Indian Sucrose Adjusts Valuation Grade Amid Competitive Market Landscape

2025-03-24 08:00:37Indian Sucrose, a microcap player in the sugar industry, has recently undergone a valuation adjustment, reflecting its current market position and financial metrics. The company's price-to-earnings ratio stands at 5.13, while its price-to-book value is recorded at 0.83. Additionally, the enterprise value to EBITDA ratio is 5.48, and the enterprise value to sales ratio is 0.75, indicating a competitive stance in the market. The company's return on capital employed (ROCE) is 14.38%, and its return on equity (ROE) is 16.11%, showcasing effective management of resources. In comparison to its peers, Indian Sucrose maintains a lower valuation profile, with competitors like Uttam Sug. Mills and Avadh Sugar exhibiting higher price-to-earnings ratios of 15.16 and 12.43, respectively. Despite a year-to-date return of -15.18%, Indian Sucrose has outperformed the Sensex over the past year, achieving an 18.13% return...

Read MoreIndian Sucrose Adjusts Valuation Grade, Highlighting Competitive Position in Sugar Sector

2025-02-24 12:57:16Indian Sucrose, a microcap player in the sugar industry, has recently undergone a valuation adjustment, reflecting changes in its financial metrics and market position. The company's price-to-earnings ratio stands at 4.63, while its price-to-book value is recorded at 0.75. Other key metrics include an EV to EBIT ratio of 6.18 and an EV to EBITDA ratio of 5.22, indicating its operational efficiency relative to its enterprise value. In terms of profitability, Indian Sucrose has a return on capital employed (ROCE) of 14.38% and a return on equity (ROE) of 16.11%. These figures suggest a solid performance in generating returns from its capital and equity. When compared to its peers, Indian Sucrose's valuation metrics appear more favorable, particularly in the context of the broader sugar industry. Competitors like Dhampur Sugar and Avadh Sugar exhibit significantly higher price-to-earnings ratios, indicating ...

Read More

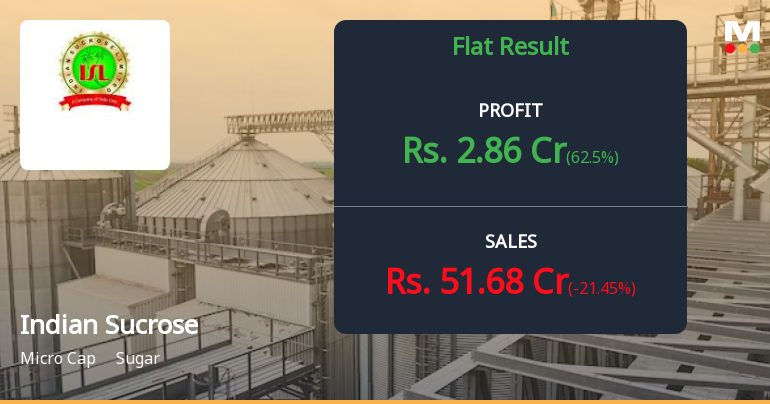

Indian Sucrose Reports Stable Financial Results Amid Score Revision in February 2025

2025-02-17 17:32:39Indian Sucrose has announced its financial results for the quarter ending December 2024, revealing stability in its performance. The company's score has improved significantly, reflecting a reassessment of its financial standing. This information may be of interest to stakeholders evaluating the company's position in the sugar industry.

Read More

Indian Sucrose Faces Financial Challenges Amid Declining Sales and High Debt Ratios

2025-01-27 18:41:11Indian Sucrose, a microcap in the sugar sector, has experienced a recent evaluation adjustment due to a decline in net sales and concerns over its debt servicing capabilities. The company's long-term growth prospects appear limited, with stagnant sales growth and a low operating profit to interest ratio, despite maintaining an attractive valuation.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate pursuant to regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025.

Disclosure Pursuant To Regulation 31(4) Of SEBI (Substantial Acquisition Of Shares And Takeovers) Regulations 2011.

07-Apr-2025 | Source : BSEDisclosure as per attached file.

Announcement under Regulation 30 (LODR)-Credit Rating

26-Mar-2025 | Source : BSEIntimation of Credit Rating.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available