Surge in Open Interest Signals Increased Activity for IRB Infrastructure Developers Ltd

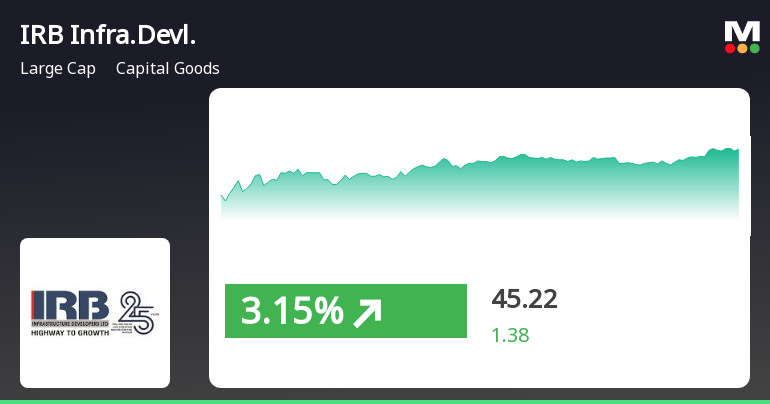

2025-03-27 15:00:11IRB Infrastructure Developers Ltd, a prominent player in the Capital Goods sector, has experienced a significant increase in open interest (OI) today. The latest OI stands at 19,187 contracts, reflecting a rise of 2,949 contracts or 18.16% from the previous OI of 16,238. This uptick in OI comes alongside a trading volume of 9,314 contracts, indicating heightened activity in the derivatives market. In terms of price performance, IRB Infrastructure has outperformed its sector by 0.43%, recovering from two consecutive days of decline. The stock is currently valued at Rs 45, with a total futures value of approximately Rs 37,342.11 lakhs and an options value of around Rs 676.66 crore, bringing the total value to Rs 37,563.87 lakhs. Despite this positive movement, the stock's delivery volume has seen a decline of 4.93% compared to its five-day average, with a delivery volume of 78.77 lakhs recorded on March 26....

Read MoreSurge in Open Interest Signals Shifting Market Dynamics for IRB Infrastructure Developers

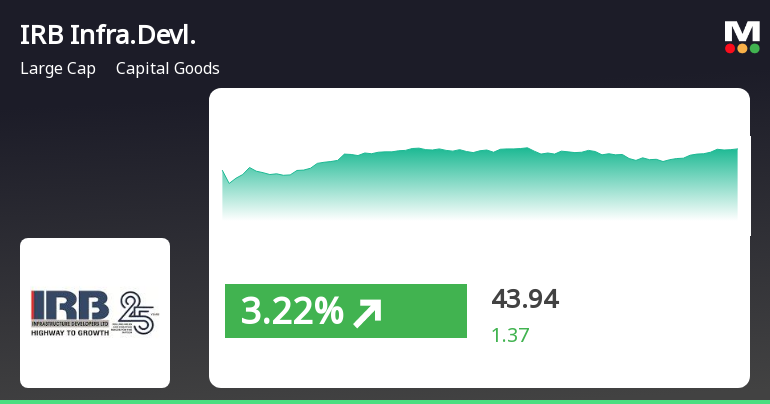

2025-03-27 14:00:09IRB Infrastructure Developers Ltd, a prominent player in the Capital Goods sector, has experienced a significant increase in open interest today. The latest open interest stands at 18,625 contracts, reflecting a rise of 2,387 contracts or 14.7% from the previous open interest of 16,238. This uptick in open interest is accompanied by a trading volume of 7,523 contracts, indicating active market participation. In terms of price performance, IRB Infrastructure has outperformed its sector by 0.53%, marking a positive trend reversal after two consecutive days of decline. The stock is currently trading at an underlying value of Rs 45. Notably, while the stock is above its 20-day moving average, it remains below the 5-day, 50-day, 100-day, and 200-day moving averages, suggesting mixed momentum in the short to medium term. Despite a slight decline in delivery volume, which fell by 4.93% against the 5-day average,...

Read MoreSurge in Open Interest Signals Increased Market Activity for IRB Infrastructure Developers

2025-03-27 13:00:05IRB Infrastructure Developers Ltd, a prominent player in the Capital Goods sector, has experienced a significant increase in open interest today. The latest open interest stands at 18,193 contracts, reflecting a rise of 1,955 contracts or 12.04% from the previous open interest of 16,238. This uptick in open interest comes alongside a trading volume of 6,060 contracts, indicating active participation in the market. In terms of price performance, IRB Infrastructure has shown resilience, gaining 0.71% today, which is in line with the sector's performance of 0.68% and the Sensex's return of 0.46%. The stock has reversed its trend after two consecutive days of decline, currently trading above its 20-day moving average but below the 5-day, 50-day, 100-day, and 200-day moving averages. Despite a slight decline in delivery volume, which fell by 4.93% compared to the 5-day average, the stock remains liquid enough...

Read MoreSurge in Open Interest for IRB Infrastructure Signals Shift in Market Dynamics

2025-03-27 12:00:05IRB Infrastructure Developers Ltd, a prominent player in the Capital Goods sector, has experienced a notable increase in open interest today. The latest open interest stands at 18,033 contracts, reflecting a rise of 1,795 contracts or 11.05% from the previous open interest of 16,238. This surge in open interest is accompanied by a trading volume of 5,520 contracts, indicating active market participation. In terms of price performance, IRB Infrastructure has shown resilience, gaining 0.97% today, which aligns closely with the sector's return of 0.96% and the Sensex's return of 0.47%. The stock has managed to reverse its trend after two consecutive days of decline, suggesting a potential shift in momentum. While the stock's current price is higher than its 20-day moving averages, it remains below the 5-day, 50-day, 100-day, and 200-day moving averages. Additionally, the delivery volume has seen a decline o...

