Indrayani Biotech Sees Significant Buying Activity Amid Broader Market Decline

2025-04-03 09:35:17Indrayani Biotech Ltd is currently witnessing significant buying activity, with the stock rising by 4.96% today, contrasting sharply with the Sensex, which has declined by 0.58%. Over the past week, Indrayani Biotech has shown a robust performance, gaining 11.34%, while the Sensex has fallen by 1.85%. Notably, the stock has experienced consecutive gains for the last three days, accumulating a total return of 16.54% during this period. Despite its recent positive momentum, Indrayani Biotech's longer-term performance reveals challenges, with a 71.02% decline over the past year compared to a 3.11% increase in the Sensex. The stock's performance over three months shows a significant drop of 54.43%, while the Sensex has only decreased by 3.85%. Today's trading session opened with a gap up, and the intraday high reflects the ongoing buying pressure. The floriculture sector, in which Indrayani Biotech operates,...

Read MoreIndrayani Biotech Ltd Sees Notable Price Surge Amid Sector Resilience and Increased Buying Activity

2025-04-02 09:35:24Indrayani Biotech Ltd, a microcap player in the floriculture industry, is witnessing significant buying activity, with the stock rising by 4.94% today. This performance stands in stark contrast to the Sensex, which has only gained 0.54% during the same period. Over the past two days, Indrayani Biotech has recorded consecutive gains, totaling an impressive 11.02%. Despite this recent uptick, the stock's longer-term performance reveals challenges, with a decline of 71.01% over the past year compared to the Sensex's 3.42% increase. In the last month, the stock has dropped by 24.80%, while the Sensex has risen by 4.42%. However, the floriculture sector as a whole has shown resilience, gaining 4.99% today. The stock opened with a gap up, indicating strong initial buyer interest, and reached an intraday high that reflects the current bullish sentiment. While the stock remains below its longer-term moving averag...

Read More

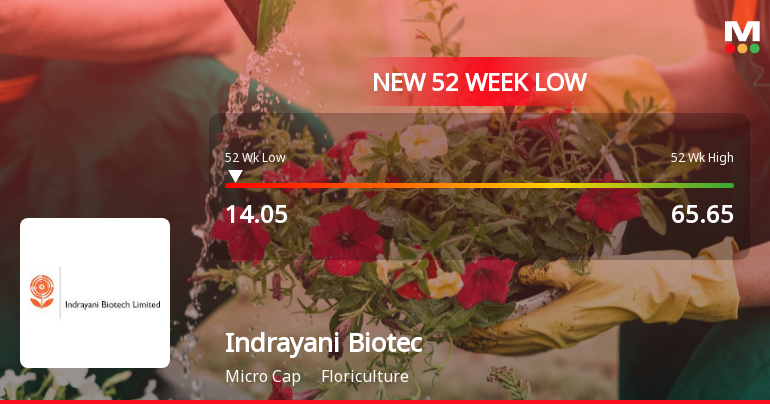

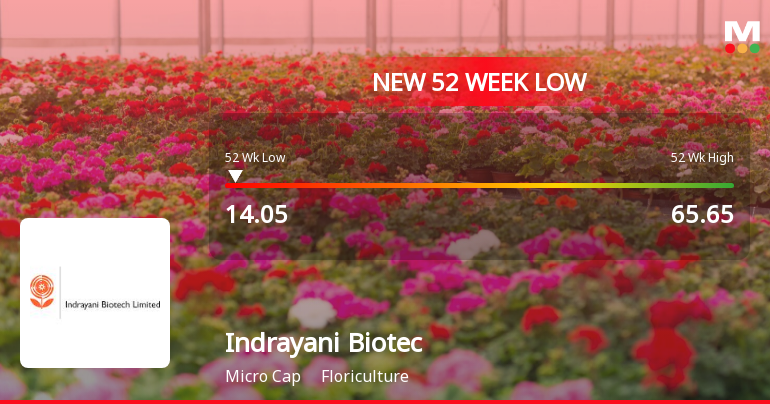

Indrayani Biotech Faces Continued Decline Amid Broader Market Challenges and Debt Concerns

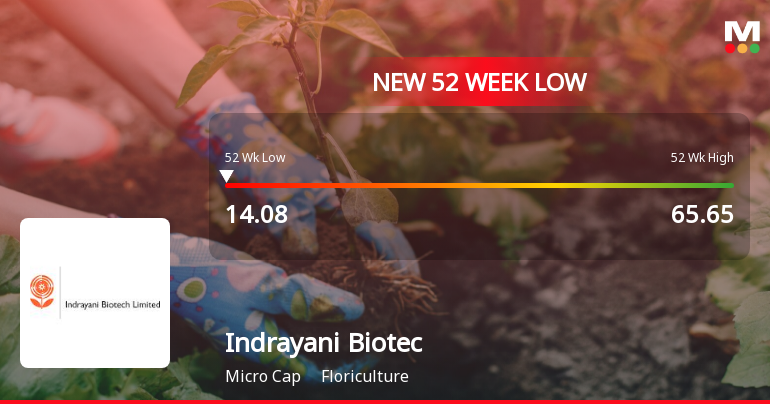

2025-04-01 11:49:04Indrayani Biotech, a microcap in the floriculture sector, has reached a new 52-week low, continuing a downward trend with a 71% decline over the past year. The company faces financial challenges, including a high Debt to EBITDA ratio and consecutive quarters of negative results, amid broader market declines.

Read More

Indrayani Biotech Faces Ongoing Challenges Amid Significant Stock Volatility and Weak Fundamentals

2025-04-01 11:49:02Indrayani Biotech, a microcap in the floriculture sector, has hit a new 52-week low, continuing a downward trend with a 71% decline over the past year. The company faces ongoing challenges, including reduced operating profit and negative quarterly results, alongside weak financial metrics and bearish technical indicators.

