JBM Auto Faces Technical Trend Shifts Amidst Market Volatility and Performance Disparities

2025-04-02 08:05:31JBM Auto, a midcap player in the auto ancillary industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 605.50, showing a notable shift from its previous close of 589.30. Over the past year, JBM Auto has experienced significant volatility, with a 52-week high of 1,169.23 and a low of 489.30. In terms of technical indicators, the weekly MACD is positioned in a bearish trend, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) indicates a bullish stance on a weekly basis, but shows no signal for the monthly period. Bollinger Bands and KST metrics also reflect a mildly bearish trend on both weekly and monthly scales. Daily moving averages are currently bearish, suggesting a cautious market sentiment. When comparing the stock's performance to the Sensex, JBM Auto has faced challenges, particularly in the year-t...

Read MoreJBM Auto Faces Technical Trend Shifts Amidst Market Volatility and Long-Term Resilience

2025-03-25 08:03:03JBM Auto, a midcap player in the auto ancillary industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 662.35, showing a notable increase from the previous close of 572.00. Over the past year, JBM Auto has experienced a significant decline of 29.14%, contrasting with a 7.07% gain in the Sensex during the same period. However, the company has demonstrated resilience over longer time frames, with a remarkable 2955.12% return over the past five years, significantly outperforming the Sensex's 192.36%. In terms of technical indicators, the MACD and KST are showing bearish trends on both weekly and monthly scales, while the Bollinger Bands and moving averages indicate a mildly bearish stance. The Dow Theory presents a mixed picture, with a mildly bullish outlook on the weekly chart but a bearish trend on the monthly. The recent performanc...

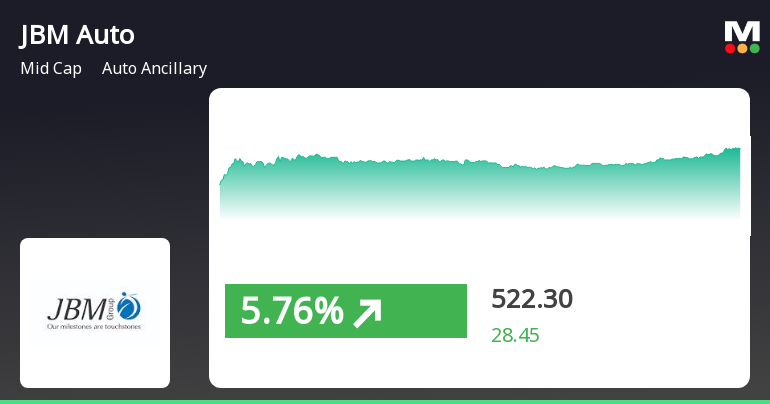

Read MoreJBM Auto Ltd Sees Surge in Trading Activity and Market Engagement

2025-03-24 14:00:03JBM Auto Ltd, a prominent player in the Auto Ancillary sector, has emerged as one of the most active stocks today, with a total traded volume of 8,923,559 shares and a total traded value of approximately Rs 57.18 crores. The stock opened at Rs 574.7 and reached an intraday high of Rs 668.8, reflecting a significant increase of 17.74% during the trading session. Currently, the last traded price stands at Rs 666.4. In terms of performance, JBM Auto has outperformed its sector by 15.48%, marking a notable achievement as it has gained 35.5% over the past five days. The stock has exhibited high volatility today, with an intraday volatility of 5.15%. It has traded within a wide range of Rs 94.05, indicating active market engagement. Additionally, the stock's liquidity remains robust, with a delivery volume of 2.8 lakh shares on March 21, reflecting a 28.39% increase compared to the five-day average. JBM Auto's ...

Read More

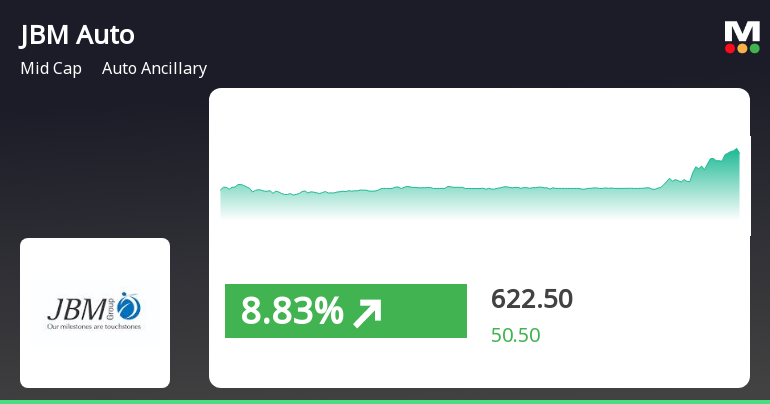

JBM Auto Shows Strong Short-Term Gains Amid Broader Market Uptrend

2025-03-24 12:05:16JBM Auto has experienced notable activity, gaining 6.3% and outperforming its sector over five consecutive days, resulting in a total return of 20.11%. The stock reached an intraday high of Rs 595.85, while the broader market, including the Sensex and BSE Mid Cap index, showed positive trends.

Read More

JBM Auto Shows Signs of Recovery Amidst Long-Term Performance Challenges

2025-03-18 14:50:16JBM Auto, a midcap auto ancillary company, experienced a notable performance on March 18, 2025, reversing a five-day decline with a significant intraday high. The stock outperformed its sector and the Sensex, although it has faced declines over the past month and year, while showing strong long-term growth.

