ISGEC Heavy Engineering Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-28 08:03:14ISGEC Heavy Engineering, a midcap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1061.00, showing a notable increase from the previous close of 1042.00. Over the past year, ISGEC has demonstrated a return of 17.76%, significantly outperforming the Sensex, which recorded a return of 6.32% in the same period. In terms of technical indicators, the MACD and Bollinger Bands suggest a bearish sentiment on a weekly basis, while the monthly outlook is mildly bearish. The moving averages indicate a mildly bearish trend on a daily basis, with the KST also reflecting a bearish stance. However, the Dow Theory presents a mildly bullish perspective on a weekly basis, indicating some mixed signals in the short term. The company's performance over various time frames highlights its resilience...

Read MoreISGEC Heavy Engineering Faces Technical Trend Shifts Amid Market Evaluation Revision

2025-03-27 08:03:10ISGEC Heavy Engineering, a midcap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1042.00, having closed at 1055.95 previously. Over the past year, ISGEC has demonstrated a notable return of 18.72%, significantly outperforming the Sensex, which recorded a return of 6.65% in the same period. In terms of technical indicators, the stock's MACD and Bollinger Bands suggest a bearish sentiment in the weekly timeframe, while the monthly indicators show a mildly bearish trend. The moving averages also reflect a bearish stance on a daily basis. The KST and OBV metrics present a mixed picture, with the weekly KST indicating bearishness and the OBV showing a mildly bullish trend. When comparing ISGEC's performance to the Sensex, the company has shown resilience over longer periods, partic...

Read MoreISGEC Heavy Engineering Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-24 08:02:19ISGEC Heavy Engineering, a midcap player in the engineering and industrial equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,085.00, showing a notable increase from the previous close of 984.45. Over the past year, ISGEC has demonstrated a return of 25.01%, significantly outperforming the Sensex, which recorded a return of 5.87% in the same period. In terms of technical indicators, the company exhibits a mixed outlook. The MACD signals a bearish trend on a weekly basis while leaning mildly bearish on a monthly scale. The Bollinger Bands and On-Balance Volume (OBV) also reflect a mildly bearish sentiment, indicating some caution among traders. However, the Dow Theory suggests a mildly bullish trend on a weekly basis, hinting at potential resilience in certain market conditions. Looking at the company's performance over...

Read More

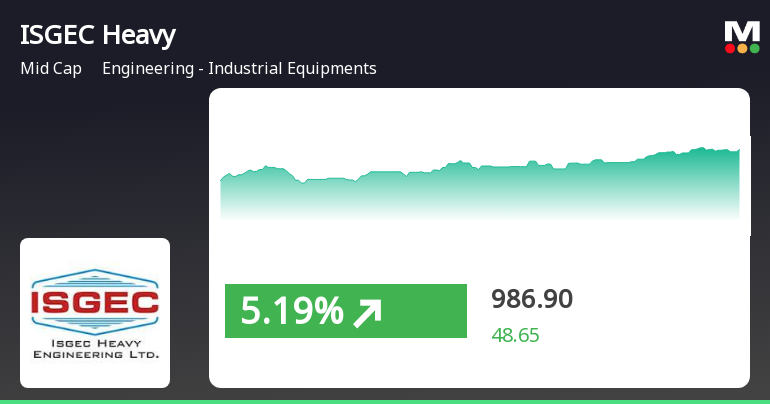

ISGEC Heavy Engineering Shows Trend Reversal Amid Broader Market Recovery

2025-03-21 11:20:21ISGEC Heavy Engineering has experienced a notable uptick, reversing a two-day decline and outperforming its sector. The stock is currently above its short-term moving averages but below longer-term ones. Over the past week, it has gained significantly, contrasting with its year-to-date performance against the Sensex.

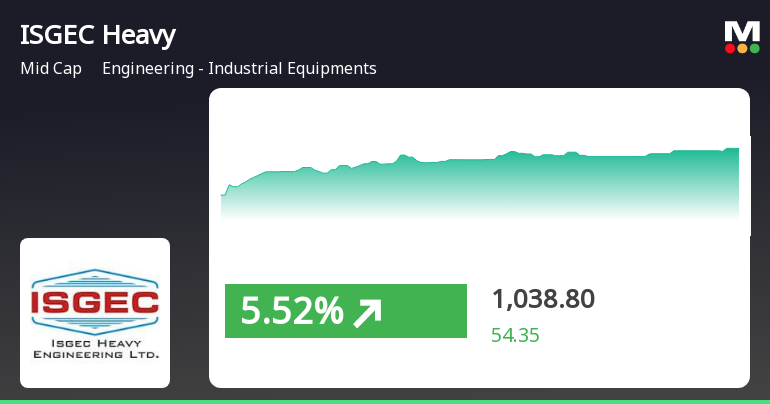

Read MoreISGEC Heavy Engineering Shows Strong Short-Term Gains Amid Mixed Market Signals

2025-03-05 09:35:14ISGEC Heavy Engineering, a midcap player in the engineering and industrial equipment sector, has shown significant activity today, opening with a gain of 4.63%. This uptick has allowed the stock to outperform its sector by 3.15%. Over the past three days, ISGEC Heavy Engineering has demonstrated a positive trend, accumulating a total return of 7.84%. During today's trading session, the stock reached an intraday high of Rs 1014.95, reflecting a robust performance against the backdrop of a broader market. In terms of moving averages, the stock is currently positioned higher than its 5-day moving average, although it remains below the 20-day, 50-day, 100-day, and 200-day moving averages, indicating mixed signals in its short to medium-term performance. In the context of broader market performance, ISGEC Heavy Engineering's one-day performance of 4.41% stands in contrast to the Sensex, which recorded a modest...

