India Cements Shows Mixed Technical Trends Amid Strong Long-Term Performance

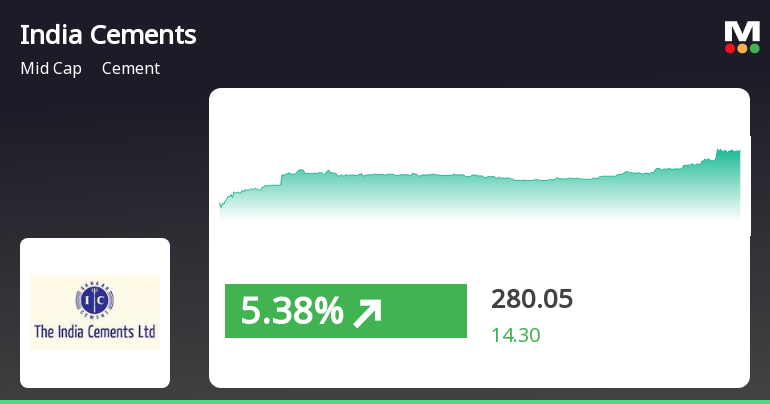

2025-04-02 08:03:47India Cements, a midcap player in the cement industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 279.60, showing a slight increase from the previous close of 274.00. Over the past year, India Cements has demonstrated a notable return of 26.92%, significantly outperforming the Sensex, which recorded a return of 2.72% in the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a bearish trend on a weekly basis while leaning mildly bearish on a monthly scale. The Relative Strength Index (RSI) presents a bullish signal weekly, with no signal on a monthly basis. Bollinger Bands reflect a mildly bearish stance for both weekly and monthly evaluations. Daily moving averages indicate a bearish trend, while the KST shows a contrasting bullish trend on a monthly basis. In terms of stock ...

Read MoreIndia Cements Faces Technical Trend Shifts Amid Market Volatility and Mixed Indicators

2025-03-26 08:01:48India Cements, a midcap player in the cement industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 274.35, down from a previous close of 281.05, with a notable 52-week high of 385.50 and a low of 172.55. Today's trading saw a high of 288.30 and a low of 273.00, indicating some volatility. The technical summary reveals a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Similarly, Bollinger Bands and moving averages also reflect bearish tendencies. The KST indicator presents a mixed picture, being bearish weekly but bullish monthly. The On-Balance Volume (OBV) indicates a mildly bullish trend over both weekly and monthly periods. In terms of performance, India Cements has shown varied returns compared to the Sensex. Over the past week, the stock re...

Read MoreIndia Cements Faces Mixed Technical Trends Amidst Market Sentiment Shifts

2025-03-19 08:01:56India Cements, a midcap player in the cement industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 272.95, showing a slight increase from the previous close of 266.90. Over the past year, India Cements has demonstrated a notable return of 33.54%, significantly outperforming the Sensex, which recorded a return of 3.51% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly perspective shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly assessments. Bollinger Bands also reflect a mildly bearish stance on both timeframes. Moving averages present a bearish outlook on a daily basis, while the KST shows a contrasting bullish trend on a monthly basis. The company's performance over various periods highlights its resil...

Read MoreIndia Cements Faces Technical Trend Shifts Amid Mixed Market Sentiment

2025-03-12 08:01:04India Cements, a midcap player in the cement industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 281.60, down from a previous close of 287.35, with a notable 52-week high of 385.50 and a low of 172.55. Today's trading saw a high of 285.60 and a low of 278.70. The technical summary indicates a bearish sentiment in the weekly MACD and Bollinger Bands, while the monthly indicators show a mix of mildly bearish and sideways trends. The daily moving averages also reflect a bearish stance. Notably, the KST shows a bearish trend on a weekly basis but is bullish monthly, suggesting some divergence in short-term and long-term outlooks. In terms of performance, India Cements has experienced varied returns compared to the Sensex. Over the past week, the stock has returned -4.56%, contrasting with a 1.52% gain in the Sensex. However, on a yea...

Read MoreIndia Cements Faces Mixed Performance Amid Broader Market Fluctuations

2025-03-10 14:20:05India Cements, a midcap player in the cement industry, has experienced significant activity today, opening with a loss of 4.03%. The stock underperformed its sector by 2%, reflecting broader market trends. Throughout the trading session, India Cements reached an intraday low of Rs 284.3, marking a decline of 4.03%. In terms of moving averages, the stock is currently positioned higher than its 5-day and 20-day moving averages, yet it remains below the 50-day, 100-day, and 200-day moving averages. This positioning may indicate a mixed performance trend over different time frames. Over the past month, India Cements has shown a positive return of 4.22%, contrasting with the Sensex, which has declined by 3.82% during the same period. However, the stock's one-day performance reflects a decrease of 2.87%, while the Sensex has remained relatively stable with a slight increase of 0.04%. These metrics highlight the...

