Inspirisys Solutions Adjusts Valuation Grade, Highlighting Competitive Financial Positioning in IT Sector

2025-04-02 08:02:28Inspirisys Solutions, a microcap player in the IT software industry, has recently undergone a valuation adjustment, reflecting a notable shift in its financial standing. The company's price-to-earnings (PE) ratio stands at 13.31, while its price-to-book value is recorded at 9.13. Other key metrics include an enterprise value to EBITDA ratio of 14.41 and a PEG ratio of 0.04, indicating a favorable valuation relative to its earnings growth. In terms of profitability, Inspirisys boasts a return on capital employed (ROCE) of 39.72% and a return on equity (ROE) of 40.67%, showcasing strong operational efficiency. Despite recent stock performance showing a decline year-to-date and over the past year, the company has demonstrated resilience over a longer three to five-year horizon, with returns of 23.46% and 270.39%, respectively. When compared to its peers, Inspirisys stands out with a more attractive valuation...

Read More

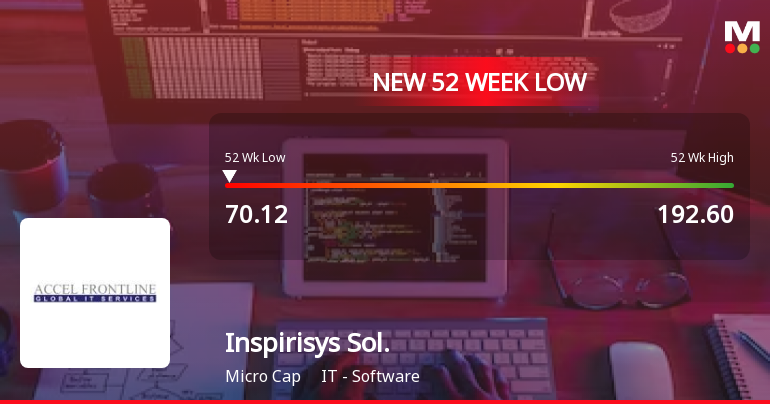

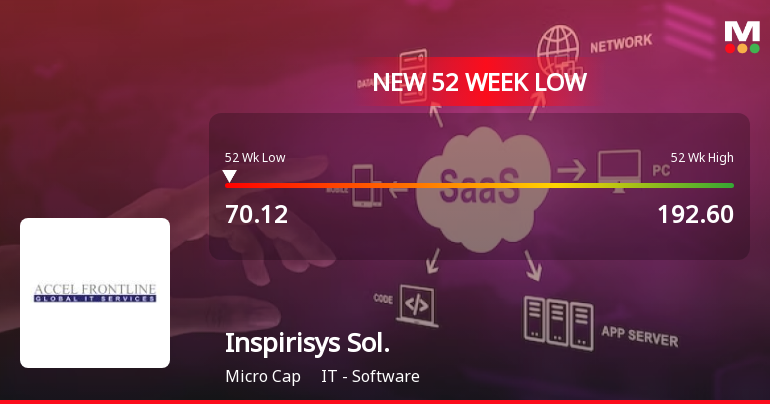

Inspirisys Solutions Faces Significant Volatility Amid Weak Fundamentals and Market Challenges

2025-03-17 15:42:35Inspirisys Solutions, an IT software microcap, has faced notable volatility, reaching a new 52-week low. The stock has dropped significantly over the past week and is trading below key moving averages. Long-term fundamentals show weak growth and high debt concerns, contributing to its underperformance relative to the market.

Read More

Inspirisys Solutions Faces Significant Volatility Amid Weak Long-Term Fundamentals

2025-03-17 15:42:22Inspirisys Solutions has faced significant volatility, reaching a new 52-week low amid a notable decline over the past week. The company's long-term fundamentals show weakness, with disappointing financial results and a high debt-to-EBITDA ratio. Over the past year, the stock has underperformed compared to broader market indices.

Read MoreInspirisys Solutions Ltd Experiences Significant Stock Rebound Amid Market Volatility

2025-03-05 15:00:10Inspirisys Solutions Ltd, a microcap player in the IT software industry, has made headlines today by hitting its upper circuit limit. The stock reached an intraday high of Rs 83.07, reflecting a notable change of 7.42 points, which translates to a 10% price band increase. This performance marks a significant turnaround for the stock, which had experienced seven consecutive days of decline prior to today. The total traded volume stood at approximately 0.12815 lakh shares, with a turnover of Rs 0.10139228 crore. Despite the day's volatility, with an intraday fluctuation of 8.88%, the stock has outperformed its sector by 8.26%. The day's performance also showcased a wide trading range of Rs 8.07, indicating active market engagement. While the stock's weighted average price suggests more volume traded closer to its low price, it remains above the 5-day moving averages, although it is lower than the 20-day, 50...

