India Nippon Electricals Faces Mixed Technical Trends Amid Market Challenges

2025-04-03 08:03:03India Nippon Electricals, a small-cap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 604.65, showing a slight increase from the previous close of 598.00. Over the past year, the stock has experienced a decline of 14.94%, contrasting with a 3.67% gain in the Sensex, highlighting a challenging performance relative to the broader market. In terms of technical indicators, the weekly MACD and KST are positioned in a bearish trend, while the monthly indicators show a mildly bearish stance. The Relative Strength Index (RSI) indicates a bullish trend on a weekly basis, yet presents no signal on a monthly scale. Bollinger Bands and moving averages also reflect a mildly bearish outlook, suggesting a cautious market sentiment. Despite recent challenges, India Nippon Electricals has demonstrated resi...

Read MoreIndia Nippon Electricals Faces Bearish Technical Trends Amid Mixed Performance Indicators

2025-04-02 08:04:57India Nippon Electricals, a small-cap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 598.00, slightly down from its previous close of 599.05. Over the past year, the stock has faced challenges, with a return of -17.82%, contrasting with a positive return of 2.72% for the Sensex during the same period. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands and moving averages also reflect bearish conditions, suggesting a cautious market environment. Notably, the stock's performance over different time frames reveals a mixed picture; while it has seen a significant return of 213.25% over five years, it has struggled in the shorter term, particularly year-to-date with a...

Read MoreIndia Nippon Electricals Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-25 08:02:35India Nippon Electricals, a small-cap player in the auto ancillary sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 639.00, showing a notable increase from the previous close of 585.10. Over the past year, the stock has experienced fluctuations, with a 52-week high of 860.00 and a low of 545.20. In terms of technical indicators, the MACD and KST suggest a bearish sentiment on a weekly basis, while the monthly outlook remains mildly bearish. The Bollinger Bands and moving averages also indicate a similar trend, highlighting a cautious market environment. Notably, the Dow Theory presents a mildly bullish signal on a weekly basis, contrasting with the monthly bearish outlook. When comparing the stock's performance to the Sensex, India Nippon Electricals has shown a strong return over the past week, outperforming the index significa...

Read More

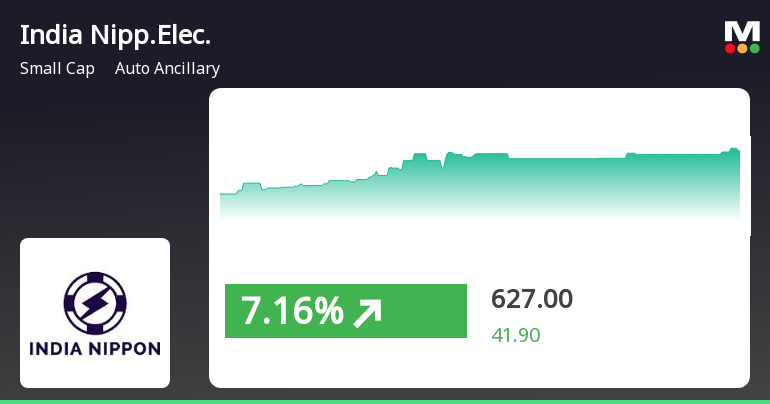

India Nippon Electricals Shows Strong Short-Term Gains Amidst Broader Market Trends

2025-03-24 14:00:23India Nippon Electricals, a small-cap auto ancillary company, experienced notable gains on March 24, 2025, outperforming both its sector and the broader market. The stock has risen for four consecutive days, achieving significant returns recently, while showing resilience over the past three to five years despite longer-term challenges.

Read More

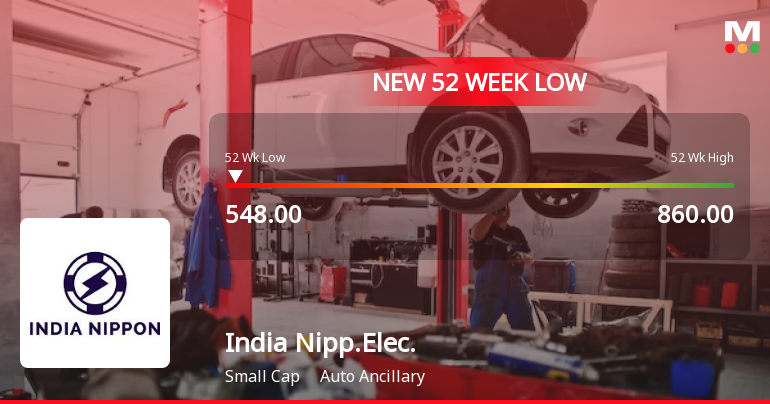

India Nippon Electricals Hits 52-Week Low Amid Mixed Financial Performance Signals

2025-03-17 11:07:12India Nippon Electricals, a small-cap auto ancillary firm, has reached a new 52-week low, underperforming its sector. Despite modest growth in net sales and strong quarterly results, the stock's technical indicators suggest a bearish trend, and its valuation remains high compared to competitors.

