JHS Svendgaard Laboratories Stock Surges, Indicating Resilience in FMCG Sector

2025-04-03 10:00:10JHS Svendgaard Laboratories Ltd, a microcap player in the FMCG sector, has made headlines today as its stock hit the upper circuit limit, closing at a high price of Rs 12.31. This marks a notable increase of Rs 0.58, translating to a 4.94% rise in value. The stock's performance today outpaced its sector by 5.68%, showcasing its strength in a challenging market environment. Throughout the trading session, JHS Svendgaard Laboratories recorded a total traded volume of approximately 0.47047 lakh shares, resulting in a turnover of Rs 0.05786781 crore. The stock has shown consistent upward momentum, gaining for three consecutive days and achieving a total return of 15.56% over this period. In terms of moving averages, the stock is currently above its 5-day and 20-day averages, although it remains below the 50-day, 100-day, and 200-day averages. Notably, investor participation has seen a decline, with delivery v...

Read MoreJHS Svendgaard Laboratories Sees Strong Buying Activity Amid Broader Market Decline

2025-04-03 09:40:03JHS Svendgaard Laboratories Ltd is currently witnessing significant buying activity, with the stock rising by 4.96% today, contrasting sharply with the Sensex, which has declined by 0.38%. Over the past week, JHS Svendgaard has shown a robust performance, gaining 10.53%, while the Sensex has dropped by 1.64%. Notably, the stock has experienced consecutive gains for the last three days, accumulating a total return of 15.68% during this period. In terms of price summary, JHS Svendgaard opened with a gap up and reached an intraday high, reflecting strong buyer sentiment. The stock's performance over the past month shows a modest increase of 1.25%, although it has faced challenges over longer time frames, including a 41.40% decline over the past three months and a 31.91% drop over the past year. Despite these longer-term challenges, the recent buying pressure may be attributed to various factors, including ma...

Read MoreJHS Svendgaard Laboratories Sees Notable Buying Activity Amid Recent Price Gains

2025-04-02 10:05:03JHS Svendgaard Laboratories Ltd is witnessing significant buying activity, with the stock rising by 4.95% today, outperforming the Sensex, which gained only 0.41%. This marks the second consecutive day of gains for JHS Svendgaard, with a total increase of 10.22% over this period. Despite this recent uptick, the stock's performance over longer time frames reveals a more complex picture. Over the past month, JHS Svendgaard has declined by 5.96%, while the Sensex has increased by 4.29%. Year-to-date, the stock is down 43.24%, contrasting sharply with the Sensex's decline of just 2.31%. The price summary indicates that the stock opened with a gap up and reached an intraday high, contributing to the strong buying pressure. Currently, JHS Svendgaard's price is above its 5-day moving average but remains below its 20-day, 50-day, 100-day, and 200-day moving averages. This trend may suggest a short-term recovery...

Read MoreJHS Svendgaard Laboratories Sees Surge in Trading Activity Amid FMCG Sector Strength

2025-04-02 10:00:06JHS Svendgaard Laboratories Ltd, a microcap player in the FMCG sector, has experienced significant activity today, hitting its upper circuit limit with a high price of Rs 11.73. The stock recorded a change of Rs 0.55, reflecting a percentage increase of 4.92%. This performance stands out as it has outperformed its sector by 5.55%, while the broader market, represented by the Sensex, saw a modest gain of 0.49%. Throughout the trading session, JHS Svendgaard Laboratories saw a total traded volume of approximately 0.32349 lakh shares, resulting in a turnover of Rs 0.0374 crore. The stock has shown a consistent upward trend, gaining 10.02% over the last two days. However, it is noteworthy that the stock's delivery volume has seen a significant decline, dropping by 96.37% compared to the five-day average. In terms of moving averages, the stock is currently above its five-day moving average but below the longer...

Read MoreJHS Svendgaard Laboratories Sees Notable Buying Surge Amid Market Volatility

2025-04-01 14:25:03JHS Svendgaard Laboratories Ltd is currently witnessing significant buying activity, with a notable performance of 5.02% increase today, contrasting sharply with the Sensex, which has declined by 1.80%. This uptick comes after three consecutive days of declines, indicating a potential trend reversal. Over the past week, JHS Svendgaard's performance has been down by 5.79%, while the Sensex fell by 2.56%. In the longer term, the stock has faced challenges, with a 49.94% drop over the last three months and a 31.86% decrease over the past year. However, it is important to note that the stock has outperformed its sector by 5.81% today. The stock opened with a gap up, and its intraday high reflects the strong buying momentum. Currently, it is trading 4.96% away from its 52-week low of Rs 11.12. Despite the recent gains, JHS Svendgaard Laboratories remains below its moving averages across various time frames, i...

