Indo-City Infotech Faces Intense Selling Pressure Amid Significant Price Declines

2025-03-06 15:10:08Indo-City Infotech Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced a notable decline, with a one-day performance of -9.18%, starkly contrasting with the Sensex's gain of 0.86%. This trend of losses has persisted, as Indo-City Infotech has recorded a staggering -22.56% over the past week and a -38.45% drop in the last month. In comparison to the Sensex, which has only seen a minor decline of -0.33% over the week and -4.73% over the month, Indo-City Infotech's performance highlights a concerning divergence. Year-to-date, the stock has plummeted by -36.37%, while the Sensex has decreased by just -4.83%. The stock's performance metrics indicate a trend reversal, having fallen after two consecutive days of gains. Additionally, Indo-City Infotech is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, furthe...

Read MoreIndo-City Infotech Ltd Sees Significant Buying Activity Amid Recent Price Gains

2025-03-05 09:35:21Indo-City Infotech Ltd is currently witnessing significant buying activity, with the stock gaining 9.91% today, outperforming the Sensex, which rose by only 0.63%. This marks the second consecutive day of gains for Indo-City Infotech, with a total increase of 21.73% over this period. The stock opened with a notable gap up, reflecting strong buyer sentiment, and reached an intraday high of Rs 11.09. Despite this recent uptick, Indo-City Infotech's performance over the past week shows a decline of 15.92%, and it has experienced a more substantial drop of 35.71% over the past month. Year-to-date, the stock is down 29.36%, contrasting with the Sensex's decline of 6.00%. However, over a longer horizon, Indo-City Infotech has demonstrated resilience, with a 48.26% increase over the past three years and an impressive 516.11% rise over the last five years. The current buying pressure may be attributed to various ...

Read MoreIndo-City Infotech Ltd Sees Significant Buying Surge Amid Broader Market Decline

2025-03-04 12:20:07Indo-City Infotech Ltd is witnessing significant buying activity today, with a notable increase of 10.76%, contrasting sharply with the Sensex, which has declined by 0.27%. This marks a trend reversal for the stock, which had experienced three consecutive days of declines prior to today’s gains. Despite the positive movement today, Indo-City Infotech has faced challenges over the past week, with a decrease of 23.50%, and a more substantial drop of 36.98% over the past month. In terms of price summary, the stock opened with a gap up, indicating strong buyer interest from the outset. The intraday high reflects this momentum, although specific figures were not provided. Over the longer term, Indo-City Infotech has shown resilience, with a remarkable 460.56% increase over the past five years, compared to the Sensex's 89.78% growth during the same period. The current buying pressure may be attributed to variou...

Read More

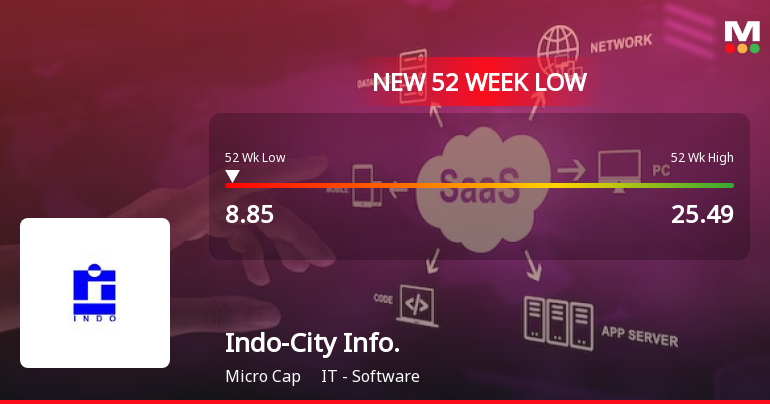

Indo-City Infotech Faces Significant Volatility Amidst Persistent Downward Trend

2025-03-03 10:36:08Indo-City Infotech, a microcap IT software company, has faced notable volatility, hitting a new 52-week low of Rs. 8.85. The stock has dropped 25.09% over three days and is trading below all key moving averages, reflecting a challenging year with a 16.02% decline compared to the Sensex's minor decrease.