Read More

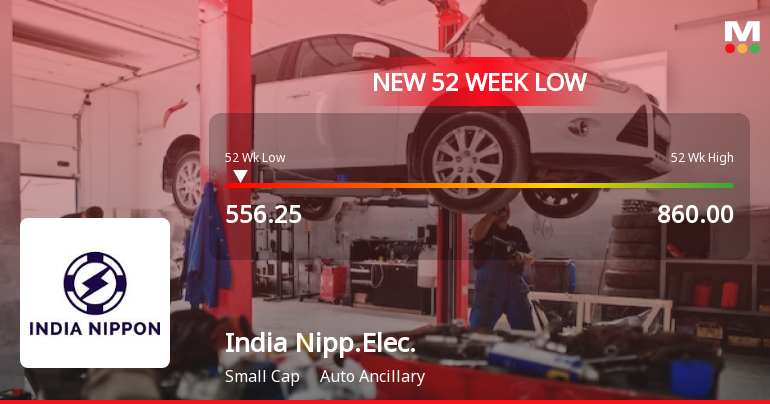

India Nippon Electricals Hits 52-Week Low Amidst Market Volatility and Underperformance

2025-03-12 13:06:47India Nippon Electricals, a small-cap auto ancillary firm, reached a new 52-week low amid notable market volatility. The company has faced challenges with an annual return of -18.53%, despite positive net sales growth. Its low debt-to-equity ratio and recent profitability contrast with a lack of institutional investment interest.

Read More

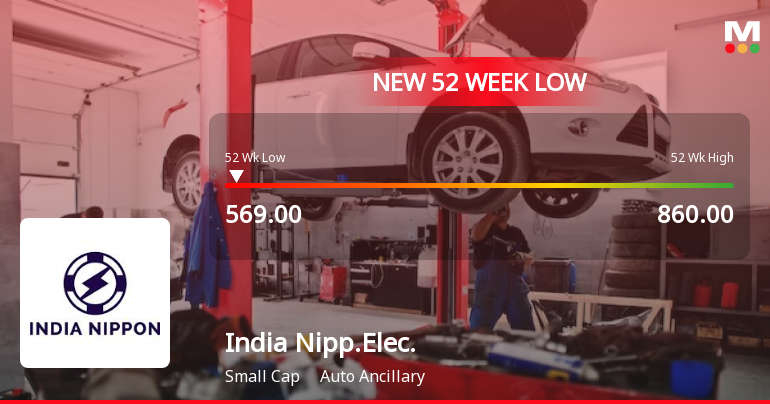

India Nippon Electricals Faces Ongoing Challenges Amidst Auto Ancillary Sector Decline

2025-02-28 10:05:40India Nippon Electricals, a small-cap auto ancillary company, has hit a new 52-week low, continuing a downward trend with a cumulative drop of over 10% in six days. The stock is trading below multiple moving averages, reflecting ongoing challenges in a declining sector, which has also faced headwinds.

Read MoreIndia Nippon Electricals Adjusts Valuation Grade Amid Market Challenges and Competitive Metrics

2025-02-24 12:57:06India Nippon Electricals, a small-cap player in the auto ancillary sector, has recently undergone a valuation adjustment reflecting its current market standing. The company's price-to-earnings ratio stands at 18.47, while its price-to-book value is recorded at 2.10. Other key financial metrics include an EV to EBITDA ratio of 14.07 and a PEG ratio of 0.43, indicating a favorable growth outlook relative to its earnings. In terms of performance, India Nippon has faced challenges, with a year-to-date return of -14.79%, significantly underperforming the Sensex, which has returned -4.59% over the same period. However, over a longer horizon, the company has shown resilience, with a 10-year return of 197.93%, outpacing the Sensex's 157.03%. When compared to its peers, India Nippon's valuation metrics present a competitive edge, particularly in the PEG ratio, which is lower than several competitors, suggesting a ...

Read More

India Nippon Electricals Reports Record Sales Amid Decline in Profitability for December 2024

2025-02-13 21:33:36India Nippon Electricals reported its highest quarterly net sales in five quarters at Rs 214.67 crore for the quarter ending December 2024. Operating profit also peaked at Rs 25.73 crore, with an operating profit margin of 11.99%. However, profit after tax declined to Rs 15.96 crore, indicating profitability challenges.

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEIntimation of Closure of Trading Window

Announcement under Regulation 30 (LODR)-Investor Presentation

20-Mar-2025 | Source : BSEPlease find enclosed herewith the Investor Presentation - February 2025

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

13-Mar-2025 | Source : BSEIntimation of schedule of Investor/Analyst meet to be held on Friday 21st March 2025.

Corporate Actions

No Upcoming Board Meetings

India Nippon Electricals Ltd has declared 250% dividend, ex-date: 21 Feb 25

India Nippon Electricals Ltd has announced 5:10 stock split, ex-date: 21 Mar 18

India Nippon Electricals Ltd has announced 2:5 bonus issue, ex-date: 20 Sep 11

No Rights history available