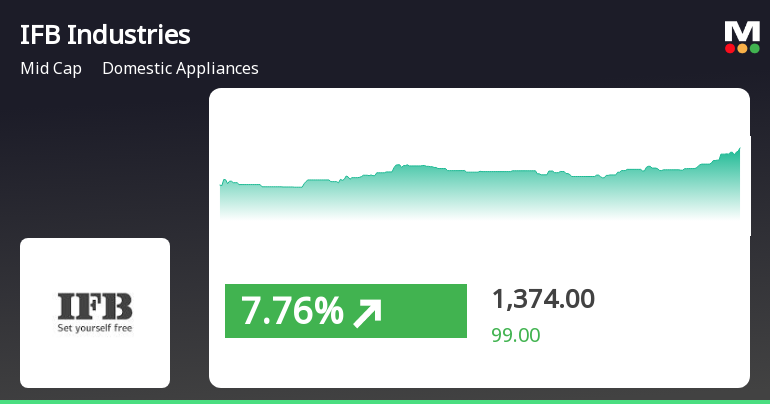

2025-04-03 08:03:42IFB Industries, a midcap player in the domestic appliances sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1294.15, showing a slight increase from the previous close of 1289.85. Over the past year, IFB Industries has experienced a 15.92% decline, contrasting with a 3.67% gain in the Sensex, highlighting the challenges faced by the company in a competitive market. In terms of technical indicators, the MACD and KST metrics indicate a bearish stance on both weekly and monthly assessments, while the moving averages suggest a mildly bearish outlook on a daily basis. The Bollinger Bands also reflect a bearish trend, indicating potential volatility in the stock's performance. Despite these technical challenges, IFB Industries has shown resilience in certain time frames. Over the past month, the stock has returned 20.09%, significantly...

Read MoreIFB Industries Faces Bearish Technical Trends Amidst Mixed Performance Indicators

2025-04-02 08:05:44IFB Industries, a midcap player in the domestic appliances sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1289.85, down from a previous close of 1330.65, with a notable 52-week high of 2,359.00 and a low of 1,020.05. Today's trading saw a high of 1322.95 and a low of 1281.00. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Bollinger Bands and moving averages also reflect bearish conditions, suggesting a cautious outlook. Notably, the KST aligns with this sentiment, indicating bearish trends on a weekly basis and mildly bearish on a monthly basis. In terms of performance, IFB Industries has shown varied returns compared to the Sensex. Over the past week, the stock returned -0.47%, while the Sensex de...

Read More

IFB Industries Shows Strong Short-Term Gains Amid Broader Market Volatility

2025-03-28 13:45:25IFB Industries has experienced notable trading activity, with a significant increase today and a positive trend over the past two days. The stock is currently above its short-term moving averages but below longer-term ones. Despite recent gains, its performance over the last three months and year-to-date shows a decline compared to the broader market.

Read MoreIFB Industries Faces Mixed Technical Trends Amidst Market Evaluation Revision

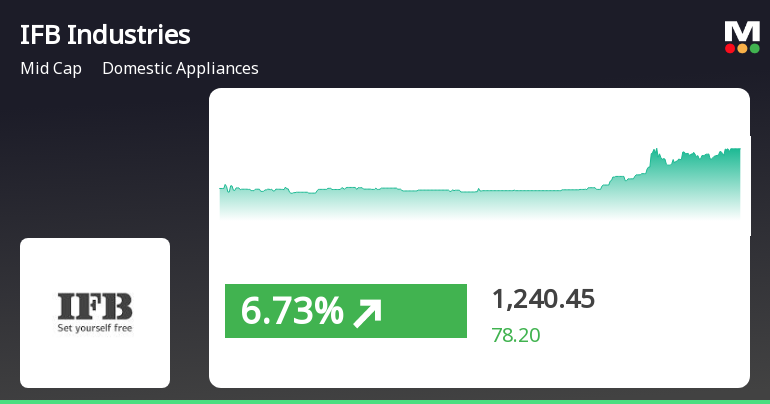

2025-03-24 08:01:25IFB Industries, a midcap player in the domestic appliances sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1260.30, showing a slight increase from the previous close of 1240.45. Over the past year, IFB Industries has experienced a 4.73% decline, contrasting with a 5.87% gain in the Sensex, highlighting a challenging performance relative to the broader market. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands also reflect a mildly bearish sentiment, indicating potential volatility in the stock's price movements. The On-Balance Volume (OBV) suggests a bullish trend on both weekly and monthly scales, which may indicate underlying buying interest despite the overall bearish indicators. Looking at the company's return metrics, IFB Indu...

