Indo Farm Equipment Adjusts Valuation Amidst Competitive Market Dynamics and Mixed Performance Metrics

2025-04-02 08:03:21Indo Farm Equipment, a microcap player in the automobiles-tractors sector, has recently undergone a valuation adjustment. The company's current price stands at 164.70, reflecting a notable increase from the previous close of 154.65. Over the past week, Indo Farm Equipment has shown a stock return of 4.67%, contrasting sharply with a decline in the Sensex, which fell by 2.55%. Key financial metrics reveal a PE ratio of 58.45 and an EV to EBITDA ratio of 19.92, indicating a premium valuation relative to its peers. The company's return on capital employed (ROCE) is reported at 7.62%, while the return on equity (ROE) is at 4.08%. These figures suggest a mixed performance in terms of profitability and efficiency. In comparison to its industry peers, Indo Farm Equipment's valuation metrics highlight a competitive landscape, with its price-to-book value at 2.39 and an EV to sales ratio of 2.70. The company's PEG...

Read More

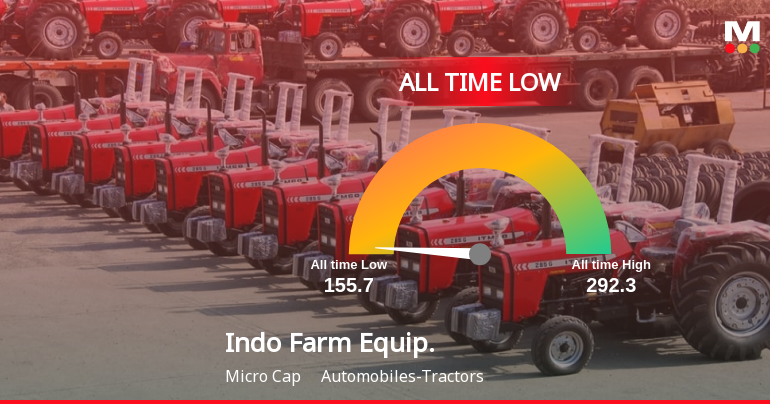

Indo Farm Equipment Reaches All-Time Low Amidst Sector Gains and Market Volatility

2025-03-26 13:32:35Indo Farm Equipment, a microcap in the automobiles-tractors sector, has faced notable volatility, hitting an all-time low. The stock has underperformed its sector and is trading below key moving averages, reflecting a sustained downward trend. Over the past month, it has significantly declined compared to broader market gains.

Read MoreIndo Farm Equipment Adjusts Valuation Grade Amidst Market Dynamics and Performance Variability

2025-03-25 08:01:07Indo Farm Equipment, a microcap player in the automobiles-tractors sector, has recently undergone a valuation adjustment reflecting its current market standing. The company's price-to-earnings ratio stands at 58.61, while its price-to-book value is recorded at 2.39. Other key financial metrics include an EV to EBIT ratio of 25.42 and an EV to EBITDA ratio of 19.97, indicating its operational efficiency relative to its enterprise value. Despite a current price of 165.15, which is below its 52-week high of 292.30, Indo Farm Equipment has shown varied performance in comparison to the Sensex. Over the past week, the stock returned 3.09%, while the Sensex returned 5.14%. However, in the one-month period, Indo Farm experienced a decline of 15.02%, contrasting with the Sensex's gain of 4.74%. In terms of return on capital employed (ROCE) and return on equity (ROE), Indo Farm reported figures of 7.62% and 4.08%,...

Read MoreIndo Farm Equipment Adjusts Valuation Amidst Market Volatility and Competitive Metrics

2025-03-19 08:01:04Indo Farm Equipment, a microcap player in the automobiles-tractors sector, has recently undergone a valuation adjustment. The company's current price stands at 161.05, reflecting a slight increase from the previous close of 160.20. Over the past year, Indo Farm Equipment has experienced significant volatility, with a 52-week high of 292.30 and a low of 155.70. Key financial metrics reveal a PE ratio of 57.15 and an EV to EBITDA ratio of 19.56, indicating the company's market positioning relative to its earnings potential. The PEG ratio is notably at 0.00, suggesting a unique valuation perspective. Additionally, the company's return on capital employed (ROCE) is recorded at 7.62%, while the return on equity (ROE) is at 4.08%. In comparison to its peers, Indo Farm Equipment's valuation metrics present a distinct profile. While the company has faced challenges reflected in its recent stock performance—showin...

Read MoreIndo Farm Equipment Experiences Valuation Grade Change Amidst Competitive Market Landscape

2025-03-01 08:00:35Indo Farm Equipment, a microcap player in the automobiles-tractors sector, has recently undergone a valuation adjustment. The company's financial metrics reveal a PE ratio of 68.08 and an EV to EBITDA ratio of 22.65, indicating a premium valuation relative to its peers. The price-to-book value stands at 2.78, while the EV to sales ratio is recorded at 3.07. In terms of profitability, Indo Farm Equipment shows a return on capital employed (ROCE) of 7.62% and a return on equity (ROE) of 4.08%. These figures provide insight into the company's operational efficiency and shareholder returns. When compared to its peer, Yamuna Syndicate, which has a significantly lower PE ratio of 6.75 and an EV to EBITDA of 788.79, Indo Farm Equipment's valuation appears elevated. This contrast highlights the varying market perceptions and financial health within the sector. Overall, the evaluation revision reflects the com...

Read More

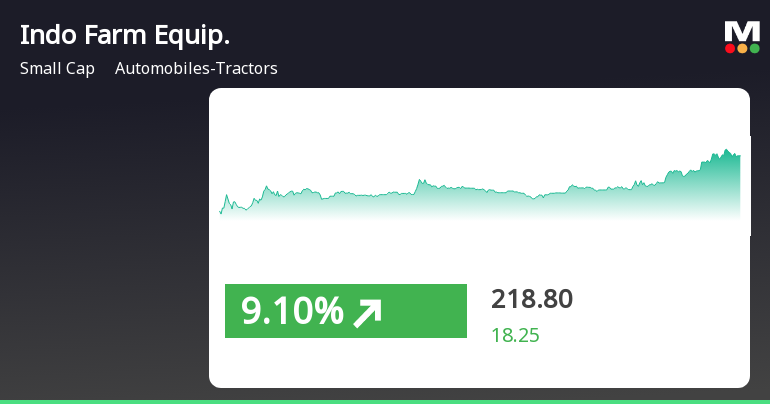

Indo Farm Equipment Shows Strong Resilience Amid Broader Market Trends

2025-02-06 15:20:27Indo Farm Equipment, a small-cap player in the automobiles-tractors sector, gained 9.37% on February 6, 2025, outperforming its sector significantly. The stock has shown strong momentum with a total return of 19.31% over three days, reflecting active trading and investor interest amid broader market trends.

Read MoreClosure of Trading Window

28-Mar-2025 | Source : BSEIntimation of Closure of Trading Window.

Announcement under Regulation 30 (LODR)-Acquisition

12-Mar-2025 | Source : BSEPursuant to Regulation 30 of the SEBI (LODR) Regulation 2015 Investment in the Equity share of Barota Finance Limited ( Wholly owned subsidiary of the Company.

Announcement under Regulation 30 (LODR)-Newspaper Publication

15-Feb-2025 | Source : BSENewspaper Publication dated February 15th 2025 is attached herewith.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available