Innova Captab Opens Strong with 6.14% Gain, Reflecting Robust Market Activity

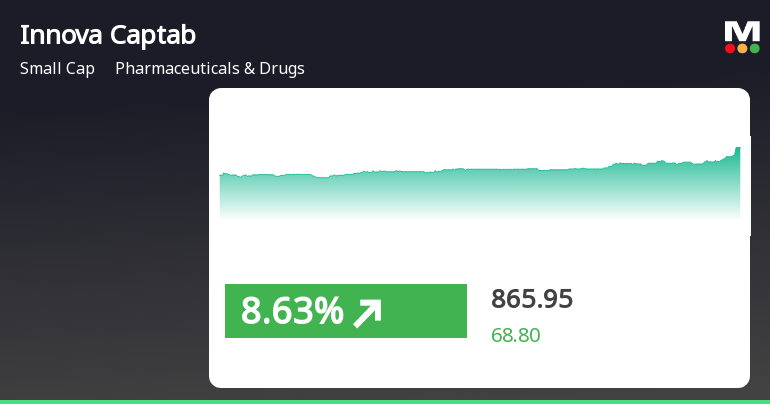

2025-03-24 10:05:18Innova Captab, a midcap player in the Pharmaceuticals & Drugs industry, has shown significant activity today, opening with a gain of 6.14%. The stock has outperformed its sector by 0.89%, reflecting a strong performance amid broader market trends. Over the past six days, Innova Captab has consistently gained, accumulating a remarkable 20.16% return during this period. Today, the stock reached an intraday high of Rs 972.95, further highlighting its upward momentum. In terms of performance metrics, Innova Captab's one-day performance stands at 2.20%, compared to the Sensex's 0.88%, while its one-month performance is an impressive 21.12% against the Sensex's 4.20%. From a technical perspective, the stock's moving averages are currently higher than the 5-day, 20-day, 50-day, and 200-day averages, although it remains below the 100-day moving average. The stock is classified as high beta, with an adjusted beta ...

Read MoreInnova Captab Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-21 08:03:29Innova Captab, a midcap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 892.40, showing a notable increase from the previous close of 873.65. Over the past year, Innova Captab has demonstrated a significant return of 88.11%, outperforming the Sensex, which recorded a return of 5.89% in the same period. The technical summary indicates a mixed performance across various indicators. The Moving Averages on a daily basis suggest a positive trend, while the MACD and KST on a weekly basis show a mildly bearish stance. The On-Balance Volume (OBV) reflects a mildly bullish trend, indicating some positive momentum in trading activity. In terms of price performance, Innova Captab has reached a 52-week high of 1,259.00 and a low of 421.55, showcasing its volatility. Recent returns over shorter periods,...

Read More

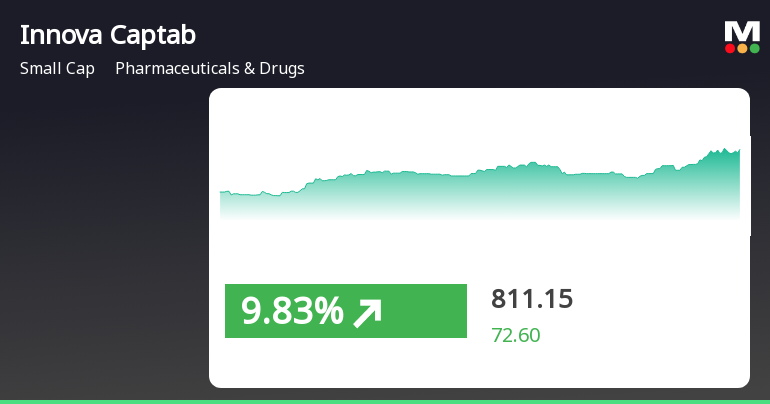

Innova Captab Shows Resilience Amidst Market Volatility and Small-Cap Gains

2025-03-18 15:45:59Innova Captab, a small-cap pharmaceutical company, experienced notable activity on March 18, 2025, with a significant gain and a total return of 11.88% over two days. The stock reached an intraday high and demonstrated resilience amid market fluctuations, outperforming its sector and contributing to the broader market's upward trend.

Read MoreInnova Captab Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-18 08:04:51Innova Captab, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 797.15, showing a notable increase from the previous close of 774.00. Over the past week, Innova Captab has demonstrated a stock return of 1.61%, significantly outperforming the Sensex, which returned just 0.07%. Despite this short-term gain, the company's performance over the past month has been less favorable, with a return of -0.28%, while the Sensex declined by 2.40%. Year-to-date, Innova Captab has faced challenges, with a return of -27.79%, compared to the Sensex's -5.08%. However, the company has shown resilience over the longer term, achieving a remarkable 66.26% return over the past year, in stark contrast to the Sensex's modest 2.10% gain. The technical indicators present a mixed picture, with various metri...

