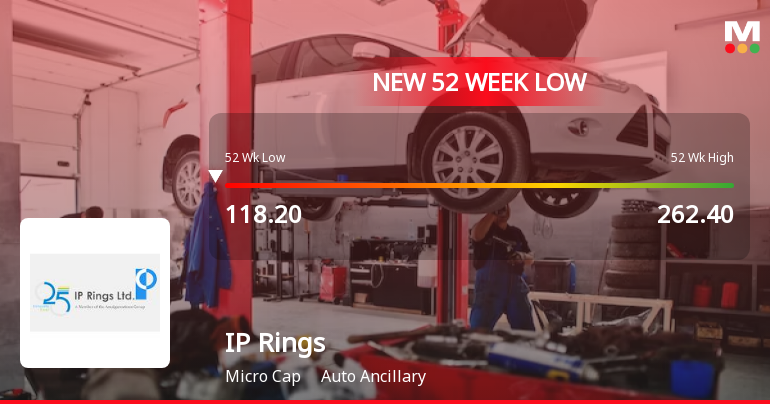

IP Rings Faces Significant Challenges Amidst Broader Auto Ancillary Sector Gains

2025-03-18 10:35:15IP Rings, a microcap in the auto ancillary sector, has faced significant volatility, reaching a new 52-week low. The stock has underperformed its sector and has seen a notable decline over the past six days. Financial metrics reveal challenges, including a negative CAGR in operating profits and disappointing quarterly results.

Read More

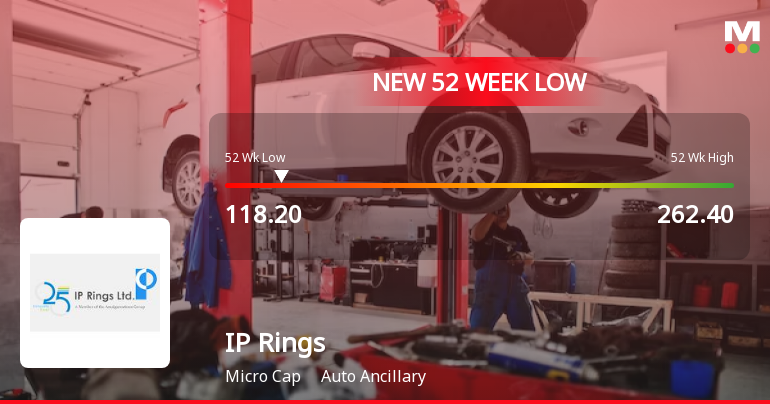

IP Rings Faces Significant Volatility Amidst Declining Performance and High Debt Concerns

2025-03-17 11:05:43IP Rings, a microcap in the auto ancillary sector, is facing significant volatility, nearing its 52-week low. The stock has declined 20.22% over the past five days and is trading below key moving averages. Long-term fundamentals show concerning trends, including a negative CAGR in operating profits and a high debt-to-EBITDA ratio.

Read More

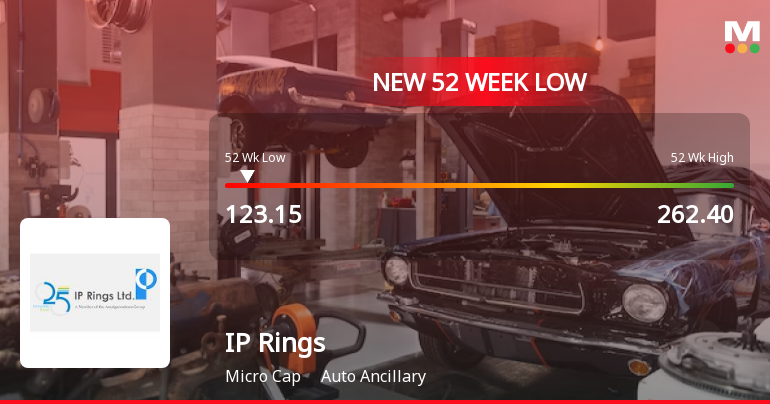

IP Rings Faces Significant Volatility Amid Broader Market Challenges and Declining Fundamentals

2025-03-13 15:35:30IP Rings, a microcap in the auto ancillary sector, has faced notable volatility, trading near its 52-week low. The stock has declined consecutively over four days, reflecting broader market trends. Concerns about its long-term fundamentals are evident, with significant drops in operating profits and a high debt-to-EBITDA ratio.

Read MoreIP Rings Adjusts Valuation Amidst Mixed Financial Performance in Auto Ancillary Sector

2025-03-13 08:00:17IP Rings, a microcap player in the auto ancillary sector, has recently undergone a valuation adjustment. The company's financial metrics reveal a PE ratio of -42.85 and an EV to EBITDA ratio of 10.31, indicating a unique position within its industry. The price to book value stands at 1.58, while the EV to sales ratio is notably low at 0.81. Despite facing challenges, such as a return on equity (ROE) of -0.79% and a return on capital employed (ROCE) of 5.20%, IP Rings maintains a competitive stance compared to its peers. For instance, Z F Steering is positioned at a higher valuation with a PE ratio of 48.45, while Rane (Madras) is currently loss-making, reflecting a different set of challenges. In terms of market performance, IP Rings has experienced a decline in stock returns over various periods, including a year-to-date drop of 32.42%. However, over a five-year horizon, the company has outperformed th...

