Infibeam Avenues Faces Mixed Technical Trends Amid Ongoing Market Challenges

2025-04-02 08:08:46Infibeam Avenues, a small-cap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 17.25, showing a slight increase from the previous close of 16.57. Over the past year, Infibeam has faced significant challenges, with a return of -52.2%, contrasting sharply with a positive return of 2.72% for the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish trends on both weekly and monthly scales, while the Relative Strength Index (RSI) presents a bullish outlook on the same timeframes. Bollinger Bands and KST also reflect mildly bearish conditions, suggesting a cautious market sentiment. Daily moving averages remain bearish, indicating potential headwinds for the stock. In terms of returns, Infibeam's performance has been notably wea...

Read More

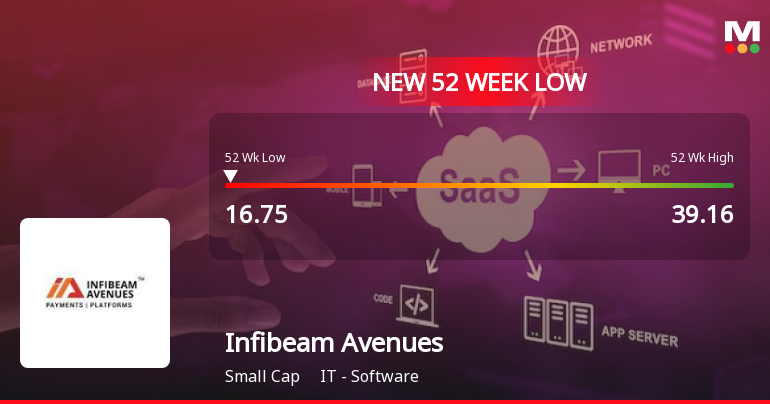

Infibeam Avenues Hits 52-Week Low Amid Broader Market Downturn and Sector Underperformance

2025-03-28 14:07:36Infibeam Avenues, a small-cap IT software firm, reached a new 52-week low amid a broader market decline. The company has consistently reported positive results for 14 quarters, maintaining a strong debt-to-equity ratio and notable return on capital employed, despite a significant year-over-year stock decline.

Read More

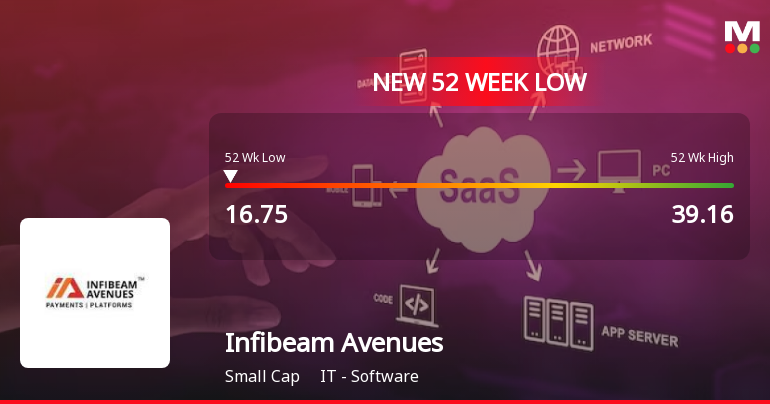

Infibeam Avenues Hits 52-Week Low Amid Broader Market Recovery and Strong Financials

2025-03-27 10:06:55Infibeam Avenues, a small-cap IT software firm, reached a new 52-week low today, continuing a three-day decline. The stock has underperformed its sector significantly over the past year, despite reporting positive results for 14 consecutive quarters and maintaining a strong financial position with low debt.

Read More

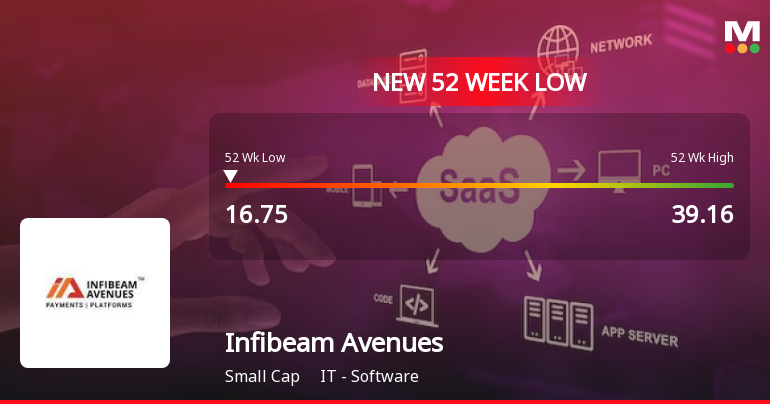

Infibeam Avenues Faces Continued Volatility Amid Broader Market Resilience

2025-03-27 10:06:54Infibeam Avenues, a small-cap IT software company, has hit a new 52-week low amid ongoing volatility, underperforming its sector. Despite strong financial metrics and a low debt-to-equity ratio, the stock has seen a significant decline over the past year, contrasting with broader market gains.

