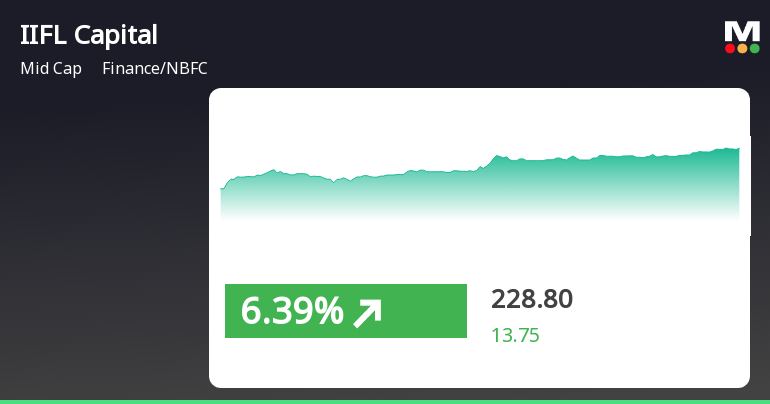

IIFL Capital Services Rebounds After Six-Day Decline Amid Mixed Market Conditions

2025-04-03 11:50:25IIFL Capital Services experienced a notable rebound on April 3, 2025, after six days of decline, gaining 5.91% and reaching an intraday high of Rs 228.35. The stock has outperformed its sector today and has shown a strong monthly gain, despite a decline over the past three months.

Read More

IIFL Capital Services Adjusts Stock Evaluation Amid Strong Fundamentals and Valuation Metrics

2025-04-03 08:12:09IIFL Capital Services has recently adjusted its evaluation, reflecting changes in financial metrics and market position. The stock is currently in a mildly bearish range, yet it maintains strong long-term fundamentals, including a high Return on Equity and consistent operating profit growth, alongside attractive valuation metrics.

Read MoreIIFL Capital Services Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-03 08:06:13IIFL Capital Services, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 215.05, slightly down from its previous close of 216.35. Over the past year, IIFL has shown a notable return of 63.97%, significantly outperforming the Sensex, which recorded a return of 3.67% during the same period. In terms of technical indicators, the weekly MACD and KST are currently bearish, while the monthly assessments show a mildly bearish trend. The Bollinger Bands indicate a mildly bullish stance on a monthly basis, suggesting some volatility in price movements. The daily moving averages remain bearish, indicating a cautious outlook in the short term. When comparing returns, IIFL's performance over three years stands out with a remarkable 133.24% return, compared to the Sensex's 29.25%. This long-term growth tra...

Read MoreIIFL Capital Services Adjusts Valuation Grade Amid Competitive Market Positioning

2025-04-03 08:00:48IIFL Capital Services has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the finance and non-banking financial company (NBFC) sector. The company's price-to-earnings (PE) ratio stands at 8.72, while its price-to-book value is recorded at 3.00. Additionally, the enterprise value to EBITDA ratio is noted at 2.61, indicating a competitive valuation relative to its peers. In terms of performance, IIFL Capital has demonstrated a return on equity (ROE) of 32.31%, showcasing its efficiency in generating profits from shareholders' equity. However, the company has reported negative capital employed, which may raise questions regarding its operational leverage. The dividend yield is currently at 1.39%, providing some return to shareholders. When compared to its peers, IIFL Capital's valuation metrics appear favorable, particularly against companies lik...

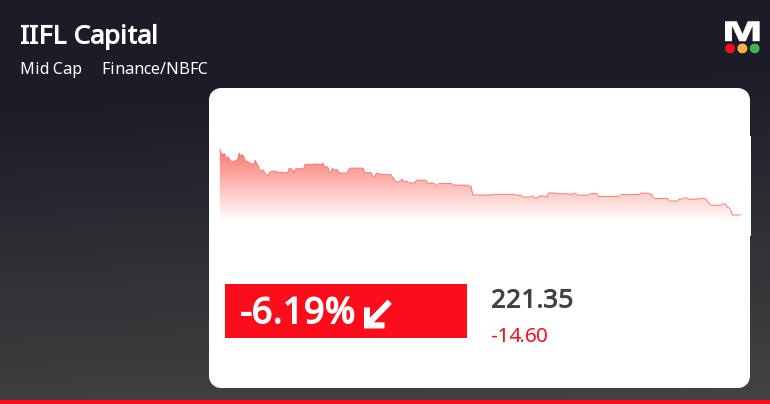

Read MoreIIFL Capital Services Faces Bearish Technical Trends Amid Mixed Performance Indicators

2025-04-02 08:09:40IIFL Capital Services, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 216.35, slightly down from the previous close of 216.65. Over the past year, IIFL has shown a notable return of 68.37%, significantly outperforming the Sensex, which recorded a return of 2.72% in the same period. However, the company's performance has been mixed in shorter time frames. For instance, it has experienced a decline of 33.8% year-to-date, while the Sensex has seen a modest drop of 2.71%. In the last week, IIFL's stock return was -8.31%, compared to the Sensex's -2.55%. Technical indicators present a bearish outlook, with the MACD and KST both signaling bearish trends on a weekly basis. The Bollinger Bands indicate a bearish stance as well, while moving averages also reflect a bearish sentiment. Despite these ...

