Jai Balaji Industries Faces Technical Shift Amid Long-Term Growth and Market Challenges

2025-03-25 08:15:24Jai Balaji Industries, a midcap player in the steel sector, has experienced a recent evaluation adjustment reflecting a shift in technical trends. Despite long-term growth in operating profit, the company faces challenges with declining net sales and profit after tax, alongside underperformance compared to the broader market.

Read MoreJai Balaji Industries Faces Mixed Technical Trends Amidst Strong Long-Term Performance

2025-03-25 08:01:55Jai Balaji Industries, a midcap player in the Steel/Sponge Iron/Pig Iron sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's technical indicators present a mixed picture, with the MACD and Bollinger Bands signaling bearish trends on both weekly and monthly bases. Meanwhile, the moving averages indicate a bearish stance on a daily timeframe, while the KST shows a similar bearish trend weekly, with a mildly bearish outlook monthly. Despite these technical signals, Jai Balaji Industries has demonstrated notable performance in certain timeframes. Over the past week, the stock returned 6.17%, outperforming the Sensex, which returned 5.14%. In the one-month period, the stock also surpassed the Sensex with a return of 7.69% compared to the index's 4.74%. However, the year-to-date performance shows a decline of 20.64%, contrasting sharply with the Sensex's mi...

Read More

Jai Balaji Industries Faces Profit Decline Amidst Long-Term Growth Potential and Market Challenges

2025-03-19 08:07:18Jai Balaji Industries has experienced a recent evaluation adjustment amid concerns over a significant decline in profit after tax and a low debtors turnover ratio. Despite these challenges, the company has shown strong long-term growth and a favorable return on capital employed, although it has underperformed the broader market.

Read MoreJai Balaji Industries Faces Mixed Technical Trends Amidst Market Challenges

2025-03-19 08:01:49Jai Balaji Industries, a midcap player in the Steel/Sponge Iron/Pig Iron sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 139.80, showing a notable increase from the previous close of 134.60. Over the past year, Jai Balaji Industries has faced challenges, with a return of -29.37%, contrasting sharply with the Sensex's gain of 3.51% during the same period. The technical summary indicates a mixed outlook, with various indicators showing differing trends. The MACD and KST metrics suggest bearish tendencies on a weekly basis, while the monthly indicators reflect a mildly bearish stance. Notably, the Bollinger Bands also align with this mildly bearish sentiment. However, the On-Balance Volume (OBV) shows bullish characteristics on a monthly basis, indicating some underlying strength. In terms of performance, Jai Balaji Indus...

Read More

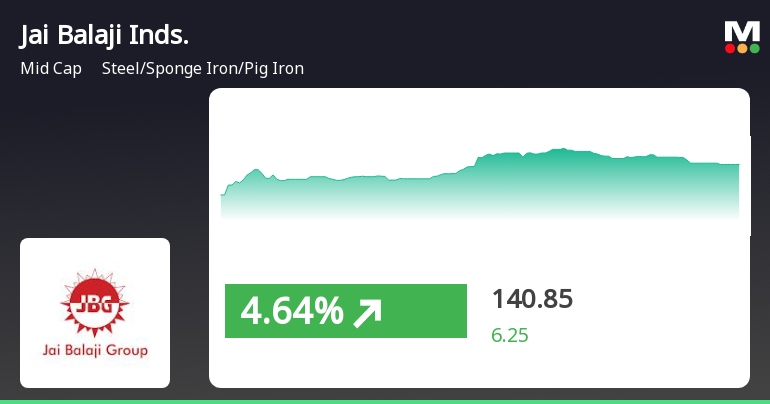

Jai Balaji Industries Sees Trend Reversal Amid Mixed Performance Signals

2025-03-18 10:35:24Jai Balaji Industries has experienced a notable rebound, gaining 5.91% on March 18, 2025, after five days of decline. The stock has outperformed its sector today and is trading above its short-term moving averages, although it faces challenges in longer-term performance compared to the Sensex.

