Indus Infra Trust Faces Technical Trend Challenges Amid Market Volatility

2025-04-02 08:10:48Indus Infra Trust, a small-cap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 107.25, showing a slight increase from the previous close of 107.16. Over the past year, the stock has experienced a high of 118.51 and a low of 95.21, indicating some volatility in its performance. In terms of technical indicators, the weekly MACD remains bearish, while the monthly indicators are not providing clear signals. The Relative Strength Index (RSI) shows no signal on a weekly basis, and Bollinger Bands indicate a mildly bearish trend for the week. Daily moving averages, however, suggest a mildly bullish sentiment. The KST and Dow Theory metrics are also reflecting a lack of clear trends. When comparing the stock's performance to the Sensex, Indus Infra Trust has faced challenges, with a return of -3.64% over the ...

Read MoreIndus Infra Trust Experiences Technical Trend Shift Amid Mixed Market Sentiment

2025-03-19 08:05:17Indus Infra Trust, a small-cap player in the Finance/NBFC sector, has recently undergone a technical trend adjustment. The current evaluation revision reflects a shift in market sentiment, as indicated by various technical indicators. The Moving Averages suggest a mildly bullish stance on a daily basis, while the MACD and Bollinger Bands point towards a mildly bearish outlook on a weekly basis. The KST and Dow Theory also align with a bearish sentiment, indicating a cautious market environment. As of the latest trading session, Indus Infra Trust's stock price stands at 112.05, slightly down from the previous close of 113.00. The stock has experienced a 52-week high of 118.51 and a low of 95.21, showcasing its volatility within the market. Today's trading saw a high of 113.54 and a low of 110.85. In terms of performance, the company has shown resilience with a 1-week return of 3.75%, outperforming the Sens...

Read MoreIndus Infra Trust Shows Mixed Technical Trends Amid Market Evaluation Revision

2025-03-18 08:04:53Indus Infra Trust, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 113.00, showing a notable increase from the previous close of 110.79. Over the past year, Indus Infra Trust has demonstrated a return of 9.28%, outperforming the Sensex, which recorded a return of 2.10% in the same period. The technical summary indicates a mixed performance across various indicators. The Moving Averages signal a bullish trend on a daily basis, while the MACD and KST suggest a bearish outlook on a weekly basis. The Bollinger Bands indicate a sideways movement, aligning with the overall evaluation adjustment. Notably, the stock has experienced a 52-week high of 118.51 and a low of 95.21, showcasing its volatility. In terms of returns, Indus Infra Trust has shown resilience, particularly over the past week with a...

Read More

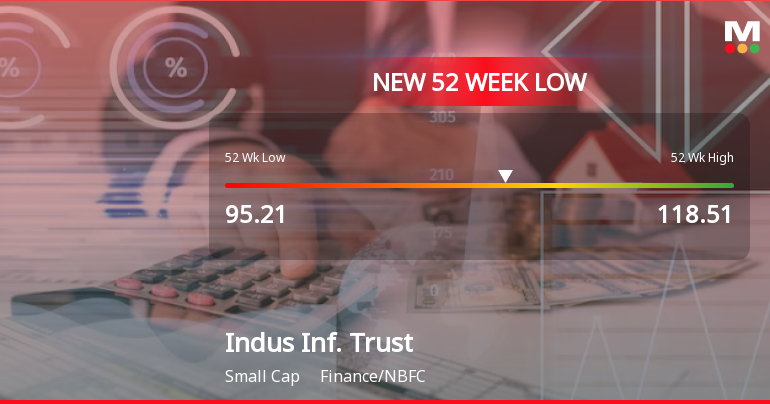

Indus Infra Trust Hits 52-Week Low Amid Broader Market Rebound and High Dividend Yield

2025-03-11 15:30:35Indus Infra Trust, a small-cap finance/NBFC stock, reached a new 52-week low today at Rs. 95.21, trading below key moving averages. Despite recent declines, it showed some recovery, hitting an intraday high of Rs. 109.85. The broader market, led by mid-cap gains, is experiencing a rebound.