Read MoreIndo-City Infotech Shows Mixed Technical Trends Amid Market Fluctuations

2025-02-25 10:31:49Indo-City Infotech, a microcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's technical indicators present a mixed picture, with the MACD signaling bearish trends on a weekly basis and mildly bearish on a monthly basis. The Bollinger Bands also indicate a bearish stance on the weekly chart, while the monthly view remains sideways. Despite these technical signals, Indo-City Infotech has shown resilience in its performance metrics over various time frames. Over the past week, the stock returned 4.94%, contrasting with a decline in the Sensex of 1.72%. However, the one-month performance reveals a decline of 12.37% for the stock, while the Sensex fell by 2.01%. Year-to-date, Indo-City Infotech has experienced a drop of 18.79%, compared to a 4.45% decline in the broader market. Looking at longer-term performance, Indo-Cit...

Read MoreIndo-City Infotech Faces Short-Term Challenges Amidst Strong Long-Term Growth Trends

2025-02-21 10:29:21Indo-City Infotech Ltd, a microcap player in the IT software industry, has experienced notable fluctuations in its stock performance today. The company's market capitalization stands at Rs 13.79 crore, with a price-to-earnings (P/E) ratio of -14.29, significantly lower than the industry average of 33.71. Over the past year, Indo-City Infotech has shown a robust performance of 24.04%, outperforming the Sensex, which recorded a gain of 3.76%. However, recent trends indicate a decline, with the stock down 3.49% today, compared to a 0.50% drop in the Sensex. The stock has also faced challenges over the past week and month, with declines of 5.42% and 12.13%, respectively. Despite these short-term setbacks, Indo-City Infotech has demonstrated impressive long-term growth, with a remarkable 636.67% increase over the past five years, significantly outpacing the Sensex's 83.03% rise during the same period. As the c...

Read More

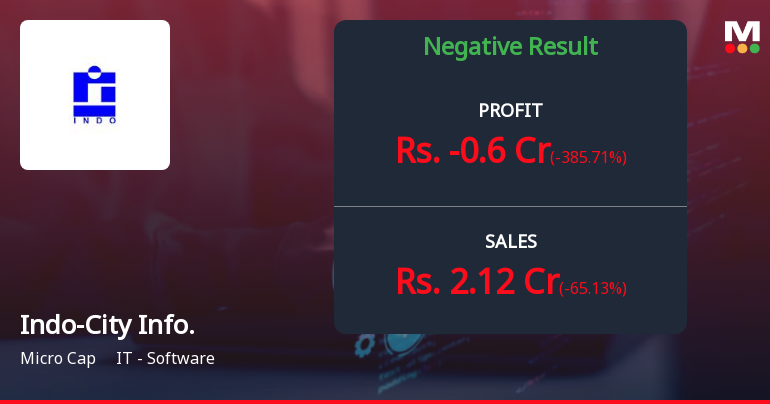

Indo-City Infotech Reports Q3 FY24-25 Results Amidst Ongoing Financial Challenges

2025-02-08 10:03:37Indo-City Infotech has announced its financial results for the quarter ending February 2025, revealing a negative performance for Q3 FY24-25. Despite this, the company's evaluation score has improved slightly, indicating a reassessment of its financial health amid ongoing challenges in the competitive IT software sector.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEIn accordance with Regulation 74(5) of the SEBI ( Depositories and Participants) Regulations 2018 for the quarter and year ended 31st March 2025 based on the Certificate received from MCS shares Transfer Agent Ltd. (RTA) which is enclosed herewith we hereby confirm that within 90 days of receipts of securities received for dematerialization: a) The Securities comparies in the said certificate(s) of Security have been listed on the Stock Exchagne ; and b) The said certificate (s) after due verification have been mutilated and cancelled and the name of the depository has been substituted in our records as the registered owner.

Disclosure In Terms Of Regulation 31(4) Of The SEBI (Substantial Acquisition Of Shares And Takeover) Regulation 2011.

03-Apr-2025 | Source : BSEWe are enclosing herewith the annual disclosure in terms of Regulation 31(4) of the SEBI ( Substantial Acquisition of Shares and Takeover) Regulation 2011 as received from the Promoters/ Promoter Gropu / Person Acting in Concent for the financial year ended 31st March 2025.

Announcement under Regulation 30 (LODR)-Newspaper Publication

15-Feb-2025 | Source : BSEPuruant to Regulation 47(3) of SEBI (Listing Obligation and Disclosure Requirements) Regulations 2015 the Company attached herewith the extract of Un-Audited Financial Results for the quarter and nine month ended as on December 31 2024 that has been publised on 9th February 2025 in the following Newspapers :- 1) Mumbai Laksdeep ( Marthi Daily Newspaper) 2) Active Times ( English Daily Newspaper)

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available