Indostar Capital Finance Adjusts Evaluation Amid Mixed Financial Performance and Technical Trends

2025-03-21 08:03:54Indostar Capital Finance has experienced a recent evaluation adjustment, indicating a shift in technical trends. While the stock has shown a significant annual return, profitability metrics reveal challenges, including declining profits and net sales. However, certain technical indicators suggest a more favorable outlook in the market.

Read MoreIndostar Capital Finance Shows Mixed Technical Signals Amid Strong Performance Trends

2025-03-21 08:03:00Indostar Capital Finance, a small-cap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 295.20, showing a notable increase from the previous close of 286.65. Over the past year, Indostar has demonstrated a strong performance with a return of 46.03%, significantly outpacing the Sensex, which returned 5.89% in the same period. The technical summary indicates mixed signals across various indicators. While the MACD shows a bearish trend on a weekly basis, it is bullish on a monthly scale. The Bollinger Bands reflect bullish conditions for both weekly and monthly assessments, suggesting potential volatility. The moving averages present a mildly bearish outlook on a daily basis, contrasting with the bullish signals from the On-Balance Volume (OBV) indicator. In terms of recent performance, Indostar has outper...

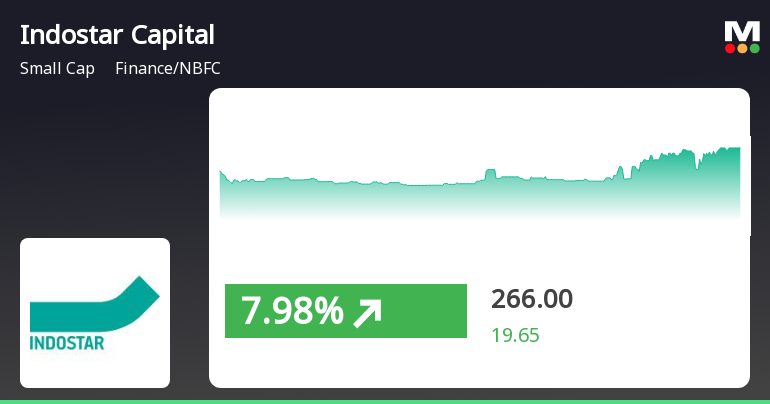

Read MoreIndostar Capital Finance Shows Mixed Technical Signals Amid Strong Yearly Performance

2025-03-18 08:04:14Indostar Capital Finance, a small-cap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 268.05, showing a slight increase from the previous close of 266.00. Over the past year, Indostar has demonstrated a notable return of 37.04%, significantly outperforming the Sensex, which recorded a return of 2.10% during the same period. The technical summary indicates mixed signals across various indicators. The MACD shows a bearish trend on a weekly basis while being bullish monthly. Bollinger Bands reflect a bullish stance in both weekly and monthly assessments. However, moving averages suggest a mildly bearish outlook on a daily basis. The KST presents a bearish trend weekly but bullish monthly, while the On-Balance Volume indicates no trend weekly and bullish monthly. In terms of stock performance, Indostar ha...

Read More

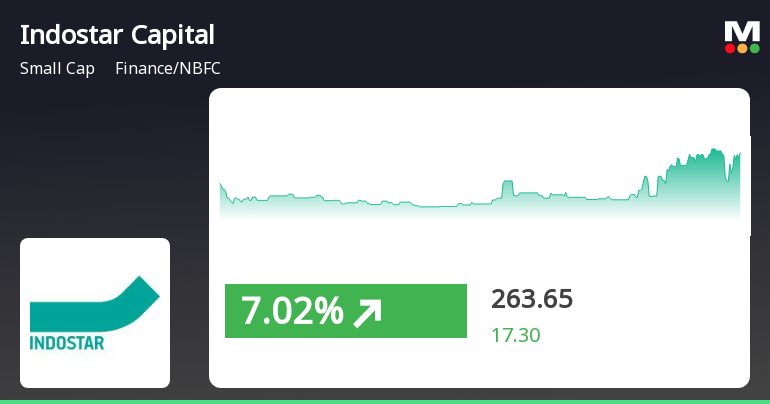

Indostar Capital Finance Shows Strong Performance Amid Broader Market Challenges

2025-03-13 15:05:25Indostar Capital Finance has demonstrated notable performance, gaining 7.29% on March 13, 2025, and outperforming its sector. The stock has seen consecutive gains over two days, totaling 15.43%. Despite a challenging broader market, Indostar remains above its short-term moving averages.

