IKIO Lighting Adjusts Valuation Amidst Competitive Consumer Electronics Landscape

2025-04-01 08:00:53IKIO Lighting, a small-cap player in the consumer durables electronics sector, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (PE) ratio of 42.72 and a price-to-book value of 3.32, indicating a premium valuation relative to its earnings and book value. Additionally, its enterprise value to EBITDA stands at 24.63, while the enterprise value to sales ratio is 3.72. The company also reports a return on capital employed (ROCE) of 13.91% and a return on equity (ROE) of 9.78%, reflecting its operational efficiency. In comparison to its peers, IKIO Lighting's valuation metrics appear elevated. For instance, Electronics Mart shows a more attractive PE ratio of 27.7 and a significantly lower enterprise value to EBITDA of 13.79. Meanwhile, Orient Electric and Wonder Electric present even higher valuations, with PE ratios of 69.2 and 165.7, respectively. This context...

Read More

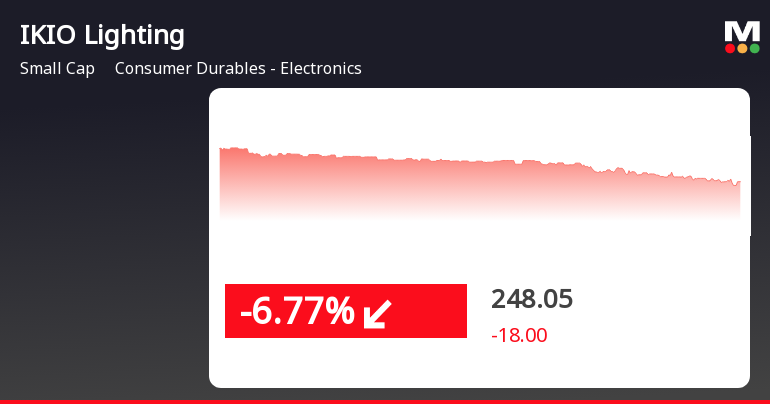

IKIO Lighting Faces Significant Stock Decline Amid Broader Market Fluctuations

2025-03-26 15:35:28IKIO Lighting's shares fell significantly today, underperforming the broader consumer durables and electronics sector. The stock has seen a cumulative decline over the past three days, with its year-to-date performance remaining modest compared to a notable one-year decline. The overall market also experienced a downturn.

Read More

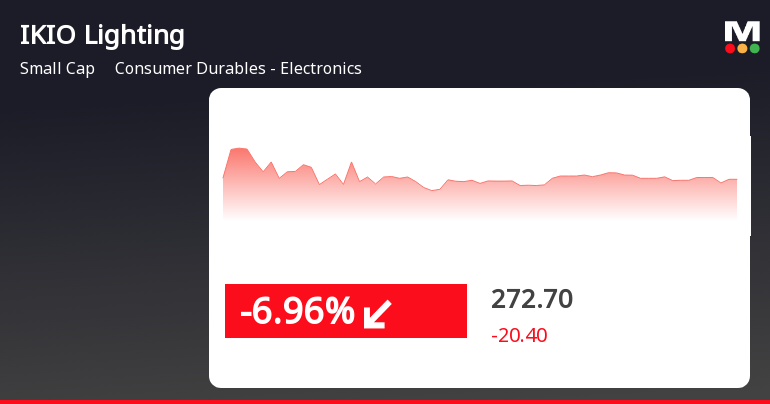

IKIO Lighting Faces Decline Amid Broader Market Resilience and Small-Cap Gains

2025-03-24 09:50:30IKIO Lighting saw a significant decline on March 24, 2025, following a six-day gain streak, reaching an intraday low. Despite this downturn, the company remains above its moving averages, indicating a longer-term positive trend. In the broader market, small-cap stocks are performing well, with the Sensex also showing resilience.