Read MoreJHS Svendgaard Laboratories Shows Significant Rebound Amid FMCG Sector Challenges

2025-04-01 13:00:04JHS Svendgaard Laboratories Ltd, a microcap player in the FMCG sector, has made headlines today by hitting its upper circuit limit with a high price of Rs 11.73. The stock experienced a notable change of Rs 0.47, reflecting a percentage increase of 4.2%. This performance comes after a trend reversal, as the stock has gained following three consecutive days of decline. The trading session saw a total volume of approximately 0.27767 lakh shares, resulting in a turnover of Rs 0.032 crore. The last traded price (LTP) stood at Rs 11.65, indicating a solid performance against the backdrop of a sector that has underperformed, with JHS Svendgaard outperforming its sector by 5.52%. Despite trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, the stock's liquidity remains adequate for trading, with a delivery volume of 52,950 shares noted on March 28, although this reflects a decline of 3...

Read More

JHS Svendgaard Laboratories Faces Financial Struggles Amid Market Volatility and Declining Sales

2025-04-01 12:40:14JHS Svendgaard Laboratories is experiencing notable trading activity as it nears a 52-week low. Despite outperforming its sector today, the company faces long-term challenges, including declining net sales and a negative return on capital employed. Its one-year performance significantly lags behind broader market trends.

Read More

JHS Svendgaard Laboratories Faces Continued Decline Amid Broader Market Volatility

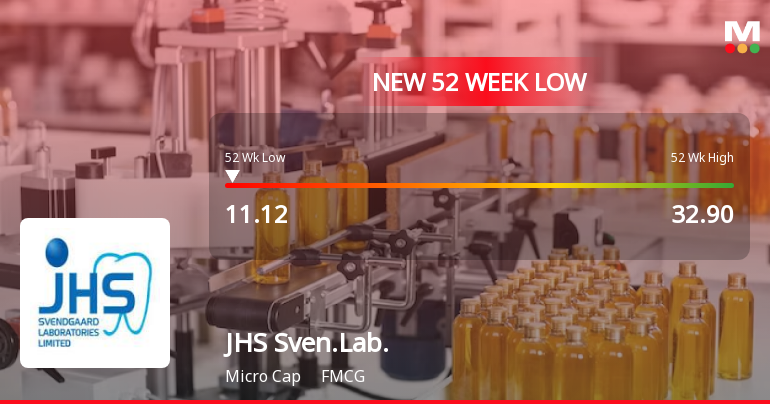

2025-03-28 10:05:14JHS Svendgaard Laboratories has faced notable volatility, reaching a new 52-week low and underperforming its sector. The company's stock has declined significantly over the past year, with weak long-term fundamentals, negative sales growth, and substantial losses impacting its financial health and returns on capital employed.

Read MoreJHS Svendgaard Laboratories Faces Trading Challenges Amid Increased Delivery Volume

2025-03-28 10:00:08JHS Svendgaard Laboratories Ltd, a microcap player in the FMCG sector, experienced significant trading activity today as its stock hit the lower circuit limit. The last traded price (LTP) stood at Rs 11.83, reflecting a decline of Rs 0.41 or 3.35% from the previous close. The stock reached an intraday low of Rs 11.62, just 2.71% above its 52-week low of Rs 11.50. During the trading session, JHS Svendgaard saw a total traded volume of approximately 3.00 lakh shares, resulting in a turnover of Rs 0.36 crore. The stock underperformed compared to its sector, which recorded a 1.50% return, while JHS Svendgaard's 1D return was -1.45%. Additionally, the stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend. Despite the recent downturn, there has been a notable increase in delivery volume, which rose by 45.15% compared to the 5-day average. ...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018 for the quarter ended March 31 2025.

Format of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

08-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | JHS Svendgaard Laboratories Ltd |

| 2 | CIN NO. | L74110HP2004PLC027558 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 0.00 |

| 4 | Highest Credit Rating during the previous FY | NA |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | Not Applicable |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: Company Secretary and Compliance Officer

EmailId: cs@svendgaard.com

Designation: Chief Financial Officer

EmailId: ashish@svendgaard.com

Date: 08/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Closure of Trading Window

25-Mar-2025 | Source : BSETrading Window Closure for the Quarter ended 31st March 2025..

Corporate Actions

No Upcoming Board Meetings

JHS Svendgaard Laboratories Ltd has declared 8% dividend, ex-date: 26 Dec 11

No Splits history available

No Bonus history available

No Rights history available