International Travel House Adjusts Valuation Amid Competitive Travel Services Landscape

2025-03-17 08:00:25International Travel House has recently undergone a valuation adjustment, reflecting its current standing in the travel services industry. The company's price-to-earnings ratio stands at 13.81, while its price-to-book value is recorded at 2.32. Key performance indicators such as the EV to EBIT ratio of 8.96 and EV to EBITDA ratio of 7.16 further illustrate its financial health. The company also boasts a notable return on capital employed (ROCE) of 51.43% and a return on equity (ROE) of 16.84%, indicating efficient use of capital and shareholder equity. In comparison to its peers, International Travel House presents a competitive valuation profile. While some competitors, like Growington Ventures, also hold an attractive valuation, others, such as Yaan Enterprises, are positioned at a significantly higher valuation level. This differentiation highlights International Travel House's relative market position ...

Read MoreInternational Travel House Adjusts Valuation Amidst Competitive Travel Services Landscape

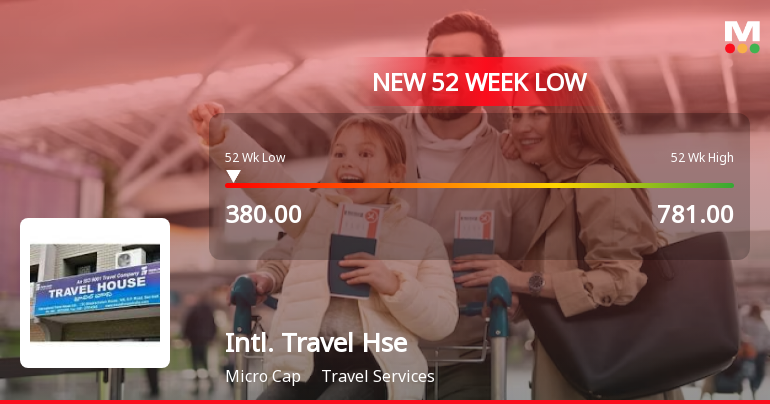

2025-03-10 08:00:31International Travel House has recently undergone a valuation adjustment, reflecting a shift in its financial standing within the travel services industry. The company's current price stands at 484.40, with a notable 52-week range between 380.00 and 781.00. Key financial metrics include a price-to-earnings (PE) ratio of 15.10 and an EV to EBITDA ratio of 8.08, which provide insights into its valuation relative to earnings and operational performance. The company's return metrics reveal a mixed performance over various periods. While it has shown a significant return of 389.29% over three years and 714.80% over five years, its year-to-date return is down by 29.18%, contrasting with a slight gain of 0.29% over the past year. In comparison to its peers, International Travel House's valuation metrics indicate a competitive position, particularly when juxtaposed with companies like Growington Ventures and Yaa...

Read More

International Travel House Faces Significant Trading Volatility Amidst Sector Challenges

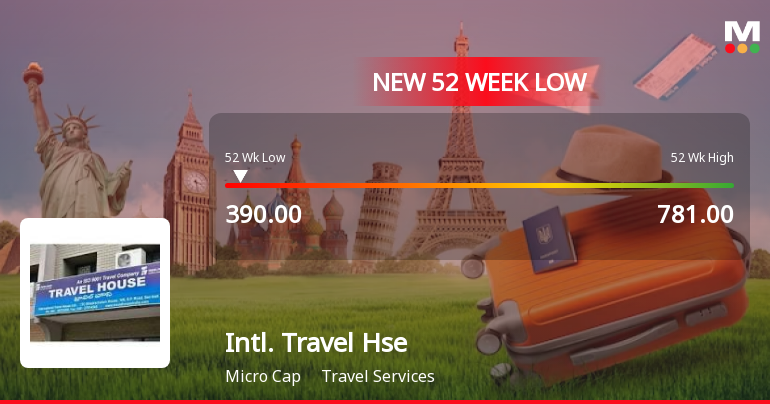

2025-03-03 11:35:30International Travel House has seen significant trading activity, hitting a new 52-week low and experiencing notable intraday volatility. The stock has underperformed its sector and is trading below key moving averages, reflecting ongoing challenges in the travel services industry amid a turbulent market environment.

