Indus Towers Shows Mixed Technical Trends Amid Strong Yearly Performance

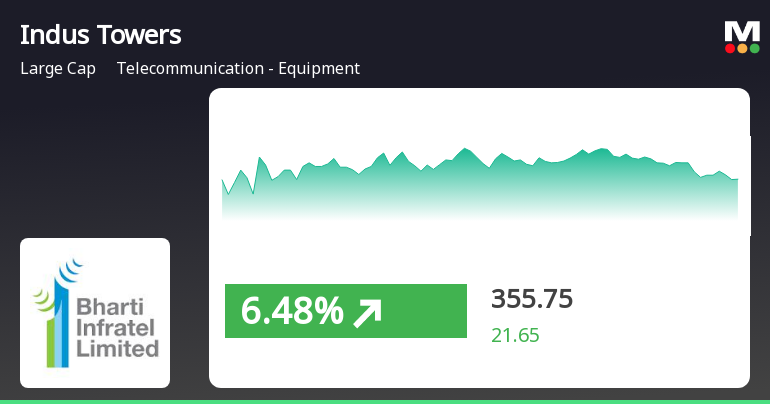

2025-04-03 08:02:06Indus Towers, a prominent player in the telecommunication equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 360.95, showing a notable increase from the previous close of 352.60. Over the past year, Indus Towers has demonstrated a return of 18.40%, significantly outperforming the Sensex, which recorded a return of 3.67% during the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands indicate bullish trends on both weekly and monthly scales, suggesting some volatility in the stock's price movement. The daily moving averages, however, reflect a mildly bearish stance, indicating mixed signals in the short term. The company's performance over various time frames highlights its resilience, p...

Read MoreIndus Towers Shows Strong Trading Activity and Positive Momentum in Telecom Sector

2025-04-02 10:00:08Indus Towers Ltd, a prominent player in the Telecommunication Equipment industry, has emerged as one of the most active equities today, with a total traded volume of 21,049,199 shares and a total traded value of approximately Rs 74.91 crore. The stock opened at Rs 349.90 and reached a day high of Rs 360.90, before settling at a last traded price of Rs 352.25, reflecting a 1.13% increase for the day. Notably, Indus Towers has outperformed its sector by 1.34%, marking a positive trend as the stock has gained for the last two consecutive days, yielding a total return of 5.95% during this period. The stock's performance is also supported by its liquidity, with a delivery volume of 5.32 lakh shares on April 1, which represents a significant increase of 109.5% compared to the five-day average delivery volume. In terms of moving averages, the stock is currently above its 5-day, 20-day, 50-day, and 100-day movi...

Read MoreIndus Towers Shows Significant Recovery Amid Increased Trading Activity and Sector Gains

2025-04-01 12:00:06Indus Towers Ltd, a prominent player in the Telecommunication Equipment industry, has emerged as one of the most active equities today, with a total traded volume of 14,174,625 shares and a total traded value of approximately Rs 50.56 crore. The stock opened at Rs 349.9, reflecting a gain of 4.67% from the previous close of Rs 334.3, and reached an intraday high of Rs 360.9, marking a notable increase of 7.96%. After experiencing four consecutive days of decline, Indus Towers has shown a trend reversal, outperforming its sector by 1.96%. The stock's performance today is particularly noteworthy, as the Telecommunication Equipment sector itself gained 4.72%. Additionally, the stock's liquidity remains robust, with a delivery volume of 39.07 lakh shares on March 28, which is a 40.37% increase compared to the five-day average. In terms of moving averages, Indus Towers is currently above the 5-day, 20-day, 50-...

Read MoreIndus Towers Shows Significant Rebound Amidst Recent Declines in Telecom Sector

2025-04-01 11:00:06Indus Towers Ltd, a prominent player in the Telecommunication Equipment industry, has emerged as one of the most active stocks today, with a total traded volume of 11,723,129 shares and a total traded value of approximately Rs 41.83 crore. The stock opened at Rs 349.9, reflecting a gain of 4.67% from the previous close of Rs 334.3, and reached an intraday high of Rs 360.9, marking a notable increase of 7.96% during the trading session. Today’s performance indicates a trend reversal for Indus Towers, as it has gained after four consecutive days of decline. The stock has outperformed its sector by 1.51%, while the broader Telecommunication Equipment sector itself has seen a rise of 4.59%. Notably, the stock's liquidity remains robust, with a delivery volume of 390,700 shares on March 28, which is a 40.37% increase compared to the five-day average. In terms of moving averages, Indus Towers is currently above...