Read MoreIndostar Capital Finance Adjusts Valuation Amid Competitive Market Landscape

2025-03-13 08:00:49Indostar Capital Finance has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the finance and non-banking financial company (NBFC) sector. The company's price-to-earnings (PE) ratio stands at 44.53, while its price-to-book value is at 1.00. Other key metrics include an enterprise value to EBITDA ratio of 11.86 and a return on capital employed (ROCE) of 7.62%. In comparison to its peers, Indostar Capital's valuation appears elevated, particularly when juxtaposed with companies like Indus Inf. Trust, which has a significantly higher PE ratio of 331.95, and MAS Financial Services, which maintains a more attractive valuation with a PE of 15.03. Notably, Indostar's performance over the past year has yielded a return of 26.2%, contrasting with the Sensex's modest gain of 0.49% during the same period. However, over a longer horizon, the company's retu...

Read MoreIndostar Capital Finance Adjusts Valuation Amid Competitive Market Landscape

2025-03-13 08:00:49Indostar Capital Finance has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the finance and non-banking financial company (NBFC) sector. The company's price-to-earnings (PE) ratio stands at 44.53, while its price-to-book value is at 1.00. Other key metrics include an enterprise value to EBITDA ratio of 11.86 and a return on capital employed (ROCE) of 7.62%. In comparison to its peers, Indostar Capital's valuation appears elevated, particularly when juxtaposed with companies like Indus Inf. Trust, which has a significantly higher PE ratio of 331.95, and MAS Financial Services, which maintains a more attractive valuation with a PE of 15.03. Notably, Indostar's performance over the past year has yielded a return of 26.2%, contrasting with the Sensex's modest gain of 0.49% during the same period. However, over a longer horizon, the company's retu...

Read More

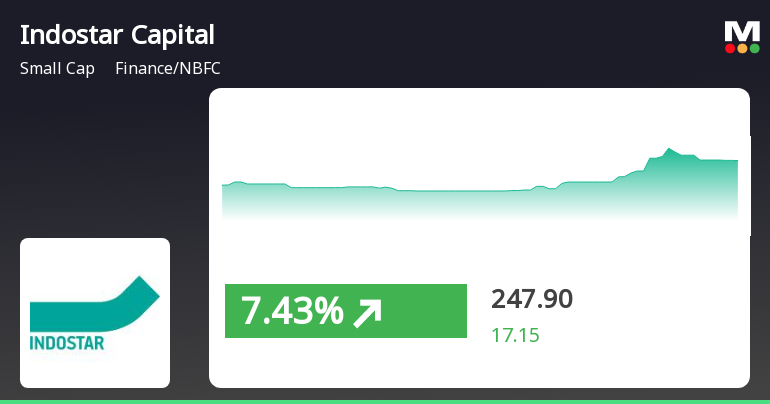

Indostar Capital Finance Shows Trend Reversal Amid Broader Market Decline

2025-03-12 14:05:25Indostar Capital Finance experienced a notable rebound today, gaining 7.29% after two days of decline. The stock outperformed its sector and reached an intraday high, although its moving averages present a mixed outlook. Over the past year, it has significantly outperformed the Sensex, despite a year-to-date decline.

Read More

Indostar Capital Finance Surges Amid Broader Market Gains and High Volatility

2025-03-07 10:30:57Indostar Capital Finance has experienced notable trading activity, with significant intraday volatility and a marked performance that surpassed the broader market. The stock's current position relative to various moving averages indicates mixed trends, while its year-over-year return contrasts sharply with the Sensex's modest gains.

Read MoreIndostar Capital Finance Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-07 08:03:50Indostar Capital Finance, a small-cap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 230.75, down from a previous close of 234.10, with a notable 52-week range between 180.00 and 339.70. Today's trading saw a high of 241.90 and a low matching the current price. The technical summary indicates a mixed outlook, with various indicators showing differing trends. The MACD suggests a bearish stance on a weekly basis while leaning mildly bearish on a monthly scale. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly periods. Bollinger Bands present a bearish trend weekly but indicate a mildly bullish sentiment monthly. Daily moving averages are bearish, while the KST reflects a bearish weekly trend but a bullish monthly outlook. Dow Theory aligns with a mildly bearish p...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Reg.74 (5) of SEBI (DP) Regulation 2018

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

02-Apr-2025 | Source : BSEAllotment of ESOPs dated 02 April 2025

Intimation For Sale Of Commercial Vehicle Loan Portfolio

29-Mar-2025 | Source : BSEIntimation for sale of Commercial Vehicle Loan Portfolio

Corporate Actions

No Upcoming Board Meetings

Indostar Capital Finance Ltd has declared 10% dividend, ex-date: 19 Nov 19

No Splits history available

No Bonus history available

No Rights history available