Jayant Agro Organics Adjusts Valuation Amidst Competitive Chemicals Market Landscape

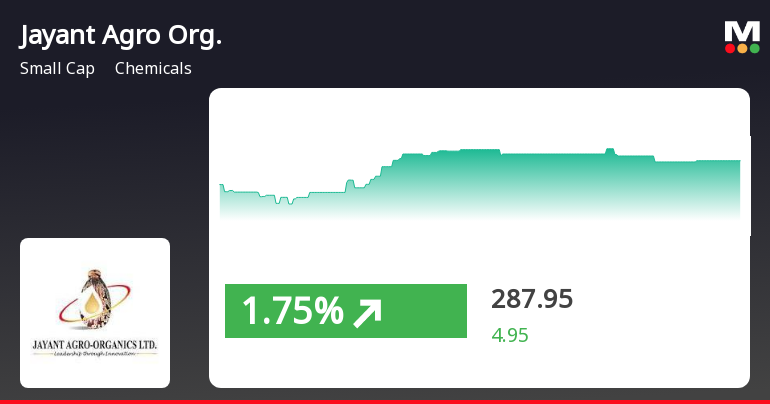

2025-03-26 08:00:32Jayant Agro Organics, a small-cap player in the chemicals industry, has recently undergone a valuation adjustment. The company's current price stands at 234.60, reflecting a notable shift from its previous close of 244.15. Over the past year, Jayant Agro has shown a stock return of 3.08%, which is below the Sensex's return of 7.12% during the same period. Key financial metrics for Jayant Agro include a PE ratio of 18.74 and an EV to EBITDA ratio of 11.73, indicating a competitive position within its sector. The company also boasts a dividend yield of 1.99% and a return on capital employed (ROCE) of 11.33%. In comparison to its peers, Jayant Agro's valuation appears more favorable. For instance, Neogen Chemicals is positioned at a significantly higher valuation, while Gujarat Alkalies is currently loss-making. Other competitors like Balaji Amines and Grauer & Weil have varying valuations, with Balaji Amin...

Read MoreJayant Agro Organics Adjusts Valuation Grade Amid Competitive Industry Landscape

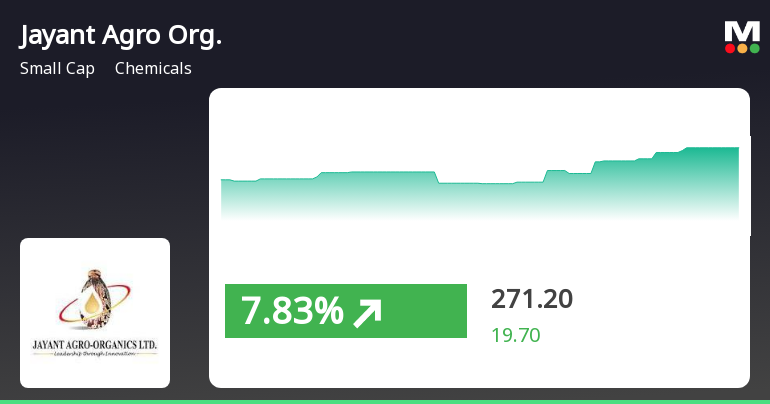

2025-03-17 08:00:34Jayant Agro Organics, a small-cap player in the chemicals industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently boasts a price-to-earnings (P/E) ratio of 19.26 and a price-to-book value of 2.11, indicating a solid valuation framework. Its enterprise value to EBITDA stands at 12.00, while the EV to EBIT ratio is recorded at 14.39, suggesting a competitive position within its sector. In terms of profitability, Jayant Agro demonstrates a return on capital employed (ROCE) of 11.33% and a return on equity (ROE) of 10.10%. The company also offers a dividend yield of 1.94%, which adds to its appeal among investors seeking income. When compared to its peers, Jayant Agro's valuation metrics appear favorable. For instance, Neogen Chemicals and Fischer Medical are positioned at significantly higher valuation levels, while competitors like Balaji ...

Read MoreJayant Agro Organics Adjusts Valuation Grade Amid Competitive Market Landscape

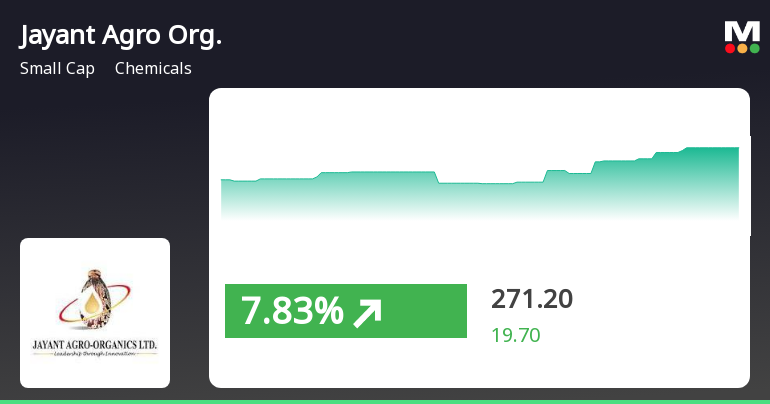

2025-03-05 08:00:45Jayant Agro Organics, a small-cap player in the chemicals industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently reports a price-to-earnings (P/E) ratio of 19.24 and an enterprise value to EBITDA ratio of 11.99, indicating a competitive position within its sector. Additionally, its return on capital employed (ROCE) stands at 11.33%, while the return on equity (ROE) is at 10.10%, showcasing its operational efficiency. In comparison to its peers, Jayant Agro's valuation metrics appear more favorable. For instance, companies like Fischer Medical and Neogen Chemicals exhibit significantly higher P/E ratios, suggesting a stark contrast in market perceptions. Furthermore, while some peers are categorized as very expensive, Jayant Agro maintains a more attractive valuation profile, which may appeal to certain market segments. Despite recent fl...

