Imagicaaworld Faces Mixed Technical Signals Amidst Competitive Market Challenges

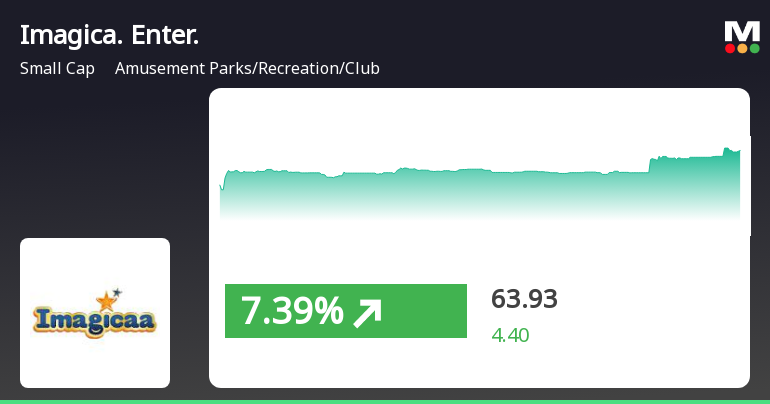

2025-03-27 08:00:33Imagicaaworld Entertainment, a small-cap player in the amusement parks and recreation industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 64.65, showing a slight increase from the previous close of 63.97. Over the past year, the stock has experienced a decline of 13.44%, contrasting with a 6.65% gain in the Sensex, highlighting the challenges faced by the company in a competitive landscape. The technical summary indicates mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Relative Strength Index (RSI) remains neutral, indicating no significant momentum in either direction. Bollinger Bands and moving averages suggest bearish tendencies, particularly on a daily basis, while the On-Balance Volume (OBV) reflects a mildly bullish sent...

Read MoreImagicaaworld Entertainment Faces Bearish Technical Trends Amidst Long-Term Growth Potential

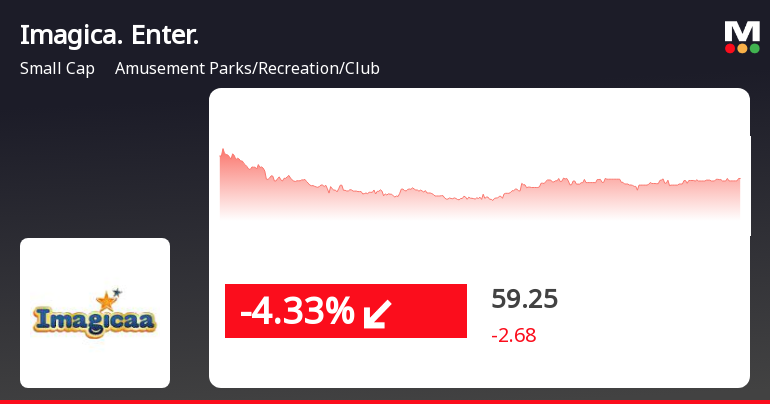

2025-03-26 08:00:54Imagicaaworld Entertainment, a small-cap player in the amusement parks and recreation industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 63.97, down from a previous close of 65.81, with a 52-week high of 103.24 and a low of 57.01. Today's trading saw a high of 66.91 and a low of 63.71. The technical summary indicates a bearish sentiment in various indicators, including the MACD and Bollinger Bands on both weekly and monthly scales. The moving averages also reflect a bearish trend, while the KST shows a mildly bullish stance on a weekly basis, contrasting with its monthly outlook. The On-Balance Volume (OBV) remains mildly bullish for both weekly and monthly periods, suggesting some underlying strength despite the overall bearish indicators. In terms of performance, Imagicaaworld's stock return over the past year has been notably...

Read MoreImagicaaworld Entertainment Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-19 08:00:51Imagicaaworld Entertainment, a small-cap player in the amusement parks and recreation industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 62.15, showing a slight increase from the previous close of 61.92. Over the past year, the stock has experienced a decline of 17.04%, contrasting with a 3.51% gain in the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) remains neutral, with no signals detected for both weekly and monthly assessments. Bollinger Bands also reflect a bearish trend on the weekly scale, transitioning to mildly bearish on a monthly basis. Despite recent challenges, Imagicaaworld has demonstrated resilience over longer periods,...