Read More

International Travel House Faces Continued Decline Amid Broader Market Weakness

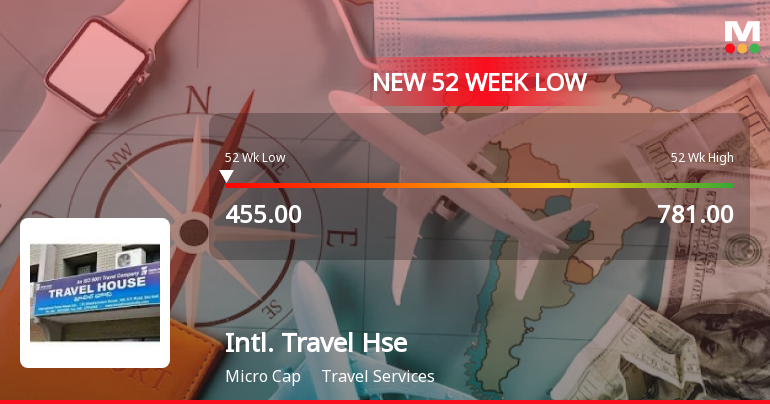

2025-02-28 14:05:21International Travel House, a microcap in the travel services sector, hit a new 52-week low today, continuing a downward trend with a 13.66% drop over four days. The stock underperformed against its sector and is trading below key moving averages, reflecting a bearish outlook.

Read More

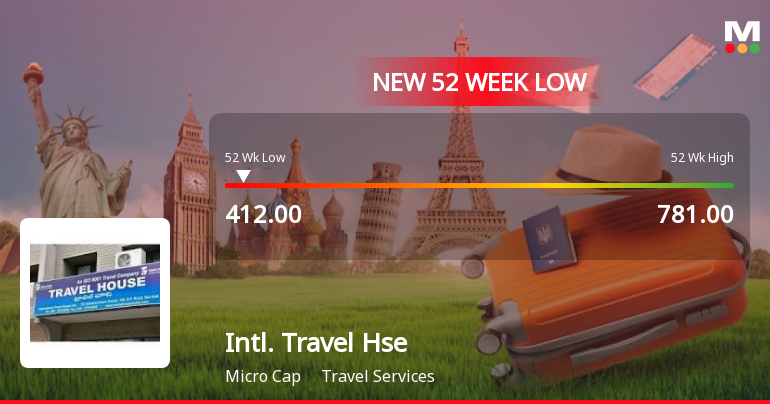

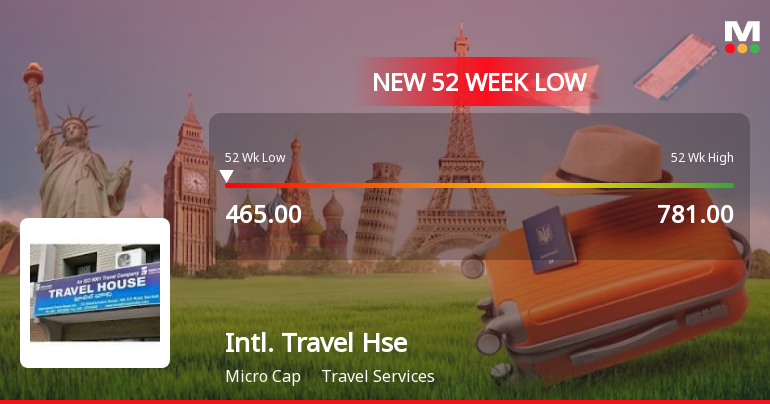

International Travel House Faces Significant Trading Volatility Amidst Sector Downturn

2025-02-27 14:05:19International Travel House has seen notable trading activity, reaching a new 52-week low and experiencing significant volatility. The stock underperformed its sector amid a broader downturn in the Travel Services industry. Over the past year, it has declined substantially, contrasting with the modest gains of the Sensex.

