Indegene's Stock Shows Mixed Technical Trends Amid Market Evaluation Revision

2025-04-03 08:06:45Indegene, a midcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 577.95, showing a slight increase from the previous close of 571.75. Over the past week, Indegene has demonstrated a stock return of 7.23%, significantly outperforming the Sensex, which recorded a decline of 0.87%. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the daily moving averages indicate a mildly bearish trend. The Relative Strength Index (RSI) shows no signal, and the KST also reflects a bearish outlook. Notably, the stock has a 52-week high of 736.60 and a low of 468.90, indicating a considerable range of price movement over the year. When comparing Indegene's performance to the Sensex over the past month, the stock has returned 11.48%, while the Sensex has gained 4....

Read MoreIndegene Adjusts Valuation Grade Amid Mixed IT Sector Performance Metrics

2025-04-01 08:00:58Indegene, a midcap player in the IT software industry, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (P/E) ratio of 36.30 and an enterprise value to EBITDA ratio of 23.78. These metrics reflect its market positioning and operational efficiency, with a return on capital employed (ROCE) at a notable 47.58% and a return on equity (ROE) of 15.73%. In comparison to its peers, Indegene's valuation metrics present a mixed picture. For instance, Zensar Technologies has a lower P/E ratio of 24.59, while Newgen Software stands out with a higher P/E of 45.13. Additionally, Cyient shows a more favorable EV to EBITDA ratio of 11.16 compared to Indegene. This context highlights the competitive landscape within the IT software sector, where valuation metrics can vary significantly among companies. Indegene's stock price has seen fluctuations, with a current price of 57...

Read More

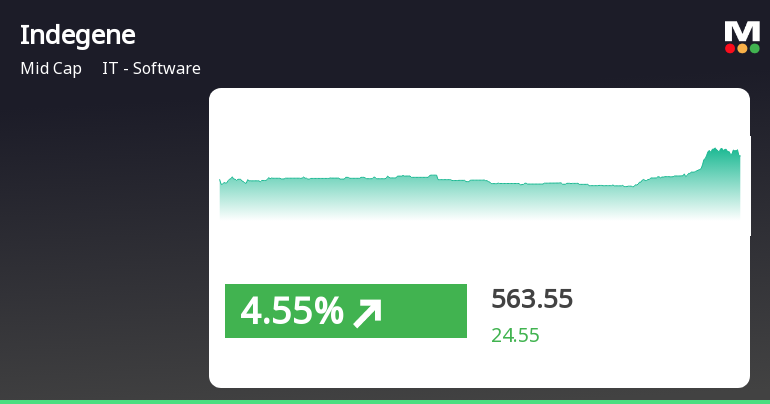

Indegene Shows Strong Intraday Performance Amid Broader Market Recovery Trends

2025-03-27 15:20:36Indegene, a midcap IT software company, experienced notable trading activity, reaching an intraday high and showing significant volatility. While its recent performance has been strong over the past month, it has faced challenges in the longer term compared to the broader market, particularly the Sensex.

Read More

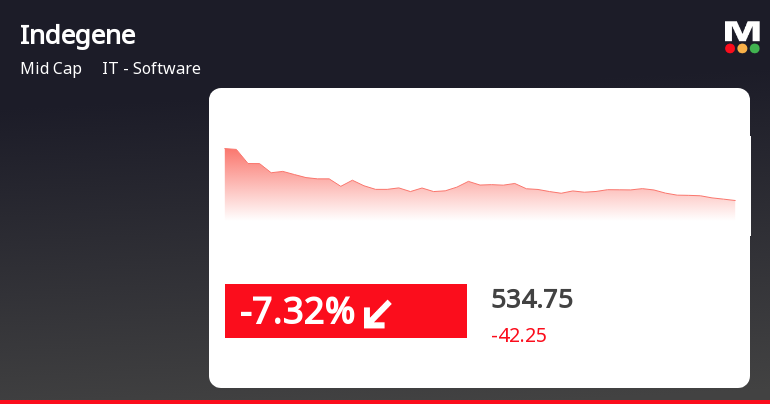

Indegene Faces Notable Stock Decline Amid Broader Market Challenges

2025-03-12 09:35:25Indegene's stock has seen a notable decline today, opening lower and reaching an intraday low. While it has underperformed against the broader market, it has shown a slight gain over the past week. Monthly performance remains unfavorable, with mixed signals from its moving averages.

Read MoreIndegene Adjusts Valuation Grade, Reflecting Competitive Positioning in IT Software Sector

2025-03-12 08:00:55Indegene, a midcap player in the IT software sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently exhibits a price-to-earnings (P/E) ratio of 36.18 and an enterprise value to EBITDA ratio of 23.69, indicating its market valuation relative to earnings and operational performance. Additionally, Indegene's return on capital employed (ROCE) stands at an impressive 47.58%, showcasing its efficiency in generating returns from its capital investments. In comparison to its peers, Indegene's valuation metrics present a mixed picture. For instance, Zensar Technologies and Sonata Software share a similar valuation status, but with notably lower P/E ratios of 23.91 and 24.27, respectively. Meanwhile, companies like Cyient and Birlasoft Ltd are positioned more favorably with lower P/E ratios and attractive valuation metrics. On the other hand, firms ...