Read MoreIndus Infra Trust Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-10 08:02:13Indus Infra Trust, a small-cap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 108.70, down from a previous close of 110.57, with a 52-week high of 118.51 and a low of 101.00. Today's trading saw a high of 110.28 and a low of 107.35. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bearish trend on a weekly basis, while the moving averages suggest a mildly bullish stance on a daily timeframe. However, the Bollinger Bands and On-Balance Volume (OBV) both reflect a mildly bearish outlook on a weekly basis, indicating some caution in market sentiment. In terms of returns, Indus Infra Trust has experienced a decline of 4.72% over the past week, contrasting with a positive return of 1.55% from the Sensex. Over the past month, the stock's return stands a...

Read MoreIndus Infra Trust Faces Mixed Technical Trends Amid Market Volatility

2025-03-07 08:04:12Indus Infra Trust, a small-cap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 110.57, showing a slight increase from the previous close of 109.98. Over the past year, it has reached a high of 118.51 and a low of 101.00, indicating some volatility in its trading range. The technical summary reveals a mixed outlook, with various indicators suggesting different trends. The Moving Averages on a daily basis indicate a mildly bullish sentiment, while the MACD and KST on a weekly basis lean towards a mildly bearish stance. The Bollinger Bands also reflect a bearish trend on a weekly basis, contributing to the overall cautious sentiment surrounding the stock. In terms of performance, Indus Infra Trust has shown a return of -2.87% over the past week, compared to a -0.37% return from the Sensex. However, on a ...

Read MoreIndus Infra Trust Shows Resilience Amid Mixed Technical Indicators and Market Volatility

2025-02-27 08:01:50Indus Infra Trust, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision that reflects its current market dynamics. The stock is currently priced at 114.85, showing a notable increase from the previous close of 111.22. Over the past week, the stock has reached a high of 114.85 and a low of 111.79, indicating some volatility within a defined range. In terms of technical indicators, the weekly MACD suggests a mildly bearish trend, while the monthly indicators show a mixed picture with some bullish signals from Bollinger Bands and moving averages. The KST indicator also points towards bullish momentum on a weekly basis, contrasting with the mildly bearish signals from the OBV. When comparing the stock's performance to the Sensex, Indus Infra Trust has demonstrated resilience. Over the past week, the stock returned 2.47%, while the Sensex declined by 1.80%. In the one-month...

Read More

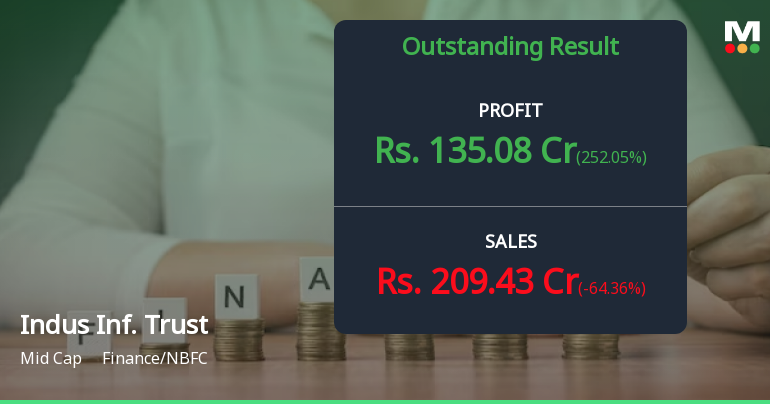

Indus Infra Trust Reports Strong Q4 Results, Signaling Positive Market Positioning

2025-01-30 10:04:24Indus Infra Trust has announced its financial results for the quarter ending December 2024, showcasing significant growth in net sales, profit before tax, and profit after tax. The company also reported its highest operating profit in five quarters and an increase in earnings per share, reflecting strong financial health.

Read MoreUnit Holding Pattern

04-Apr-2025 | Source : BSEIndus Infra Trust has informed the Exchange regarding Unitholding pattern for Report Q4 FY 2024-25

Investor Complaints

03-Apr-2025 | Source : BSEIndus Infra Trust has informed the Exchange regarding Investor grievance report for Report Q4 FY 2024-25

Reg 23(5)(i): Disclosure of material issue

28-Mar-2025 | Source : BSEIndus Infra Trust has informed the Exchange regarding Disclosure of material issue

Corporate Actions

No Upcoming Board Meetings

Indus Infra Trust has declared 2% dividend, ex-date: 03 Feb 25

No Splits history available

No Bonus history available

No Rights history available