Read MoreIndrayani Biotech Ltd Experiences Notable Buying Surge Amid Market Volatility

2025-04-01 11:40:31Indrayani Biotech Ltd is currently witnessing significant buying activity, marking a notable performance shift after a prolonged period of decline. Today, the stock surged by 5.80%, contrasting sharply with the Sensex, which fell by 1.52%. This uptick comes after seven consecutive days of losses, indicating a potential trend reversal. Despite this daily gain, the stock's performance over the past week shows a decline of 9.27%, while it has experienced a substantial drop of 28.34% over the past month. Over the longer term, Indrayani Biotech has faced considerable challenges, with a 71.00% decrease in value over the past year and a 59.06% decline over the last three months. However, it has shown resilience over a five-year period, with a gain of 79.28%, albeit underperforming compared to the Sensex's 169.73% increase. Today's trading session opened with a gap up, reaching an intraday high, although it also ...

Read MoreIndrayani Biotech Faces Intense Selling Pressure Amid Significant Price Declines

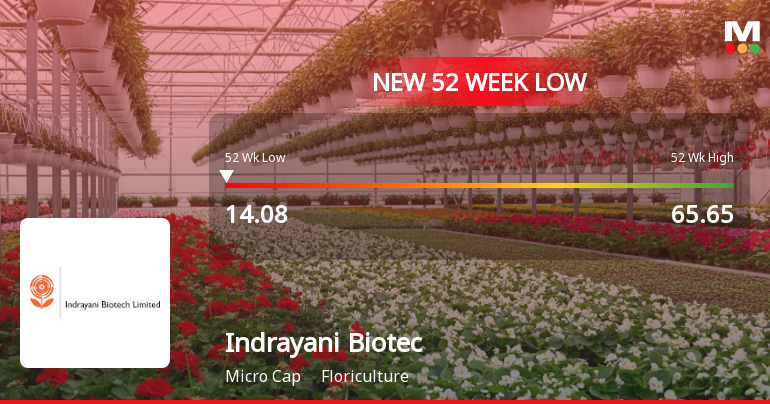

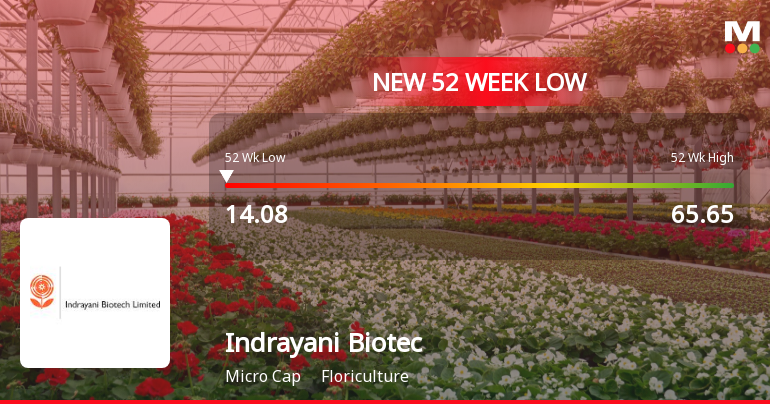

2025-03-28 13:40:06Indrayani Biotech Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced a consecutive decline over the past seven days, resulting in a total loss of 20.73% during this period. Today, the stock fell by 4.93%, contrasting sharply with the Sensex, which only declined by 0.24%. Over the past week, Indrayani Biotech's performance has been particularly poor, down 18.71%, while the Sensex gained 0.67%. The stock has also seen a staggering 32.60% drop over the past month, compared to a 5.77% increase in the Sensex. Year-to-date, Indrayani Biotech has lost 61.30%, while the Sensex has only dipped by 0.92%. The stock recently hit a new 52-week low of Rs. 14.08 and is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages. The floriculture sector itself has also faced challenges, with a decline of 4.15%. These factors col...

Read More

Indrayani Biotech Faces Financial Struggles Amid Sector Volatility and Weak Fundamentals

2025-03-28 09:48:00Indrayani Biotech, a microcap in the floriculture sector, has faced notable volatility, reaching a new 52-week low. The company has underperformed its sector, with significant declines in operating profit and profit after tax. Its long-term fundamentals show weaknesses, including a low Return on Capital Employed and high debt levels.

Read More

Indrayani Biotech Faces Severe Financial Struggles Amidst Sector Volatility

2025-03-28 09:47:56Indrayani Biotech, a microcap in the floriculture sector, has faced notable volatility, reaching a new 52-week low. The company has struggled with weak fundamentals, including a low Return on Capital Employed and high Debt to EBITDA ratio. Recent financial results show significant declines in both operating profit and profit after tax.

Read More

Indrayani Biotech Faces Significant Challenges Amidst Declining Financial Performance and Volatility

2025-03-28 09:47:56Indrayani Biotech, a microcap in the floriculture sector, has hit a 52-week low amid significant volatility. The company faces challenges with weak fundamentals, including a low Return on Capital Employed and high Debt to EBITDA ratio. Recent financial results show a sharp decline in profits and a substantial year-over-year loss.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSECompliance certificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended 31st March 2025

Announcement under Regulation 30 (LODR)-Raising of Funds

03-Apr-2025 | Source : BSEAnnouncement with respect to the amendments to the terms of Rights issue of equity shares as partly paid up equity shares instead of fully paid up equity shares as approved by the Board of Directors on 3rd April 2025.

Appointment Of Dhinakaran Rajagopal As Chief Financial Officer (CFO) Of The Company

03-Apr-2025 | Source : BSEAnnouncement with regard to Appointment of Dhinakaran Rajagopal as Chief Financial Officer of the Company with effect from 3rd April 2025.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available