J Kumar Infraprojects Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-03 08:05:09J Kumar Infraprojects, a midcap player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 691.20, showing a notable increase from the previous close of 677.70. Over the past year, J Kumar Infraprojects has achieved a return of 6.51%, outperforming the Sensex, which recorded a return of 3.67% in the same period. The technical summary indicates a mixed outlook, with various indicators suggesting a cautious stance. The MACD shows bearish tendencies on a weekly basis, while the monthly perspective leans mildly bearish. The Bollinger Bands present a mildly bearish signal weekly, contrasting with a bullish monthly outlook. Moving averages also reflect a mildly bearish trend on a daily basis. In terms of performance, J Kumar Infraprojects has demonstrated significant resilience over longer periods, with a remarkable ...

Read MoreJ Kumar Infraprojects Adjusts Valuation Grade Amid Strong Financial Metrics and Market Position

2025-04-02 08:02:06J Kumar Infraprojects has recently undergone a valuation adjustment, reflecting its strong financial metrics and market position within the capital goods industry. The company's price-to-earnings ratio stands at 13.64, while its price-to-book value is recorded at 1.84. Notably, J Kumar's enterprise value to EBITDA ratio is 6.74, and its enterprise value to sales ratio is 0.98, indicating efficient operational performance. The company also showcases a robust return on capital employed (ROCE) of 19.55% and a return on equity (ROE) of 13.48%, highlighting its effective management of resources. In comparison to its peers, J Kumar Infraprojects demonstrates a competitive edge, particularly in its PEG ratio of 0.56, which is significantly lower than that of several competitors, suggesting a favorable valuation relative to growth expectations. Over the past year, J Kumar has delivered a stock return of 2.27%, sl...

Read More

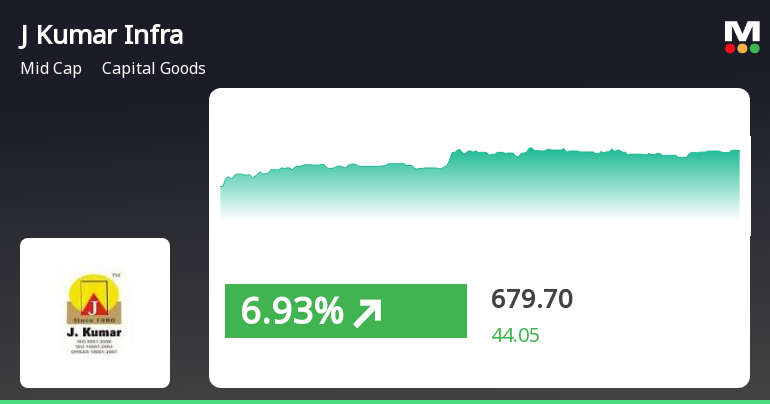

J Kumar Infraprojects Shows Trend Reversal Amid Broader Market Decline

2025-04-01 11:40:22J Kumar Infraprojects experienced a notable uptick on April 1, 2025, reversing a four-day decline and outperforming its sector. The stock is currently above its short-term moving averages but below longer-term ones. Despite recent mixed results, it has shown substantial long-term growth over the past three and five years.

Read MoreJ Kumar Infraprojects Faces Bearish Technical Trends Amid Market Volatility

2025-03-26 08:03:52J Kumar Infraprojects, a midcap player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 668.15, down from a previous close of 700.00, with a 52-week high of 935.50 and a low of 560.55. Today's trading saw a high of 704.55 and a low of 665.30, indicating some volatility. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Bollinger Bands also reflect a bearish stance weekly, with a sideways trend monthly. Moving averages and KST confirm the bearish outlook on a daily and weekly basis, respectively. In terms of performance, J Kumar Infraprojects has shown varied returns compared to the Sensex. Over the past week, the stock returned 1.11%, while the Sensex gained 3.61%. Year-to-date,...

Read MoreJ Kumar Infraprojects Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-24 08:02:05J Kumar Infraprojects, a midcap player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 672.20, showing a slight increase from the previous close of 670.30. Over the past year, J Kumar Infraprojects has demonstrated a return of 11.48%, outperforming the Sensex, which recorded a return of 5.87% in the same period. The technical summary indicates a mixed outlook, with various indicators suggesting different trends. The MACD shows bearish signals on a weekly basis, while the monthly perspective leans towards a mildly bearish stance. The Bollinger Bands present a mildly bearish trend weekly, contrasting with a bullish monthly outlook. Additionally, the moving averages indicate bearish conditions on a daily basis. In terms of performance, J Kumar Infraprojects has shown significant growth over longer periods, wit...

Read More

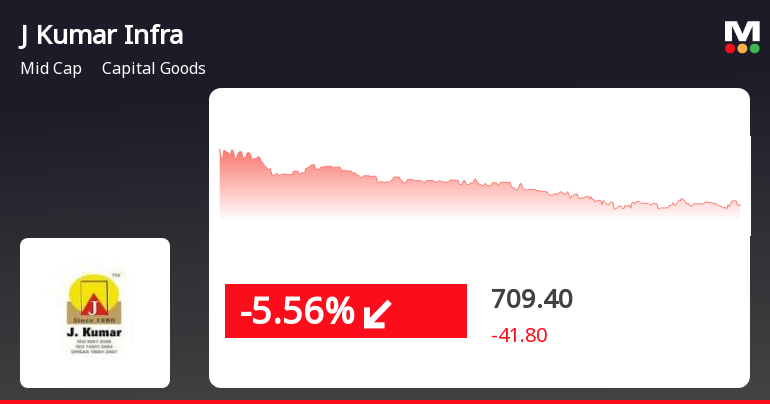

J Kumar Infraprojects Faces Sustained Stock Weakness Amid Broader Market Decline

2025-02-11 14:05:19J Kumar Infraprojects has faced a notable decline in stock performance, losing 5.52% on February 11, 2025, and continuing a downward trend over the past three days. The stock is trading below key moving averages and has underperformed compared to the broader capital goods sector and the Sensex.