Read MoreJayant Agro Organics Adjusts Valuation Grade Amid Strong Market Performance and Competitive Metrics

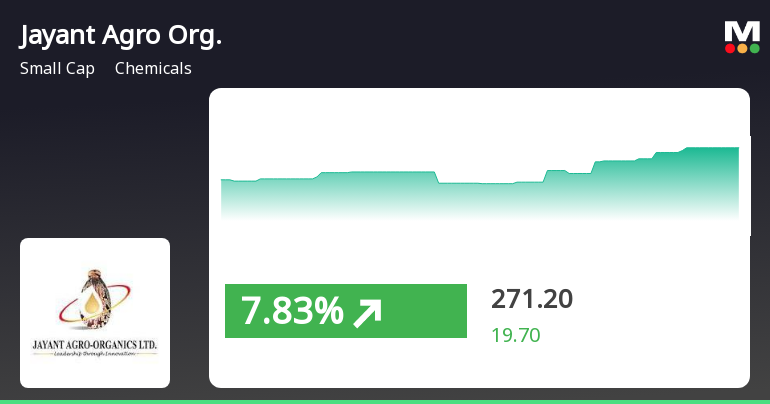

2025-02-24 12:57:21Jayant Agro Organics, a small-cap player in the chemicals industry, has recently undergone a valuation adjustment reflecting its current market position. The company's price-to-earnings ratio stands at 20.99, while its price-to-book value is recorded at 2.30. Other key financial metrics include an EV to EBIT ratio of 15.46 and an EV to EBITDA ratio of 12.89, indicating a competitive stance within its sector. The company also boasts a dividend yield of 1.78% and a return on capital employed (ROCE) of 11.33%, alongside a return on equity (ROE) of 10.10%. In comparison to its peers, Jayant Agro's valuation appears more favorable, particularly when contrasted with companies like Balaji Amines and Neogen Chemicals, which are positioned at higher valuation levels. Over the past year, Jayant Agro has delivered a stock return of 10.89%, significantly outperforming the Sensex's return of 1.96%. This trend continu...

Read More

Jayant Agro Organics Faces Sustained Downward Trend Amid Broader Market Challenges

2025-02-12 10:15:38Jayant Agro Organics, a small-cap chemicals company, saw a notable decline in its stock performance, dropping significantly today. The stock opened lower and reached an intraday low, underperforming its sector and the broader market. It has also lagged over the past month, trading below key moving averages.

Read More

Jayant Agro Organics Reports Flat Q3 Performance Amid Positive Sales Growth and Liquidity Concerns

2025-02-08 17:34:02Jayant Agro Organics has reported flat financial performance for Q3 FY24-25, with net sales for the half-year at Rs 1,177.84 crore, up 21.56% year-on-year. Profit after tax for nine months is Rs 43.46 crore, a 20.99% increase. However, inventory and debtors turnover ratios have declined, indicating operational challenges.

Read More

Jayant Agro Organics Shows Trend Reversal Amid Broader Market Dynamics

2025-01-29 12:20:22Jayant Agro Organics experienced notable trading activity on January 29, 2025, rebounding after three days of decline. The stock outperformed its sector and the Sensex, despite trading below key moving averages. Over the past month, it has shown a slight decline, though better than the broader market.

Read More

Jayant Agro Organics Shows Trend Reversal Amid Broader Market Dynamics

2025-01-29 12:20:22Jayant Agro Organics experienced notable trading activity on January 29, 2025, rebounding after three days of decline. The stock outperformed its sector and the Sensex, despite trading below key moving averages. Over the past month, it has shown a slight decline, though better than the broader market.

Read More

Jayant Agro Organics Shows Trend Reversal Amid Broader Market Dynamics

2025-01-29 12:20:22Jayant Agro Organics experienced notable trading activity on January 29, 2025, rebounding after three days of decline. The stock outperformed its sector and the Sensex, despite trading below key moving averages. Over the past month, it has shown a slight decline, though better than the broader market.

Read MoreClosure of Trading Window

28-Mar-2025 | Source : BSEClosure of Trading Window

Update

10-Feb-2025 | Source : BSEUpdate

Announcement under Regulation 30 (LODR)-Newspaper Publication

10-Feb-2025 | Source : BSENewspaper Advertisement

Corporate Actions

No Upcoming Board Meetings

Jayant Agro Organics Ltd has declared 100% dividend, ex-date: 12 Jul 24

No Splits history available

Jayant Agro Organics Ltd has announced 1:1 bonus issue, ex-date: 01 Aug 17

No Rights history available