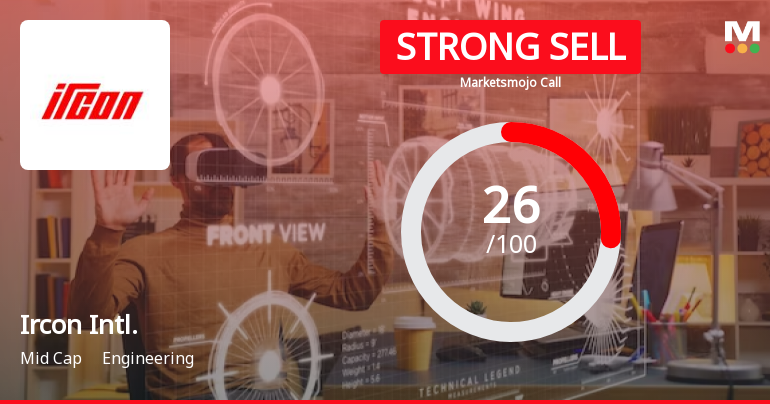

Ircon International Faces Financial Challenges Amidst Declining Sales and Market Concerns

2025-04-02 08:38:19Ircon International has recently experienced a change in its evaluation due to shifts in financial metrics and market position. The company reported a decline in net sales and modest operating profit growth, raising concerns about its long-term stability and attracting cautious sentiment from institutional investors.

Read MoreIrcon International Faces Mixed Technical Trends Amidst Market Challenges and Resilience

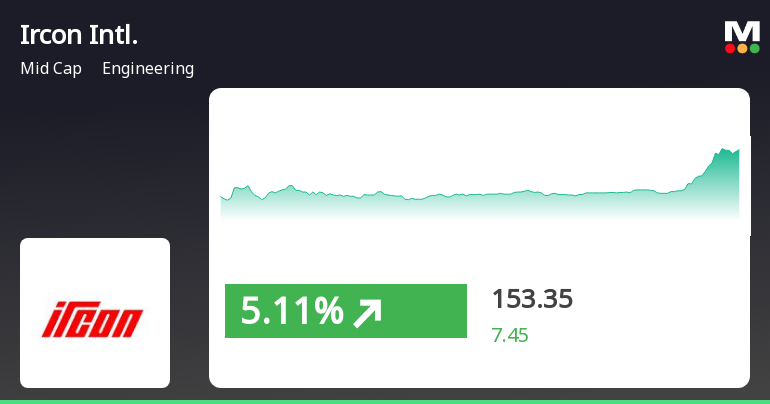

2025-04-02 08:00:03Ircon International, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 159.30, showing a slight increase from the previous close of 156.30. Over the past year, Ircon has faced challenges, with a notable decline of 29.9%, contrasting with a modest gain of 2.72% in the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) presents no signal on a weekly basis but indicates bullish momentum monthly. Bollinger Bands and KST also reflect a mildly bearish trend over both weekly and monthly periods. In terms of returns, Ircon has experienced a significant drop of 25.91% year-to-date, while the ...

Read More

Ircon International Faces Evaluation Score Adjustment Amid Financial Performance Challenges

2025-03-20 08:11:11Ircon International has undergone a recent adjustment in its evaluation score, reflecting a cautious outlook on its performance metrics. The company has faced financial challenges, including declining net sales and profit, and has underperformed compared to market indices, raising concerns about its long-term growth prospects.

Read MoreIrcon International Experiences Technical Trend Shift Amid Mixed Market Performance

2025-03-20 08:00:03Ircon International, a midcap player in the engineering sector, has recently undergone a technical trend adjustment, reflecting shifts in its market performance. The company's current stock price stands at 155.30, showing a notable increase from the previous close of 145.90. Over the past week, Ircon has demonstrated a stock return of 8.53%, significantly outperforming the Sensex, which returned 1.92% in the same period. Despite this short-term gain, the longer-term outlook reveals challenges, with a year-to-date return of -27.77%, compared to the Sensex's -3.44%. The stock's performance over the past year has also been underwhelming, with a decline of 27.68%, while the Sensex has seen a positive return of 4.77%. However, looking back over three and five years, Ircon has shown remarkable resilience, with returns of 276.48% and 374.42%, respectively, compared to the Sensex's 30.39% and 166.72%. The technic...

