Indoco Remedies Faces Technical Trend Challenges Amid Market Volatility

2025-04-03 08:03:29Indoco Remedies, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 246.40, showing a slight increase from the previous close of 245.05. Over the past year, the stock has experienced significant volatility, with a 52-week high of 385.50 and a low of 190.00. In terms of technical indicators, the MACD and KST metrics are showing bearish signals on both weekly and monthly charts, while the Bollinger Bands indicate a mildly bearish trend. The daily moving averages also reflect a mildly bearish sentiment. Notably, the Relative Strength Index (RSI) shows no clear signals, suggesting a period of indecision in the market. When comparing the stock's performance to the Sensex, Indoco Remedies has shown mixed results. Over the past week, the stock returned 4.85%, significantly outperforming...

Read More

Indoco Remedies Faces Ongoing Financial Challenges Amid Market Sentiment Shift

2025-04-03 08:01:29Indoco Remedies, a small-cap pharmaceutical company, has experienced a recent score adjustment reflecting ongoing financial challenges. The company has faced a decline in operating profit and negative results over the past nine quarters, with technical indicators suggesting a bearish market sentiment. Despite low debt levels, concerns persist regarding its financial performance.

Read More

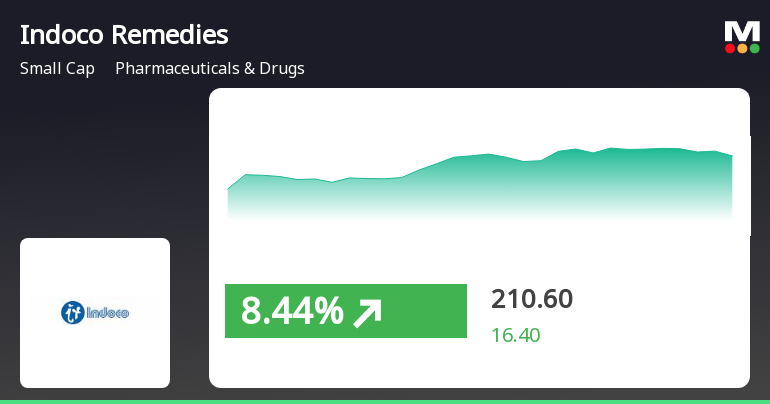

Indoco Remedies Shows Strong Intraday Gains Amid Broader Market Rally

2025-03-24 14:05:15Indoco Remedies, a small-cap pharmaceutical company, experienced notable gains on March 24, 2025, outperforming its sector. The stock opened higher and reached an intraday peak, while the broader market, represented by the Sensex, also showed positive movement. However, Indoco Remedies has faced significant declines over the past year and three years.

Read MoreIndoco Remedies Experiences Valuation Grade Change Amidst Complex Financial Metrics

2025-03-17 08:00:27Indoco Remedies, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment. The company's financial metrics reveal a PE ratio of -81.06 and a price-to-book value of 1.85, indicating a complex financial landscape. The EV to EBIT stands at 74.51, while the EV to EBITDA is recorded at 18.83. Additionally, the EV to sales ratio is 1.63, and the PEG ratio is at 0.00, suggesting unique challenges in growth relative to its valuation. In terms of profitability, Indoco Remedies shows a return on capital employed (ROCE) of 4.93% and a return on equity (ROE) of 2.25%. The dividend yield is modest at 0.69%. When compared to its peers, Indoco Remedies appears to be positioned differently within the market. Competitors such as Supriya Lifesciences and Hikal are noted for their higher valuation metrics, while others like Innova Captab and Sequent Scientific share a similar ...

Read MoreIndoco Remedies Experiences Valuation Grade Change Amidst Profitability Challenges and Market Decline

2025-03-11 08:00:18Indoco Remedies, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment. The company's financial metrics reveal a PE ratio of -86.49, indicating significant challenges in profitability. The Price to Book Value stands at 1.97, while the EV to EBIT is notably high at 78.09, suggesting potential concerns regarding operational efficiency. Additionally, the EV to EBITDA ratio is recorded at 19.73, and the EV to Sales ratio is 1.70, reflecting the company's market valuation relative to its earnings and sales. In terms of returns, Indoco Remedies has faced a challenging year, with a year-to-date decline of 30.05%, contrasting with a modest 5.15% drop in the Sensex. Over a three-year period, the company's stock has decreased by 37.35%, while the Sensex has appreciated by 33.63%. When compared to its peers, Indoco Remedies presents a mixed picture. While some compe...