Read More

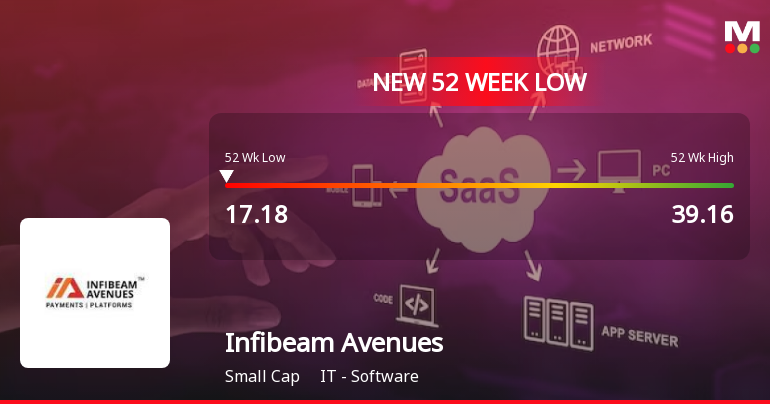

Infibeam Avenues Faces Significant Volatility Amid Broader Market Resilience

2025-03-27 10:06:53Infibeam Avenues, a small-cap IT software firm, has hit a new 52-week low amid significant volatility, underperforming its sector. Despite a challenging year with a notable decline, the company has reported positive results for 14 consecutive quarters and maintains a strong financial position with low debt.

Read More

Infibeam Avenues Hits 52-Week Low Amid Broader Market Decline and Operational Strength

2025-03-26 14:06:59Infibeam Avenues, a small-cap IT software company, reached a new 52-week low today, continuing a downward trend. Despite a significant one-year decline, the company has maintained a low debt-to-equity ratio and reported positive results for 14 consecutive quarters, indicating operational strength amid stock performance challenges.

Read MoreInfibeam Avenues Sees Surge in Trading Activity Amid Market Challenges

2025-03-25 13:00:05Infibeam Avenues Ltd, a small-cap player in the IT software industry, has emerged as one of the most active equities today, with a total traded volume of 22,788,103 shares and a total traded value of approximately Rs 40.36 crore. The stock opened at Rs 18.46 but has since seen a decline, with the last traded price (LTP) recorded at Rs 17.58, marking a 3.41% drop for the day. Despite the recent activity, Infibeam Avenues is currently trading close to its 52-week low, just 2.05% above Rs 17.20. The stock has underperformed its sector by 4.65% today, reversing a trend of two consecutive days of gains. Additionally, it is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend. On a positive note, investor participation has risen significantly, with a delivery volume of 2.27 crore shares on March 24, reflecting a 115.35% increase compared to the 5-day average....

Read MoreInfibeam Avenues Adjusts Valuation Grade, Signaling Competitive Strength in IT Sector

2025-03-25 08:00:57Infibeam Avenues, a midcap player in the IT software industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price is 18.16, slightly above the previous close of 17.92, with a 52-week high of 39.16 and a low of 17.21. Key financial metrics reveal a PE ratio of 22.41 and an EV to EBITDA of 16.65, indicating a competitive position within its sector. The PEG ratio stands at 0.45, suggesting a favorable growth outlook relative to its earnings. Additionally, the company has a dividend yield of 0.27% and a return on capital employed (ROCE) of 6.23%, alongside a return on equity (ROE) of 5.76%. When compared to its peers, Infibeam Avenues demonstrates a more attractive valuation profile, particularly in terms of its PEG ratio, which is significantly lower than that of competitors like Zensar Technologies and Newgen Software. This evaluation re...

Read More

Infibeam Avenues Faces Significant Volatility Amidst Ongoing Downward Trend and Operational Efficiency

2025-03-17 15:43:35Infibeam Avenues, a small-cap IT software firm, has reached a new 52-week low, continuing a downward trend with significant volatility. Despite a substantial year-over-year decline, the company has reported consistent positive results and maintains a low debt-to-equity ratio, indicating operational efficiency amidst market challenges.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulation 2018 for the quarter ended March 31 2025.

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

07-Apr-2025 | Source : BSEDeclaration of Voting Results of the Postal Ballot

Shareholder Meeting / Postal Ballot-Scrutinizers Report

07-Apr-2025 | Source : BSEDeclaration of Voting Results of the Postal Ballot.

Corporate Actions

No Upcoming Board Meetings

Infibeam Avenues Ltd has declared 5% dividend, ex-date: 07 Aug 24

Infibeam Avenues Ltd has announced 1:10 stock split, ex-date: 31 Aug 17

Infibeam Avenues Ltd has announced 1:1 bonus issue, ex-date: 14 Mar 22

No Rights history available