Read More

IFB Industries Shows Strong Short-Term Gains Amid Mixed Long-Term Performance Trends

2025-03-20 15:45:21IFB Industries experienced notable activity on March 20, 2025, with a significant gain, outperforming the broader market. The stock has shown a strong upward trend over the past week, although it has faced declines in the longer term. Over five years, it has delivered impressive returns compared to the Sensex.

Read MoreIFB Industries Faces Technical Trend Shifts Amidst Market Challenges and Resilience

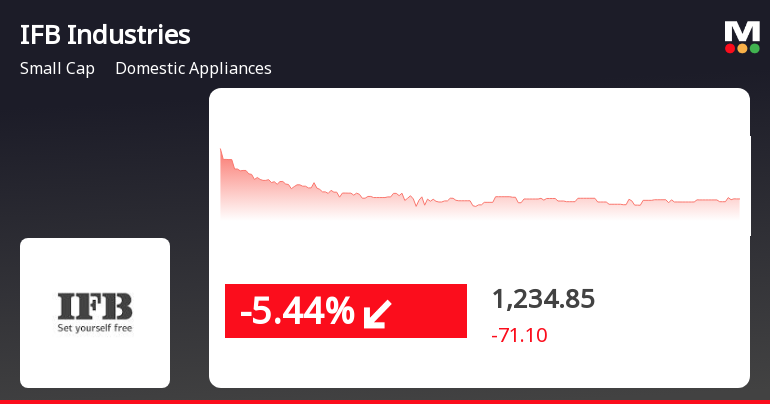

2025-03-20 08:01:53IFB Industries, a small-cap player in the domestic appliances sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1162.25, showing a notable increase from the previous close of 1136.55. Over the past year, IFB Industries has experienced a decline of 10.50%, contrasting with a 4.77% gain in the Sensex, highlighting the challenges faced by the company in the broader market context. In terms of technical indicators, the weekly MACD and KST are both bearish, while the monthly MACD shows a mildly bearish trend. The Relative Strength Index (RSI) presents no signal on a weekly basis but indicates a bullish stance monthly. Moving averages reflect a bearish sentiment on a daily basis, suggesting a cautious outlook. Despite these technical trends, IFB Industries has shown resilience over longer periods, with a remarkable 341.67% return over ...

Read MoreIFB Industries Faces Mixed Technical Trends Amidst Competitive Market Challenges

2025-03-19 08:02:47IFB Industries, a small-cap player in the domestic appliances sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,136.55, showing a notable increase from the previous close of 1,110.00. Over the past year, IFB Industries has experienced a decline of 15.44%, contrasting with a 3.51% gain in the Sensex, highlighting the challenges faced by the company in a competitive landscape. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents no signal on a weekly basis but indicates bullish momentum monthly. Bollinger Bands and KST also reflect a mildly bearish stance, suggesting cautious market sentiment. In terms of returns, IFB Industries has faced significant challenges year...

Read More

IFB Industries Reports Strong Q3 FY24-25 Growth Amid Long-Term Challenges

2025-02-11 19:07:34IFB Industries has recently adjusted its evaluation following a strong financial performance in Q3 FY24-25, with significant growth in profit metrics and a high return on capital employed. Despite these positive results, the company faces challenges in long-term growth and has underperformed against the BSE 500 index.

Read More

IFB Industries Faces Continued Stock Volatility Amid Broader Market Challenges

2025-02-11 10:15:25IFB Industries has faced notable stock volatility, declining for four consecutive days and significantly underperforming its sector. After an initial gain, the stock reversed direction, experiencing a substantial drop over the past month. Currently, it trades below key moving averages, reflecting ongoing bearish trends in the market.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSEWe hereby enclose the certificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulation 2018 for the quarter ended 31st March 2025 as received from the RTA of the company.

Closure of Trading Window

27-Mar-2025 | Source : BSEPursuant to The SEBI (PIT) Regulation 2015 the Trading Window for purchasing /selling or dealing in shares of the company will be closed from 1st April 2025 and it will open after 48 hours from the announcement to stock exchange in connection with the Audited Financial Statement of the company for the quarter and year ended 31st Mach 2025.

Announcement under Regulation 30 (LODR)-Newspaper Publication

25-Mar-2025 | Source : BSEPursuant to Reg 30 of the SEBI (LODR) Regulations2015 please find enclosed the newspaper clippings of the advertisement published on 25th March 2025 in connection with the Notice of the Postal Ballot.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available