Indo Amines Adjusts Valuation Amid Strong Performance and Competitive Market Positioning

2025-03-24 08:00:34Indo Amines, a microcap player in the chemicals industry, has recently undergone a valuation adjustment. The company's current price stands at 128.50, reflecting a notable increase from the previous close of 123.00. Over the past year, Indo Amines has delivered a return of 14.63%, outperforming the Sensex, which recorded a 5.87% return in the same period. Key financial metrics for Indo Amines include a price-to-earnings (PE) ratio of 16.98 and an EV to EBITDA ratio of 12.22. The company's return on equity (ROE) is reported at 17.75%, while the return on capital employed (ROCE) stands at 13.86%. These figures indicate a solid operational performance relative to its peers. In comparison, companies within the same sector exhibit a range of valuations, with some classified as expensive and others as attractive. For instance, Shivalik Rasayan shows a significantly higher PE ratio of 59.98, while Nitta Gelatin ...

Read MoreIndo Amines Adjusts Valuation Grade Amidst Competitive Market Landscape and Stock Challenges

2025-03-17 08:00:28Indo Amines, a microcap player in the chemicals industry, has recently undergone a valuation adjustment, reflecting a notable shift in its financial standing. The company currently boasts a price-to-earnings (P/E) ratio of 14.44 and an enterprise value to EBITDA ratio of 10.77, indicating a competitive position within its sector. Additionally, its return on equity (ROE) stands at 17.75%, showcasing effective management of shareholder equity. Despite the recent valuation revision, Indo Amines has faced challenges in stock performance, with a year-to-date return of -35.40%, contrasting with a -5.52% return for the Sensex over the same period. Over a longer horizon, however, the company has demonstrated resilience, achieving a remarkable 466.32% return over the past five years, significantly outpacing the Sensex's 116.48% return. In comparison to its peers, Indo Amines maintains a favorable valuation profile...

Read MoreIndo Amines Adjusts Valuation Amidst Competitive Chemicals Sector Landscape

2025-03-10 08:00:32Indo Amines, a microcap player in the chemicals industry, has recently undergone a valuation adjustment. The company's current price stands at 123.00, reflecting a slight increase from the previous close of 119.70. Over the past year, Indo Amines has experienced a stock return of -5.49%, contrasting with a modest gain of 0.29% in the Sensex. Key financial metrics for Indo Amines include a PE ratio of 16.25 and an EV to EBITDA ratio of 11.80, which positions the company within a competitive landscape. The company's return on equity (ROE) is reported at 17.75%, while the return on capital employed (ROCE) is at 13.86%. These figures provide insight into the company's operational efficiency and profitability. When compared to its peers, Indo Amines presents a mixed picture. For instance, Sr. Rayala Hypo is noted for its attractive valuation metrics, while Sadhana Nitro and Chemcon Speciality are categorized a...

Read More

Indo Amines Faces Market Volatility Amid Declining Financial Performance and Investor Sentiment

2025-03-04 10:03:55Indo Amines, a microcap in the chemicals sector, faced significant volatility, reaching a new 52-week low. The company's financial metrics indicate challenges, including a low debtors turnover ratio and a decline in quarterly profit. Its long-term performance lags behind the broader market, reflecting cautious investor sentiment.

Read MoreIndo Amines Adjusts Valuation Grade Amid Competitive Chemicals Sector Landscape

2025-03-04 08:00:29Indo Amines, a microcap player in the chemicals industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price is 112.65, with a previous close of 117.00. Over the past year, Indo Amines has experienced a stock return of -17.89%, contrasting with a modest -0.98% return from the Sensex during the same period. Key financial metrics for Indo Amines include a price-to-earnings (PE) ratio of 14.88 and an EV to EBITDA ratio of 11.02, indicating a competitive position within its sector. The company's return on equity (ROE) stands at 17.75%, while the return on capital employed (ROCE) is reported at 13.86%. In comparison to its peers, Indo Amines presents a more favorable valuation profile, particularly when looking at its PE and EV to EBITDA ratios. Notably, competitors such as TGV Sraac and Gulshan Polyols exhibit higher valuation metrics, sug...