Read More

Ircon International Shows Strong Short-Term Gains Amid Mixed Long-Term Trends

2025-03-19 11:45:25Ircon International has experienced significant trading activity, achieving a notable gain and outperforming its sector. The stock has shown consecutive gains over two days, reaching an intraday high. However, its performance over the past month indicates a decline, contrasting with broader market trends.

Read MoreIrcon International Sees Surge in Trading Activity and Positive Sector Momentum

2025-03-19 10:00:04Ircon International Ltd, a midcap player in the engineering sector, has emerged as one of the most active equities today, with a total traded volume of 36,097,996 shares and a total traded value of approximately Rs 5,300.63 million. The stock opened at Rs 143.60 and reached a day high of Rs 150.40, reflecting a notable intraday performance. As of the latest update, the last traded price stands at Rs 145.60. In terms of performance, Ircon International has outperformed its sector by 1.26%, marking a consecutive gain over the last two days with a total return of 7.58% during this period. The stock's day-to-day return is recorded at 1.60%, while the sector's return is at 0.61%. Investor participation has also seen a significant uptick, with a delivery volume of 344,300 shares on March 18, which is an increase of 198.55% compared to the five-day average delivery volume. The stock's liquidity remains robust, ...

Read More

Ircon International Faces Financial Challenges Amid Declining Sales and Profitability Concerns

2025-03-19 08:12:07Ircon International has recently experienced a change in evaluation, highlighting challenges in its financial performance, particularly in Q3 FY24-25. The company reported declining net sales and reduced profit after tax, raising concerns about long-term sustainability despite a manageable debt-to-equity ratio and fair valuation metrics.

Read MoreIrcon International Faces Mixed Technical Trends Amid Market Volatility

2025-03-19 08:00:02Ircon International, a midcap player in the engineering sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 145.90, showing a notable increase from the previous close of 138.25. Over the past year, Ircon has experienced significant volatility, with a 52-week high of 351.65 and a low of 134.30. In terms of technical indicators, the MACD suggests a bearish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Relative Strength Index (RSI) indicates bullish momentum on both weekly and monthly scales, contrasting with the Bollinger Bands, which reflect a mildly bearish trend. Moving averages are bearish on a daily basis, while the KST shows a bearish trend weekly and mildly bearish monthly. When comparing the company's performance to the Sensex, Ircon's returns have been mixed. Over the pas...

Read MoreIrcon International Sees Surge in Trading Activity Amid Sector Rebound

2025-03-18 11:00:04Ircon International Ltd, a mid-cap player in the engineering sector, has emerged as one of the most active stocks today, with a total traded volume of 18,588,045 shares and a total traded value of approximately Rs 2,743.04 million. The stock opened at Rs 143.6, reflecting a gain of 3.93% from the previous close of Rs 138.17, and reached an intraday high of Rs 150.4, marking an increase of 8.85% during the trading session. Notably, Ircon International has outperformed its sector, which saw a gain of 2.38%, by 3.65%. This performance comes after a five-day period of consecutive declines, indicating a potential trend reversal. The stock's last traded price stands at Rs 147.44, while its liquidity remains robust, with a delivery volume of 127,800 shares on March 17, reflecting a 7.13% increase against the five-day average. In terms of moving averages, the stock is currently above its five-day moving average b...

Read MoreAnnouncement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

28-Mar-2025 | Source : BSELetter of Award to IRCON through its Joint Venture i.e. IRCON-SSNR JV

Board Comments On Fine Levied By Stock Exchnages For The Quarter Ended 31St December 2025.

26-Mar-2025 | Source : BSEBoard Comments on fine levied by Stock Exchanges for the quarter ended 31st December 2025.

Closure of Trading Window

24-Mar-2025 | Source : BSETrading window of Ircon International Limited will remain closed from 1st April 2025 till 48 hours after the financial results of the Company are made public.

Corporate Actions

No Upcoming Board Meetings

Ircon International Ltd has declared 82% dividend, ex-date: 17 Feb 25

Ircon International Ltd has announced 2:10 stock split, ex-date: 03 Apr 20

Ircon International Ltd has announced 1:1 bonus issue, ex-date: 20 May 21

No Rights history available