Read More

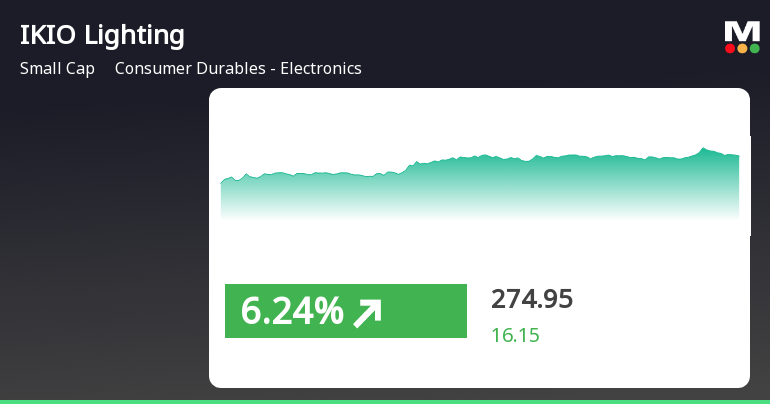

IKIO Lighting Shows Strong Performance Amid Broader Market Recovery Trends

2025-03-21 11:35:29IKIO Lighting has experienced notable gains, marking its sixth consecutive day of increases and achieving a substantial return over that period. The stock is trading above key moving averages, indicating a strong upward trend. In the broader market, small-cap stocks are leading, with the Sensex recovering from a negative opening.

Read MoreIKIO Lighting Adjusts Valuation Grade Amid Competitive Industry Landscape

2025-03-21 08:00:55IKIO Lighting, a small-cap player in the Consumer Durables - Electronics sector, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's price-to-earnings ratio stands at 46.75, while its price-to-book value is recorded at 3.63. Additionally, IKIO's enterprise value to EBITDA ratio is 27.06, indicating a significant valuation relative to its earnings before interest, taxes, depreciation, and amortization. In terms of profitability, IKIO Lighting has a return on capital employed (ROCE) of 13.91% and a return on equity (ROE) of 9.78%. The company also offers a modest dividend yield of 0.39%. When compared to its peers, IKIO Lighting's valuation metrics highlight a notable disparity. For instance, Electronics Mart presents a more attractive valuation with a PE ratio of 27.92, while Orient Electric and Wonder Electric are also positioned in t...

Read More

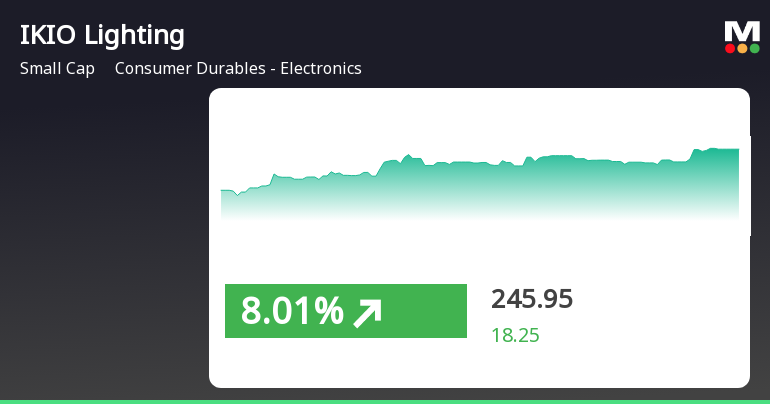

IKIO Lighting Shows Strong Short-Term Gains Amid Broader Market Trends

2025-03-20 11:20:29IKIO Lighting has demonstrated strong performance, gaining 7.66% on March 20, 2025, and achieving a notable 28.35% increase over the past five days. The stock has outperformed its sector and the broader market, despite a year-over-year decline, while currently positioned above several key moving averages.