Read More

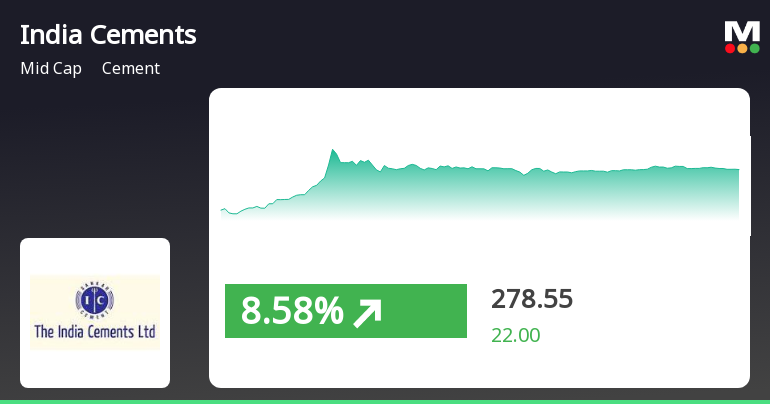

India Cements Outperforms Market Amid Broader Decline, Signaling Positive Momentum

2025-03-04 10:25:47India Cements has demonstrated strong performance, gaining 8.83% on March 4, 2025, and outperforming its sector. The stock has achieved a cumulative return of 13.16% over three days, reaching an intraday high of Rs 292.05. Despite a declining broader market, it has shown resilience over the past year.

Read MoreIndia Cements Faces Technical Trend Shifts Amidst Market Volatility and Underperformance

2025-02-25 10:30:02India Cements, a midcap player in the cement industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The current price stands at 252.55, slightly down from the previous close of 255.25. Over the past year, the stock has experienced a high of 385.50 and a low of 172.55, indicating significant volatility. The technical summary reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Bollinger Bands also reflect a bearish stance, and moving averages indicate a bearish trend on a daily basis. The KST presents a mixed picture, being bearish weekly but bullish monthly. Meanwhile, the Dow Theory suggests a mildly bearish outlook. In terms of performance, India Cements has faced challenges compared to the Sensex. Over the past week, the stock returned -7.05%, while the Se...

Read MoreIndia Cements Faces Mixed Performance Amid Market Fluctuations and Technical Challenges

2025-02-25 09:57:14India Cements, a mid-cap player in the cement industry, has experienced notable fluctuations in its stock performance recently. With a market capitalization of Rs 7,910.00 crore, the company currently holds a price-to-earnings (P/E) ratio of -14.46, significantly lower than the industry average of 47.67. Over the past year, India Cements has shown a performance increase of 3.90%, outperforming the Sensex, which rose by 2.21%. However, the stock has faced challenges in the short term, with a decline of 0.27% today, contrasting with the Sensex's gain of 0.41%. The stock's performance over the past week has been particularly weak, down 6.31%, while it has dropped 13.84% over the past month. Longer-term trends indicate a mixed performance, with a 3-year increase of 29.18% compared to the Sensex's 33.83% rise. Over the last five years, India Cements has delivered a robust return of 191.92%, significantly outpa...

Read More

India Cements Shows Significant Rebound Amidst Broader Market Volatility

2025-02-04 15:15:14India Cements experienced significant trading activity on February 4, 2025, outperforming its sector. The stock reached an intraday high and low, reflecting notable volatility. Despite recent challenges over the past month, today's performance suggests a rebound amid ongoing dynamics in the cement industry.

Read MoreAnnouncement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

09-Apr-2025 | Source : BSEIntimation regarding Earning Call

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under Reg. 74(5) of SEBI (DP) Regulations 2018

Shareholder Meeting / Postal Ballot-Scrutinizers Report

19-Mar-2025 | Source : BSEVoting Results of Postal Ballot through remote E-voting process and Scrutinizers Report

Corporate Actions

No Upcoming Board Meetings

India Cements Ltd has declared 10% dividend, ex-date: 20 Sep 22

No Splits history available

No Bonus history available

No Rights history available