J.G.Chemicals Shows Resilience Amid Market Decline with Notable Stock Recovery

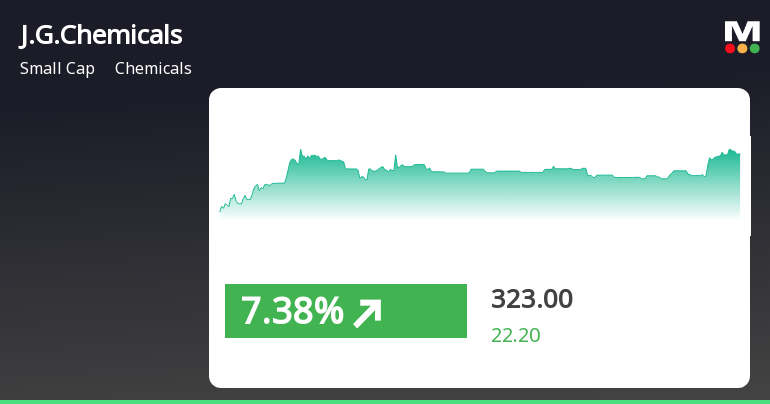

2025-04-01 15:35:32J.G.Chemicals saw a significant rebound on April 1, 2025, after four days of decline, outperforming its sector amid a broader market downturn. While the Sensex dropped sharply, small-cap stocks showed resilience. Over the past year, J.G.Chemicals has notably outperformed the Sensex.

Read MoreJ.G. Chemicals Faces Technical Trend Shifts Amid Market Volatility and Bearish Indicators

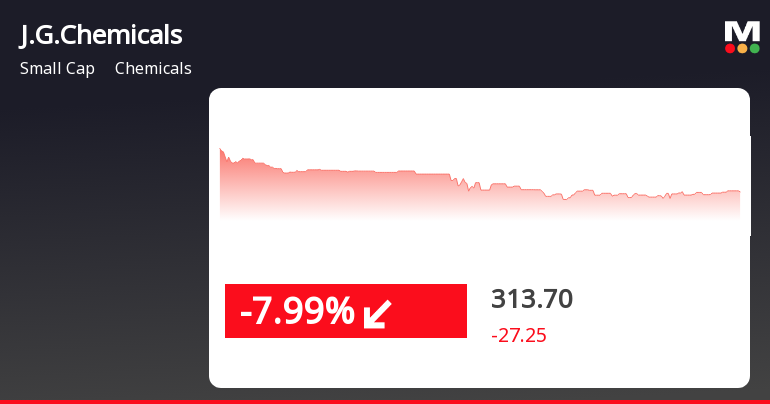

2025-03-12 08:03:35J.G. Chemicals, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The stock is currently priced at 311.70, showing a slight increase from the previous close of 310.35. Over the past week, J.G. Chemicals has demonstrated a stock return of 2.77%, outperforming the Sensex, which returned 1.52% in the same period. However, a closer look at the technical summary reveals a bearish sentiment across several indicators. The MACD and Bollinger Bands on a weekly basis indicate a bearish trend, while the daily moving averages also reflect a similar stance. The On-Balance Volume (OBV) shows no significant trend on a weekly basis, with a mildly bearish outlook on a monthly scale. In terms of performance, J.G. Chemicals has faced challenges year-to-date, with a return of -23.04%, contrasting with the Sensex's decline of only -5.17%...

Read MoreJ.G. Chemicals Shows Mixed Performance Amid Broader Market Trends and Bearish Indicators

2025-03-11 18:00:28J.G. Chemicals, a small-cap player in the chemicals industry, has shown notable activity in today's trading session, with a slight increase of 0.43%. This performance stands in contrast to the broader market, as the Sensex recorded a marginal decline of 0.02%. Over the past week, J.G. Chemicals has outperformed the Sensex, gaining 2.77% compared to the index's 1.52% rise. However, the stock's performance over longer periods reveals a more complex picture. In the last month, J.G. Chemicals has seen a decline of 2.41%, while the Sensex fell by 2.87%. The three-month performance shows a significant drop of 31.81% for J.G. Chemicals, compared to a 9.11% decline in the Sensex. Year-to-date, the stock is down 23.04%, against the Sensex's decrease of 5.17%. With a market capitalization of Rs 1,202.00 crore, J.G. Chemicals has a price-to-earnings ratio of 37.93, which is lower than the industry average of 43.82. ...

Read MoreJ.G. Chemicals Faces Mixed Technical Signals Amid Market Volatility and Strategic Challenges

2025-03-06 08:03:21J.G. Chemicals, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 318.50, showing a notable increase from the previous close of 303.30. Over the past week, the stock reached a high of 321.10 and a low of 295.05, indicating some volatility in its trading range. In terms of technical indicators, the weekly MACD remains bearish, while the monthly indicators show mixed signals. The Relative Strength Index (RSI) does not provide a clear signal on the weekly timeframe, and Bollinger Bands indicate a mildly bearish trend on the weekly scale. However, daily moving averages suggest a mildly bullish sentiment, which contrasts with the overall bearish outlook from the KST and Dow Theory on the weekly basis. When comparing the stock's performance to the Sensex, J.G. Chemicals has faced challenges, partic...