Read More

ISGEC Heavy Engineering Faces Continued Stock Decline Amid Broader Market Challenges

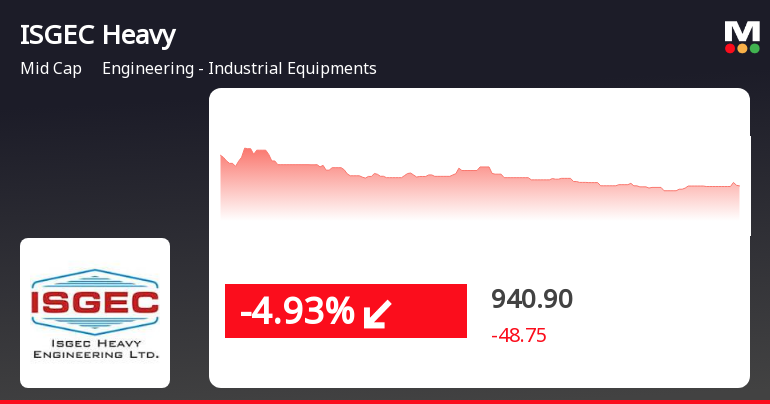

2025-02-28 11:50:21ISGEC Heavy Engineering's shares have declined significantly, continuing a downward trend over two consecutive days. The stock has underperformed relative to its sector and is trading below key moving averages. Over the past month, it has experienced a notable decline, contrasting with the broader market's performance.

Read MoreISGEC Heavy Engineering Faces Sustained Underperformance Amid Market Volatility

2025-02-28 10:05:10ISGEC Heavy Engineering, a midcap player in the engineering and industrial equipment sector, has experienced significant volatility today. The stock opened with a notable loss of 5.24%, marking a challenging start to the trading session. Throughout the day, ISGEC Heavy Engineering has underperformed its sector, showing a decline of 1.32% compared to industry peers. This marks the second consecutive day of losses for the stock, which has seen a total decline of 3.49% over this period. The stock reached an intraday low of Rs 937.8, reflecting the ongoing downward trend. In terms of moving averages, ISGEC Heavy Engineering is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a sustained period of underperformance. Over the past month, the stock has declined by 11.15%, while the broader Sensex index has only fallen by 3.02%. These metrics highlight the challe...

Read More

ISGEC Heavy Engineering Shows Strong Performance Amid Broader Market Decline

2025-02-21 12:05:19ISGEC Heavy Engineering experienced significant trading activity, with a notable rise in its stock price on February 21, 2025. The company outperformed its sector and reached an intraday high, despite facing challenges over the past month. Its current price shows mixed momentum relative to various moving averages.

Read More

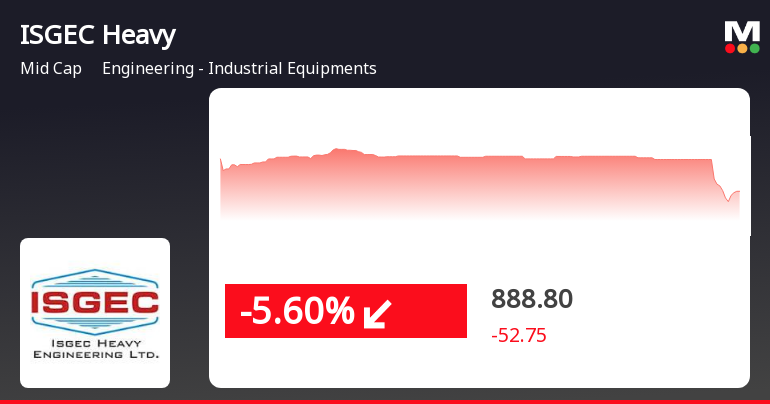

ISGEC Heavy Engineering Faces Market Volatility Amid Broader Sector Challenges

2025-02-20 12:20:21ISGEC Heavy Engineering faced notable volatility on February 20, 2025, opening with gains before closing lower, underperforming its sector. The stock recorded a significant decline over the past month and is trading below multiple moving averages, reflecting a challenging market position and bearish trend in performance metrics.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025.

Announcement under Regulation 30 (LODR)-Credit Rating

27-Mar-2025 | Source : BSEICRA Limited has re-affirmed the credit rating assigned for bank facilities for Rs.5550 Crores vide their letter dated March 27 2025.

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation of closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

ISGEC Heavy Engineering Ltd has declared 400% dividend, ex-date: 21 Aug 24

ISGEC Heavy Engineering Ltd has announced 1:10 stock split, ex-date: 28 Mar 19

No Bonus history available

No Rights history available