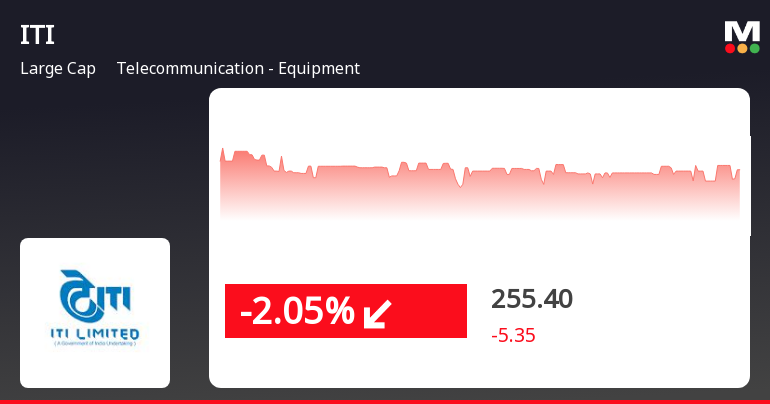

Telecommunication Equipment Sector Faces Pressure as ITI Stock Declines Amid Market Fluctuations

2025-03-26 13:15:20ITI, a major player in telecommunications, has seen its shares decline for two consecutive days, reflecting a broader market trend. The stock is trading below key moving averages and has underperformed compared to the Sensex, which has shown resilience recently. Despite current challenges, ITI has achieved significant long-term growth.

Read More

ITI Faces Financial Challenges Amid Significant Sales Growth and Bearish Technical Indicators

2025-03-25 08:08:45ITI, a key player in the Telecommunication Equipment sector, has experienced an evaluation adjustment reflecting changes in its technical indicators amid mixed financial results. Despite a substantial increase in net sales, the company faces challenges such as operating losses and a high debt-to-EBITDA ratio, raising concerns about its financial stability.

Read MoreTechnical Indicators Signal Bearish Sentiment for ITI Amidst Stock Volatility

2025-03-25 08:00:52ITI, a prominent player in the telecommunication equipment sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The stock is currently priced at 266.00, showing a slight increase from the previous close of 260.50. Over the past year, ITI has experienced a high of 592.85 and a low of 210.20, indicating significant volatility. The technical summary reveals a bearish sentiment in the weekly MACD and moving averages, while the monthly indicators show a mildly bearish trend. Notably, the Bollinger Bands also reflect a mildly bearish stance, suggesting potential challenges in price stability. The KST aligns with this sentiment, indicating bearish conditions on a weekly basis. In terms of performance, ITI's stock return over the past week stands at 7.26%, outperforming the Sensex, which returned 5.14%. However, the year-to-date return shows a decline of 31.24%, con...

Read MoreITI Ltd's Stock Activity Highlights Competitive Dynamics in Telecommunications Sector

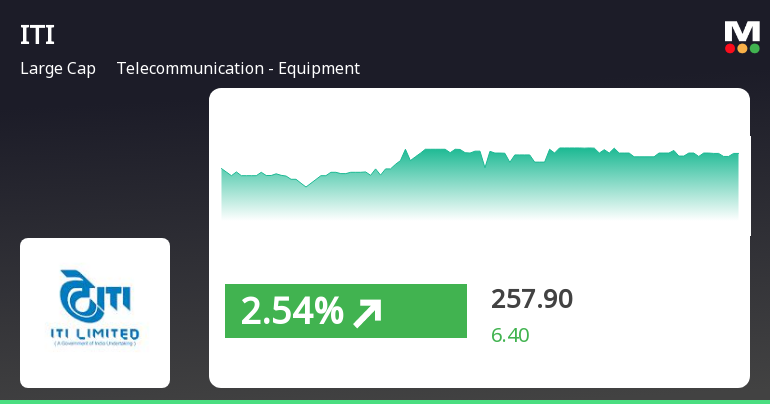

2025-03-24 18:00:16ITI Ltd, a prominent player in the telecommunication equipment industry, has shown significant activity in the stock market today. With a market capitalization of Rs 25,315.00 crore, ITI operates within a sector characterized by rapid technological advancements and competitive dynamics. Today, ITI's stock price increased by 2.11%, outperforming the Sensex, which rose by 1.40%. Over the past week, ITI has demonstrated a robust performance, gaining 7.26%, compared to the Sensex's 5.14%. However, the stock's one-month performance reflects a decline of 3.06%, contrasting with the Sensex's positive growth of 4.74%. In terms of valuation, ITI's price-to-earnings ratio stands at -60.57, significantly higher than the industry average of 17.42, indicating potential concerns regarding profitability. Over the past year, ITI's performance has been relatively subdued, with a gain of only 1.90%, while the Sensex has a...

