Indbank Merchant Banking Faces Decline Amid Weak Financial Performance and Volatility

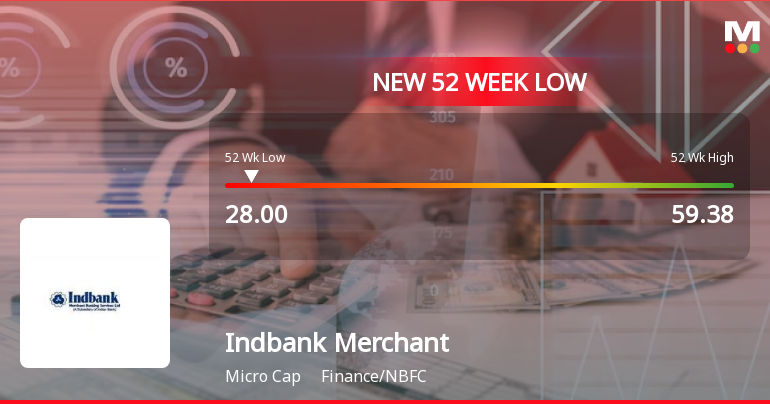

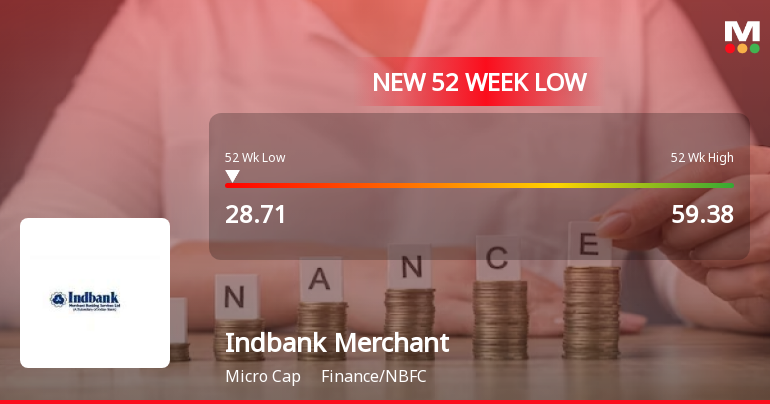

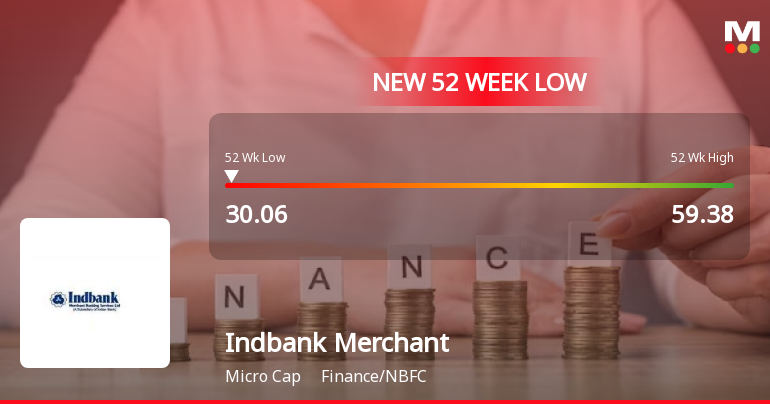

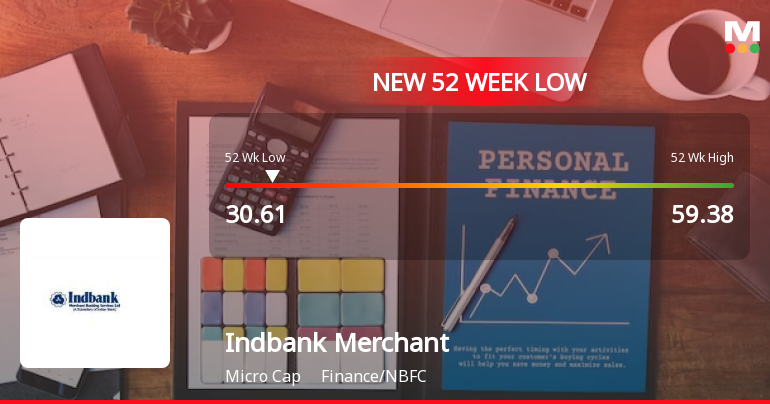

2025-03-28 15:41:19Indbank Merchant Banking Services has faced notable volatility, hitting a 52-week low and underperforming its sector. The company reported a significant decline in net profit and sales, alongside a modest return on equity. Despite an attractive valuation, technical indicators point to a bearish trend for the stock.

