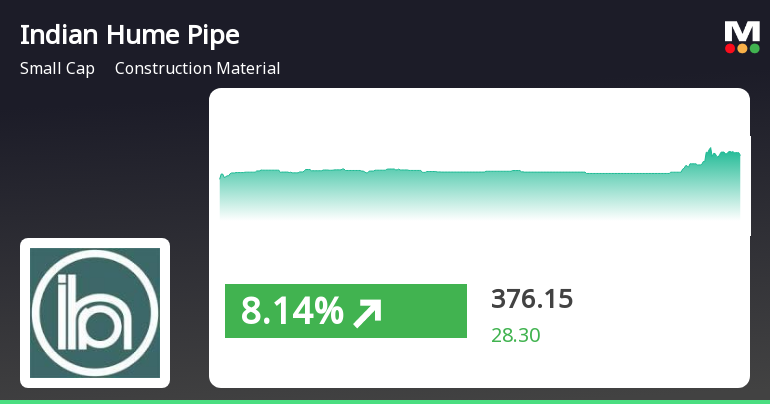

Indian Hume Pipe Company Adjusts Valuation Grade Amid Strong Financial Performance

2025-04-02 08:02:13Indian Hume Pipe Company, a small-cap player in the construction materials sector, has recently undergone a valuation adjustment reflecting its strong financial metrics. The company's price-to-earnings ratio stands at 18.97, while its price-to-book value is recorded at 2.25. Additionally, the enterprise value to EBITDA ratio is 12.25, indicating a solid operational performance. The company has demonstrated robust returns, with a year-to-date stock return of 2.12% and an impressive one-year return of 32.22%, significantly outperforming the Sensex, which has seen a return of just 2.72% over the same period. Over the last five years, Indian Hume Pipe has achieved a remarkable return of 206.06%, compared to the Sensex's 168.97%. When compared to its peers, Indian Hume Pipe's valuation metrics appear favorable. For instance, while Ramco Industries holds an attractive valuation, Rhetan TMT Ltd is categorized as...

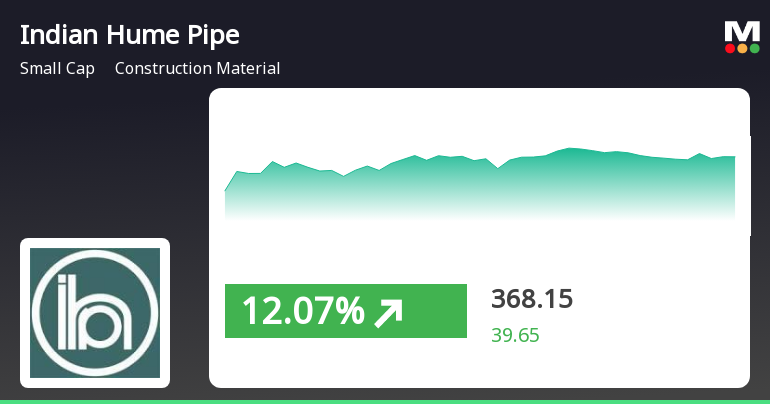

Read MoreIndian Hume Pipe Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-25 08:04:59Indian Hume Pipe Company, a player in the construction materials sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 382.35, showing a notable increase from the previous close of 377.15. Over the past year, Indian Hume Pipe has demonstrated strong performance, with a return of 42.99%, significantly outpacing the Sensex's return of 7.07% during the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands indicate bullish conditions on both weekly and monthly charts, suggesting potential volatility in price movements. The daily moving averages reflect a mildly bearish trend, contrasting with the overall positive sentiment indicated by the KST and OBV metrics. The company's performance over var...

Read More

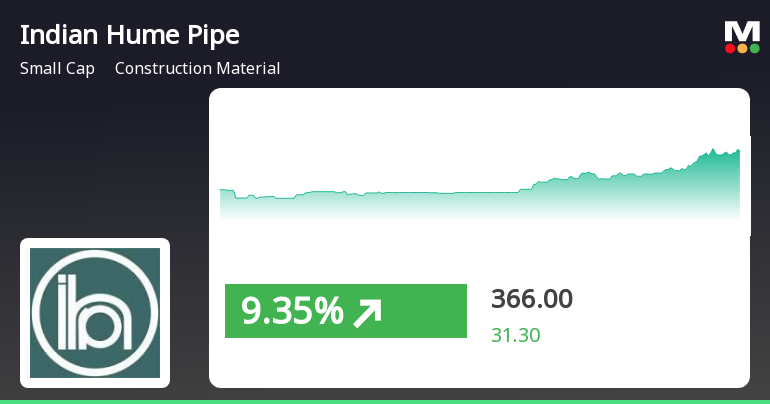

Indian Hume Pipe Company Shows Strong Performance Amidst Market Volatility

2025-03-21 15:05:26Indian Hume Pipe Company has experienced notable stock activity, outperforming its sector and showing a strong upward trend over the past four days. The stock has demonstrated high volatility and is currently above several key moving averages, reflecting its solid position in the construction material industry.