Read More

Indo Amines Reports Stable Q3 FY24-25 Results Amid Evaluation Adjustment

2025-02-11 20:03:19Indo Amines has announced its financial results for the quarter ending February 2025, showing stable performance for Q3 FY24-25. An adjustment in evaluation reflects the company's current market standing, providing insights into its operational dynamics and overall health within the chemicals sector during the reporting period.

Read More

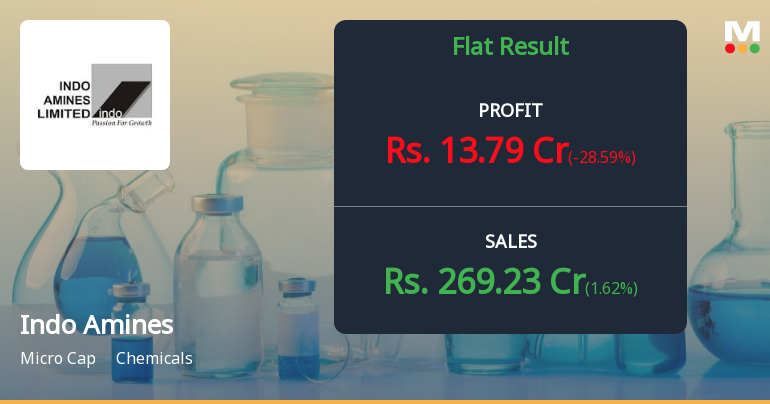

Indo Amines Faces Financial Challenges Amid Flat Q2 Performance and Low Liquidity Ratios

2025-02-10 18:51:22Indo Amines, a small-cap chemicals company, has recently seen a change in its evaluation amid flat financial performance for Q2 FY24-25. Key metrics reveal challenges in operational efficiency, including a high Debt to EBITDA ratio and low Debtors Turnover Ratio, raising concerns about liquidity and long-term growth prospects.

Read More

Indo Amines Reports Flat Q2 FY24-25 Performance Amid Debt Challenges and Market Adjustments

2025-02-03 18:30:54Indo Amines, a small-cap chemicals company, has recently adjusted its evaluation amid flat financial performance for Q2 FY24-25. Despite a slight profit increase, the company faces challenges such as a high debt to EBITDA ratio and low debtor turnover. The stock is currently trading at a discount to historical valuations.

Read More

Indo Amines Faces Financial Stability Concerns Amid Flat Q2 Performance and Low Ratios

2025-01-27 18:49:50Indo Amines, a microcap chemicals company, has recently experienced an evaluation adjustment amid flat financial performance for Q2 FY24-25. Key metrics indicate challenges in operational efficiency, with concerns about debt servicing capability and limited long-term growth potential, as reflected in low turnover and dividend payout ratios.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSEPlease find attached the Certificate under Regulation 74(5) of SEBI (DP) Regulations 2018 for the quarter ended 31st March 2025.

Closure of Trading Window

26-Mar-2025 | Source : BSEPlease find attached the Intimation of Trading Window Closure for Quarter Ended 31st March 2025 w.e.f 01st April 2025.

Announcement Under Regulation 30 (LODR) - Reclassification Of Promoters Under Regulation 31A Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

26-Mar-2025 | Source : BSEPlease find attached herewith approval letter received from Stock Exchanges for application filed by the Company under Regulation 31 A of SEBI (LODR) Regulations 2015 - Reclassification of Promoter and Promoter Group category.

Corporate Actions

No Upcoming Board Meetings

Indo Amines Ltd has declared 10% dividend, ex-date: 17 Sep 24

Indo Amines Ltd has announced 5:10 stock split, ex-date: 13 Jan 22

Indo Amines Ltd has announced 1:1 bonus issue, ex-date: 16 Sep 13

No Rights history available