Jain Irrigation Systems Adjusts Valuation, Highlighting Strong Market Position in Agriculture Sector

2025-04-02 08:00:43Jain Irrigation Systems has recently undergone a valuation adjustment, reflecting a shift in its financial standing within the agriculture sector. The company currently exhibits a price-to-earnings (PE) ratio of 109.24, alongside an EV to EBITDA ratio of 10.85. Its price-to-book value stands at 0.72, indicating a favorable comparison to its market valuation. In terms of performance metrics, Jain Irrigation's return on capital employed (ROCE) is recorded at 5.00%, while its return on equity (ROE) is at 0.82%. The PEG ratio, a measure of growth relative to earnings, is noted at 0.60, suggesting a competitive edge in growth potential compared to its peers. When compared to Bombay Super Hybrid, which is categorized differently in terms of valuation, Jain Irrigation demonstrates a more favorable position with a significantly lower PE ratio of 51.28 and a much higher PEG ratio of 2.49. This evaluation adjustmen...

Read More

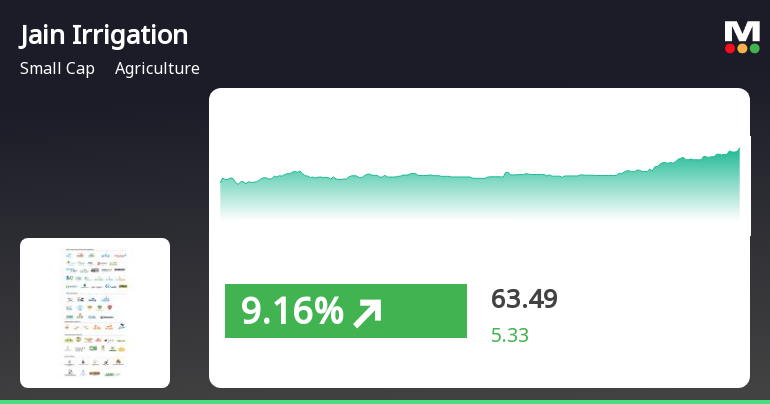

Jain Irrigation Systems Outperforms Sector Amid Broader Market Gains and Mixed Trends

2025-03-06 12:35:14Jain Irrigation Systems has experienced notable stock activity, achieving a significant gain today and outperforming its sector. The stock has shown an upward trend over the past three days, with a substantial total return. In the broader market, small-cap stocks are leading, while the Sensex opened higher.

Read MoreJain Irrigation Shows Resilience Amid Market Volatility and Sector Challenges

2025-03-04 11:07:48Jain Irrigation Systems Ltd, a small-cap player in the agriculture sector, has shown significant activity today, with its stock rising by 3.67%. This uptick contrasts with the broader market, as the Sensex experienced a slight decline of 0.11%. Over the past year, Jain Irrigation has outperformed the Sensex, posting a gain of 0.93% compared to the index's drop of 1.18%. However, the stock has faced challenges in the short term, with a 5.25% decline over the past week and an 18.32% drop in the last month. Year-to-date, Jain Irrigation's performance stands at -16.97%, while the Sensex has decreased by 6.57%. Despite recent volatility, Jain Irrigation has demonstrated resilience over a longer horizon, with a notable 45.11% increase over the past three years and an impressive 1126.03% rise over the last five years. The company's market capitalization is currently at Rs 3,787.16 crore, and it operates with a ...

Read MoreJain Irrigation Systems Faces Mixed Technical Trends Amid Recent Stock Decline

2025-02-27 08:01:52Jain Irrigation Systems, a small-cap player in the agriculture sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 59.65, down from the previous close of 61.10, with a 52-week high of 84.10 and a low of 43.75. Today's trading saw a high of 61.69 and a low of 59.27. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish trends on both weekly and monthly scales, while the Bollinger Bands also reflect a bearish stance. The KST aligns with this sentiment, indicating mildly bearish conditions over both timeframes. However, the daily moving averages suggest a mildly bullish outlook, presenting a contrast to the overall bearish indicators. In terms of performance, Jain Irrigation's stock has faced challenges recently, with a notable decline of 18.66% over the past month compared to a...

Read MoreJain Irrigation Systems Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-02-25 10:28:37Jain Irrigation Systems, a small-cap player in the agriculture sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 61.23, showing a slight increase from the previous close of 61.10. Over the past year, Jain Irrigation has demonstrated a stock return of 5.26%, outperforming the Sensex, which recorded a return of 2.09% in the same period. In terms of technical indicators, the company exhibits a mixed performance. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly periods. Bollinger Bands and KST also reflect a mildly bearish trend on a weekly basis, with moving averages suggesting a mildly bullish stance daily. Notably, Jain Irrigation's performance over longer periods is impressive, with a sta...

Read More

Jain Irrigation Reports Q3 FY24-25 Results, Highlights Debt Reduction and Profit Decline

2025-01-30 14:32:34Jain Irrigation Systems has announced its financial results for Q3 FY24-25, showing a revised evaluation score and achieving its lowest Debt-Equity Ratio in recent periods. However, the company faces challenges with a notable decline in both Profit Before Tax and Profit After Tax, raising concerns about its business model sustainability.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018 for the quarter/year ended 31st March 2025.

Disclosures under Reg. 31(1) and 31(2) of SEBI (SAST) Regulations 2011.

02-Apr-2025 | Source : BSEThe Exchange has received Disclosure under Regulation 31(1) and 31(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 on April 02 2025 for Jalgaon Investments Pvt Ltd

Announcement under Regulation 30 (LODR)-Credit Rating

31-Mar-2025 | Source : BSEIntimation of Credit Rating Reaffirmation by CRISIL

Corporate Actions

No Upcoming Board Meetings

Jain Irrigation Systems Ltd has declared 50% dividend, ex-date: 12 Sep 19

Jain Irrigation Systems Ltd has announced 2:10 stock split, ex-date: 29 Oct 10

Jain Irrigation Systems Ltd has announced 1:20 bonus issue, ex-date: 08 Nov 11

No Rights history available