Read MoreInnova Captab Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-13 08:02:55Innova Captab, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 775.85, slightly down from the previous close of 783.00. Over the past year, Innova Captab has demonstrated a notable return of 51.03%, significantly outperforming the Sensex, which recorded a mere 0.49% return in the same period. The technical summary indicates a mixed performance across various indicators. The Moving Averages on a daily basis suggest a mildly bullish sentiment, while the MACD and KST on a weekly basis show a mildly bearish trend. The Relative Strength Index (RSI) presents no signal on a weekly basis but indicates bullish momentum on a monthly scale. In terms of price movement, the stock has seen a 52-week high of 1,259.00 and a low of 421.55, with today's trading range between 767.35 and 799.95. N...

Read MoreInnova Captab Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-13 08:02:55Innova Captab, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 775.85, slightly down from the previous close of 783.00. Over the past year, Innova Captab has demonstrated a notable return of 51.03%, significantly outperforming the Sensex, which recorded a mere 0.49% return in the same period. The technical summary indicates a mixed performance across various indicators. The Moving Averages on a daily basis suggest a mildly bullish sentiment, while the MACD and KST on a weekly basis show a mildly bearish trend. The Relative Strength Index (RSI) presents no signal on a weekly basis but indicates bullish momentum on a monthly scale. In terms of price movement, the stock has seen a 52-week high of 1,259.00 and a low of 421.55, with today's trading range between 767.35 and 799.95. N...

Read MoreInnova Captab Experiences Valuation Adjustment Amid Strong Yearly Performance in Pharmaceuticals Sector

2025-03-10 08:01:04Innova Captab, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment. The company's current price stands at 765.00, reflecting a notable increase from the previous close of 738.55. Over the past year, Innova Captab has demonstrated a return of 45.84%, significantly outperforming the Sensex, which recorded a mere 0.29% return during the same period. Key financial metrics for Innova Captab include a PE ratio of 34.36 and an EV to EBITDA ratio of 26.17, indicating its market positioning relative to peers. The company's return on capital employed (ROCE) is reported at 13.74%, while the return on equity (ROE) stands at 13.22%. When compared to its peers, Innova Captab's valuation metrics present a mixed picture. For instance, Unichem Labs and Hikal are positioned at higher valuation levels, while SPARC is noted as loss-making. This context highlights the compe...

Read More

Innova Captab Surges Amid Broader Small Cap Market Strength and Volatility

2025-03-07 13:00:57Innova Captab, a small-cap pharmaceutical company, experienced notable activity on March 7, 2025, with a significant intraday high. The stock has shown a strong upward trend over the past three days and has outperformed the broader market and its sector recently, despite facing challenges year-to-date.

Read MoreInnova Captab's Technical Indicators Reflect Mixed Market Sentiment and Performance Shifts

2025-03-07 08:04:11Innova Captab, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 738.55, showing a notable increase from the previous close of 720.60. Over the past year, Innova Captab has demonstrated a return of 41.08%, significantly outperforming the Sensex, which recorded a modest gain of 0.34%. The technical summary indicates a mixed performance across various indicators. The MACD and KST metrics are showing mildly bearish trends on a weekly basis, while the moving averages reflect a mildly bullish stance on a daily timeframe. The Relative Strength Index (RSI) presents no signal on a weekly basis but is bullish on a monthly scale, suggesting some underlying strength. In terms of volatility, the stock has experienced a 52-week high of 1,259.00 and a low of 421.55, indicating a wide trading ra...

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEPursuant to provision of SEBI (Prohibition of Insider Trading)Regulation 2015 as amended from time to time we wish to inform you that in terms of Companys Code Conduct for regulating and monitoring and reporting of trading by insiders the trading window for dealing in the securities of the Company will remains closed for all designated persons and their immediate relative from 01st April 2025 till 48 hours after the declaration of Audited Financial Results of the Company for the quarter and year ended on 31st March 2025.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

19-Mar-2025 | Source : BSEPursuant to the Regulation 30 read with Schedule III (Part A) (15) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we wish to inform you that the officials of the Company will be attending the Conference and will meet various investors/analysts and group of investors/analysts.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

17-Mar-2025 | Source : BSEPursuant to the Regulation 30 read with Schedule III (Part A) (15) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we wish to inform you that officials of the Company will be meeting Investors/ Analysts (Participants) in the form of visit to Manufacturing Facility & Group Meeting on Friday 21st March 2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available