Read More

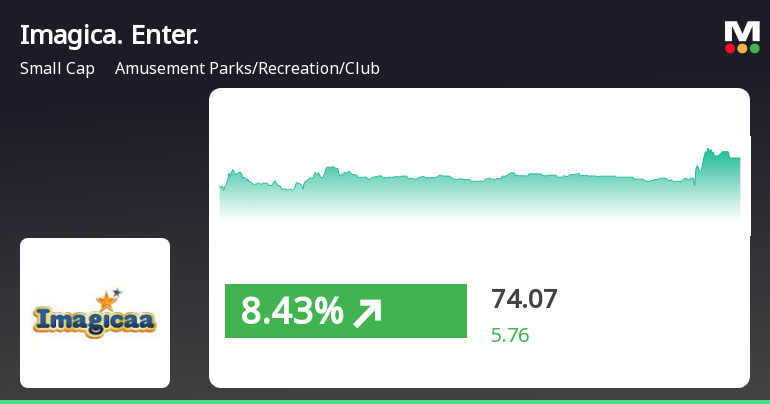

Imagicaaworld Entertainment Shows Strong Short-Term Gains Amid Ongoing Market Challenges

2025-03-05 14:15:21Imagicaaworld Entertainment has seen a significant rise in its stock price, outperforming its sector and achieving consecutive gains over two days. Despite this recent uptick, the company's performance over the past month and year reflects declines, highlighting ongoing challenges within the market.

Read More

Imagicaaworld Entertainment Faces High Volatility Amid Challenging Market Conditions

2025-03-03 11:50:25Imagicaaworld Entertainment's stock faced significant volatility, declining to a new 52-week low amid a challenging trading environment. The company underperformed its sector and broader market indices over the past month, with high intraday volatility observed. Its stock is currently trading below key moving averages, indicating a bearish trend.

Read More

Imagicaaworld Entertainment Faces Significant Volatility Amid Broader Sector Challenges

2025-03-03 10:35:32Imagicaaworld Entertainment has faced notable volatility, hitting a new 52-week low during trading. The stock opened positively but quickly declined, underperforming its sector. It is trading below key moving averages and has seen a significant year-over-year decline, reflecting challenges in the competitive amusement parks and recreation market.

Read MoreImagicaaworld Entertainment Faces Mixed Technical Trends Amid Market Challenges

2025-02-25 10:27:47Imagicaaworld Entertainment, a small-cap player in the amusement parks and recreation sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 65.65, showing a slight increase from the previous close of 65.40. Over the past year, the stock has faced challenges, with a return of -21.4%, contrasting sharply with a positive return of 2.05% for the Sensex during the same period. The technical summary indicates a bearish sentiment in various indicators, including the MACD and Bollinger Bands, which suggest a cautious outlook. The moving averages also reflect a bearish trend, while the KST shows a mildly bullish stance on a weekly basis, indicating some mixed signals in the short term. In terms of performance, Imagicaaworld has demonstrated resilience over longer periods, with a remarkable return of 400% over three years and an impressive 167...

Read More

Imagicaaworld Entertainment Reports Mixed Financial Results for December 2024, Highlighting Growth and Challenges

2025-02-12 19:16:46Imagicaaworld Entertainment's financial results for the quarter ending December 2024 show a mixed performance. While net sales increased significantly, the company faced challenges with declining profits and rising interest expenses, reflecting a complex financial landscape influenced by both positive and negative factors.

Read More

Imagicaaworld Entertainment Shows Resilience with Notable Stock Performance in February 2025

2025-02-12 15:30:17Imagicaaworld Entertainment's stock surged on February 12, 2025, following a three-day decline, indicating a potential trend reversal. The company outperformed its sector and has shown strong relative performance over the past month, despite mixed signals from longer-term moving averages.

Read MoreAnnouncement under Regulation 30 (LODR)-Press Release / Media Release

08-Apr-2025 | Source : BSEPlease find enclosed herewith a press release titled Wet njoy Lonavala adds 10 new Thrilling rides this summer.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEPlease find enclosed certificate under Reg. 74(5) of SEBI (Depositories and Participants) Regulations 2018

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

01-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Malpani Parks Pvt Ltd

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available