Read More

Indus Towers Shows Mixed Performance Amid Broader Market Volatility and Sector Gains

2025-04-01 10:15:18Indus Towers has experienced significant activity, gaining 6.28% today and outperforming the Sensex over the past week. The stock is above several moving averages but below its 200-day average, indicating mixed performance. Over the past year, it has risen 23.58%, contrasting with the Sensex's modest gain.

Read MoreIndus Towers Sees Significant Open Interest Surge Amid Mixed Market Performance

2025-03-26 15:00:18Indus Towers Ltd, a prominent player in the Telecommunication Equipment sector, has experienced a significant increase in open interest today. The latest open interest stands at 79,316 contracts, marking a rise of 10,565 contracts or 15.37% from the previous open interest of 68,751. This uptick in open interest coincides with a trading volume of 40,536 contracts, indicating active participation in the derivatives market. In terms of price performance, Indus Towers has outperformed its sector by 0.66%, despite a slight decline of 0.04% in its stock price today. The stock is currently trading at an underlying value of Rs 339. Notably, the stock's performance relative to moving averages shows it is above the 20-day moving average but below the 5-day, 50-day, 100-day, and 200-day averages. Investor participation has seen a decline, with delivery volume dropping by 29.4% compared to the 5-day average, totaling...

Read MoreIndus Towers Sees Significant Open Interest Surge Amid Active Market Participation

2025-03-26 14:00:12Indus Towers Ltd, a prominent player in the Telecommunication Equipment sector, has experienced a significant increase in open interest today. The latest open interest stands at 76,692 contracts, reflecting a rise of 7,941 contracts or 11.55% from the previous open interest of 68,751. This uptick in open interest comes alongside a trading volume of 31,085 contracts, indicating active market participation. In terms of price performance, Indus Towers has outperformed its sector by 0.53% today, despite facing a consecutive decline over the past two days, resulting in a total drop of 3.22%. The stock is currently trading at an underlying value of Rs 336. While it remains above the 20-day moving average, it is below the 5-day, 50-day, 100-day, and 200-day moving averages, suggesting mixed momentum in its price trajectory. Additionally, the stock's liquidity remains robust, with a delivery volume of 21.89 lakh ...

Read MoreIndus Towers Sees Significant Open Interest Surge Amid Mixed Market Momentum

2025-03-26 13:00:11Indus Towers Ltd, a prominent player in the Telecommunication Equipment sector, has experienced a significant increase in open interest today. The latest open interest stands at 75,707 contracts, reflecting a rise of 6,956 contracts or 10.12% from the previous open interest of 68,751. This uptick comes alongside a trading volume of 26,429 contracts, indicating active market engagement. In terms of performance, Indus Towers has outperformed its sector by 0.43% today, despite facing a consecutive decline over the past two days, resulting in a total return of -3.45% during this period. The stock is currently trading above its 20-day moving average but below its 5-day, 50-day, 100-day, and 200-day moving averages, suggesting mixed momentum. Investor participation appears to be waning, with a delivery volume of 21.89 lakh shares on March 25, down 29.4% compared to the 5-day average. The stock maintains a marke...

Read MoreIndus Towers Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-26 08:01:37Indus Towers, a prominent player in the telecommunication equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 339.25, down from a previous close of 348.75, with a notable 52-week high of 460.70 and a low of 274.30. Today's trading saw a high of 351.00 and a low of 337.50. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands present a bearish signal weekly, contrasting with a bullish stance monthly. Moving averages also reflect bearish trends, suggesting a cautious market sentiment. In terms of returns, Indus Towers has shown varied performance compared to the Sensex. Over the past year, the stock has delivered a return of 25.32%, significantly outperforming the Sensex's 7.12%. How...

Read MoreUpdate On Transaction With Bharti Hexacom Limited And Bharti Airtel Limited

09-Apr-2025 | Source : BSEIndus Towers Limited has informed the Exchange regarding an update on transaction with Bharti Hexacom Limited and Bharti Airtel Limited

Closure of Trading Window

26-Mar-2025 | Source : BSEIndus Towers Limited has informed the Exchange regarding Trading Window closure pursuant to SEBI (Prohibition of Insider Trading) Regulations 2015

Shareholder Meeting / Postal Ballot-Scrutinizers Report

18-Mar-2025 | Source : BSEIndus Towers Limited has informed the Exchange about Scrutinizer Report

Corporate Actions

No Upcoming Board Meetings

Indus Towers Ltd has declared 110% dividend, ex-date: 13 May 22

No Splits history available

No Bonus history available

No Rights history available