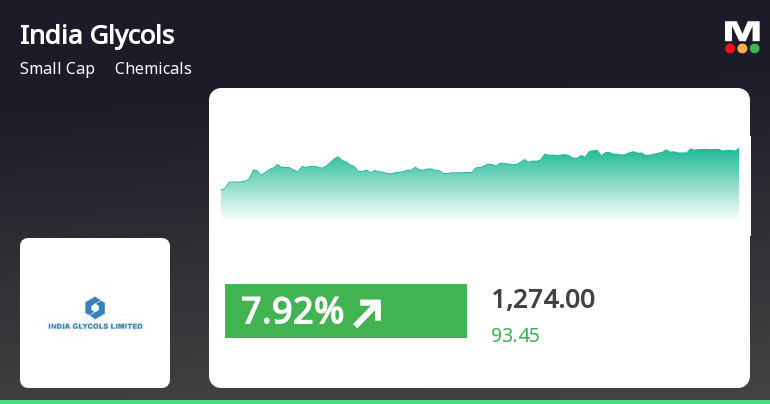

India Glycols Outperforms Market with Strong Gains Amid Volatile Trading Day

2025-04-03 11:20:23India Glycols, a small-cap chemicals company, experienced notable gains on April 3, 2025, outperforming its sector and demonstrating a strong upward trend over the past week. The stock is trading above multiple moving averages, reflecting robust short- to medium-term performance, while the broader market showed volatility.

Read More

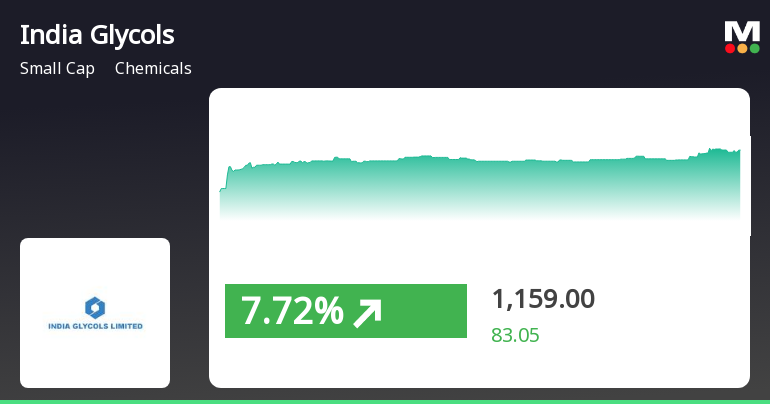

India Glycols Faces Financial Challenges Amid Shifting Market Sentiment and Performance Metrics

2025-03-25 08:16:22India Glycols, a small-cap chemicals company, has recently experienced an evaluation adjustment reflecting shifts in its financial metrics and market position. Despite a flat quarterly performance and concerns over its debt levels, the company has achieved a notable annual return, outperforming broader market indices.

Read MoreIndia Glycols Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-25 08:05:05India Glycols, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current price stands at 1,090.30, slightly above the previous close of 1,087.85. Over the past year, India Glycols has demonstrated a notable return of 39.00%, significantly outperforming the Sensex, which recorded a return of 7.07% during the same period. In terms of technical metrics, the MACD indicates a bearish trend on a weekly basis, while the monthly perspective shows a mildly bearish stance. The Relative Strength Index (RSI) presents a bullish signal weekly, but lacks a definitive signal on a monthly basis. Bollinger Bands reflect a mildly bearish trend weekly, contrasting with a bullish outlook monthly. Daily moving averages indicate a bearish trend, while the KST shows a bearish trend weekly and a bullish trend monthly. Despite th...

Read MoreIndia Glycols Exhibits Mixed Market Performance Amid Long-Term Growth Potential

2025-03-24 18:00:31India Glycols Ltd, a small-cap player in the chemicals industry, has shown notable activity in the market today. With a market capitalization of Rs 3,348.00 crore, the company has a price-to-earnings (P/E) ratio of 16.14, significantly lower than the industry average of 45.80. Over the past year, India Glycols has delivered a robust performance of 39.00%, outperforming the Sensex, which recorded a gain of 7.07%. However, recent trends indicate a mixed performance. In the last day, the stock rose by 0.23%, while it has seen a decline of 0.30% over the past week. The monthly performance reflects a decrease of 4.36%, contrasting with the Sensex's increase of 4.74%. Year-to-date, the stock is down by 15.68%, while the Sensex has remained relatively stable with a decline of just 0.20%. Notably, India Glycols has shown impressive long-term growth, with a remarkable 501.54% increase over the past five years. T...

Read MoreIndia Glycols Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-05 08:02:48India Glycols, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,085.90, showing a notable increase from the previous close of 1,053.90. Over the past year, India Glycols has demonstrated resilience with a return of 27.87%, significantly outperforming the Sensex, which recorded a mere 1.19% return in the same period. The technical summary indicates a mixed outlook, with various indicators reflecting different trends. The MACD shows bearish signals on a weekly basis while being mildly bearish monthly. The Bollinger Bands present a mildly bearish trend weekly but shift to bullish on a monthly scale. Daily moving averages suggest a mildly bullish sentiment, while the KST indicates a similar pattern. In terms of stock performance, India Glycols has faced challenges recently, with a 22.75% decli...

Read More

India Glycols Shows Significant Rebound Amid Broader Market Challenges

2025-02-19 15:05:21India Glycols, a small-cap chemicals company, experienced a notable rebound on February 19, 2025, after four days of decline. The stock outperformed its sector while the broader market saw a slight dip. Despite today's gains, it remains below key moving averages, suggesting a mixed performance outlook.

Read More

India Glycols Reports Mixed Q3 Results Amid Rising Debt and Improved Sales Efficiency

2025-02-04 21:02:42India Glycols has announced its financial results for the quarter ending December 2024, showing a mixed performance. The company reported a Profit After Tax of Rs 106.52 crore, a significant year-on-year increase. While net sales reached a five-quarter high, challenges include a declining Operating Profit to Interest ratio and increased interest expenses.

Read More

India Glycols Reports Strong Q2 FY24 Sales Amid Financial Challenges and Debt Concerns

2025-02-04 18:37:31India Glycols, a small-cap chemicals company, has recently seen a change in its evaluation, highlighting its financial performance and market position. The firm reported a 31.85% increase in net sales for Q2 FY24, alongside strong operating cash flow, though it faces challenges with modest profit growth and high debt levels.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSEPursuant to Regulation 74(5) of SEBI (Depository and Participants) Regulations 2018 please find enclosed a copy of the certificate for the quarter ended 31st March 2025 as received from MCS Share Transfer Agent Limited the Registrar and Share Transfer Agent of the Company.

Disclosure Under Regulation 30 Of Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015 (SEBI Listing Regulations) - Update On Enhancement Of Capacity Of Grain Based Distillery And Bio-Fuel Ethanol Plant

31-Mar-2025 | Source : BSEPlease find attached

Announcement under Regulation 30 (LODR)-Credit Rating

25-Mar-2025 | Source : BSEPlease refer to attachment.

Corporate Actions

No Upcoming Board Meetings

India Glycols Ltd has declared 80% dividend, ex-date: 21 Aug 24

No Splits history available

No Bonus history available

No Rights history available