India Motor Parts & Accessories Faces Mixed Technical Trends Amid Market Volatility

2025-04-02 08:07:16India Motor Parts & Accessories, a small-cap player in the trading industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 973.20, showing a slight increase from the previous close of 964.00. Over the past year, the stock has experienced a high of 1,503.00 and a low of 836.00, indicating significant volatility. The technical summary reveals a mixed picture. The MACD indicates bearish momentum on a weekly basis, while the monthly trend shows a mildly bearish stance. The Relative Strength Index (RSI) presents a bullish signal weekly, but lacks a clear indication on a monthly scale. Bollinger Bands and KST metrics also reflect a mildly bearish trend over both weekly and monthly periods. Daily moving averages suggest bearish conditions, while Dow Theory and On-Balance Volume show no definitive trends. In terms of performance, India Motor...

Read MoreIndia Motor Parts & Accessories Faces Mixed Technical Trends Amid Market Evaluation Revision

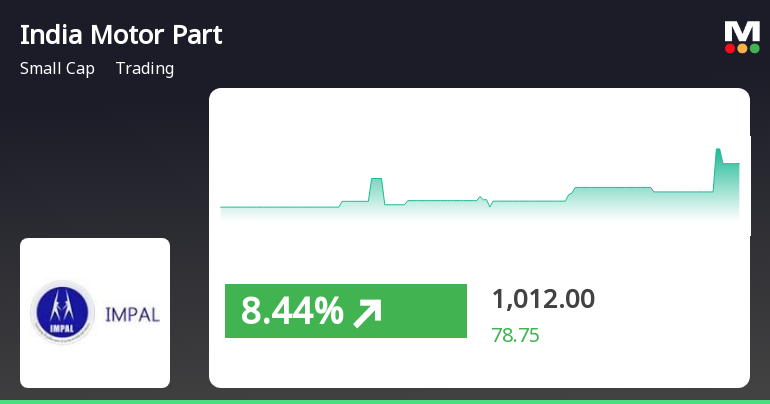

2025-04-01 08:02:46India Motor Parts & Accessories, a small-cap player in the trading industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 964.00, down from a previous close of 1000.00, with a notable 52-week high of 1,503.00 and a low of 836.00. Today's trading saw a high of 1,010.00 and a low matching the current price. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish trends on a weekly basis while leaning mildly bearish on a monthly scale. The Relative Strength Index (RSI) presents a bullish signal weekly, but no clear signal monthly. Bollinger Bands and KST also reflect a mildly bearish stance on both weekly and monthly evaluations. Meanwhile, the Dow Theory suggests a mildly bullish trend weekly, with no discernible trend monthly. In terms of returns, India Motor Parts has shown a strong perf...

Read MoreIndia Motor Parts & Accessories Faces Technical Trend Shifts Amid Market Volatility

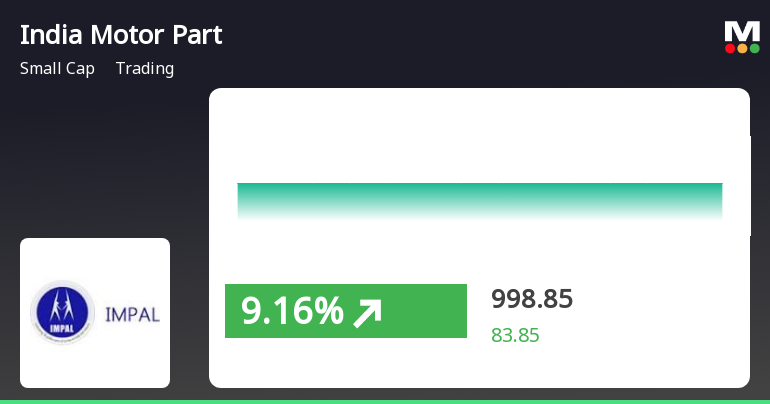

2025-03-28 08:02:57India Motor Parts & Accessories, a small-cap player in the trading industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,000.00, showing a notable increase from the previous close of 965.00. Over the past year, the stock has reached a high of 1,503.00 and a low of 836.00, indicating significant volatility. In terms of technical indicators, the weekly MACD and KST are both in a bearish position, while the monthly readings show a mildly bearish trend. The Bollinger Bands also reflect a mildly bearish stance on both weekly and monthly bases. Moving averages indicate a bearish trend on a daily basis, suggesting a cautious outlook in the short term. When comparing the stock's performance to the Sensex, India Motor Parts & Accessories has shown a strong return over the past week and month, outperforming the index significantly. However...

Read More

India Motor Parts & Accessories Shows Strong Performance Amid Broader Market Gains

2025-03-24 13:05:21India Motor Parts & Accessories has experienced notable trading activity, achieving significant gains and outperforming its sector. The stock has shown a positive trend over two consecutive days, with a strong opening and reaching an intraday high. The broader market, including the Sensex, is also experiencing upward movement.