Read MoreIP Rings Adjusts Valuation Amidst Mixed Financial Performance in Auto Ancillary Sector

2025-03-13 08:00:17IP Rings, a microcap player in the auto ancillary sector, has recently undergone a valuation adjustment. The company's financial metrics reveal a PE ratio of -42.85 and an EV to EBITDA ratio of 10.31, indicating a unique position within its industry. The price to book value stands at 1.58, while the EV to sales ratio is notably low at 0.81. Despite facing challenges, such as a return on equity (ROE) of -0.79% and a return on capital employed (ROCE) of 5.20%, IP Rings maintains a competitive stance compared to its peers. For instance, Z F Steering is positioned at a higher valuation with a PE ratio of 48.45, while Rane (Madras) is currently loss-making, reflecting a different set of challenges. In terms of market performance, IP Rings has experienced a decline in stock returns over various periods, including a year-to-date drop of 32.42%. However, over a five-year horizon, the company has outperformed th...

Read MoreIP Rings Adjusts Valuation Grade Amidst Competitive Auto Ancillary Landscape

2025-03-07 08:00:48IP Rings, a microcap player in the auto ancillary industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price is 137.00, with a previous close of 147.00. Over the past year, IP Rings has experienced a stock return of -22.38%, contrasting with a slight gain of 0.34% in the Sensex. Key financial metrics reveal a PE ratio of -44.99 and an EV to EBITDA ratio of 10.65, indicating a unique position within its sector. The company's return on capital employed (ROCE) stands at 5.20%, while the return on equity (ROE) is reported at -0.79%. These figures highlight the challenges IP Rings faces in generating shareholder value. In comparison to its peers, IP Rings shows a more favorable valuation profile, particularly when juxtaposed with companies like Enkei Wheels and Sar Auto Products, which exhibit significantly higher PE ratios and EV to EBITD...

Read More

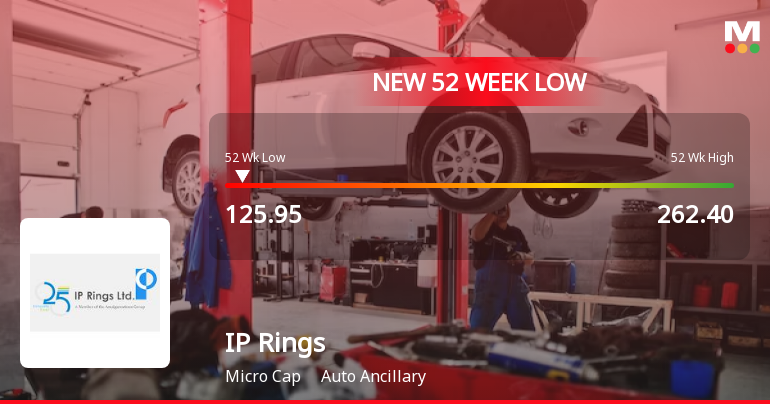

IP Rings Hits 52-Week Low Amidst High Volatility and Sector Underperformance

2025-03-03 14:20:19IP Rings, a microcap in the auto ancillary sector, has reached a new 52-week low, reflecting significant volatility and underperformance compared to its peers. The stock has declined over the past year, facing persistent challenges in its operational and financial landscape amid broader market trends.

Read More

IP Rings Faces Market Volatility Amid Broader Auto Ancillary Sector Challenges

2025-02-27 13:05:12IP Rings, a microcap in the auto ancillary sector, has shown notable volatility, with significant fluctuations in its stock price today. Over the past two days, it has underperformed its sector and is trading below key moving averages, reflecting ongoing challenges in its market performance. The stock has declined 26.20% over the past year.

Read More

IP Rings Faces Significant Volatility Amid Broader Market Challenges and Declining Performance

2025-02-18 13:05:17IP Rings, a microcap in the auto ancillary sector, has seen significant trading volatility, reaching a new 52-week low. The stock has underperformed its sector and is trading below multiple moving averages, reflecting ongoing challenges. Over the past year, it has declined notably compared to the Sensex's gains.

Read MoreBoard Meeting Intimation for Considering And Approving The Audited Financial Results For The Quarter And Year Ended March 31 2025.

08-Apr-2025 | Source : BSEIP Rings Ltd-has informed BSE that the meeting of the Board of Directors of the Company is scheduled on 29/05/2025 inter alia to consider and approve the Audited Financial Results for the Quarter and Year Ended March 31 2025.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEWe herewith submit the Compliance certificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025.

Announcement Under Regulation 30- Shifting Of Operations Of One Of The Leased Plant Of The Company

28-Mar-2025 | Source : BSEThis is to inform you that pursuant to expiry of existing lease agreement the company has decided to shift one of its leased factories.

Corporate Actions

29 May 2025

IP Rings Ltd has declared 10% dividend, ex-date: 04 Aug 23

No Splits history available

No Bonus history available

IP Rings Ltd has announced 4:5 rights issue, ex-date: 16 Jan 17