Read More

IIFL Capital Services Faces Volatility Amidst Mixed Performance Trends and Sector Underperformance

2025-03-26 14:35:26IIFL Capital Services faced notable volatility on March 26, 2025, with a significant decline following two consecutive days of losses. Despite an initial gain, the stock reversed direction, reflecting a day of high fluctuations. Over the past year, it has outperformed the Sensex, but year-to-date performance shows a decline.

Read MoreIIFL Capital Services Experiences Mixed Technical Trends Amid Market Volatility

2025-03-25 08:06:04IIFL Capital Services, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, which closed at 240.50, has shown notable fluctuations, with a 52-week high of 449.00 and a low of 111.85. Today's trading saw the stock reach a high of 253.25 and a low of 222.00, indicating volatility in its performance. The technical summary reveals a mixed outlook across various indicators. The MACD shows a bearish trend on a weekly basis while leaning mildly bearish on a monthly scale. The Bollinger Bands present a mildly bearish signal weekly, contrasting with a bullish stance monthly. Moving averages indicate a mildly bearish trend, while the KST reflects a bearish weekly trend but a bullish monthly outlook. In terms of performance, IIFL Capital Services has outperformed the Sensex over several periods. Over the past week, the stock ret...

Read More

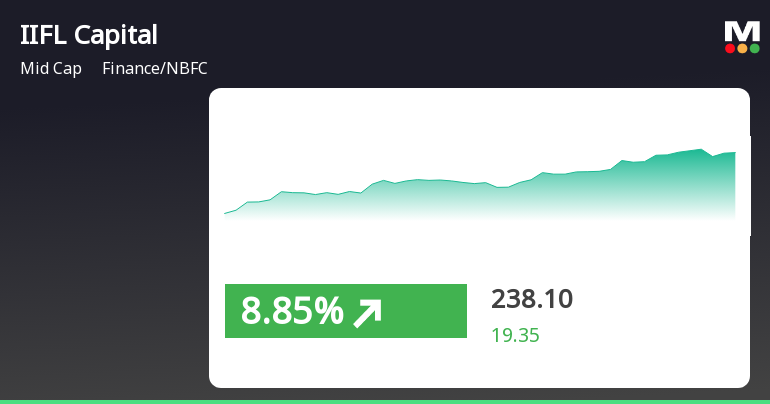

IIFL Capital Services Shows Strong Short-Term Gains Amid Broader Market Rally

2025-03-24 09:35:32IIFL Capital Services has demonstrated notable performance, gaining 5.03% on March 24, 2025, and outperforming its sector. The stock has achieved consecutive gains over five days, totaling 17.82%. Despite strong annual growth, it has faced challenges with a year-to-date decline of 29.36%.

Read More

IIFL Capital Services Faces Valuation Shift Amid Changing Market Sentiment and Technical Indicators

2025-03-24 08:09:27IIFL Capital Services has recently experienced a change in its evaluation, reflecting shifts in technical indicators and valuation metrics. While the company's long-term fundamentals remain strong, including consistent profit growth and high institutional holdings, its current valuation has moved to a more neutral position.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSEWith reference to the captioned subject as required under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 we are enclosing herewith certificate received from the Companys Registrar and Share Transfer Agent for the quarter ended March 31 2025.

Intimation Under Regulation 30 Of Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015

03-Apr-2025 | Source : BSEIntimation under Regulation 30 of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015

Closure of Trading Window

26-Mar-2025 | Source : BSEPursuant to the Companys Code of Conduct for Prevention of Insider Trading the Trading Window for dealing in securities of the Company shall be closed from Tuesday April 01 2025 till 48 hours after the financial results for the quarter and year ended March 31 2025 is approved by the Board of Directors and filed with stock exchanges.

Corporate Actions

No Upcoming Board Meetings

IIFL Capital Services Ltd has declared 150% dividend, ex-date: 17 Feb 25

No Splits history available

No Bonus history available

No Rights history available