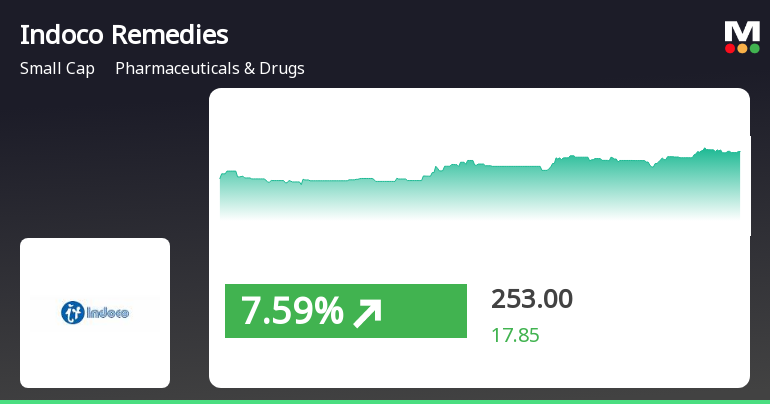

Read MoreIndoco Remedies Opens Strong with 8.89% Gain Amid Market Volatility

2025-03-07 10:30:36Indoco Remedies, a small-cap player in the Pharmaceuticals & Drugs industry, has shown significant activity today, opening with an impressive gain of 8.89%. The stock has outperformed its sector by 2.14%, marking a notable performance amidst a volatile trading environment. Over the past two days, Indoco Remedies has recorded a cumulative return of 4.87%, indicating a short-term upward trend. Today, the stock reached an intraday high of Rs 251.8, reflecting its high volatility with an intraday fluctuation of 7.66%. In terms of moving averages, the stock is currently above its 5-day average but remains below the 20-day, 50-day, 100-day, and 200-day averages, suggesting mixed signals in its performance trajectory. On a broader scale, Indoco Remedies has experienced a decline of 15.80% over the past month, compared to a 4.37% drop in the Sensex. Technical indicators present a bearish outlook on both weekly an...

Read More

Indoco Remedies Experiences Notable Reversal Amid Ongoing Long-Term Challenges

2025-03-03 09:35:13Indoco Remedies, a small-cap pharmaceutical company, experienced a notable uptick today, reversing a four-day decline. Despite this positive movement, the stock remains below key moving averages and has seen a significant decline over the past month, contrasting with the broader market's performance.

Read More

Indoco Remedies Faces Continued Volatility Amidst Broader Market Challenges

2025-02-28 10:05:42Indoco Remedies, a small-cap pharmaceutical company, has hit a new 52-week low, continuing a downward trend with a 15.2% decline over four days. Despite this, it outperformed its sector slightly today. Over the past year, the company has faced significant challenges, with a 44.18% performance drop.

Read More

Indoco Remedies Faces Continued Volatility Amid Broader Market Trends

2025-02-27 09:35:48Indoco Remedies, a small-cap pharmaceutical company, has hit a new 52-week low, continuing a downward trend with a 10.54% decline over three days. The stock has underperformed significantly over the past year, trading below key moving averages, reflecting broader market influences on its performance.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEAttached the Certificate issued by MUFG Intime India Pvt Ltd Registrar & Transfer Agent of the Company confirming compliance under Regulation 74(5) of SEBI (D&P) Regulations2018 for the quarter ended 31-03-2025.

Closure of Trading Window

28-Mar-2025 | Source : BSEIntimation regarding Closure of Trading Window

Disclosure Under Regulation 30 Of The SEBI (LODR) Regulations2015 (Listing Regulations)

27-Mar-2025 | Source : BSEThe Company has received an Assessment Order u/s 143(3) dated 26-03-2025 for Assessment year 2023-24 from Assessment Unit Income tax Department.

Corporate Actions

No Upcoming Board Meetings

Indoco Remedies Ltd has declared 75% dividend, ex-date: 19 Sep 24

Indoco Remedies Ltd has announced 2:10 stock split, ex-date: 17 May 12

Indoco Remedies Ltd has announced 1:2 bonus issue, ex-date: 17 May 12

No Rights history available