Read MoreJ.G. Chemicals Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-05 08:03:53J.G. Chemicals, a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 303.30, showing a slight increase from the previous close of 301.00. Over the past week, J.G. Chemicals has experienced a decline of 4.92%, while the Sensex has decreased by 2.16%. This trend continues over the month, with the stock down 18.14% compared to the Sensex's 7.12% drop. The technical summary indicates a mixed performance across various indicators. The MACD and KST metrics are bearish on a weekly basis, while the moving averages show a mildly bullish trend daily. The Relative Strength Index (RSI) currently signals no significant movement, suggesting a period of consolidation. Additionally, the Bollinger Bands and On-Balance Volume (OBV) metrics reflect a bearish sentiment on a weekly basis. In terms of historical perf...

Read More

J.G.Chemicals Faces Continued Stock Volatility Amid Broader Market Stability

2025-02-11 11:50:26J.G.Chemicals has faced notable stock volatility, declining for five consecutive days and accumulating a total loss of 14.64%. The stock opened lower today and reached an intraday low, underperforming compared to its sector. It is currently trading below multiple moving averages, indicating a challenging market position.

Read More

J.G.Chemicals Reports Strong Q3 FY24-25 Results with Record Profit After Tax

2025-02-04 19:32:15J.G.Chemicals reported strong financial results for the quarter ending December 2024, with a Profit After Tax of Rs 16.97 crore, the highest in five quarters. The company achieved net sales of Rs 421.16 crore for the half-year, reflecting a 34.14% year-on-year growth, alongside an operating profit of Rs 23.10 crore.

Read More

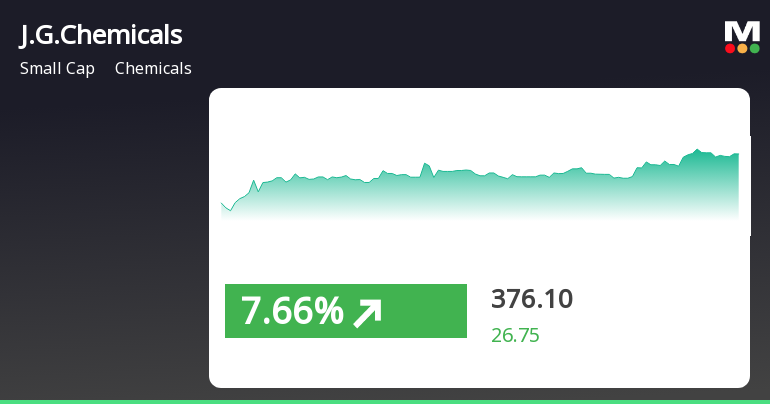

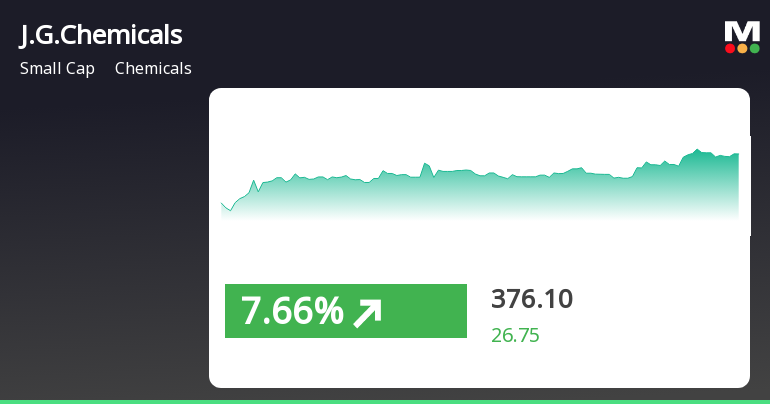

J.G.Chemicals Shows Strong Recovery Amid Broader Market Trends on February 4, 2025

2025-02-04 11:05:25J.G.Chemicals experienced a notable performance on February 4, 2025, reversing a two-day decline with an 8.2% increase. The stock outperformed its sector and reached an intraday high, reflecting a positive shift in market sentiment despite a decline over the past month compared to the broader market.

Read More

J.G.Chemicals Shows Strong Recovery Amid Broader Market Trends on February 4, 2025

2025-02-04 11:05:25J.G.Chemicals experienced a notable performance on February 4, 2025, reversing a two-day decline with an 8.2% increase. The stock outperformed its sector and reached an intraday high, reflecting a positive shift in market sentiment despite a decline over the past month compared to the broader market.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEIntimation to exchange regarding Certificate under Reg. 74(5) of SEBI (DP) Regulations

Closure of Trading Window

31-Mar-2025 | Source : BSECLOSURE OF TRADING WINDOW FROM 1ST APRIL 2025 TILL DECLARATION OF AUDITED FINANCIAL RESULTS FOR THE QUARTER AND FINANCIAL YEAR ENDED 31ST MARCH 2025

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

12-Mar-2025 | Source : BSEINTIMATION REGARDING INVESTOR MEET ON 20TH MARCH 2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available