Read MoreJai Balaji Industries Faces Technical Trend Shifts Amid Market Volatility

2025-03-11 08:01:51Jai Balaji Industries, a midcap player in the Steel/Sponge Iron/Pig Iron sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 144.00, down from a previous close of 152.10, with a 52-week high of 249.99 and a low of 124.00. Today's trading saw a high of 152.50 and a low of 144.00. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly indicators show a mildly bearish trend. The daily moving averages also reflect a bearish stance. Notably, the On-Balance Volume (OBV) indicates a bullish trend on a monthly basis, contrasting with the overall bearish signals from other metrics. When comparing the company's performance to the Sensex, Jai Balaji Industries has shown significant volatility. Over the past week, the stock returned 11.03%, outperforming the Sensex, which r...

Read More

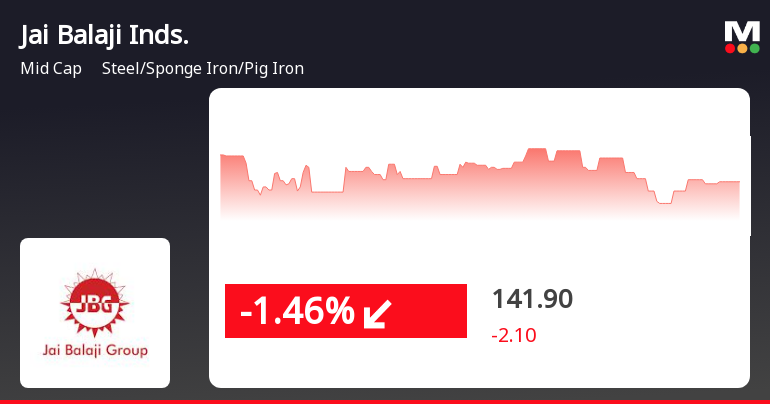

Jai Balaji Industries Faces Decline Amid Broader Market Challenges and Mixed Signals

2025-03-10 15:45:22Jai Balaji Industries, a midcap player in the steel sector, saw a significant decline on March 10, 2025, following three days of gains. The stock underperformed its sector and reached an intraday low, while broader market indices also faced challenges, reflecting a bearish trend.

Read MoreJai Balaji Industries Shows Mixed Technical Trends Amidst Volatile Market Dynamics

2025-03-10 08:00:52Jai Balaji Industries, a midcap player in the Steel/Sponge Iron/Pig Iron sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 152.10, showing a notable increase from the previous close of 142.10. Over the past week, the stock has reached a high of 156.85 and a low of 142.00, indicating some volatility. The technical summary reveals a mixed outlook, with various indicators suggesting a mildly bearish trend. The MACD and KST indicators are bearish on a weekly basis, while the Bollinger Bands and moving averages also reflect a mildly bearish sentiment. However, the On-Balance Volume (OBV) shows bullish momentum on both weekly and monthly scales, indicating some positive trading activity. In terms of performance, Jai Balaji Industries has demonstrated significant returns over longer periods. Over the past three years, the stock has surg...

Read MoreJai Balaji Industries Adjusts Valuation Grade Amid Competitive Market Landscape

2025-03-10 08:00:21Jai Balaji Industries, a midcap player in the Steel/Sponge Iron/Pig Iron sector, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (PE) ratio of 18.37 and an EV to EBITDA ratio of 14.59, indicating its financial metrics are positioned within a competitive range. The return on capital employed (ROCE) stands at an impressive 41.47%, while the return on equity (ROE) is at 45.09%, showcasing strong profitability. In terms of market performance, Jai Balaji Industries has shown notable resilience over the long term, with a staggering 3-year return of 1593.76% and a remarkable 5-year return of 3470.42%. However, the company has faced challenges in the shorter term, with a year-to-date return of -15.53% compared to a slight decline in the Sensex. When compared to its peers, Jai Balaji Industries maintains a competitive edge in certain financial metrics, although som...

Read MoreAnnouncement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

01-Apr-2025 | Source : BSEIntimation under Regulation 30 of SEBI (LODR) Regulations 2015 for Investor meet to be held on 1st & 2nd April.

Closure of Trading Window

24-Mar-2025 | Source : BSEClosure of Trading window

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

12-Mar-2025 | Source : BSEIntimation Under Regulation 30 of SEBI (LODR) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Jai Balaji Industries Ltd has declared 4% dividend, ex-date: 15 Sep 11

Jai Balaji Industries Ltd has announced 2:10 stock split, ex-date: 17 Jan 25

No Bonus history available

No Rights history available