Read MoreIndia Motor Parts & Accessories Adjusts Valuation Amid Competitive Market Landscape

2025-03-24 08:00:42India Motor Parts & Accessories has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the trading industry. The company's price-to-earnings ratio stands at 14.85, while its price-to-book value is notably low at 0.46. Other key metrics include an EV to EBIT ratio of 18.96 and an EV to EBITDA ratio of 18.56, indicating its operational efficiency relative to its enterprise value. The company offers a dividend yield of 3.00%, which may appeal to income-focused investors. However, its return on capital employed (ROCE) and return on equity (ROE) are relatively modest at 2.32% and 3.11%, respectively. When compared to its peers, India Motor Parts & Accessories presents a more favorable valuation profile, particularly against companies with significantly higher price-to-earnings ratios and enterprise value metrics. This context highlights the competiti...

Read MoreIndia Motor Parts & Accessories Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-19 08:03:35India Motor Parts & Accessories, a small-cap player in the trading industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 921.15, showing a notable shift from its previous close of 901.05. Over the past year, the stock has experienced a decline of 6.16%, contrasting with a 3.51% gain in the Sensex, highlighting a challenging performance relative to broader market trends. In terms of technical indicators, the MACD shows a bearish stance on a weekly basis while leaning mildly bearish on a monthly scale. The Relative Strength Index (RSI) indicates bullish momentum weekly, but lacks a clear signal monthly. Bollinger Bands and KST both reflect a mildly bearish trend over the monthly period, while the daily moving averages suggest bearish conditions. Despite these mixed signals, the company has shown resilience over longer time frames, wi...

Read More

India Motor Parts & Accessories Experiences Notable Trend Reversal Amid Market Volatility

2025-03-13 10:20:18India Motor Parts & Accessories has experienced a notable rebound after four days of decline, with significant intraday volatility. The stock is currently trading above its short-term moving averages and has a high dividend yield. Over the past year, it has outperformed the Sensex, despite recent challenges.

Read MoreIndia Motor Parts & Accessories Adjusts Valuation Amid Competitive Market Landscape

2025-03-03 08:00:10India Motor Parts & Accessories has recently undergone a valuation adjustment, reflecting changes in its financial metrics and market position. The company's current price stands at 879.00, down from a previous close of 912.90, with a 52-week range between 836.00 and 1,503.00. Key financial indicators reveal a PE ratio of 13.98 and an EV to EBITDA ratio of 17.38, which positions the company within a competitive landscape. The dividend yield is noted at 3.19%, while the return on capital employed (ROCE) and return on equity (ROE) are reported at 2.32% and 3.11%, respectively. When compared to its peers, India Motor Parts & Accessories shows a higher valuation relative to companies like PTC India, which has a significantly lower PE ratio of 7.22 and a more favorable EV to EBITDA ratio of 5.12. Other competitors in the trading sector, such as Optiemus Infra and D.P. Abhushan, also exhibit higher valuation ...

Read MoreIndia Motor Parts & Accessories Adjusts Valuation Amid Competitive Trading Landscape

2025-02-25 10:23:25India Motor Parts & Accessories has recently undergone a valuation adjustment, reflecting a reassessment of its financial metrics and market position within the trading industry. The company's current price stands at 945.90, slightly up from the previous close of 940.10. Over the past year, the stock has experienced a return of -11.37%, contrasting with a positive return of 1.73% for the Sensex. Key financial indicators for India Motor Parts include a PE ratio of 14.80 and a price-to-book value of 0.46, suggesting a relatively favorable valuation compared to some peers. The company also boasts a dividend yield of 3.01%, which may appeal to income-focused investors. However, its return on capital employed (ROCE) and return on equity (ROE) are at 2.32% and 3.11%, respectively, indicating areas for potential improvement. In comparison to its peers, India Motor Parts presents a more attractive valuation profi...

Read MoreClosure of Trading Window

28-Mar-2025 | Source : BSEIndia Motor Parts & Accessories Ltd has informed BSE regarding Closure of Trading Window.

Newspaper Advertisement - Regulation 47 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 (SEBI LODR)

30-Jan-2025 | Source : BSEIndia Motor Parts & Accessories Ltd has informed BSE regarding Newspaper Advertisement - Regulation 47 of the SEBI (Listing Obligationsand Disclosure Requirements) Regulations 2015 (SEBI LODR).

Standalone Financial Results Limited Review Report for December 31 2024

28-Jan-2025 | Source : BSEIndia Motor Parts & Accessories Ltd has informed BSE about :

1. Standalone Financial Results for the period ended December 31 2024

2. Standalone Limited Review for the period ended December 31 2024

Corporate Actions

No Upcoming Board Meetings

India Motor Parts & Accessories Ltd has declared 100% dividend, ex-date: 06 Feb 25

No Splits history available

India Motor Parts & Accessories Ltd has announced 1:2 bonus issue, ex-date: 25 Oct 19

No Rights history available