Read More

IRB Infrastructure Developers Outperforms Sector Amid Mixed Market Trends and Small-Cap Gains

2025-03-19 11:15:24IRB Infrastructure Developers has experienced significant trading activity, outperforming its sector and achieving consecutive gains over two days. The stock is currently above its 5-day moving average but below longer-term averages. Meanwhile, the broader market shows a mixed trend, with small-cap stocks leading gains.

Read MoreIRB Infrastructure Developers Shows Increased Trading Activity Amid Market Challenges

2025-03-12 11:00:04IRB Infrastructure Developers Ltd, a prominent player in the Capital Goods sector, has emerged as one of the most active equities today, with a total traded volume of 10,208,538 shares and a total traded value of approximately Rs 449.69 crore. The stock opened at Rs 43.65 and reached a day high of Rs 44.50, while the day low was recorded at Rs 43.44. As of the latest update, the last traded price stands at Rs 44.04. Today’s performance indicates that IRB Infrastructure has outperformed its sector by 1.9%, marking a notable trend reversal after three consecutive days of decline. However, it is important to note that the stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a challenging market position. Investor participation appears to be waning, with delivery volume on March 11 dropping by 30.49% compared to the 5-day average. Despite this, the stock...

Read MoreIRB Infrastructure Developers Shows Notable Market Activity Amid Mixed Performance Trends

2025-03-10 10:00:08IRB Infrastructure Developers Ltd, a prominent player in the Capital Goods sector, has emerged as one of the most active equities today, with a total traded volume of 9,535,651 shares and a total traded value of approximately Rs 429.49 crore. The stock opened at Rs 45.15, reaching a day high of Rs 45.95 and a day low of Rs 44.37, with the last traded price recorded at Rs 44.70. In terms of performance, IRB Infrastructure has outperformed its sector by 0.67%, while the broader market, represented by the Sensex, saw a return of 0.39%. However, the stock's moving averages indicate a mixed trend, as it is currently higher than its 5-day moving average but lower than the 20-day, 50-day, 100-day, and 200-day moving averages. Investor participation appears to be declining, with delivery volume on March 7 falling by 18.94% compared to the 5-day average. Despite this, the stock remains liquid enough for trades of ...

Read More

IRB Infrastructure Developers Shows Signs of Trend Reversal Amidst Market Challenges

2025-03-05 09:45:35IRB Infrastructure Developers experienced a notable uptick today, breaking a seven-day decline. The stock reached an intraday high, although it remains below key moving averages. Over the past week and month, it has faced significant declines, contrasting with its substantial growth over the past five years.

Read More

IRB Infrastructure Developers Faces Sustained Stock Decline Amid Market Challenges

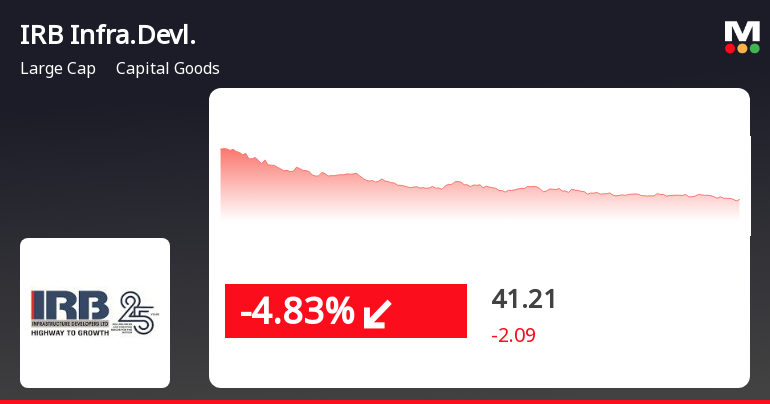

2025-03-03 10:15:42IRB Infrastructure Developers has faced a notable decline in stock performance, reaching a new 52-week low. The company has underperformed the broader market over the past month and has seen a continuous downward trend for six days, raising concerns among stakeholders in the capital goods sector.

Read MoreDisclosures under Reg. 31(1) and 31(2) of SEBI (SAST) Regulations 2011.

07-Apr-2025 | Source : BSEThe Exchange has received Disclosure under Regulation 31(1) and 31(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 on April 05 2025 for Smt. Sudha Dattatray Mhaiskar

Disclosures of reasons for encumbrance by promoter of listed companies under Reg. 31(1) read with Regulation 28(3) of SEBI (SAST) Regulations 2011.

07-Apr-2025 | Source : BSEThe Exchange has received the Disclosures of reasons for encumbrance by promoter of listed companies under Reg. 31(1) read with Regulation 28(3) of SEBI (SAST) Regulations 2011 on April 05 2025 for Smt. Sudha Dattatray Mhaiskar

Disclosures under Reg. 31(1) and 31(2) of SEBI (SAST) Regulations 2011.

26-Mar-2025 | Source : BSEThe Exchange has received Disclosure under Regulation 31(1) and 31(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 on March 25 2025 for Smt. Sudha Dattatray Mhaiskar

Corporate Actions

No Upcoming Board Meetings

IRB Infrastructure Developers Ltd has declared 10% dividend, ex-date: 06 Feb 25

IRB Infrastructure Developers Ltd has announced 1:10 stock split, ex-date: 22 Feb 23

No Bonus history available

No Rights history available