Read More

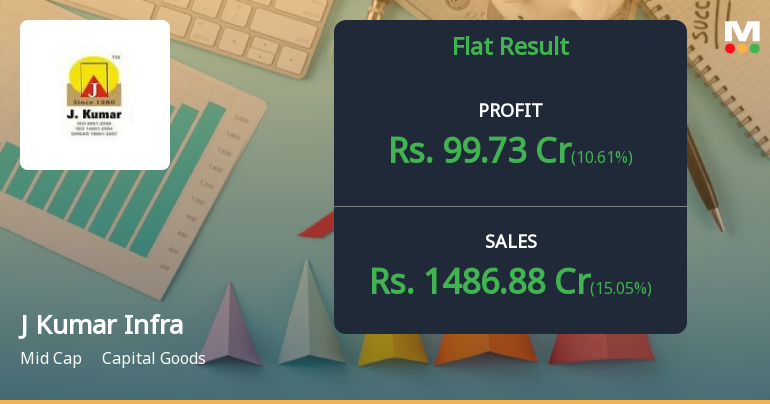

J Kumar Infraprojects Reports Strong Half-Year Growth Amid Rising Interest Costs

2025-02-04 15:32:38J Kumar Infraprojects has announced its financial results for the quarter ending December 2024, highlighting a 21.82% year-on-year growth in Profit After Tax, reaching Rs 190.13 crore. The company also reported its highest quarterly net sales in five quarters at Rs 1,486.88 crore, despite rising interest costs impacting profitability.

Read More

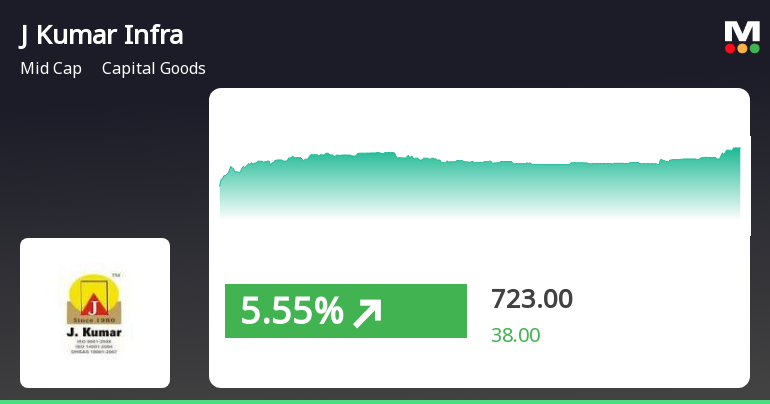

J Kumar Infraprojects Shows Resilience Amid Mixed Market Trends in Capital Goods Sector

2025-01-29 15:35:16J Kumar Infraprojects has demonstrated notable activity, gaining 5.55% on January 29, 2025, with an intraday high of Rs 720.7. While outperforming its sector, the stock's moving averages indicate mixed trends. Over the past month, it has declined 4.45%, contrasting with the broader market's performance.

Read MoreJ Kumar Infraprojects Shows Mixed Performance Amidst Sector Outperformance and Short-Term Gains

2025-01-29 09:50:07J Kumar Infraprojects, a midcap player in the capital goods sector, has shown significant activity today, opening with a gain of 4.08%. The stock reached an intraday high of Rs 712.95, reflecting a strong performance that outpaced its sector by 2.29%. In terms of short-term performance, J Kumar Infraprojects has recorded a 1-day increase of 3.53%, notably outperforming the Sensex, which rose by only 0.33%. However, over the past month, the stock has faced challenges, declining by 6.28%, while the Sensex experienced a smaller drop of 3.24%. When examining moving averages, the stock is currently above its 5-day moving average but remains below the 20-day, 50-day, 100-day, and 200-day moving averages, indicating mixed trends in its recent performance. This activity highlights the stock's current market position and performance indicators, reflecting both short-term gains and longer-term challenges....

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate in terms of Regulation 74(5) of the Securities and Exchange Board of India (Depositories and Participants) Regulations 2018 for the fourth quarter ended as on March 31 2025.

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation of closure of Trading window pursuant to the provisions of Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations 2015.

Announcement under Regulation 30 (LODR)-Award_of_Order_Receipt_of_Order

24-Mar-2025 | Source : BSEJ. Kumar Infraprojects Limited has informed the Exchange that the Company is in receipt of Letter of Acceptance from M/s. City and Industrial Development Corporation of Maharashtra (CIDCO) Limited for the project: Design and Construction of Coastal Road from Jalmarg Sector-16 Kharghar to PMAY Housing scheme near Kharghar Railway Station and Pedestrian Underpass near Delhi Public School Nerul Navi Mumbai for the total contract value amounting to Rs. 10207021000 (Rupees One Thousand Twenty Crore Seventy Lakh Twenty- One Thousand Only) and is exclusive of GST.

Corporate Actions

No Upcoming Board Meetings

J Kumar Infraprojects Ltd has declared 80% dividend, ex-date: 17 Sep 24

J Kumar Infraprojects Ltd has announced 5:10 stock split, ex-date: 10 Dec 15

No Bonus history available

No Rights history available