Read More

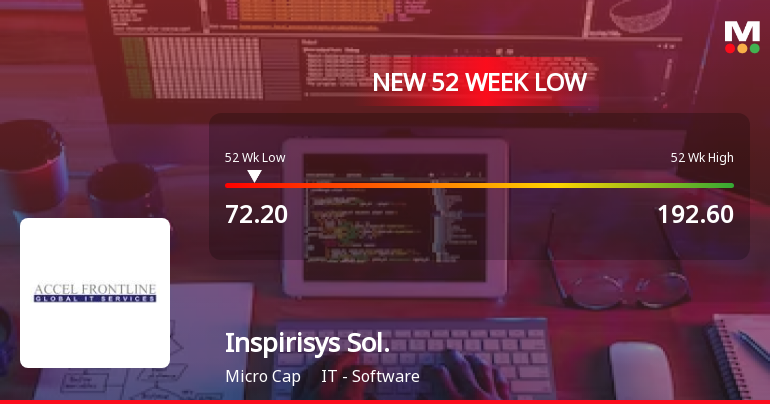

Inspirisys Solutions Hits New Low Amid Broader Market Decline and Financial Struggles

2025-03-04 12:20:52Inspirisys Solutions has reached a new 52-week low amid a broader market decline, reflecting a challenging year with a 26.43% drop in performance. The company faces financial difficulties, including a negative CAGR in operating profits and a high debt-to-EBITDA ratio, despite a strong return on capital employed.

Read More

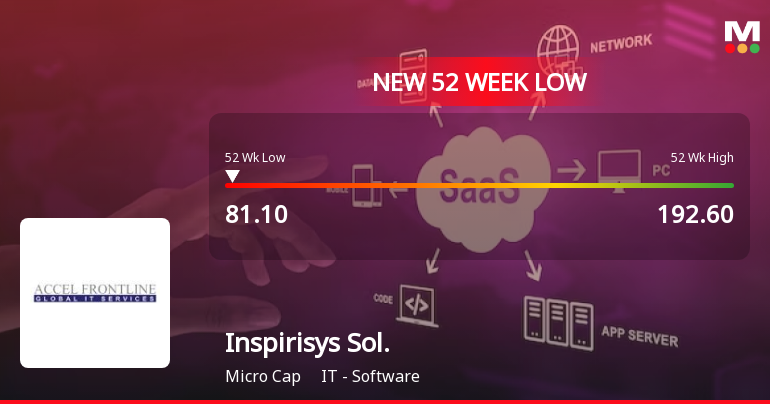

Inspirisys Solutions Faces Market Challenges Amid Significant Stock Activity and Decline

2025-03-03 11:25:19Inspirisys Solutions, a microcap IT software firm, has reached a 52-week low, trading slightly above its recent low. The company has underperformed its sector and is below key moving averages, reflecting ongoing challenges. Over the past year, its stock has declined significantly compared to the broader market.

Read More

Inspirisys Solutions Faces Significant Challenges Amidst IT Sector Volatility

2025-02-27 12:35:26Inspirisys Solutions, an IT software microcap, has faced significant volatility, hitting a 52-week low and experiencing a notable intraday decline. Over the past year, the stock has decreased substantially, underperforming against the Sensex and trading below key moving averages, indicating ongoing challenges in the market.

Read More

Inspirisys Solutions Hits 52-Week Low Amidst Significant Market Volatility

2025-02-14 10:35:35Inspirisys Solutions, a microcap IT software firm, has hit a new 52-week low amid significant volatility, underperforming its sector. Over the past year, the stock has declined nearly 30%, contrasting with the Sensex's gains, and is trading below its moving averages across multiple time frames.

Read More

Inspirisys Solutions Faces Significant Volatility Amidst Underperformance in IT Sector

2025-02-12 10:36:08Inspirisys Solutions, a microcap IT software firm, has hit a new 52-week low amid significant volatility, trailing its sector by 6.39%. The stock has dropped 11.1% over three days and has underperformed over the past year, declining 25.71% compared to a 6.46% gain in the Sensex.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018

Intimation Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

28-Mar-2025 | Source : BSEIntimation under Regulation 30 of SEBI (LODR) Regulations 2015

Intimation Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

28-Mar-2025 | Source : BSEIntimation under Regulation 30 of SEBI (LODR) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Inspirisys Solutions Ltd has declared 15% dividend, ex-date: 11 Dec 12

No Splits history available

No Bonus history available

No Rights history available