Read More

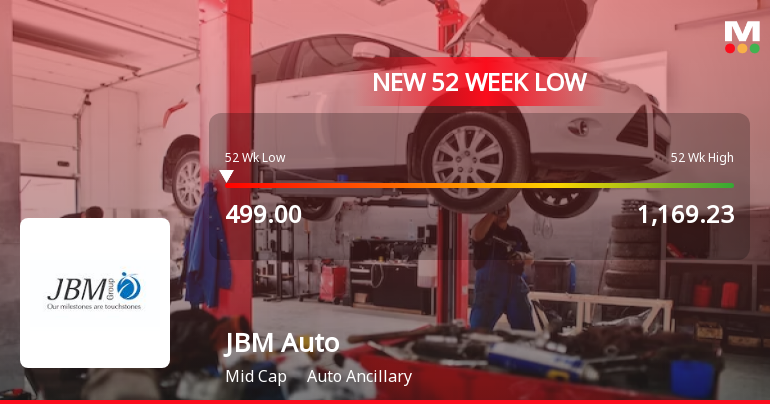

JBM Auto Faces Stock Volatility Amid High Debt and Weak Market Sentiment

2025-03-17 15:39:14JBM Auto has faced notable stock volatility, reaching a new 52-week low and experiencing a significant decline over the past five days. The company struggles with a high Debt to EBITDA ratio and low operating profit to interest ratio, while its stock has dropped substantially over the past year amid bearish technical indicators.

Read More

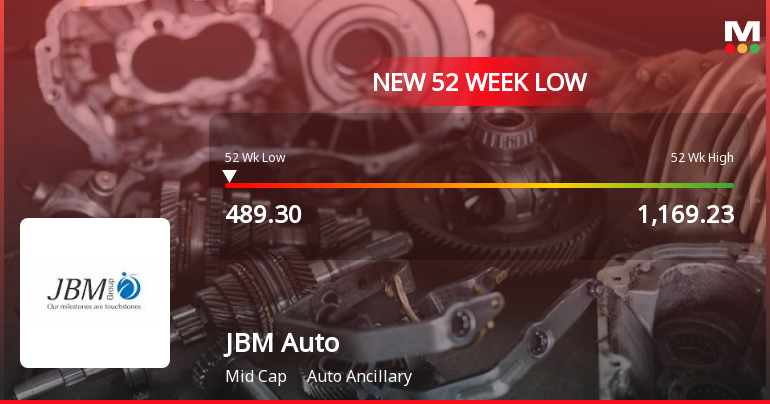

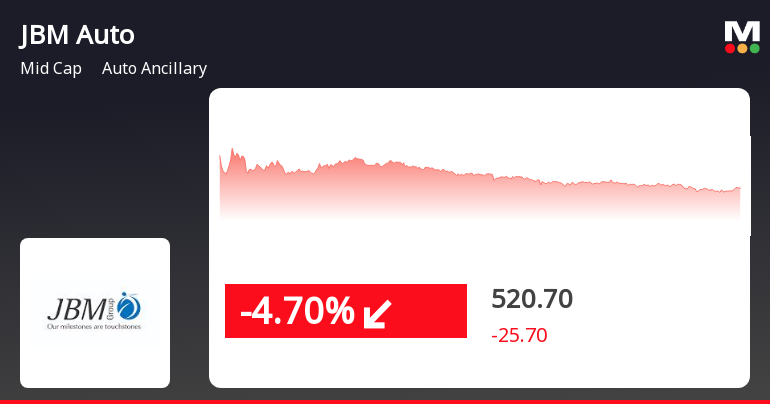

JBM Auto Faces Ongoing Challenges Amid Significant Stock Volatility and Decline

2025-03-03 09:36:28JBM Auto, a midcap auto ancillary firm, has hit a new 52-week low amid significant volatility, underperforming its sector. The stock has declined 20.71% over the past week and 52.98% over the past year, contrasting sharply with the Sensex's minor dip, reflecting ongoing market challenges.

Read More

JBM Auto Faces Sustained Decline Amid Broader Market Weakness and Sector Underperformance

2025-02-28 14:50:13JBM Auto, a midcap auto ancillary company, saw its shares decline significantly today, reaching a new 52-week low. The stock has faced a continuous drop over the past six days, underperforming its sector and the broader market, with notable declines over the past month.

Read More

JBM Auto Faces Significant Decline Amidst Broader Sector Challenges and Volatility

2025-02-28 09:37:20JBM Auto, a midcap auto ancillary company, has hit a new 52-week low, reflecting significant volatility and a 16.8% decline over the past six days. The stock is trading below all major moving averages and has seen a substantial annual drop of 51.07%, contrasting with the Sensex's modest gain.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECertificate under Reg. 74(5) of SEBI (DP) Regulation 2018

Resignation By Senior Management Personnel

02-Apr-2025 | Source : BSEResignation by Senior Management Personnel.

Resignation By Senior Management Personnel

31-Mar-2025 | Source : BSEResignation by Senior Management Personnel.

Corporate Actions

No Upcoming Board Meetings

JBM Auto Ltd has declared 75% dividend, ex-date: 05 Sep 24

JBM Auto Ltd has announced 1:2 stock split, ex-date: 31 Jan 25

JBM Auto Ltd has announced 1:1 bonus issue, ex-date: 08 Oct 14

No Rights history available