Read More

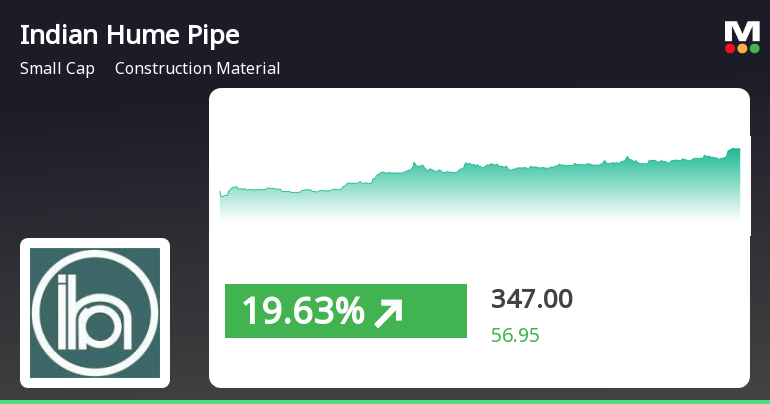

Indian Hume Pipe Company Outperforms Sector Amid Positive Market Trends

2025-03-20 09:35:25Indian Hume Pipe Company has experienced notable stock activity, outperforming its sector and achieving significant gains over the past three days. The stock reached an intraday high, demonstrating volatility and maintaining a position above several short-term moving averages. The broader market also showed positive trends, particularly in small-cap stocks.

Read MoreIndian Hume Pipe Faces Technical Trend Shifts Amidst Market Volatility

2025-03-20 08:03:08Indian Hume Pipe Company, a small-cap player in the construction materials sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 328.50, showing a notable increase from the previous close of 315.70. Over the past year, Indian Hume Pipe has demonstrated a strong performance with a return of 22.90%, significantly outperforming the Sensex, which recorded a return of 4.77% during the same period. In terms of technical indicators, the MACD and KST metrics indicate a bearish sentiment on a weekly basis, while the monthly outlook remains mildly bearish. The Bollinger Bands and moving averages also reflect a similar trend, suggesting a cautious market environment. Notably, the stock has experienced a 52-week high of 613.15 and a low of 250.60, highlighting its volatility. When comparing returns, Indian Hume Pipe has shown resilience...

Read MoreIndian Hume Pipe Company Faces Technical Trend Shifts Amid Market Dynamics

2025-03-10 08:01:39Indian Hume Pipe Company, a player in the construction material sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 332.20, slightly down from the previous close of 336.25. Over the past year, Indian Hume Pipe has shown a return of 19.17%, significantly outperforming the Sensex, which recorded a modest increase of 0.29% during the same period. In terms of technical indicators, the weekly MACD and KST are showing bearish signals, while the monthly indicators reflect a mildly bearish trend. The Bollinger Bands also indicate a mildly bearish stance on a weekly basis. Despite these trends, the stock has demonstrated resilience, particularly over longer time frames, with a notable return of 102.31% over the past five years compared to the Sensex's 97.82%. The company's performance metrics reveal a 52-week high of 613.15 and a ...

Read MoreIndian Hume Pipe Company Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-07 08:03:06Indian Hume Pipe Company, a player in the construction material sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 336.25, showing a notable increase from the previous close of 322.55. Over the past year, Indian Hume Pipe has demonstrated a return of 19.58%, significantly outperforming the Sensex, which recorded a modest gain of 0.34% during the same period. In terms of technical indicators, the MACD suggests a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend weekly, with a sideways movement monthly. Moving averages also reflect a mildly bearish sentiment on a daily basis. The company's performance over various time frames highlights its resil...

Read More

Indian Hume Pipe Company Shows Strong Stock Performance Amid Market Volatility

2025-02-24 13:20:19Indian Hume Pipe Company has seen notable trading activity, with a significant rise in stock performance today. The stock reached an intraday high of Rs 368 and has shown a strong upward trend over the past three days, outperforming its sector and the broader market index.

Read More

Indian Hume Pipe Company Shows Strong Rebound Amid Construction Materials Sector Activity

2025-02-17 11:20:25Indian Hume Pipe Company saw notable stock activity on February 17, 2025, rebounding after two days of decline. The stock reached an intraday high of Rs 317.05, with significant volatility. Despite a recent monthly decline, today's performance indicates a shift in momentum within the construction materials sector.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECompliance certificate under Reg.74(5) of SEBI (DP) Regulation as per attached letter.

Closure of Trading Window

28-Mar-2025 | Source : BSEIntimation for Closure of Trading Window as per attached letter.

Disclosure Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015.

26-Mar-2025 | Source : BSEDisclosure under Regulation 30 of SEBI (LODR) Regulations 2015 as per attached letter.

Corporate Actions

No Upcoming Board Meetings

Indian Hume Pipe Company Ltd has declared 75% dividend, ex-date: 19 Jul 24

Indian Hume Pipe Company Ltd has announced 2:10 stock split, ex-date: 30 Aug 10

Indian Hume Pipe Company Ltd has announced 1:1 bonus issue, ex-date: 09 Dec 16

No Rights history available