Jeevan Scientific Technology's Valuation Upgrade Signals Potential Market Shift Amid Stock Challenges

2025-04-02 08:17:30Jeevan Scientific Technology, a microcap in the Pharmaceuticals & Drugs sector, has recently adjusted its valuation metrics, achieving a very attractive status. Key indicators include a PE ratio of 64.59 and a PEG ratio of 0.52, reflecting a strong growth outlook despite recent stock underperformance.

Read MoreJeevan Scientific Technology Experiences Valuation Grade Change Amidst Financial Landscape Shift

2025-04-02 08:00:37Jeevan Scientific Technology, a microcap player in the Pharmaceuticals & Drugs sector, has recently undergone a valuation adjustment, reflecting a notable shift in its financial standing. The company's current price is 40.79, slightly above the previous close of 40.10, with a 52-week high of 67.80 and a low of 37.99. Key financial metrics reveal a PE ratio of 64.59 and an EV to EBITDA of 8.92, indicating a complex valuation landscape. The PEG ratio stands at 0.52, suggesting a potentially favorable growth outlook relative to its earnings. However, the company's return metrics show a decline over various periods, with a year-to-date return of -17.68% compared to a modest -2.71% for the Sensex. In comparison to its peers, Jeevan Scientific Technology's valuation appears more favorable, particularly when contrasted with companies like Shukra Pharma and Shree Ganesh Rem, which exhibit higher PE ratios and EV...

Read More

Jeevan Scientific Technology Adjusts Evaluation Amid Mixed Financial Performance and Market Trends

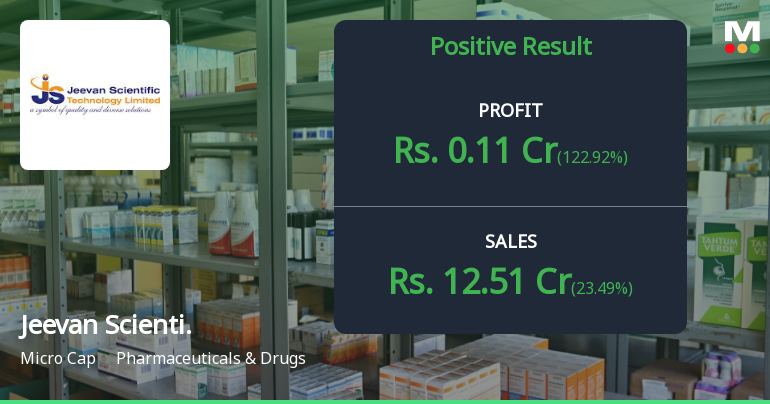

2025-02-27 18:51:02Jeevan Scientific Technology, a microcap in the Pharmaceuticals & Drugs sector, has recently experienced a score adjustment amid mixed financial indicators. In Q3 FY24-25, the company reported a 23.49% increase in net sales and a low Debt to EBITDA ratio, despite facing stock performance challenges over the past year.

Read MoreJeevan Scientific Technology Faces Technical Trend Challenges Amid Market Dynamics

2025-02-25 10:28:19Jeevan Scientific Technology, a microcap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 47.00, slightly down from the previous close of 47.75. Over the past year, the stock has faced challenges, with a return of -17.01%, contrasting with a positive return of 2.09% for the Sensex during the same period. The technical indicators present a mixed picture. The MACD signals a bearish trend on both weekly and monthly charts, while the Bollinger Bands indicate a bearish stance on the weekly and a mildly bearish outlook on the monthly. The KST also reflects a bearish trend across both timeframes. Notably, the stock's performance has been under pressure, particularly over the last three years, where it has seen a significant decline of 64.49%, compared to a 33.68% gain in the Sensex. Despite some po...

Read More

Jeevan Scientific Technology Shows Financial Stability Amidst Market Challenges and Underperformance

2025-02-21 18:14:08Jeevan Scientific Technology, a microcap in the Pharmaceuticals & Drugs sector, has recently experienced an evaluation adjustment reflecting its market position. The company has shown strong debt management and positive sales growth, although it has underperformed against benchmarks over the past three years. Its valuation metrics suggest potential attractiveness compared to peers.

Read More

Jeevan Scientific Technology Hits 52-Week Low Amid Sustained Bearish Trend

2025-02-11 10:35:23Jeevan Scientific Technology, a microcap in the Pharmaceuticals & Drugs sector, has hit a new 52-week low amid significant volatility. The stock has underperformed its sector and is trading below multiple moving averages, reflecting ongoing challenges in a competitive market, with a notable decline over the past year.

Read More

Jeevan Scientific Technology Faces Significant Volatility Amid Broader Sector Challenges

2025-02-10 13:35:14Jeevan Scientific Technology, a microcap in the Pharmaceuticals & Drugs sector, hit a new 52-week low today after significant volatility. The stock has underperformed the sector and is trading below all major moving averages, reflecting a sustained downward trend amid broader industry challenges.

Read More

Jeevan Scientific Technology Faces Significant Volatility Amid Broader Market Challenges

2025-02-07 10:35:16Jeevan Scientific Technology, a microcap in the Pharmaceuticals & Drugs sector, reached a new 52-week low today after two days of gains. The stock exhibited high volatility, with significant intraday fluctuations and a notable decline over the past year, underperforming compared to broader market indices.

Read More

Jeevan Scientific Technology Reports Profit Turnaround and Strong Sales Growth for December Quarter

2025-02-07 10:04:33Jeevan Scientific Technology has announced its financial results for the quarter ending December 2024, reporting a profit after tax of Rs 0.35 crore, a turnaround from a loss in the previous year. Net sales reached Rs 12.51 crore, indicating a year-on-year growth of 23.49%.

Read MoreInformation About Successful Completion Of Inspection Of JSTL Clinical And Bioanalytical Facilities By CDSCO (Central Drugs Standard Control Organisation) Under Regulation 30 Of SEBI (LODR) Regulations 2015.

09-Apr-2025 | Source : BSEInformation about successful completion of Inspection of JSTL Clinical and Bioanalytical facilities by CDSCO (Central Drugs Standard Control Organisation) under Regulation 30 of SEBI(LODR) Regulations 2015.

Shareholder Meeting / Postal Ballot-Outcome of EGM

27-Mar-2025 | Source : BSEOutcome of the EGM held on 27.03.2025

Shareholder Meeting / Postal Ballot-Scrutinizers Report

27-Mar-2025 | Source : BSEScrutiniser report of the EGM held on 27.03.2025

Corporate Actions

No Upcoming Board Meetings

Jeevan Scientific Technology Ltd has declared 12% dividend, ex-date: 21 Sep 22

No Splits history available

No Bonus history available

No Rights history available