Read More

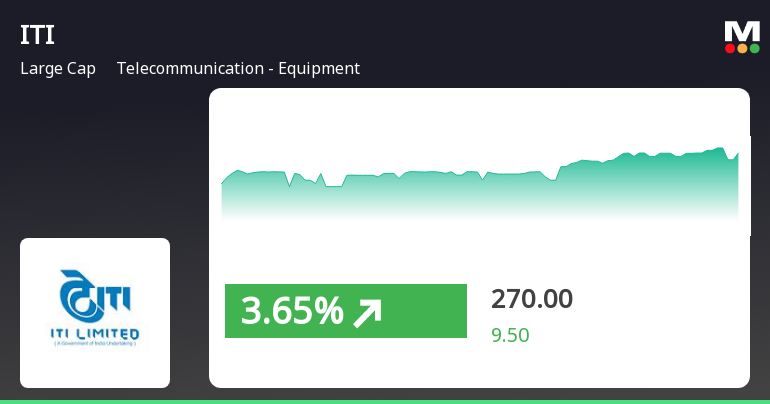

ITI Outperforms Sector Amid Mixed Long-Term Performance Signals

2025-03-24 10:45:19ITI, a key player in telecommunications, has experienced a notable increase in stock performance, surpassing its sector's gains. The stock's recent activity reflects a positive short-term trend, although it shows mixed signals in longer-term moving averages. Meanwhile, the broader market, represented by the Sensex, continues to rise.

Read More

ITI Faces Mixed Financial Indicators Amid Significant Sales Growth and High Debt Concerns

2025-03-20 08:03:13ITI, a key player in the Telecommunication Equipment sector, has recently adjusted its evaluation amid mixed performance indicators. While net sales surged significantly, the company grapples with operating losses and a high debt-to-EBITDA ratio, raising concerns about its long-term financial health and profitability.

Read MoreITI Stock Shows Mixed Technical Indicators Amid Strong Long-Term Performance

2025-03-20 08:00:34ITI, a prominent player in the telecommunication equipment sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 261.85, showing a notable increase from the previous close of 251.50. Over the past week, ITI has demonstrated a robust performance with a return of 7.32%, significantly outpacing the Sensex, which recorded a return of 1.92%. In terms of technical indicators, the company exhibits a mixed outlook. The MACD and Bollinger Bands suggest a mildly bearish sentiment on both weekly and monthly scales, while daily moving averages indicate a mildly bullish trend. Notably, the stock has experienced fluctuations within a 52-week range, with a high of 592.85 and a low of 210.20. Looking at the company's performance over various time frames, ITI has shown resilience, particularly over the long term, with a remarkable return of 443.26% o...

Read More

ITI Outperforms Market with Consecutive Gains Amid Mixed Moving Averages

2025-03-19 10:30:18ITI, a key player in telecommunications, experienced significant gains today, outperforming the broader market. The stock has shown consecutive gains over the past two days, achieving a notable return. Despite its recent performance, ITI's moving averages indicate mixed trends across different time frames. The broader market also saw positive movement, particularly in small-cap stocks.

Read MoreITI Ltd Experiences Notable Rebound Amidst Mixed Technical Indicators and Market Activity

2025-03-13 10:00:05ITI Ltd, a prominent player in the Telecommunication Equipment industry, has shown significant activity today as it hit its upper circuit limit. The stock reached an intraday high of Rs 253.36, reflecting a 5% increase from its previous close. This upward movement comes after a three-day period of consecutive declines, marking a notable trend reversal. The stock opened with a gain of 2.33%, contributing to a total traded volume of approximately 1.07 million shares, resulting in a turnover of Rs 2.68 crore. Despite this positive performance, ITI is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a mixed technical outlook. In terms of market performance, ITI outperformed its sector by 3.77%, while the broader Sensex recorded a modest return of 0.08%. The stock's liquidity remains adequate, with a delivery volume of 32,070 shares noted on March 12, although...

Read MoreAnnouncement under Regulation 30 (LODR)-Press Release / Media Release

09-Apr-2025 | Source : BSEAnnouncement under Regulation 30 (LODR) - Press Release

Closure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading Window

Entrustment Of Additional Charge Of The Post Of Director -(HR)

01-Mar-2025 | Source : BSEEntrustment of Additional Charge of the post of Director - (HR)

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available