Read More

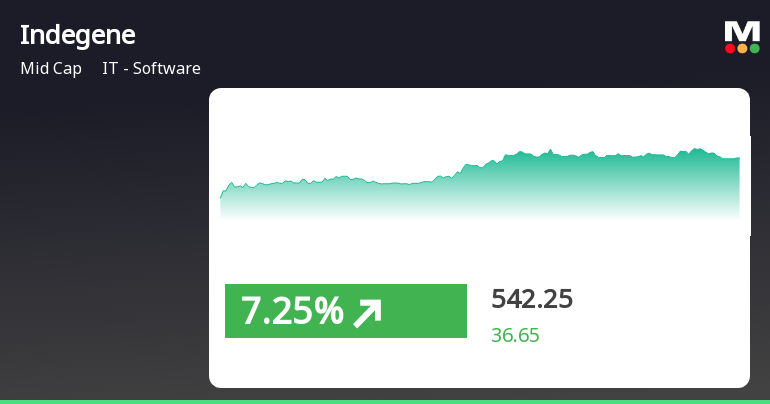

Indegene's Stock Surges Amid Broader Market Decline, Highlighting Mixed Momentum Trends

2025-03-11 10:50:25Indegene, a midcap IT software company, experienced significant activity on March 11, 2025, with a notable intraday high. While the stock is above its 5-day moving average, it remains below longer-term averages. Year-to-date, Indegene has declined more than the broader market index, the Sensex.

Read More

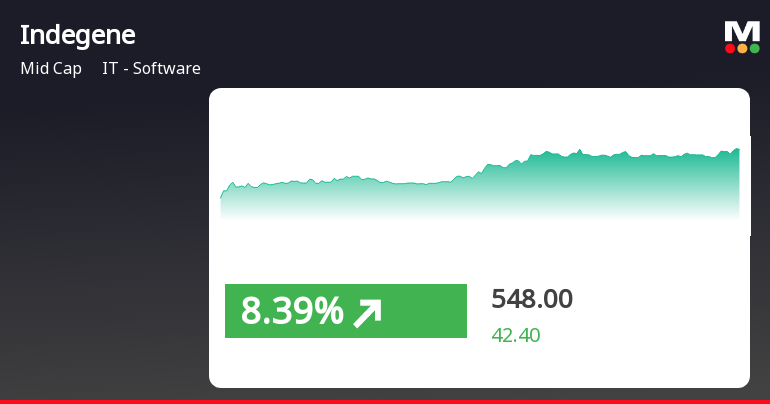

Indegene Faces Significant Stock Decline Amid Broader Market Weakness

2025-03-10 14:35:39Indegene's stock has seen a notable decline, dropping 5.51% today, underperforming the sector. It is trading below all key moving averages, reflecting a bearish trend. Over the past month, the stock has decreased by 17.94%, while the broader market also shows negative sentiment. Year-to-date, Indegene is down 16.03%.

Read MoreIndegene Faces Technical Challenges Amidst Market Volatility and Bearish Indicators

2025-03-04 08:01:48Indegene, a midcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 527.10, showing a slight increase from the previous close of 518.45. Over the past year, Indegene has experienced a 52-week high of 736.60 and a low of 468.90, indicating notable volatility. The technical summary reveals a bearish sentiment in the weekly MACD and daily moving averages, while the Bollinger Bands indicate a mildly bearish trend on a weekly basis. The Dow Theory also reflects a mildly bearish stance in both weekly and monthly assessments. Notably, the Relative Strength Index (RSI) shows no signal, suggesting a lack of momentum in either direction. In terms of performance, Indegene's stock return has lagged behind the Sensex across various time frames. Over the past week, the stock returned -2.5%, compared to the Sensex's...

Read MoreIndegene Faces Technical Trend Challenges Amid Market Volatility and Declining Performance

2025-02-28 08:00:34Indegene, a midcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 503.40, down from a previous close of 512.90, with a 52-week high of 736.60 and a low of 468.90. Today's trading saw a high of 515.45 and a low of 501.35, indicating some volatility. The technical summary for Indegene reveals a bearish stance in several indicators, including the MACD and Bollinger Bands on a weekly basis, while the daily moving averages also reflect a bearish trend. The Dow Theory indicates a mildly bearish outlook, contrasting with the On-Balance Volume (OBV), which shows a mildly bearish trend on a weekly basis but bullish on a monthly scale. In terms of performance, Indegene's stock return has lagged behind the Sensex over various periods. Over the past week, the stock has declined by 9.4%, while the Sensex fell by...

Read MoreAnnouncement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

30-Mar-2025 | Source : BSECancellation of scheduled Analyst / Investor Meeting on 31st March 2025

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

26-Mar-2025 | Source : BSEIntimation of Schedule of Analyst / Investor Meeting

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available