Valuation Grade Change Signals Investment & Precision Castings' Premium Position in Industry

2025-04-01 08:00:26Investment & Precision Castings has recently undergone a valuation adjustment, reflecting its current financial metrics and market position within the castings and forgings industry. The company currently exhibits a price-to-earnings (PE) ratio of 71.77 and a price-to-book value of 3.93, indicating a premium valuation relative to its peers. Additionally, the enterprise value to EBITDA stands at 19.24, while the enterprise value to sales is recorded at 2.57. In comparison to its industry counterparts, Investment & Precision Castings shows a significantly higher PE ratio than Nelcast, which has a PE of 28.09, and Pradeep Metals, with a PE of 14.32. The company's return on capital employed (ROCE) is 9.63%, and its return on equity (ROE) is 6.53%, both of which provide insight into its operational efficiency. Despite a challenging year-to-date return of -26.80%, the company has outperformed the Sensex over va...

Read MoreInvestment & Precision Castings Faces Recent Stock Volatility Amid Strong Long-Term Growth

2025-03-12 18:00:26Investment & Precision Castings Ltd, a microcap player in the castings and forgings industry, has seen notable fluctuations in its stock performance today. The company, with a market capitalization of Rs 300.00 Cr, currently holds a price-to-earnings (P/E) ratio of 60.57, significantly higher than the industry average of 32.96. Over the past year, Investment & Precision Castings has outperformed the Sensex, delivering a return of 12.37% compared to the index's modest 0.49%. However, recent trends indicate a decline, with the stock down 1.67% today, while the Sensex fell by 0.10%. The company has experienced a challenging week, with an 8.81% drop, and a more pronounced decline of 22.37% over the past month. Longer-term performance metrics reveal a stark contrast, as the stock has surged by 118.24% over the past three years and an impressive 225.25% over five years. Despite the recent downturns, the ten-yea...

Read More

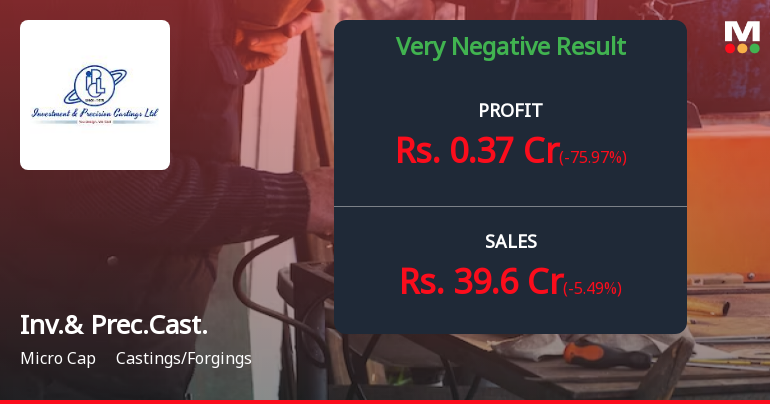

Investment & Precision Castings Faces Financial Strain Amid Declining Sales and Profitability

2025-03-03 18:43:59Investment & Precision Castings has experienced a recent evaluation adjustment, reflecting its financial challenges, including a notable Debt to EBITDA ratio and declining net sales. Despite these issues, the company shows potential for long-term growth, with a significant annual increase in operating profit and a fair stock valuation.

Read More

Investment & Precision Castings Faces Financial Challenges Amidst Long-Term Growth Potential

2025-02-24 18:26:03Investment & Precision Castings has undergone a recent evaluation adjustment based on its financial metrics and market position. The company, categorized as a microcap in the Castings/Forgings industry, has faced declining net sales and a high Debt to EBITDA ratio, while showing a strong long-term growth trajectory in operating profit.

Read More

Investment & Precision Castings Reports Decline in Key Financial Metrics for December Quarter

2025-01-31 15:32:23Investment & Precision Castings has reported its financial results for the quarter ending December 2024, highlighting significant challenges. Key metrics show declines in Profit Before Tax and Profit After Tax compared to previous quarters, while operating profit has also contracted. However, the Debt-Equity Ratio has improved, indicating reduced borrowing.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate for regulation 74(5) of SEBI for the quarter ended as on 31.03.2025

Closure of Trading Window

28-Mar-2025 | Source : BSEClosing of Trading window for the quarter ended as on 31.03.2025

Integrated Filing (Financial)

13-Feb-2025 | Source : BSEIntegrated Fillings (Financials)

Corporate Actions

No Upcoming Board Meetings

Investment & Precision Castings Ltd has declared 10% dividend, ex-date: 22 Aug 24

No Splits history available

Investment & Precision Castings Ltd has announced 3:1 bonus issue, ex-date: 24 Aug 06

No Rights history available