Read More

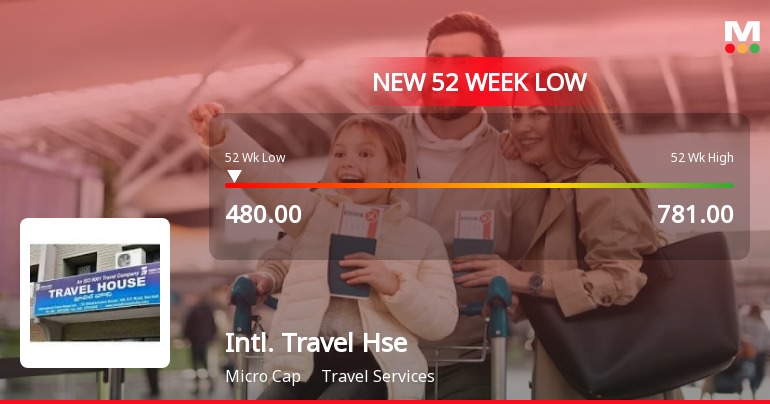

International Travel House Faces Significant Challenges Amidst Market Volatility

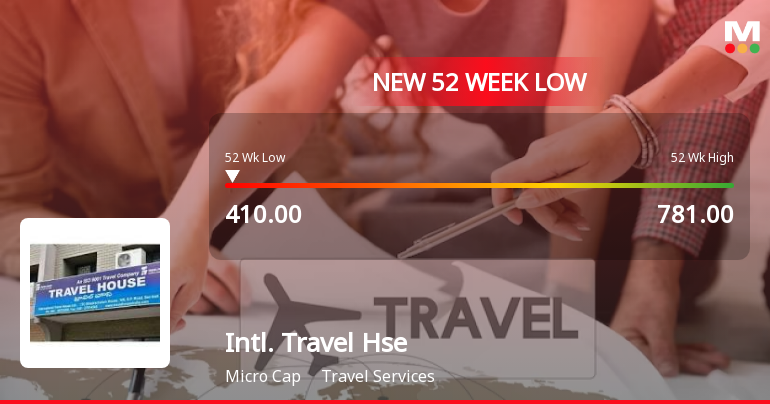

2025-02-20 09:35:38International Travel House has faced significant volatility, hitting a new 52-week low and experiencing a 26.9% decline over the past nine trading days. The stock has consistently traded below its moving averages and has seen a 30.52% drop over the past year, contrasting with the Sensex's gains.

Read More

International Travel House Hits 52-Week Low Amid Broader Travel Industry Challenges

2025-02-18 11:54:31International Travel House has reached a new 52-week low, reflecting a significant decline over the past week and year. The stock has underperformed compared to the broader market and is trading below multiple moving averages, highlighting ongoing challenges in the travel services sector.

Read More

International Travel House Shows Signs of Recovery Amid Ongoing Volatility

2025-02-17 09:38:28International Travel House has seen significant trading activity today, reversing a five-day decline with a notable intraday gain. Despite this uptick, the stock has struggled over the past year, underperforming against broader market indices and trading below key moving averages, indicating ongoing volatility and challenges.

Read More

International Travel House Faces Significant Volatility Amidst Ongoing Industry Challenges in October'23

2025-02-14 11:35:25International Travel House has faced notable volatility, hitting a 52-week low and declining over the past five days. The stock's performance has lagged behind the travel services sector, with significant intraday fluctuations. Over the past year, it has experienced a decline, contrasting with the overall market's gains.

Read MoreClosure of Trading Window

26-Mar-2025 | Source : BSEClosure of Trading Window

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

13-Mar-2025 | Source : BSEFurther to our letter dated 10th February 2025 we enclose herewith voting results of Postal Ballot through Electronic Voting.

Announcement Under Regulation 30 (LODR)- Change In Senior Management Personnel

11-Mar-2025 | Source : BSEChange in Senior Management Personnel

Corporate Actions

No Upcoming Board Meetings

International Travel House Ltd has declared 50% dividend, ex-date: 09 Aug 24

No Splits history available

No Bonus history available

No Rights history available