Read More

Indbank Faces Significant Volatility Amidst Declining Financial Performance and Market Sentiment

2025-03-28 15:41:11Indbank Merchant Banking Services has reached a new 52-week low, reflecting significant volatility and a bearish trend as it underperforms its sector. The company reported a 52.2% year-over-year drop in profit after tax for December 2024, alongside declining net sales and PBDIT figures.

Read MoreIndbank Merchant Banking Services Adjusts Valuation Grade Amid Strong Financial Fundamentals

2025-03-25 08:00:27Indbank Merchant Banking Services has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the finance and non-banking financial company (NBFC) sector. The company's price-to-earnings (PE) ratio stands at 14.99, while its price-to-book value is recorded at 1.68. Additionally, the enterprise value to EBITDA ratio is 4.90, and the enterprise value to EBIT is 5.05, indicating a competitive standing in the market. Indbank's return on capital employed (ROCE) is notably high at 116.78%, and its return on equity (ROE) is 11.23%, showcasing effective management of resources. In comparison to its peers, Indbank's valuation metrics present a more favorable outlook, particularly when contrasted with companies like Dhunseri Investments and Adit Birla Money, which exhibit lower PE ratios and varying enterprise value metrics. Despite fluctuations in stock perfor...

Read MoreIndbank Merchant Banking Services Adjusts Valuation Amid Mixed Sector Performance

2025-03-06 08:00:39Indbank Merchant Banking Services has recently undergone a valuation adjustment, reflecting its current financial standing within the finance and non-banking financial company (NBFC) sector. The company's price-to-earnings (PE) ratio stands at 15.36, while its price-to-book value is recorded at 1.72. Additionally, the enterprise value to earnings before interest and taxes (EV/EBIT) ratio is 5.32, and the EV/EBITDA ratio is 5.15, indicating its operational efficiency. The company has demonstrated a robust return on capital employed (ROCE) of 116.78% and a return on equity (ROE) of 11.23%, showcasing its ability to generate profits relative to its equity base. However, when compared to its peers, Indbank's valuation metrics reveal a mixed performance. For instance, Vardhman Holdings presents a more attractive valuation profile, while companies like Nisus Finance and Oswal Green Tech are positioned at higher ...

Read More

Indbank Faces Significant Market Challenges Amidst Declining Performance Metrics

2025-03-04 10:02:16Indbank Merchant Banking Services has faced significant volatility, hitting a new 52-week low and marking its fourth consecutive day of losses. The company reported a substantial decline in quarterly performance, with a notable drop in profit and net sales, reflecting ongoing challenges in a bearish market environment.

Read More

Indbank Merchant Banking Faces Market Challenges Amidst Stock Price Fluctuations

2025-03-03 10:06:44Indbank Merchant Banking Services is nearing a 52-week low, showing a trend reversal after two days of decline. Despite a recent uptick, the stock remains below key moving averages and has declined 39.51% over the past year, underperforming compared to the Sensex. Market observers are closely monitoring its performance.

Read More

Indbank Merchant Banking Services Hits 52-Week Low Amid Sector Challenges

2025-02-28 10:35:24Indbank Merchant Banking Services has reached a new 52-week low, reflecting ongoing challenges in the finance and non-banking financial company sector. The stock has seen consecutive losses and is trading below key moving averages, indicating a sustained downward trend over the past year.

Read More

Indbank Merchant Banking Services Hits 52-Week Low Amid Broader Market Gains

2025-02-24 09:35:44Indbank Merchant Banking Services reached a new 52-week low today, reflecting a significant decline over the past year. The stock is currently trading below its moving averages across multiple time frames, indicating a challenging position in the finance and non-banking financial company sector. Market observers are monitoring potential developments.

Read More

Indbank Merchant Banking Services Hits 52-Week Low Amid Sector Challenges

2025-02-17 09:38:41Indbank Merchant Banking Services has reached a new 52-week low, marking a challenging period for the microcap company in the finance and NBFC sector. The stock has declined consecutively over two days and has underperformed its sector, reflecting broader market difficulties and a significant annual decrease.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Reg.74(5) of SEBI (DP) Regulations 2018

Closure of Trading Window

28-Mar-2025 | Source : BSEIntimation regarding closure of Trading Window

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Mar-2025 | Source : BSECertificate under Re.74 (5) of SEBI (DP) Regulations 2018

Corporate Actions

No Upcoming Board Meetings

Indbank Merchant Banking Services Ltd has declared 8% dividend, ex-date: 07 Aug 09

No Splits history available

No Bonus history available

No Rights history available