Read MoreIKIO Lighting Faces Mixed Technical Trends Amidst Evolving Market Dynamics

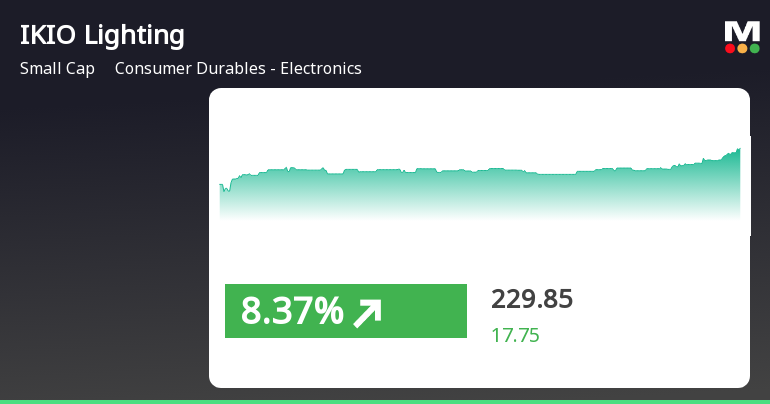

2025-03-20 08:04:19IKIO Lighting, a small-cap player in the Consumer Durables - Electronics sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, which closed at 227.70, has shown notable fluctuations, with a 52-week high of 343.00 and a low of 165.45. Today's trading saw a high of 229.85 and a low of 212.00, indicating active market participation. The technical summary reveals a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the moving averages indicate a mildly bearish stance. The Relative Strength Index (RSI) is currently bearish on a weekly basis, with no signal on the monthly chart. Additionally, the Bollinger Bands reflect a mildly bearish trend weekly, while the monthly trend is sideways. The On-Balance Volume (OBV) presents a mildly bullish outlook weekly, contrasting with a mildly bearish monthly trend. I...

Read More

IKIO Lighting Outperforms Sector Amid Broader Market Trends and Mid-Cap Gains

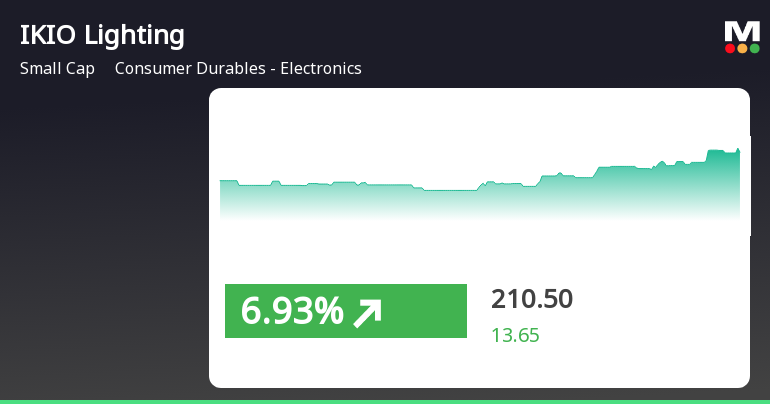

2025-03-19 15:20:29IKIO Lighting has demonstrated strong performance, gaining 7.28% on March 19, 2025, and achieving a total return of 19.14% over four days. The stock reached an intraday high of Rs 228 and is currently above its short-term moving averages, while the broader market shows mixed trends.

Read More

IKIO Lighting Experiences Significant Short-Term Gains Amid Broader Market Uptrend

2025-03-18 13:20:27IKIO Lighting has experienced significant activity, achieving a notable gain today and marking its third consecutive day of increases. The stock is currently above its short-term moving averages, while the broader consumer durables sector also shows positive momentum. However, IKIO's long-term performance remains down compared to the market.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate from RTA received under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended 31st March 2025.

Board Meeting Outcome for Intimation Of Change In Domain Of Email ID Of The Company & Its Employees And Change In Corporate Office Address & Address For Keeping And Maintaining Books Of Accounts Of The Company.

01-Apr-2025 | Source : BSEIntimation of Change in domain of Email ID of the Company & its employees and Change in Corporate Office Address & Address for Keeping and Maintaining Books of Accounts of the Company.

Closure of Trading Window

25-Mar-2025 | Source : BSEClosure of Trading Window for declaration of Financial Results for the Quarter and year ended March 31 2025

Corporate Actions

No Upcoming Board Meetings

IKIO Lighting Ltd has declared 10% dividend, ex-date: 13 Aug 24

No Splits history available

No Bonus history available

No Rights history available